Why Bitcoin is like LeBron James and an Ethereun piece of news that I won't reveal in the title

Weekend and I tend to read the crypto news and few things caught my attention.

Most of you already know the main developments and news about cryptosphere so I won't repeat them.

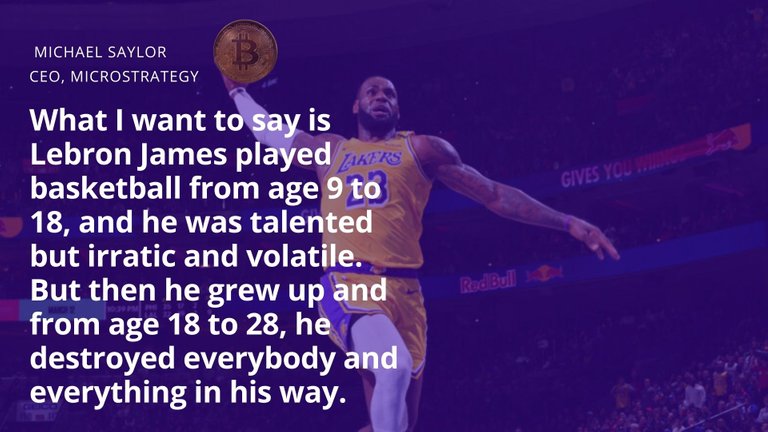

But I read an article at Cointelegraph link about an interview of Microstrategy's CEO Michael Saylor who made a very interesting comparison between Bitcoin and The King, Lebron James. He initially stated that Bitcoin is not the same as it was in 2015 or 2017 and the arguments against Bitcoin (BTC) that were relevant four years ago are no longer applicable, because Bitcoin has grown exponentially since the 2017 peak in terms of infrastructure, fundamentals and adoption. In the past year, institutions have started to increasingly see BTC as a store of value and an inflation hedge.

Microstrategy put their BTC where their mouth is recently buying $50 M worth of Bitcoin making a total hodling of $766 M.

Then he continued to say :

image from nba.com , graph from canva.com

So, Bitcoin has matured and like Lebron James will destroy everything in its way. A very entertaining analogy if you ask me...

And let me continue the analogy. We all know that all players even the greatest of them at some point in time they retire and other players take their place in the spotlight. Eventually, Lebron James will retire as well and I wonder if Bitcoin will ever "retire", I mean I wonder if another coin will ever take BTC's throne and become the King of Cryptos.

This doesn't seem possible in the foreseeable future but check this piece of news also from Cointelegraph link.

In a phone interview with Bloomberg, managing director Michael Sonnenshein said over the course of 2020 we are seeing a new group of investors who are Ethereum first and in some cases Ethereum only. There’s a growing conviction around Ethereum as an asset class, thus underscoring the asset’s growing appeal beyond the development community.

image from canva.com

Grayscale is the biggest BTC hodler in the world with $10 B worth of Bitcoin under management. Earlier this week, Grayscale announced that its Ethereum Trust would undergo a nine-for-one split on Dec. 17, which means that shareholders will receive eight additional shares for each share held. That's a pretty awesome airdrop !!!

Ethereum has a vast ecosystem and many use-cases, when Bitcoin has the first-mover advantage and the store of value narrative.

It will be very interesting to see how this dynamic will unfold over the coming years. I have invested in both coins, but if you ask me I see more potential in ETH rather than in BTC.

And until some coin over thrones Bitcoin...

Be healthy and smile...

Posted Using LeoFinance Beta

!ASH Always invest by weighing the pros and cons, develop the crypto direction, be part of the teams. After the price tag of 20,000, there will be an overflow to other coins, which is my personal opinion. You don't have to wait long, it will be fun.

Command accepted!

Aeneas is a blockchain project under development and a decentralized blogging platform based on Hive spesialized on the #social #politics #economics #indiejournalizm and all the #cryptocurrency related threads

Join Aeneas.Blog to earn more ASH for your unique content!

Dear, @iliasdiamantis, you have received

ASHtokens!Join our Discord Server for further updates!

bitcoin will never loseee! it's the immortal king! :P

Posted Using LeoFinance Beta

Bitcoin reached its all-high and now it's time for ETH to chase BTC down!

Posted Using LeoFinance Beta

if they don't screw eth 2.0 I see eth at similar prices ...