dForce DeFi

dForce is a sort of DeFi Platform that provides liquidity pool,

lending service and issue its own tokens that are paired with stable coins.

last summer, some acquaintance shared this DeFi that had some very attractive profit pools of over 50% APY.

So I looked around it a bit and tried to stake some of ETH as a demonstration.

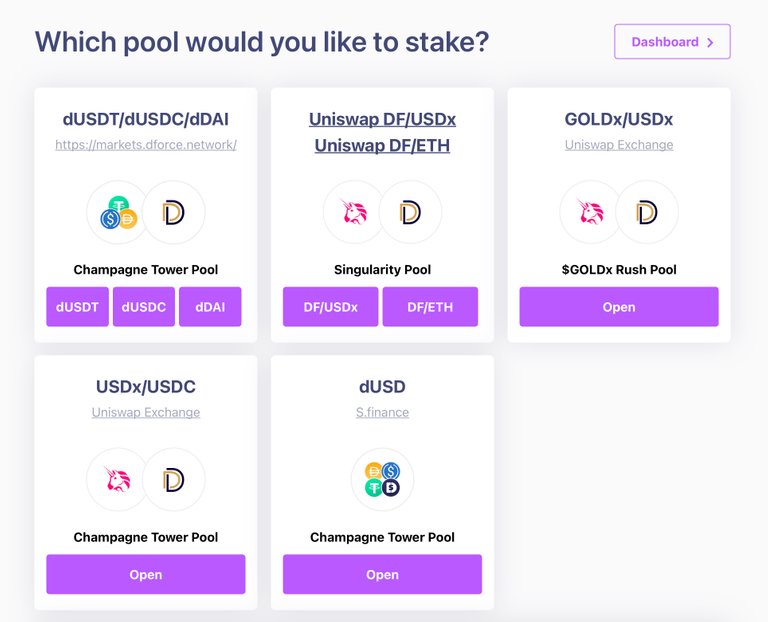

It has total 5 liquidity pools. Daily APY fluctuation is sometimes over 10%. On any point of time, the top profit pool that has best APY rate soon may have middle ratio APY among all pools.

The fluctuation is so high.

I don’t know exactly why it has that so much volatility, but maybe most of other DeFi’s have similar amount of high volatility. Still my understanding level of DeFi and Liquidity pool is not enough to see all so that I will look at more on in terms of the business model, the estimated benefit of this platform and why these DeFi’s have this volatile results.

Now dForce liquidity pools have maximum around 20% APY and lowest one is around 4%. Around 10 hours ago, the maximum APY was 17% and now got raised a bit. But sooner or later, it may decrease again. I guess that it may be hard to keep 20% APY.

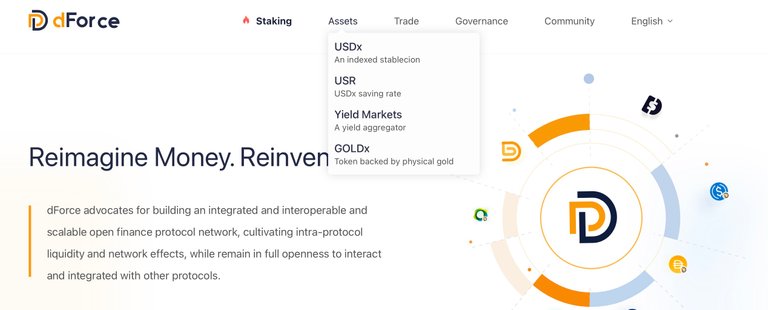

dForce also issues tokes that are USDx and GOLDx.

USDx can be issued as investor collect three stable coins of USDC, TUSD and PAX and then submit all its converting protocol to convert to USDx in dForce asset site.

You may need to have Metamask extension in Chrome or other Chrome compatible browsers. Honestly I gave up to have USDx through this process. It may take so much my energy and time to collect and submit all stable coins.

GoldX is paired with PAXG. PAXG is pared with real gold, so dForce makes the structure to pair GOLDx with real gold having PAXG bridge.

It has also Yield Farming. USDT seems to have highest yield ratio, but the profit ratio doesn’t seem to be higher than other very aggressive DeFi’s.

I still do not know much and my insight level is not enough on this matter. I will try to see other and compare all.

Posted Using LeoFinance Beta

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #appeals channel in our discord.

Sorry If I have done any bad things on Hive community... If I have made any those things, please let me know. I will correct those. thank you and Happy new year

DEFI IS THE FUTURE

Posted Using LeoFinance Beta

Yes, I think we cannot avoid the tide of DeFi and Crypto finance. There may be some unqualified spam ones that try to collect other’s money, but I think that is the process we should take in the way to decentralized and more matured DeFi and Crypto.

Posted Using LeoFinance Beta