DeFi Trend

DeFi Pulse

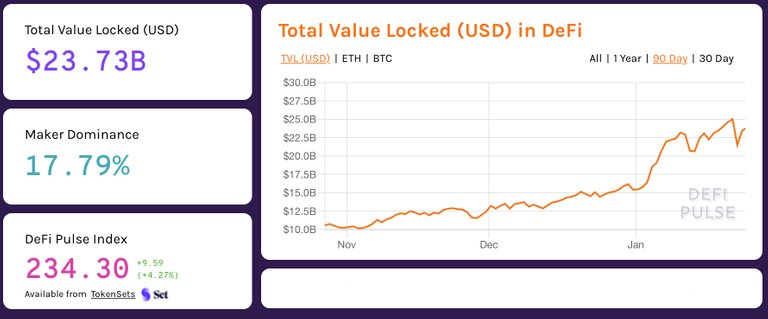

As of 24th Jan., total value locked in DeFi is US$ 23.73B based on DeFi Pulse.

And biggest DeFi service provider is still Maker who has almost 18% of DeFi market dominance.

DeFi pulse does not include all DeFi protocols or services that does only focus on mainly Ethereum base protocols.

And each DeFi provider should submit to DeFi Pulse relevant data and information that meet the criteria to be listed on its list.

I think BSC(BEP-20) protocols generally do not submit to this list that generally relatively smaller sizes and do have inefficient operation.

So regarding all these out-of scope DeFi, whole DeFi size may be bigger.

The TVL is now more than double of last November value.

This comes from the rapid increase of coin value that BTC and ETH price have been raised more than double for last 2 months. Even though the number of application cases may have increased, that doesn’t seem to be main root cause of this high value increase.

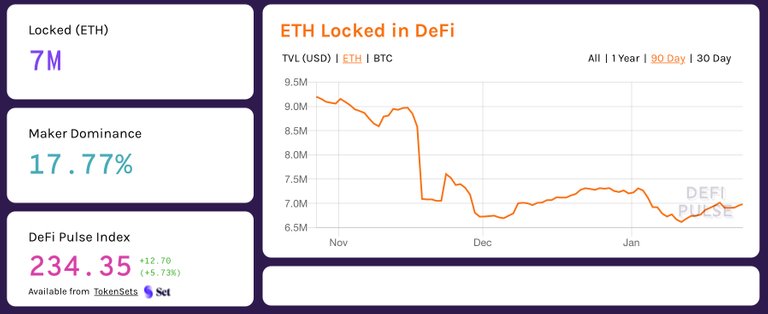

Compared with last November, total locked ETH has been reduced from 9.2M to 7M.

The number of locked Bitcoin is almost same trend with ETH.

I think much of ETH and BTC have moved to new investment sectors in this bullish market burning DAO. Many holders may think it is not necessary to get low interest waiting for future growth.

Posted Using LeoFinance Beta