Bitcoin on exchanges declining - Bullish for Bitcoin?

Direct from the desk of Dane Williams.

Yes, a declining number of Bitcoin on exchanges is bullish for Bitcoin.

And guess what?

That’s exactly what the data is telling us is happening right now.

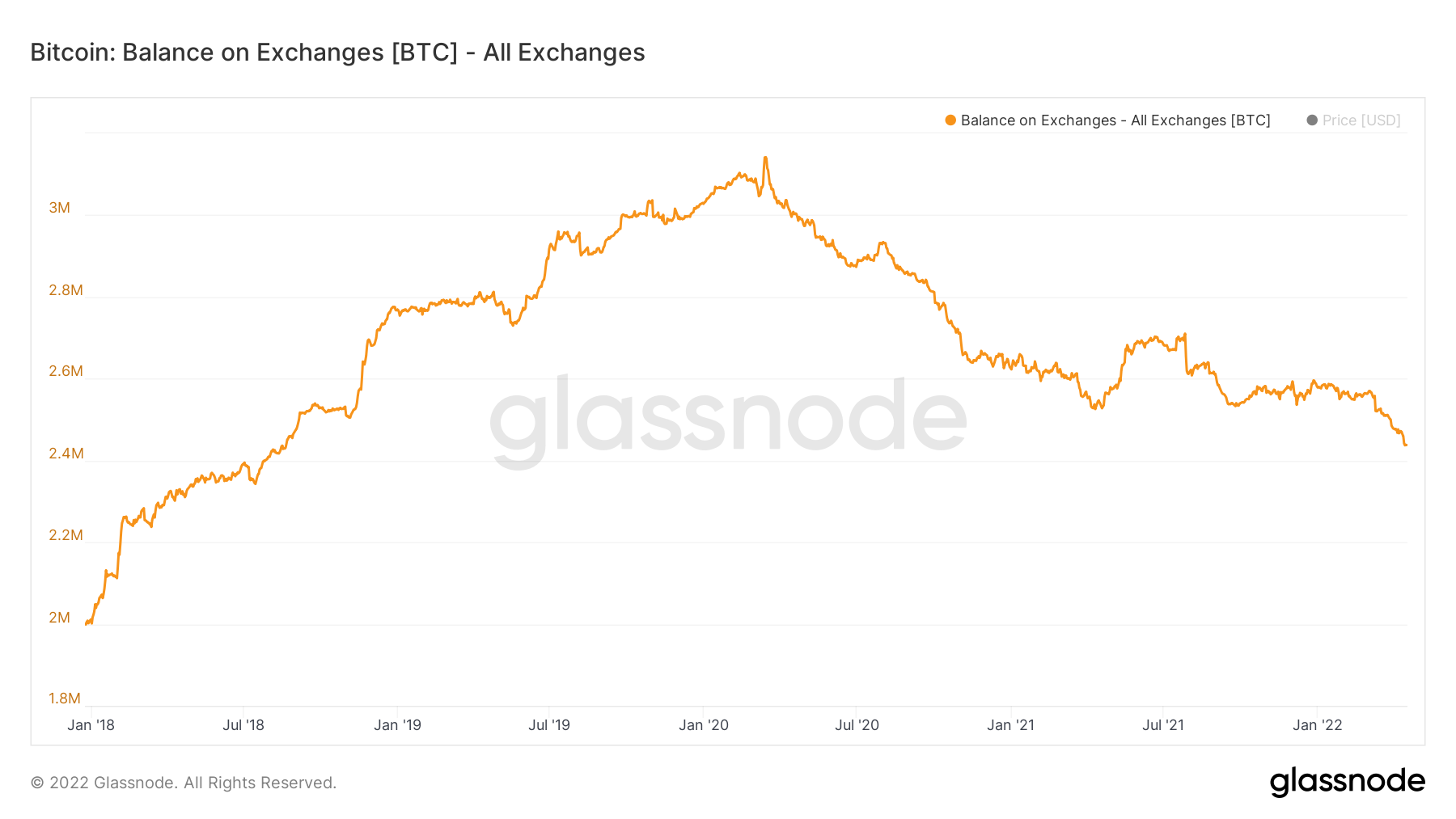

Check out the following chart from our wonderfully geeky friends at Glassnode:

Putting this into context, the number of coins held on exchanges fell by more than 20,000 BTC to 2,449,785 BTC last week.

According to the most recent Blockware Solutions newsletter (which I highly recommend you subscribe to even if just to skim when major flags such as this are raised), this rate of exchange outflows has only ever occurred 3 times before:

- Following March 2020

- December 2020

- September 2021

I’ll let you do your own scrolling back through the chart, but this decline is certainly enough for traders and analysts alike to take notice.

The significance of Bitcoin leaving exchanges

Why is Bitcoin being withdrawn off exchanges and into user-controlled wallets significant?

Well, a decline in Bitcoin available on exchanges means that there are fewer coins in hot wallets that are readily available to be sold.

The data is telling us that traders are happy to HODL their tokens and the most secure way to do that is by taking them off an exchange and into an address that they own the associated keys to.

I’m sure you’ve heard the saying not your keys, not your crypto!

Well this is that saying being put into action by the masses.

A declining number of Bitcoin on exchanges is an exciting leading indicator if you’re bullish on not only Bitcoin itself, but the entire crypto market that tends to follow the leader.

With less coins available for sale in exchange wallets, let alone actually listed for sale on order books, the supply/demand imbalance offers Bitcoin the potential for a rip higher.

When you're left with only demand, price can only go one way!

Ultimately, opinions are why we have a market

I do find it super interesting to watch the battle between the data and the macro narrative that we're spun.

I’m not sure if you heard (lol), but Russia has invaded Ukraine and war is not only less than ideal for the innocent civilians caught in the middle, but also for market bulls.

The economics textbooks tell us that markets hate uncertainty and what’s more uncertain than a psychopathic dictator with his finger on the nuke button?

Not much…

So for now, the textbooks have it right.

Those trading the narrative are on the right side of the market.

Year to date, Bitcoin has continued its slow grind down into April, extending its year to date fall to 15%.

But markets are not traded via academic textbooks and back here in real life are we about to see the bearish macro factors overtaken by what the blockchain metrics are telling us?

No doubt there's a big wave incoming, whether it's spurred on by war, the US tax season or a humble supply/demand imbalance on centralised exchanges, it doesn't matter.

All you've gotta do now is pick a side.

Which side of the market are you on?

Best of probabilities to you.

Posted Using LeoFinance Beta

It is hard to say, but I am on the bullish side. There are higher lows on the Bitcoin chart since January 17th and numerous downside attempts have failed.

Posted Using LeoFinance Beta

Yep, certainly a nice bit of confluence forming between the on-chain data and the technicals.

Posted Using LeoFinance Beta

There are so many metrics with Bitcoin that can be used. This one is as valid as any. However, all have their flaws which means we might end up going long when short was the answer.

That is why markets are always fun.

Posted Using LeoFinance Beta

Bullish!

BTC is a regular buy from me. Slowly accumulating it rain or shine

Posted Using LeoFinance Beta

You really can't go wrong with this strategy.

We forget because we're living crypto every second of the day, but we are still extremely early in the game.

Stack stack stack!

Posted Using LeoFinance Beta

So early that people are year from now will still be early birds.

Posted Using LeoFinance Beta

Dollar Cost Averaging with BTC is never a bad idea.

In fact, that is the case with all our long term holdings.

Posted Using LeoFinance Beta

I am always bullish on Bitcoin long term.

I don't think that the amount that is in exchanges is decisive for the price, but it is only my opinion.

I think what the trend shows is that users are becoming more cautious, especially with state policies.

Posted Using LeoFinance Beta

What are the state policies that you're referring to?

Posted Using LeoFinance Beta

I am referring to policies against money laundering.

Yes that is where many of us, long term view.

However, many like to play the swings which is obviously more difficult to time.

Posted Using LeoFinance Beta

Bullish baby🥰🥰

I don’t think we can ever see 2018 bearish market again because people now know the value of bitcoin and how important it is to hodl

Posted Using LeoFinance Beta

We'll definitely see a bear market again...

But I do agree that we won't see the prices as low as what we saw in 2018.

That ship has certainly sailed.

Posted Using LeoFinance Beta

The shop has certainly sailed for sure but never too late to join because the opportunities are limitless

Posted Using LeoFinance Beta

Do not get overconfident.

There are bigger players in the game now, Wall Street. And they play both sides of the coin. They could push things down in the futures markets that would crush the price of all crypto.

It is still a rather small market cap.

Posted Using LeoFinance Beta

Irrespective of what happened in the end i will be with hive 100%

Posted Using LeoFinance Beta

I think everyone should have a bit of Bitcoin since it is likely to see enormous levels at some point.

However, to be all in might not be the best since I think there will be higher alpha out there.

Posted Using LeoFinance Beta

I don't owe any btc but I think it will be good to have small. I'm all into hive and the rest coin are just noise

Posted Using LeoFinance Beta

A small amount isnt a bad idea. Ride the upcoming major wave.

Posted Using LeoFinance Beta

Just passing by from listnerds and reading good info! Maybe I add some BTC to my portfolio today :)

Thanks!

!BEER

Posted Using LeoFinance Beta

Maybe ;)

Cheers for stopping by.

!LUV

Posted Using LeoFinance Beta

@forexbrokr(1/1) gave you LUV. wallet | market | tools | discord | community | <><

wallet | market | tools | discord | community | <><

Always good to see Listnerds leading to more engagement.

Everyone should by using that application in my opinion.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @forexbrokr, here is a little bit of

BEERfrom @solymi for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.That's great news! I am buying satoshis every day. Clearly, I am on Bitcoin's side. In fact, all of us are on the same side. And crypto is our ticket to heaven. 🤑🤑

Posted Using LeoFinance Beta

Haha, you're going to hell for this comment ;)

Posted Using LeoFinance Beta

😂😂 I am already there. Can't go worse than this.

Posted Using LeoFinance Beta

That must be one of them New Age religions.

I am not sure if the traditional texts said much about crypto.

Posted Using LeoFinance Beta

😂😂 The heaven they talk about in the holy texts is actually the Metaverse on the Blockchain 🙈

Posted Using LeoFinance Beta

Ah now it makes sense. But I thought God was the one from Wizard of Oz.

Now I am so confused. I better watch Ready Player One again.

Posted Using LeoFinance Beta

Your post is so spot on. BTC is already in a mini bull run.

Posted using LeoFinance Mobile

It all depends on how far you zoom in or out, right? ;)

Posted Using LeoFinance Beta

A mini bull run can hit resistance very easily. That is when it turns into a mini crash. lol

Posted Using LeoFinance Beta

What about a mini skirt?

I'm curious to know how much of it is from concerns that these exchanges are now being targeted and hammered for KYC and regulations and if people are backing out and now using other services instead. Those other services could come in the shape of swaps and defi protocols which would lead into a rather massive jump for those systems.

Posted Using LeoFinance Beta

This is an interesting angle which I didn't really think of.

I'm definitely of the opinion that centralised exchanges lose their dominance once DeFi truly builds out its infrastructure.

And RUNE is going to play a major long-term role here.

Posted Using LeoFinance Beta

I think they will but for different reasons. As I just wrote, I dont think most care.

Why DeFi will take over is the options. Look at HBD and HIVE. Not really accessible on the CEX. But if enough DEX pick them up, who cares?

Think of all the quality projects that will never end up on a CEX.

Posted Using LeoFinance Beta

I dont think most care if they are even aware. People will sign up and provide whatever is asked. Look at what they do on Facebook and Twitter. They dont care about any of that.

Posted Using LeoFinance Beta

I am bullish about BTC but I tend to think of large price swings more as a volatility indicator than anything. Less supply on the market means people can manipulate prices easier.

Posted Using LeoFinance Beta

Depending on how you look at markets, they all trade with a level of manipulation.

That's just part of a healthy, functioning market.

The key to smart trading is to make sure you're not swimming against the tide.

Posted Using LeoFinance Beta

There is also the futures market to consider. Big money players like Blackrock in there.

Posted Using LeoFinance Beta

I ve been hearing so much regarding this upcoming supply shock....and seeing so little impact that and many other factors made me put on my bear cap.

Posted Using LeoFinance Beta

You're the only bearish comment in this entire thread.

Smart money ;)

Posted Using LeoFinance Beta

And I am normally pretty bullish, but I am seeing an outflow of money, low liquidity and hardly any impact from a lot of positive news.... that turned me bearish at least for now but it will change....it might take 18 months but it will change!

Taking a contrarian view? That could work out well at times.

Posted Using LeoFinance Beta

!BBH

Posted Using LeoFinance Beta

I'd love to hear your thoughts on Bitcoin too :)

!PIZZA

Posted Using LeoFinance Beta

I agree with you. People HODLing will be good for the price. Also good for reducing volatility, perhaps?

If there aren't as many coins on exchanges to sell, then it could definitely be good for price.

But it could actually make things more volatile to the upside if demand far outweighs supply.

Things could actually go to 100K extremely quickly if people start buying and there are no sellers.

An exciting prospect!

Posted Using LeoFinance Beta

Of course, this increases volatility and if the sentiment is to sell, it will make it worse on the downside.

Everything is magnified then.

Posted Using LeoFinance Beta

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

PIZZA Holders sent $PIZZA tips in this post's comments:

@forexbrokr(3/5) tipped @fiberfrau (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Never felt more bullish on #BTC than these days. Mostly because #BTC was invented to solve the ever-growing issues with central banks controlling and dictating the money supply.

If this situation happened in 2017 #BTC would have lost 80% of its value in a few days.

Remember how the market reacted when the COVID19 pandemic got announced, #BTC dipped down to $3K and everyone felt insanely bearish. Not this time around though.

Higher lows on both weekly and monthly are a good indicator of how market feels about btc.

Posted Using LeoFinance Beta

Except they dont. It is the commercial banks that control the money supply for the major currencies. Not the central banks.

The latter can only plead and beg (or manipulate). But they cant for commercial banks to lend and that is how the money supply expands.

Posted Using LeoFinance Beta

Regardless, the central bank lends the initial money supply with some interests, meaning that a commercial bank already started with debt.

In order to cover the expenses (inherent debt), they increase their interest rates when lending money to either businesses or individuals.

FED does support a fractional reserve system (which isn't necessarily a bad thing if under control), meaning that they can predict (to some extent) how much money will get printed over a specific period of time.

Am I getting something wrong here?

Posted Using LeoFinance Beta

The discount window is basically dead. Banks arent borrowing from the Fed nor have they in a very long time. They are flush with cash and will continue to be as long as fiscal policy is to keep running increasingly higher deficits.

The banks are making money off the reserves the Fed "prints" and puts on the balance sheets during QE. This is where banks actually make money off the Feds action. There is over $4 trillion in reserves sitting at the Fed that US commercial banks own. The Fed is paying them interest on all of it.

Plus interest rates are set by markets, not the banks. Everyone looks at what the Fed does. Here is where the expectations management enters. The Fed says they will raise interest rates, the market moves them higher. The problem is there is not enough money in the economy to get the growth required to sustain the rate. Then the market wakes up and it drops.

Happened in 2013 and again in 2018. Count on the Fed to be wrong again on this one.

The Fed can try to predict but they have no control over lending. They can beg and plead but they cant force commercial banks to lend.

And this entire discussion only deals with US Commercial banking. It ignores what is taking place in the Eurodollar system. The Fed has been out of the money game for about 50 years since they realized they didnt even know what money was after the International Banking system started to produce whatever they wanted in the 1950s.

Posted Using LeoFinance Beta

Combine these technicals with what the on-chain metrics are showing us and there's certainly some nice bullish confluence :)

Posted Using LeoFinance Beta

Bull market by summer?

My body is ready.

Posted Using LeoFinance Beta

Not selling = bullish

Posted Using LeoFinance Beta

Ever?

Posted Using LeoFinance Beta

LOL... not now anyway

Posted Using LeoFinance Beta

I understand that Bitcoin has dropped a lot and honestly I don't like to invest in BTC my friend, I prefer to invest in DeFi, PolyCub, PANCAKESWAP, UNISWAP or any other DEX because I simply think that BTC is already at a very high price and is not worth the worth investing, at least for me. Your article is very good! BEER! LUV!

Posted Using LeoFinance Beta