Tethering Stable-Coin Liquidity

In the most volatile market that's ever existed, stability is a treasured boon. Issuing a stable-coin to the cryptoverse might seem like a trivial accomplishment at first glance, but when we really think about it, the logistics get quite complicated.

What's the big deal? All you have to do is put money in a bank and then issue your stable-coins 1:1 on exchanges so they are fully collateralized.

This is what most people think. Surely it must be easy for a stable-coin issuer to maintain a peg to the dollar because they have those dollars in a 'real' bank. How hard could it possibly be?

Going through the actual steps.

Step 1: Control an exchange.

The only way to issue a stable coin is to control a market that pairs said stable coin to a cryptocurrency. For obvious simplicity, we'll use Bitcoin.

So we have our exchange and we have our stable-coin paired to Bitcoin. Currently we have zero dollars in the bank because no one has purchased our coin yet. However, eventually users start buying.

Say a million units of our stable coin get bought. Now we need a million dollars in the bank before we get in trouble for breaking collateral regulations. No problem. Not only do we currently control a million dollars worth of Bitcoin from those who just purchased our stable-coin, but we also made money from exchange fees. In addition, we may have let the value of the stable coin slip a little high than $1. This tiny bit of slippage also nets us a tiny profit.

Okay...

But what we have now is Bitcoin and what we need is dollars in the bank. How does that work? If we have a BTC/USD pair on our own exchange... we could dump the Bitcoin on our own exchange to get the dollars... however, what if we drain liquidity too much and actually lower the value of Bitcoin? Then we'd lose money and open up the exchange to arbitrage traders.

Arbitrage

It becomes clear that if we want to get those dollars in the bank we have to make sure there is no slippage. These are razor thin profit margins and our business will fail unless we are the ones doing the arbitraging.

Rather than dump the Bitcoin solely on our own exchange we have to do it across all major exchanges that we have connections with. That way a single market won't crash and we'll get the maximum amount of dollars for our Bitcoin.

Finally

After getting all the ducks in a row we've figured out how to turn the Bitcoin we received from issuing our stable-coin into USD in the bank. It took some doing. We had to make friendly connections with several major exchanges and we had to make sure everything was square with our bank storing the collateral. In addition, we had to connect our friendly contacts to our bank. Who knew this stable-coin stuff involved so much work?

But wait.

Now that we've sold a few billion stable-coin units onto the market during the bull run, here comes the dump-truck bear market. Everyone is dumping our product like a bad habit. They don't want our stable shitcoin anymore. The peg breaks below a dollar a coin and we are at risk of losing our reputation as a stable asset provider. We must buy our own product back from the market using our dollars in the bank.

Hurry up asshole!

BTC just lost 50% in a single day!

Crap

That means we need Bitcoin again to buy back the stable-coin, but what we have are dollars in the bank. So now we call up the bank and ask for our money back so we can buy the Bitcoin. Too bad the bank doesn't have our money. They loaned it out to other people. Welcome to fractional reserve banking, asshole!

What do you mean you don't have my money?

Give me my money! Dillholes!

Tether

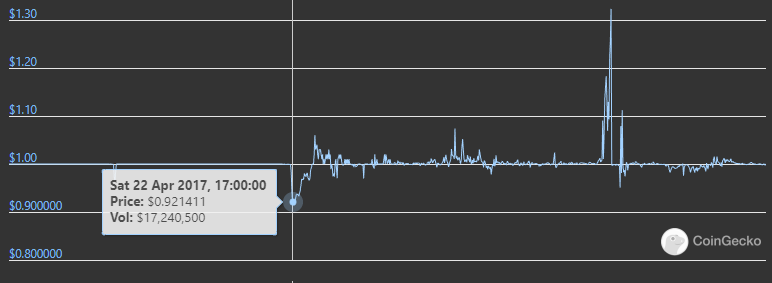

This literally happened to Tether in April 2017. They had to switch banks because the jackass bank they were using at the time did not have the liquidity to give them their own money back. The peg fell to 92 cents and they lost a lot of reputation.

The funny thing about this backwards situation is that they actually made good money in the short term. Users who dump Tether below the peg essentially just give free money to the stable coin provider. The same is true when they buy above $1.

Interestingly enough, when users do the opposite (buy below $1 and sell above $1) that helps the stable coin operator as well, as now the market is regulating their asset for them and they have to do less work. The key is demand. As long as the stable coin has DEMAND to be used (doesn't matter if it's buying or selling) then it has a lot of value.

But wait, part 2

Doesn't that mean that a stable coin can have demand in both a bear market and a bull market? Yep! It sure does! In fact, contrary to popular belief, stable coins have even more demand during bull markets than bear markets by a startling amount.

Tether has been accused of market manipulation several times over the course of history. Every time Bitcoin spikes, the number of Tether in circulation also spikes. Bitfinex was being accused of printing Tether out of thin air and pumping the market while running a fractional reserve (essentially margin trade gambling on debt). In retrospect, I very highly doubt they were actually doing this. One wrong move and they'd lose their entire business.

Bitfinex

It's far more likely that what was going on is that it was difficult to fully collateralize the Tether 100% of the time due to the logistics of getting that liquidity from Bitcoin into USD at the bank. Rather, Bitfinex has certain internal checkpoints requiring them to be 100% collateralized at the checkpoint.

Again, comparing Bitfinex's strategy with an actual bank, we see that what they've done isn't nearly as bad as what is allowed when maintaining a "real" fractional reserve banking establishment. A "real" bank doesn't even need to hold 10% of the assets they owe back to clients. In fact, during this recent state of emergency I recall hearing that banks were allowed to hold 0% collateral, and no one even seemed to make a big deal out of it. Insane.

Back to supply & demand

So it's weird to think about, but when someone dumps a stable-coin for Bitcoin, those stable-coins don't go away, they are simply owned by another person. The only reason those stable-coins need to be destroyed is if demand to use that stable-coin goes away (meaning no one wants them). Users trading stable-assets between themselves doesn't lower demand. In fact, this theoretically raises demand because the asset is actually being used more and exchange fees are being paid.

This implies that the stable-coin operator doesn't actually need to buy back their own stable coin unless the difference between the BTC/USD & BTC/stable-coin pairs is significant. In essence, as long as more USD is being dumped on the market than stable-coins, the stable-coins are actually gaining demand as the price goes up in comparison to the BTC/USD counterparts, forcing the issuers to print more, sell them on the market, and attain required collateral.

Pretty weird.

And also likely inaccurate, as the correct way to phrase that idea is this: more Bitcoin being dumped for the stable coin instead of USD raises it's demand. However, the market goes both ways, so again, it's just really weird to actually think of the liquidity logistics, especially when multiple markets and exchanges are involved in combination with supply/demand order books.

Example:

Say users start dumping our stable coin for Bitcoin. Is the value of Bitcoin going up, or is the value of the stable coin going down? What a mindfuck!

The value of Bitcoin is agreed upon via consensus. We aggregate data across multiple exchanges and average the result. Therefore, if lots of stable-coin is being dumped on one exchange but USD isn't being dumped on other exchanges, Bitcoin value is not going up, but rather the stable-coin is losing value.

All of this doesn't even take into consideration that the value of USD isn't actually stable. It fluctuates just like everything else, but these fluctuations are small enough that we just assume they are zero because it's the best anchor we've got. All these layers of complexity are not easy to parse on the grand scale.

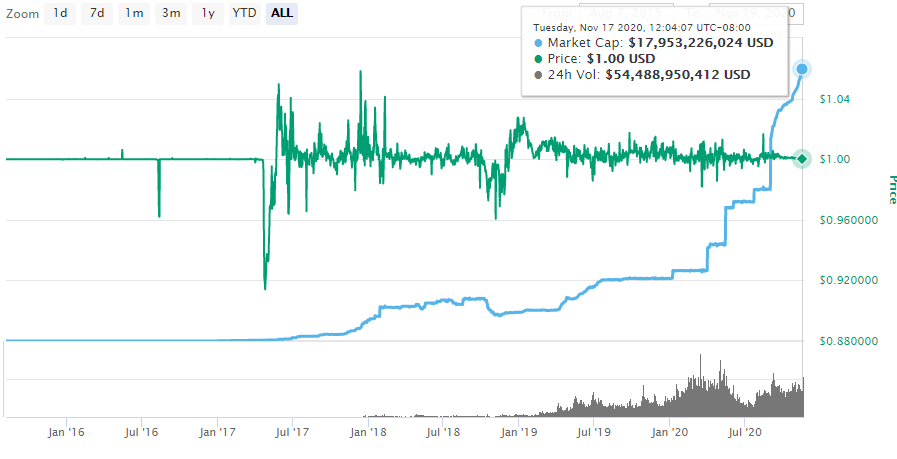

Looking at Tether all the way back to 2015, we see that the market cap has skyrocketed out of control. When we hit all time highs at $20k there was only 1 billion Tether in circulation. That's insane! Because now we have 18B Tether in circulation and we haven't even hit all time highs again. The level of support the market has today is leagues above where it was four years ago.

Speaking of x18 Tether issuance, how high would Bitcoin rise if it were to go x18 from where it is today over the next year? Right around $300k. What a coincidence that my target for Q4 2021 is around $280k. All roads lead to Rome, I suppose.

Conclusion

When there is a product or service we want to use, 99% of the time we don't care how it works. Stable-coins are no exception. As long as it works we don't care how it works, so it's easy to assume that making it work is a trivial process because the product itself is trivial. However, when we actually think about logistics, we can easily pierce the veil and see that they just make it look easy. It's much harder to accomplish than it appears from the outside looking in.

Even though it makes no logical sense that demand for stable-coins rises during a bull market and falls during a bear market, that's exactly what happens. It doesn't matter that during a bear market there is more need to avoid losses, because the demand lost by a dwindling market cap supersedes this concept, and vice versa.

Demand for stable coins is a great metric to see how much strength the market has. Last time Bitcoin was trading this high we had x20 less stable coins in circulation. This demand for stability ensures stability for the rest of the cryptosphere moving forward. However, as we've seen time and time again, seemingly without fail when this space gains stability the market spikes out of control and we lose it again. 2021 gonna be a crazy year.

Dedicated to @jrcornel :D

Posted Using LeoFinance Beta

Well, I did buy some tether at that time. Was an easy 8% ROI. Like the case we discussed yesterday,with the SBD or the HBD, buy them low and sell them over the peg value. This shall be one of the first lessons in crypto schools. But people are ignorant, and this is both a good thing and a bad one. Good as it is increases ROI, bad as they slow the mass adoption.

Posted Using LeoFinance Beta

Good

Haha well done! I was wondering if I was going to get the assist on this one! :)

non backed stable coins can kill the crypto market for a long time ( Trust wise, the price I'm not sure about).

Tether can be a single point of failure to crypto, besides the money laundering law suite.

HDB and SBDs' biggest problem is, these are not scaling to demand coins.

DAI looks for me good ( ofc there are problems too)

Posted Using LeoFinance Beta

HBD is an amazing product that we can make x10 better than DAI.

All we have to do is make a few changes...

which I have outlined to @blocktrades in detail

might need to pump HBD to fast-track the idea and make it a priority.

The reason HBD has a huge leg up on DAI is that this network is more than comfortable letting debt go underwater into the red and instituting the haircut rule. DAI has to scramble a lot harder to maintain the peg and the collateral.

I know and I agree. I like HDB/SBD more too in general. The problem is the 1$ area + you cant get enough HDB/SBD on a larger scale.

It needs some lock-up mechanic for Hive to generate HDB. But because it has at the moment no real use case and I don't see any in the next time, I would prefer to remove HDB with Author/curation rewards on Hive.

Sure it's only possible with some Social Media Tokens in place.

Posted Using LeoFinance Beta

I really like HBD's idea but I think because of a combination between irrational retail investors here and the marketcap fluctuations and the way rewards are distributed it has to deal with managing a lot of volatility by itself

Having an incentive the way DAI has to pull back capital to help rebalance the pool would be great, I remember when they tried that SBD potato thing I thought it was so dumb but okay to each their own.

I think more forces to rebalance are always better, like having HBD wrapped into a ERC-20 token listed with Curve finance where we put it in a pool with stable coins and it helps balance out the pool and we earn on the arbitrage by being a LP provider

Then there are things like having a USDT bridge and better market-making tools on the internal market, so people have a vested interest in profiting from the mismatches and keep the coin stable

Posted Using LeoFinance Beta

Can we actually say HBD and SBD are "stable" coins anymore?

LOL by name only I would say its a preferred range-bound coin if I was to make up a new marketing term for it

Would you recommend splitting up capital into multiple stable coins? or how likely do you think it is that tether could crash one day (I heard that pax or tusd etc. are better)?

No reason to put all your eggs in one basket. I use Dai myself. Unfortunately, even USD is under constant threat of collapse, which would obviously break all of them.