Refactoring Market Cycles

There are cycles and patterns everywhere.

They aren't always accurate and they are often rules of thumb that work out on average, but that's what gambling is all about: playing the odds and winning over time.

Now some people will claim that me turning bearish on the market yesterday and losing 4% was a bad play. It wasn't. It was a great bet and I'd do it 100 times if given the opportunity.

The problem with gambling is that those who don't know how it works think you can reverse engineer the outcome into whether you made a correct decision or not. Spoiler alert: if a slot machine loses 1000 times in a row, the chance of winning on the 1001st try is just as low as the first try.

So yeah, I lost 4% on my bet yesterday, but guess what? I was aiming for a 20% gain, so even if I lose that bet 5 times in a row and win on the sixth try, I've broken even.

Estimated Value (EV)

This is a term that all professional gamblers know. Estimated value is the number of dollars you expect to win on a given play. Anyone who bets on a slot machine (or any other casino game like craps or roulette), is accepting a negative EV.

The house always wins.

The only way to become a professional gambler is to net more positive EVs than negative ones over time. This is only possible in games like poker or if you're really really good at counting cards in blackjack (which gets you banned for life). There are also professionals who bet on horse races... which is insane to me... that is just flat out magic.

Also professional sports betting is a thing, but like horse racing, you have to know when the bookie is giving you good odds, which takes a lot of knowledge. Seeing as I don't care about sports or horse-racing these are arenas I would never even attempt to enter.

And then there is crypto and Technical Analysis, which is also a total crapshoot. But then again, if you're good at it, you only have to be right 55% of the time to make some serious money on average... just like in poker or any other gambling discipline. That 5% edge makes you a professional. A 10% edge is near impossible and makes you one of the top masters.

Get wrecked, noobs.

However, I've been here for 3 years and I am still learning the ropes. There are a lot of TA things I could be learning, but I'm trying to focus more on metrics that not a lot of other people are looking at. My Golden Goose is the Doubling Curve and my sidepiece is yearly market cycles.

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

The doubling curve is quite clear:

Bitcoin isn't even worth $14k yet, but we are trading at $34k. We are obviously bubbled. That being said, we are also in a mega-bubble year were Bitcoin can easily go x10 above the curve. Who am I to say that won't happen in the near future, especially considering all the corporate adoption and absolutely insane volume?

Bitcoin could easily spike to $150k in a few months.

But I don't think it will. It's funny, because when Bitcoin is traveling exactly on the doubling curve for months people read my blogs and think, "Yeah, that makes sense... cool," but then when we spike well above the curve there's always an excuse to be made about why it's never coming back down to Earth. And I thought I was a crypto permabull.

I was reading an article yesterday about how Andreas Antonopoulos thinks the economy is going to be in trouble during February and March due to COVID and the failing economy. He also shames those of us who bet for disaster, thinking this will boost the value of Bitcoin in the wake of centralized incompetence and greed.

He said this last year as well, and my brain went: LALALALALLALALAL I'm not listening!!!!1 I told everyone the Doubling Curve was GOD and to all in right before BTC crashed 50%... and some of you listened to me. If I had just been paying attention to people who knew what they were talking about and looking at how badly the Trump Admin was dealing with COVID I would have doubled my money instantly. Instead I was absolutely convinced that a pre-halving pump/dump was coming when all of the real-time evidence pointed elsewhere.

Mad cause bad.

u mad? Mad cause I said buying Bitcoin at $8k in March was a steal deal? Probably not if you held it this whole time, amirite? Sitting at x4 those prices... like a boss.

Cycles

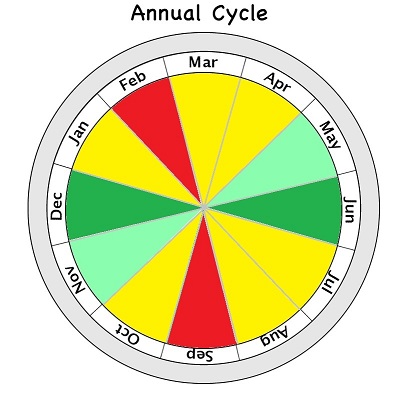

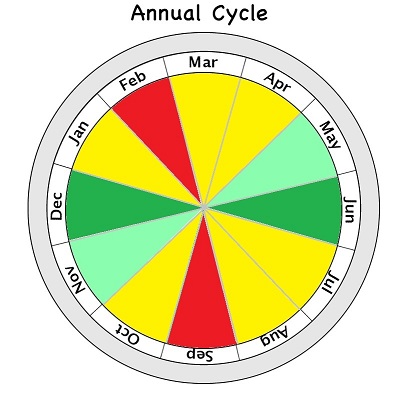

These cycles are just guidelines, and sometimes they are wholly inaccurate. In general, Q2 and Q4 are good to the economy, while Q1 and Q3 are crap. It doesn't always work out that way but it does more often than not.

REFACTOR!!!

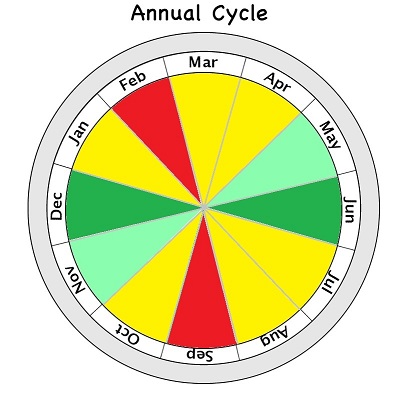

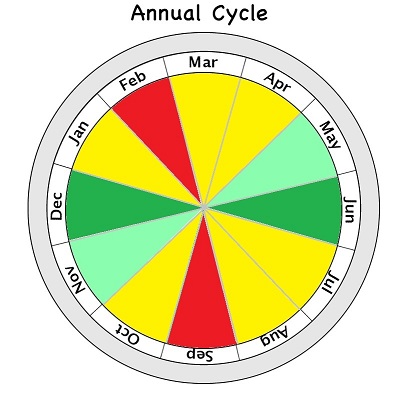

However, now that I've been here for two extra years and learned a lot along the way, I've been able to refactor these market cycles to much better reflect how they pertain to crypto specifically:

This is my new cheat sheet, and I think it's looking pretty sexy. I went back and looked at all the history, and I feel like this cycle pie graph most accurately encapsulates the cryptoshpere as it pertains to BITCOIN price-action... because let's be honest: Bitcoin is by far the easiest asset to predict in this space, and it would honestly be silly to try to gamble on anything else but the big dog. This is especially true when one considers the ability to short/long the market and trade with debt to increase risk/reward scenarios. There is no reason to gamble on any other asset when you can just increase the volatility of Bitcoin itself.

So what do we see here?

We see that February and September are much more accurately represented as my buy months. Go back in history and try to prove me wrong. On average, there is at least one point during these months where an amazing buy opportunity opens up. This is true all the way back to 2013 when the doubling curve really begins taking it's shape.

What about before 2013?

Something I never show are the years before 2013 because the doubling curve is not accurate while Bitcoin was a sapling before the first halving event. In fact, Bitcoin had to catch up to the doubling curve for 4 years because the network had no idea what it was worth.

Pre-2013 Bitcoin Doubling Curve

| 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|

| $3.125 | $6.25 | $12.5 | $25 | $50 |

Using this metric, we see that 1 BTC was actually worth more than $3 the day the network was launched. Can you believe what it would have been like if people actually knew that? LOL.

I remember when Bitcoin hit $1 parity and everyone thought that was pretty hot shit. :D IMO it was worth more than that immediately after launch due to the first ever network to solve the Byzantine Generals problem... something that was previously thought impossible from 2009 all the way back into the 70's.

Imagine someone solving a math/network problem that wasn't solved for decades and not investing in that solution... we all did it. Oops... well, we're here now, and we're still way ahead of the adoption curve. Got in even before the corporations did. Like a boss.

Bitcoin will never be: "Too Expensive"

That's not how currency works.

1 BTC = 1 BTC

1 sat = 1 sat

Back to the chart, Feb and Sept are very good buying months. September is better than Feb because the strongest bull runs are in Q4. This makes Feb insanely choppy and hard to trade during a bull run (which we are in now). Doesn't mean I'm not going to try.

Another reason Feb is a good time to buy is because of Chinese New Year. This upcoming new year (February 12) is the Year of the Ox!

Can you believe it?

2021 is literally the year of the bull? LOL! Perfect timing!

The irony behind this is that I'm betting the markets are going to crash hard, as they often do during February. Turns out, China spends quite a bit of money during new years to the point that it can drastically affect world markets.

Perhaps, like me, you remember 3 years ago when the bull run was crashing into the dirt in February and April. Everyone needs a reason for why the market bleeds, and the answers given are usually Chinese News Years in Feb and taxes in April. Personally I think it's all bullshit and the markets are just deflating and dead-cat bouncing at regular intervals after a huge pump... but you never know.

https://cryptobriefing.com/chinese-bitcoin-miners-hesitant-trade-otherwise-business-usual/

- Cryptocurrencies are currently trading at a discount of 2% to 3% in China.

- Bitcoin miners and traders are hesitant to use OTC platforms because they fear getting their accounts frozen by the government.

- Nevertheless, sources have confirmed that the crackdown is not crypto-related and hasn’t affected business in China.

Now here is some interesting information given to me by @nealmcspadden. It looks like Chinese miners are having trouble selling Bitcoin because of regulation crackdowns on over-the-counter markets at large. Cryptocurrency isn't being targeted, but the means by which Chinese crypto miners sell Bitcoin to pay the power bill is being targeted. Will the market crash when Chinese miners finally get to sell their Bitcoin? Maybe! Will it happen by Feb/March? Maybe!

COVID and Regime change.

I will not ignore Andreas Antonopoulos' advice this time around. If he says we are due for some hurt at the end of Q1, I believe him this time around. Not only does it make sense in terms of the COVID emergency, but it also makes sense in terms of traditional market cycles. In my mind there is absolutely no way this parabolic run can sustain itself come February.

There's also the issue of the Kamala administration taking power. I know I sound like a broken record, but this is going to cause irrational and emotional trades to get logged on both sides of the spectrum. Clearly, the local peak of Bitcoin will be sometime in January... BUT WHEN!?!?!?

DCA (noob)

Rather than doing what I am doing (all-in min/max glass-cannon mega-gambling) anyone who wants to take profits during this time should just sell a little bit every so often. You probably can't go wrong selling off 1% of your assets every day until the end of the month. That way you still have a ton of crypto in the bag and you've got some fiat leftover to try and buy back in when this thing inevitably crashes into the mountain.

What if it doesn't crash back into the mountain? Who cares? You only sold, what? 30%? What happens if world peace is declared and all the greedy institutions suddenly become trustworthy? Is that a future we need to hedge against? Probably not. Just like you don't need to hedge against Bitcoin continuing the parabolic move if you're already holding some. Given all the evidence and the state of the economy, the chance of a sustained parabolic move during some of the historically weakest months of the year is pretty low, even considering that 2021 is a mega-bubble year.

Bull runs will often start in April and October, and by the time we get to May/November they are in full swing and usually don't cap out until June/December.

April

If we look at the history, April is usually an amazing month to buy in. The beginning of every big bull run seems to start in April, which is absolutely incredible when you think about it because how can both Winter and Summer bull runs start in April? That's just really weird... however, go look at a Bitcoin chart and see for yourself. The month of April is literally always an amazing month to buy in.

The only really big problem with April is during the wake of a mega-bull run. All you get is a dead cat bounce, so it's a good time to swing trade the peak but it's not always a good time to buy in and hold. Looking back at April 2014 and April 2018 there were amazing dips one could buy in on and dump a month later for a nice profit, but if you held longer than that it becomes just worth it to wait until the price returns to the doubling curve.

July/August

These months are total wildcards and very heavily depend on what's happened recently given Bitcoin's price in relation to the doubling curve. They tend to be okay months but the price is winding down after the peak in June. These months can be fun for day/swing traders, but for the most part it's best to just say away from them and buy in during the bottom in September.

March

This is one of the craziest most unpredictable months out there. As COVID showed us, even buying when the price is on the doubling curve is risky. It's best to stay away from this month and not try to trade it at all IMO. It is traditionally one of the most bearish and disappointing months out there, but if you wanted to sell you probably should have done that back in January.

Oct/Nov/Dec

These are the best months of the year. They are so predictable and good. Just look at where we are at now and back at 2017! Seriously... amazing months.

Now you might be saying, what about 2018? That year sucked! Also 2015 was downright horrible! How dare you! Yeah well, that's how it goes, because a year after the mega-bubble the market is still deflating and you hit rock bottom during this time. It's a great time that the price hits the doubling curve and it's safe to buy back in. All in all, these are the most predictable and friendly months of all time for traders.

January

Total wildcard. Usually the top has blown off the mountain by this time and we are violently trading sideways waiting for the market to crash from total instability. This year due to all the unprecedented circumstances and actual institutional adoption, we are still going strong it seems.

The year after a mega-bubble... January is usually trading right on the doubling curve and it's super safe to buy in. During the middle of a raging bull run it's a really fun time for risky day/swing trades. I believe this recent volatility may have signaled that either the top has blown off the volcano or the "two weeks to peak" countdown has just started. We might see some real fireworks over the next two weeks.

Economic Wildcard

Anything could happen on the drop of a dime. Trump could declare martial law (not really but hey you never know). Natural disaster could strike. Lockdowns might seize the economy. Any one of a hundred financial mechanics could fail and cause a domino effect that wrecks the economy. We are in extremely uncertain territory.

All that being said I think it's pretty obvious that I think we should all be shorting February this year and attempting to buy back in at the low. Looking back at the 2019 bull run it took an entire 6 months for that to deflate back to the doubling curve, so it's quite possible that we are in for some serious chop over the coming months.

Because this is a mega-bubble year, we need to be very observant of what the market is doing if we want to successfully trade it. If the volcano blows it's top and we are trading sideways for six months, I think summer is going to be a really bad time for the market and the huge run we've been expecting in Q4 2021 could be pushed back to Q2 2022. This would fit the pattern of entering a bull run every 18 months that we seem to be falling in line with these days.

However, if we get massive volatility but continue dipping at higher and higher lows over the course of the year, the mega-bubble is probably just getting started and we can probably expect something crazy in Q4. Just have to play it by ear. As always, it's fun to speculate, but we'll probably just make more money if we simply hold or dollar cost average during the good/bad months.

Conclusion

Considering the current strength of this market, it looks like $50k is fully within reach during the next two weeks. A 30% retracement from there takes us back down to $35k, which is obviously still super high so I'll have no idea what to do.

When all else fails: HODL

Posted Using LeoFinance Beta

Pretty cool interpretation of the entire Bitcoin season with us being in a wildcare January. And that is quite true because while I think the current price is over what we anticipated, it can go even higher and higher. At this point the price of Bitcoin is like the price of Tesla - there isn't a clear mathematic reason at this point in time to sustain the price, but it keeps on rising. What we can do is just HODL and see it unveil if we aren't too keen to take some profits at this point.

Posted Using LeoFinance Beta

I absolutely love your last line and I am just going to hold on for dear life and watch the Bitcoin holdings that I have gained interest and continue to leverage that for more Bitcoin.

I'm definitely not going to sell any and my two cents worth of bitcoin has more than doubled now. Actually I got in at 9700 from my steem.

I bought a bunch of Hive and then our currency drops to the floor however my overall numbers means that my interest compounding is going very well and I can just sit back and hopefully one day our price will come back.

However I've got all the cryptocurrency from playing around on the internet! so thank you and other people for educating me and enabling me.

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

Go on, don't stop. I would like to frame this article and save it as my desktop wallpaper. This is a kind of article I am looking to read where a noob would find something interesting to collect from the experience customer. Keep that juice flowing. Thanks :P

And, amazing photograph to depict the seasonal cycle of crypto. Wow.

Posted Using LeoFinance Beta

ok i read some many times about the February drop here, that i am not spending any money until then to try and buy some on a discount :D it would be nice to have at least 1/4 of a btc :)

Are we going to test 17k again in the upcoming months? watching current market it looks like impossble let's see how things play

I think $20k is pretty well defended.

To be honest I think you get way too caught up in timing. Anything and everything can throw just about everything you said in this post off. That means all your time and planning was wasted. The simplest thing to do is look at past patterns and decide a price target for yourself. When it gets there you execute your plan. Everything else is just noise. For me I've decided, based on past patterns, we are going to peak late in 2021, I'm not going to try and time any of the other smaller dips along the way. It's literally dangerous to my financial health.

Eh, I'm just trying to play the odds. Pocket aces is the best hand in Texas Holdem. Doesn't mean I win automatically when I'm dealt them. This is a game of averages.

That is a good point... there are no guarantees. As long as bitcoin keeps tracking what it has already done and as long as it has so many macro tailwinds, timing the dips is a very tough game to play. I've already lost some bitcoin by thinking it was overbought and took some off the table, I was never able to get it back in, and that was like $10k ago now... :)

Yeah I might have to wait for the $40k-$50k range before I know "for sure"