Never look a gift tax horse in the mouth.

The saying "don't look a gift horse in the mouth" means that you shouldn't criticize a gift, even if you don't like it very much. A gift horse, in other words, is a gift. ... The idiom itself probably stems from the practice of determining a horse's age from looking at its teeth.

So I was looking up the gift tax exemption for 2021 because... you know... I might be a millionaire by the end of the year. Fingers crossed. I've always been dirt poor... so it's possible I may be looking to pay back all my debts and fork out some massive gifts, given the best-case scenario. I guess we'll see.

So the last time I was looking at this tax exemption I remember it being something like $12,500. Which is interesting because it's never been $12,500.

https://resources.evans-legal.com/?p=3627

| Year | Estate Tax Exclusion | Estate Tax Initial Rate (Above Exclusion) | Estate Tax Maximum Rate | Gift Tax Annual Exclusion |

|---|---|---|---|---|

| 1977 | $120,667 | 30% | 70% | $3,000 |

| 1978 | $134,000 | 30% | 70% | $3,000 |

| 1979 | $147,333 | 30% | 70% | $3,000 |

| 1980 | $161,563 | 32% | 70% | $3,000 |

| 1981 | $175,625 | 32% | 70% | $3,000 |

| 1982 | $225,000 | 32% | 65% | $10,000 |

| 1983 | $275,000 | 34% | 60% | $10,000 |

| 1984 | $325,000 | 34% | 55% | $10,000 |

| 1985 | $400,000 | 34% | 55% | $10,000 |

| 1986 | $500,000 | 37% | 55% | $10,000 |

| 1987-1996 | $600,000 | 37% | 55% | $10,000 |

| 1997 | $600,000 | 37% | 60% | $10,000 |

| 1998 | $625,000 | 37% | 60% | $10,000 |

| 1999 | $650,000 | 37% | 60% | $10,000 |

| 2000-2001 | $675,000 | 37% | 60% | $10,000 |

| 2002 | $1,000,000 | 41% | 50% | $11,000 |

| 2003 | $1,000,000 | 41% | 49% | $11,000 |

| 2004 | $1,500,000 | 45% | 48% | $11,000 |

| 2005 | $1,500,000 | 45% | 47% | $11,000 |

| 2006 | $2,000,000 | 46% | 46% | $12,000 |

| 2007-2008 | $2,000,000 | 45% | 45% | $12,000 |

| 2009 | $3,500,000 | 45% | 45% | $13,000 |

| 2010-2011 | $5,000,000 | 35% | 35% | $13,000 |

| 2012 | $5,120,000 | 35% | 35% | $13,000 |

| 2013 | $5,250,000 | 40% | 40% | $14,000 |

| 2014 | $5,340,000 | 40% | 40% | $14,000 |

| 2015 | $5,430,000 | 40% | 40% | $14,000 |

| 2016 | $5,450,000 | 40% | 40% | $14,000 |

| 2017 | $5,490,000 | 40% | 40% | $14,000 |

| 2018 | $11,180,000 | 40% | 40% | $15,000 |

| 2019 | $11,400,000 | 40% | 40% | $15,000 |

| 2020 | $11,580,000 | 40% | 40% | $15,000 |

| 2021 | $11,700,000 | 40% | 40% | $15,000 |

Alright so the answer I was looking for was $15k, a bit higher than I was expecting... cool. So anyone can give $15k to someone else without having to worry about the tax implications.

https://smartasset.com/retirement/gift-tax-limits

However, for some reason, I was compelled to keep reading.

There ended up being a lot more information here than I had ever realized existed.

There is also a lifetime exclusion of $11.7 million.

$11.7M? What?

That's a weird number... but what does it means?

Turns out that this gift tax is actually linked to your estate tax when it comes to inheritance. After all... your inheritance, as it turns out, is legally a gift. Zombies do give gifts after all!

This is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit.

Yeah yeah, whatever!

I already knew that. What I didn't know is what happens when you go over the limit... because lol... that was so far out of the realm of possibility, why would I even bother to figure that out? But now I live in crypto land where anything is possible. So here we are.

If you gift more than the exclusion to a recipient, you will need to file tax forms to disclose those gifts to the IRS. However, you won’t have to pay any taxes as long as you haven’t hit the lifetime gift tax exemption.

LOL... what?!

The $11.7M lifetime gift tax exemption? That one?

WHAT?!

Yes... every time I do research on tax law my mind gets blown. Taxes are so obviously a scam. The rules only exist so that players who know the game can jump ahead of everyone else.

So many people are running around out there thinking taxes are of the utmost importance so that we can pay for infrastructure that everyone needs. The advent of crypto in combination with the recent economic fallout prove otherwise.

If a community needs to pay for infrastructure that everyone uses but is not profitable to the developer: you simply print the money out of thin air and give it to the developer. The FED is doing it right now (quantitative easing). Hive is doing it right now (proposal funding and block rewards). Taxes only exist to strengthen the dollar so that more value can be syphoned off the top without the system collapsing.

But that doesn't matter, does it?

Because if you don't pay your taxes the men with guns come to your door and throw you in a cage that is ironically paid for by: taxes. All hail the Great Satan! He's got a pretty dark sense of humor but we love him anyway. We all love our Big Brother.

Wait, where was I?

Oh yeah...

Most taxpayers won’t ever pay gift tax because the IRS allows you to gift up to $11.7 million over your lifetime without having to pay gift tax.

YA DON'T SAY! lol

And that $11.7M doesn't even count the $15k you can give to as many people as you want every year.

So apparently what's happening here is that every time you go over the gift tax limit, your estate deduction dwindles by the same amount. So if I gave $40k to someone this year, $25k would be deducted from my $11.7M estate tax deduction. Then when I die or whatever only $11.675M would be untaxable. Pretty... weird.

In almost every case, the donor is responsible for paying gift tax, not the recipient. A recipient will only pay gift tax in special circumstances where he or she has elected to pay it through an agreement with the donor. Even though recipients don’t face any immediate tax consequences, they can face capital gains tax if they sell gifted property down the line.

I thought this was particularly interesting as well, because I figured the person who received the gift was responsible for paying taxes on it... NOPE! However, if I gifted crypto and then the crypto gained value, that would create a capital gains tax, which is annoying but expected.

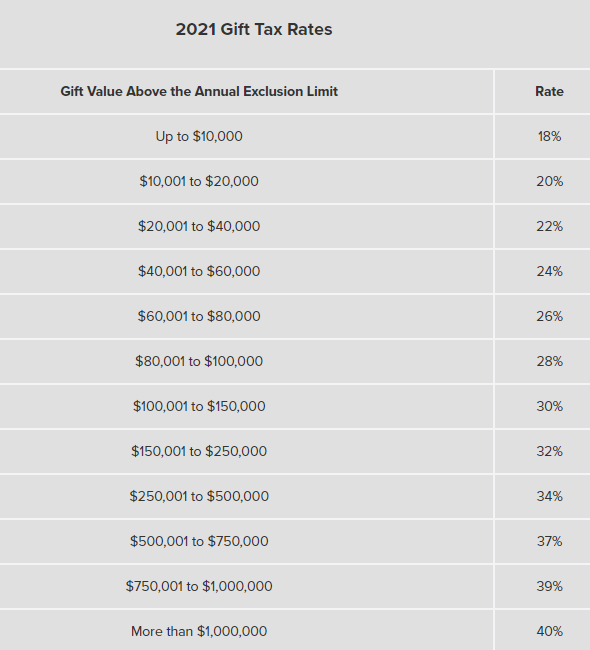

Gift tax has brackets just like income tax.

However, I feel like these tax brackets very much confuse the issue, because you'd have to give away over $11.7M in your lifetime for them to even apply. Seems like so much red tape for a rule that applies to so few people. Is what it is I guess. The legal system is a swiss-cheese loophole piece of subjective arbitrary garbage. That much is obvious.

Also, you'll notice in the table at the top of this post that the gift tax exclusion used to be $3000 from 1977 through 1981 until it was bumped up to $10k, and didn't start moving up from $10k until year 2000. Also the maximum estate tax since that time has dropped from 70% to 40%, which is an insane reduction. It should be no surprise that the rich have been getting taxed less and less over time, because the rich are in charge of this system and this gift tax clearly only applies to rich people (top 0.1%).

It's also crazy to see the lifetime Estate tax exclusion increase from $120k to $11.7M over the course of 44 years. Is that the result of inflation or the result of rich people getting out of paying taxes? Likely a bit of both. Google claims that $1 was worth $4.53 in 1977, which is only a factor of x4.53, while the estate tax exclusion factor has risen x97.5. Wow... pretty wild. That's a difference of x21.5 less inheritance tax after inflation has been accounted for.

The federal government will collect estate tax if your estate has a value of more than the federal estate tax exemption.

You can only exempt your estate up to the amount of your remaining lifetime gift tax exemption.

I can't stress enough how weird it is to see that your inheritance will be taxed more if you gave more money away when you were alive. I find this so incredibly strange... but I guess it makes sense? Just didn't realize the law worked like this. This clearly implies that legally, inheritance is a gift, which again makes logical sense but I just thought it would be its own separate thing.

All of this means that one way to prevent taxation of any assets you pass on is to gift those assets in increments of $15,000 or less. This could take some planning on your part but it is completely legal. There are also some gifts that you never have to pay tax on.

There are also some gifts that you never have to pay tax on.

Tell me more.

You can give unlimited gifts in these categories without facing a gift tax or having to file gift tax paperwork:

Anything given to a spouse who is a U.S. citizen

Anything given to a dependent

Charitable donations

Political donations

Funds paid directly to educational institutions on behalf of someone else

Funds paid directly to medical service or health insurance providers on behalf of someone else

LOL political donations are untaxable?

Of course they are... Christ.

Right up there with Charity.

So if you keep it in the family (wife and kids) it's untaxable. If you pay for school or medical bills, it's untaxable. Charity or politicians? Untaxable.

Now I see why people make such a fuss about political donations. You could literally buy a politician, have them in your back pocket, and not even pay taxes on the transaction. LOL! Pretty wild!

Also imagine the people who control charities (and church tax exemptions are even more insane)! So easy to make backdoor deals and create a black box of money flow that the federal government can't touch.

If your spouse is not a U.S. citizen, you can only give him or her $157,000 each year.

RATS!

Only $157k?! PSH!

Lastly, it’s important to note that charitable donations are not only exempt from gift tax, they may also be eligible as an itemized deduction on your individual income tax return.

Which is why when a corporation says, "Oh look at us we're so generous for donating to charity," they are absolutely full of shit and doing it because it's a massive tax write-off and they get to capitalize on public sentiment at the same time while selling their product. Definitely worth a closer look some other time.

You should complete Form 709 anytime you gift in excess of $15,000 – even if you’re within the $11.7 million lifetime limit. You’ll have to file a Form 709 each year you give a reportable gift, and each form should list all reportable gifts made during the calendar year.

Summary:

The IRS allows every taxpayer is gift up to $15,000 to an individual recipient in one year. There is no limit to the number of recipients you can give a gift to. There is also a lifetime exemption of $11.7 million. Even if you gift someone more than $15,000 in one year, you will not have to pay any gift taxes unless you go over that lifetime gift tax limit.

Analysis

This entire process was far more involved than I expected. I learned a lot of random facts. The most important of which is that gift tax is intrinsically linked to inheritance tax, the giver is responsible for paying taxes (if any) on the gift, and political donations are untaxable (yikes). But even if you go over the limit... you don't have to pay taxes on gifts until you breech $11.7 MILLION DOLLARS. That's crazy.

Why does this matter?

Because crypto is pure insanity. That's the short answer. Using crypto, we can create a community. Using a community, we can create LLCs (limited liability corporations), charities, politicians, lobbyists, and even churches. All of these legacy tools can be used to avoid, bend, or break tax laws (legally... and profitably illegally even if caught).

Once you add crypto to the mix of tools that can be used to bend and break this system, the options become limitless. Imagine funneling money through a church using privacy coins like Monero. LOL. Imagine all the tax write-offs and deductions we could make with access to an LLC that also controls a charity behind closed doors.

Add DEFI to that.

Add stable-coins to that. Add meme tokens with thin liquidity; taking fake losses in the 'billions' on paper without actually suffering a real loss; right at the end of the fiscal year. Add all the tricks used to turn short term capital gains into long term capital gains. Long and short positions... wash trading... "stock" options... there are so many tools that we are not using yet that it's actually unreal when you start to unpack it all.

Add decentralization to the mix. You can give away $15k as a gift every year untaxable? Give everyone in the community $15k. Leverage that money for other projects. You can pay 0% long term capital gains up to $40k a year? Yet another exploit when considering a large group of people working together.

Bleed them dry!

What happens when we tell our people to max out all their credit cards and take out as many personal loans as possible, only to funnel the money into Bitcoin/Monero (perhaps even through the "church") and have them drop off the grid, or better yet just pretend the money is gone (boating accident) and declare bankruptcy? Did you think I was joking when I said a war was coming? This is a financial war, and the dinosaurs need to be bled dry.

Go farther; push harder. Hire lobbyists to constantly hammer politicians with demands. Play the game; buy them out; change the law in our favor. Protect all of our citizens with the full power of the best legal teams. Deconstruct the surveillance grid. Decentralize the Internet.

Force them to legally accept that cryptocurrency is currency.

It won't be hard to beat the dinosaurs at their own stupid game while at the same time winning at the new game as well. They are old and lazy and fat and not prepared for any kind of fair fight. They've been winning the easy fights against figurative economic children their entire lives. They won't know what hit them. Like a Mack Truck to the face.

Conclusion

Kill 'em all! ... In their pocketbooks.

The next revolution won't be won with weapons.

It will be won with money.

It will be won by destroying the very concept of intellectual property.

It will be won by giving the means of production back to the people where it belongs.

Please sir you are a gift. Sirs should not tax a sir like you. Gift tax is crazy how sirs can be nice to other sirs for free without most sirs knowing this. To the moon sir so you pay no tax 😁

Posted Using LeoFinance Beta

This is absolutely proves how taxation really is theft and by knowing the rules you can get away with making money.

Sounds like you can really weaponize this knowledge and if we keep growing each other and investing in ourselves... There will be some big things happening.

Yes the first part of the comment.

And yes to the second part, together we can achieve so much more.

Posted Using LeoFinance Beta

Absolutely this is the reason why the big huge banks are getting very scared of us especially when we are building so much influence and making money doing it.

I knew that taxation was theft after I moved to France. You have 15 slots where they take money off your pay stub, not including taxes. There are at least 5 that nobody understands. You pay rental tax on the apartment you rent, TV tax, radio tax if you play music in your business. I once was slammed double taxed from one year to the next, and I'd earned less money😏 I worked full time, minimum wage (like almost everyone over there) and I couldn't even afford to eat. And you also pay tax on your inheritance. Then in the south if you have a restaurant the mafia comes to tax you lol🤣🤣😅 And most state employees never pay for anything let alone politicians. Their entire lives are free of charge😑 I left🏃♀️💨💨💨

Wow, that sounds crazy.

Posted Using LeoFinance Beta

It was totally insane. That's why they steal and mooch a little bit of this and a lot of that. For them it's normal😖😬

You should write a book mate. You are good at entertaining… plus then just ask for donations, or make it public and ask or not for donations,, damnn is this it? 😆 dope

😂 seriously, you’re good at this.

My last date looked like a horse. I looked into her mouth with my 3rd eye.

Posted Using LeoFinance Beta

You wrote that there is no limit to giving to dependents. On top of that, if you have a home-based business, you can deduct a little more than $6000 per year in wages paid to a family member. So, that's a chunk off of your gross income. Of course, the kid has to do something business-related to earn it.

Posted Using LeoFinance Beta

Cool additional knowledge.

Posted Using LeoFinance Beta

The law maker must be fed some real money for making such law and order. I don't know why Govt. put the funding to politician or even Charities Untaxable .As we know These are primary zone to manupulate the system of taxation . I have read many articles where politician break the formation of taxation through donating billion dollars to charity but only on paper record. The inside story goes absolutely scary because all these fund go back to their anonymous fund managing account.

No wonder Crypto still not lagalised in major countries because all the transaction will be recorded with time stamp which help to empower and reform economy whithout stolen of fund and tax.

But $3000 in 1977 is worth more than $15,000 in 2021

You look a horse in the mouth to determine age, health and what the horse has been eating.

Convert the crypto to ARRR

tell the Infernal Revolting Syndicate that you lost your Trezor in a freak boating accident while visiting your cousin, nephew, best friend...

Make a corporation. (trust)

Give it some of your crypto.

Get your sister (or other relative) to give the corporation their house.

Have corporation pay off the mortgage.

What a nice plan.

There is also a legend about some old dude that didn't accept a horse as a gift. When he was asked why he said he doesn't take gifts he has to feed..

I like this plan. All upkeep, real estate taxes and insurance become deductible too.

Posted Using LeoFinance Beta

Very true and I agree with you on this one @edicted

Glad that you are one of the few people who also get why the gov is always so concerned with taxes when they can theoretically print money with ease. Taxes are the money sinks that fight inflation which is why I consider MMT the full power of fiat.

Inflations hurt their power to print hence taxes for the fed gov.

State/local gov taxes make a bit more sense on tax fights as they don't have the money printer but at least those are a bit more controllable(Easier/move away from type things).

I am not sure how long people can take fake losses since I think I saw some headlines about they removing the wash rules for next year.

Posted Using LeoFinance Beta

You are misinterpreting the wash trading rule and I didn't explain myself very well. The wash trading rule only means you can't buy back the crypto immediately after selling it (you must wait 2 months before declaring the loss). This is the standard for securities and the stock market. It's not a big deal and it's a law that makes perfect sense.

Imagine this scenario:

Me and my friends made too much money in crypto this year. We need to find a way to take a big loss to offset all those winnings and avoid taxes. So we boot up a meme token that we control and give a premine to a third party we can trust (or even better a smart contract / bot).

Now, we dump all the money we want to lose into this meme token and the bot dumps on us December 31st (or we simply take away the limit buy orders and crash the market without dumping any tokens), and we lose exactly as much money as we need to for that fiscal year. Now we legally owe $0 in taxes because we made no money on paper.

On January 1st the bot relists the limit buy orders and anyone with the meme token can now dump at full price and get their money back at any time. Anyone who waits an entire year back to December 31st can now turn all those short-term capital gains into long term capital gains and pay 0% taxes up to $40,000 (and only 15% from $40k to $400k).

This is something I thought of off the top of my head. Imagine what kinds of tricks could be invented with experts in the field helping me and actually taking this seriously. The solution above can't even be defeated with this plan to employ unrealized tax gains on crypto users, because there are no gains to tax, and by the time they are taxed they turn into long-term capital gains. This is just one of dozens of possible solutions to these tax issues.

In Finland, it is apparently 5000€ over 3 years.... :D

Murica!

I guess... we have healthcare. :D

Aren't your taxes like absurdly high in order to subsidize said healthcare?

Kinda sounds like you're paying for healthcare.

Nah, I discovered recently that people in the US pay about the same in tax, often a little bit more. It is strange - US seems to be a blackhole for tax. Free (tax) health and school (including university) here, same tax.

Sounds about right.

…saving this one for later. For a friend of course…

Posted Using LeoFinance Beta

The reason the tax system is structured like this is because it's hard for the IRS to track gifts, so they figured, why don't we make this a tax exemption and act like we are being benevolent?

Income tax is different, it's easy to collect as it is deducted through payrolls, so that is what they go after.

That's it, I'm starting a church where all tithes are accepted in privacy coins... Supporters get 99.9% of their tithes back in "new" privacy coins. The hilarious thing is, you could set up a bot to run the whole operation. Pay 0.1% tax instead of 20%.

Posted Using LeoFinance Beta

Ah see, now you're getting it :D

Haha nice, isn't crazy how you can go look up one thing in the tax code and it takes you down a forever path of exemptions, rules and criteria. This is why I pay a good accountant these days, used to try and do all this myself.

Posted Using LeoFinance Beta

Too real.

Yep yep, book-keeper for years, but an accountant for sure this year.

Posted Using LeoFinance Beta

I don't regularly read things out loud like I just did.

Lol! That's crazy!

Over here (The Netherlands) parents can gift about 7000$ a year, kids to their parents 3500$ a year. There's a one time exemption but it has to be for a certain 'spending goal', like a study or house, and you can give (one time!) about 60000$. Other than very small amounts per year, and only a one time exception for a bigger amount, I don't see a max amount of times or other limit within which you can gift.

All taxes are dependent on your relationship with the gifter/deceasedm, but to keep it simple, let's talk about gifting your inheritance to a partner:

First $700k is 'untaxed'.

Quite simple brackets actually.

But since I can only give a few thousand dollars per year I guess I'll have to actually cook for my friends and family to make 'em happy :D

Cool graduated tax, very simple.

Posted Using LeoFinance Beta

Nice analysis of a complex topic (tax rules) related to what should be a simple issue (being charitable toward others).

Here's an interesting factoid that is relevant (if you are trying to figure out better ways to give more of your money away):

If you are married and the person you are wanting to give a gift to is also married, then you can actually give $60k per year.

This is because

BTW, the above is not tax advice. Just an observation. Consult with a tax attorney before giving away large sums of money.