Market Watch:Out For February Cycle!

Appearances can be deceiving!

https://twitter.com/TheCryptoDog/status/1344800740460531712

If you read some of the comments to this tweet... people are so triggered by it. Why is that? People are greedy... no matter how high Bitcoin spikes it seems like a significant percentage of people expect it to move higher indefinitely. Apparently, a unicorn asset that's literally DOUBLING EVERY YEAR is not making big enough gains. Honestly, on a certain level, this greedy mindset needs to be checked and balanced.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

The numbers are VERY CLEAR. Bitcoin is only worth $13k right now but we are trading at $29k. We are trading at x2.23 the curve. We are very obviously bubbled, and history shows that if we were to sell here we are all but GUARANTEED to return to the curve before it hits this $29k level in March 2022.

Nobody cares.

Nobody even knows what the doubling curve is. I just made it up and it happens to be a super accurate metric going back all the way to 2013. When Bitcoin makes these bubbled gains the general population doesn't realize exactly how bubbled it is like we do... they simply want the price to go up up up and anyone who tells them otherwise is the devil!

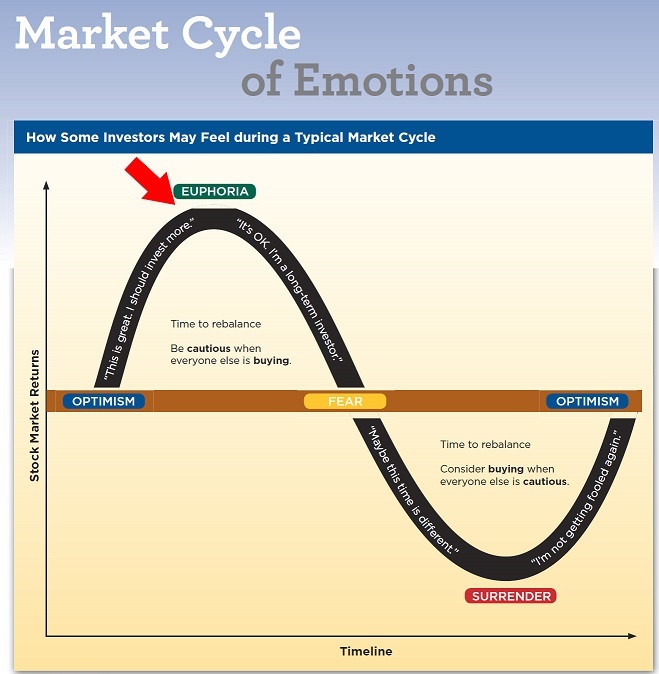

I created this little cycle chart back in May 2018. I used to make reference to it a lot, but it's not always accurate so I stopped... because the doubling curve turned out to be a godlike metric for measuring the bubble level of Bitcoin.

Even in economies like World of Warcraft you get economic cycles like this. I was a total Auction House goblin in WOW. I made over $1000 worth of gold just grinding out value any way I could. I still have hundreds of dollars on my Battle.net account from this that I can never cash out... I am only allowed to buy Blizzard products with it. Yet another reason why crypto is king.

The biggest economic cycle in WOW is the weekends. "Hardcore" addicted gamers like myself would play any and every day of the week at any time, while people who were actually willing to pay money for stuff would work on weekdays and play on weekends or after work.

So every day around 6 PM auction house volume would pick up. There was even a wave at 3 PM for people who played from the east coast and were three hours ahead.

It was even crazier on the weekends, to the point that if you bought or farmed resources on the weekdays... selling them as soon as you got them was a bad idea. It was much smarter to just wait for the weekends and sell them at a +50% jacked up price... and not only would they sell... but they would sell even faster than if you were clawing and scraping on the weekdays.

This was even more pronounced for certain resources required for raiding like certain flasks, potions, or other required consumables. That's because these resources were needed in bulk at certain times.

Even if you were in a hardcore guild with members that were online all the time, you'd still schedule a raid during a time when you know EVERYONE can make it. When you need 25-40 people to show up for something organization can get tricky. You're not going to raid at 2 PM on a Wednesday... that's not going to be a good time for a lot of people.

Therefore you could post these resources on the auction house at a certain time for a super jacked up price knowing they are going to get bought. When people need something and they need it now, they'll pay a premium because everyone wants the thing at the same time.

Supply, meet demand.

The vast majority of people in the world, in all aspects of life, are often poor planners and get exploited by capitalists in this way. You wanna live paycheck to paycheck? Ironically, there's a tax for doing so, and even though you're not in a position to pay extra while already living beyond your means, that's exactly what's going to happen.

So not only do people get screwed over from Triforce Slavery (wage/debt/tax) the thing they get most fucked over by is their own phycology that was ingrained in them from birth. It's no accident that nearly everyone is bad with money and everyone wants instant gratification. That phycology is learned and even celebrated, especially in American culture.

I can't believe it's taken me two posts just to get to one prediction. I guess I just can't help myself.

In any case, Bitcoin is looking pretty strong. We are right under the unit-bias level of $30k and we still have 20k volume a day on Coinbase (no wash-trading). This is impressive considering the USD value of Bitcoin keeps going up because that means USD volume is rising while the number of Bitcoin exchanging hands is staying largely constant.

6-hour candles are my favorite.

So in the above scenario, the bull run is over pretty much now. This makes perfect sense, because when you look at Bitcoin's monthly candles we've made such huge gains over such a long period of time that it only stands to reason that the bull run would end at this unit-bias rejection.

Looking at the one-month candles... isn't it obvious? Even during the huge runs of Q4 2017 and Q2 2019 we only got 3 solid months of UP before everything crashed. Wouldn't it be foolish tunnel-vision to assume otherwise this time around?

We'll fall back to $27k, complete this bearish head and shoulders pattern, and fall back to $20k support within a few months. This would actually be pretty ideal, and it also makes a lot of sense in terms of retracements. A drop from $29.4k to $20k is a 32% retracement, which is pretty much exactly what you would expect in a situation like this before the price is ready to go higher.

The Upside Scenario

However, let's look at the one-month candles again with a new perspective. What are the differences this time around? Do you see it? The end of December is an all time high. Three months of sustained parabolic gains and still at all time highs with good volume. This is unprecedented.

Not only do we still have good volume and completely miniscule pullbacks all along the way, but there doesn't seem to be a lot of FOMO out there like there normally would be. The flags up have been measured and controlled and people like Michael Saylor are running around convincing other corporations they need to enter Bitcoin or face the wrath of the never-ending brrrr machine and increased taxes from the liberals.

President Trump seems to be the most hated and loved president of all time, and he is about to leave office. Surely, emotions are going to run high on both sides when that happens. Emotional trading leads to an emotionally irrational and volatile market.

Investors on the right are going to want to enter the markets to avoid the brrrr machine and increased taxes. Investors on the left are going to want to enter the markets because they feel as though sanity has returned to the world and it is now safe to do so under the "sound leadership" of our new overlords. Either way, both sides are going to enter the markets... and they are going to be doing so in an emotionally charged state.

Now, some people on both sides are worried/excited that maybe Trump will declare martial and engage in a coup. Hm yeah... I'm sure this cowardly actor, who the military hates, is going to pull that off. That's not how this works.

Want to know how it does work? Trump seeds the fear that it MIGHT happen and then he fires a bunch of people and replaces them with puppets, destabilizing the government like he's been doing for the last four years. He is literally doing the left's job for him. These people work together to fuck us over.

He's creating fear and legitimate emergencies, and now the left will roll in and be like "SSSHHHHHHH, it's okay now we're here to protect you from the bad man. Just give us what little freedom you have left and we will offer you security in return." Seriously, this shit is playing out like clockwork. There will be no coup, and when all those fears are put to rest investors can start solidifying their positions worldwide in anticipation of this new regime change.

--6 January 2021: the House and Senate hold a joint session to count the electoral votes. If one ticket has received 270 or more electoral votes, the president of the Senate, currently vice-president Mike Pence, announces the results.

January 6th is only 5 days away now. This could be a significant day for the market in either direction depending how it goes. Again, I assume Mike Pence will announce a Biden victory. The market might certainty go up in response to such a definitive answer from the right.

How high can Bitcoin go?

Well, the 2017 mega bull run went x13 the doubling curve. That's not going to happen, as we aren't in the four year pocket. However, the 2019 bull run went x2.9 the doubling curve, which would be $37k Bitcoin today. This means that $40k unit-bias resistance is going to be very hard to break, and $50k unit-bias resistance will likely be impossible to break in my opinion. Even though this run feels stronger than 2019... it's not THAT much stronger, and I feel as though we have less than a month before the local peak hits.

February, ew!

Again, I think February is going to be a TERRIBLE month for crypto, and the higher Bitcoin peaks in January, the worse the crash will be farther down the line. Volatility begets volatility.

What about Hive?

Even the biggest permabulls like myself are stretched thin and not about to make another big buy (and thus take even more risk) at this level. I'm looking to buy Hive at all time lows, hopefully in February or March. That means if Hive crashes to the 7-8 cent level... I'm buying... a lot.

Hive morale is at all time lows because price is near all time lows while Bitcoin soars. That is fully demoralizing. I've seen this before with Steem, and once Bitcoin starts crashing, there is no way Hive won't crash as well. Interestingly enough, if Bitcoin retraces 32% and Hive does the same, Hive will cost exactly 8 cents. These numbers seem to be lining up quite well.

Lie Still!

https://leofinance.io/@marki99/why-hive-s-price-is-behaving-exactly-as-expected

This point by @marki99 seems right on the money. Due to all the crippling defeats this community has endured over the last 3 years, we haven't made any progress in terms of price action. Hive is repeating the EXACT same pattern that Steem went through when it was launched.

This means I expect Hive to hit all time lows in Q1 2021 just like Steem did back in Q1 2017. From there, it looks like Hive might do the exact same thing again and double in value immediately (due to airdrop FOMO) right when it hits all time lows.

The rest is history, as the possible upside by the end of the year is x100 from those all time lows. If that sounds crazy then you don't remember just how powerful the FOMO feedback loop of powering up and controlling inflation can be. It absolutely can happen again with Bitcoin trading above $250k (x10 the doubling curve in Q4 2021).

This is exactly why I get so triggered when people say we need to reduce inflation. Are you trying to kill this x100 run? Cut the shit.

Conclusion

The market is in extremely uncertain territory. I believe we are due for a third flag up with Bitcoin that will take us to at least $37k... possibly as high as $50k, but at the same time many signs point to the bull run being fully tapped out right now. Dollar cost average selling is not a bad strategy at this point.

Hive appears to be repeating it's old history from back when it was called Steem. New brand, same cycle. Go figure. The only thing I'm quite certain of at this point is that February will not be a good month for crypto this time around, as is usually the case, especially during a bubble.

Posted Using LeoFinance Beta

That’s a hell of a crazy damn good post !

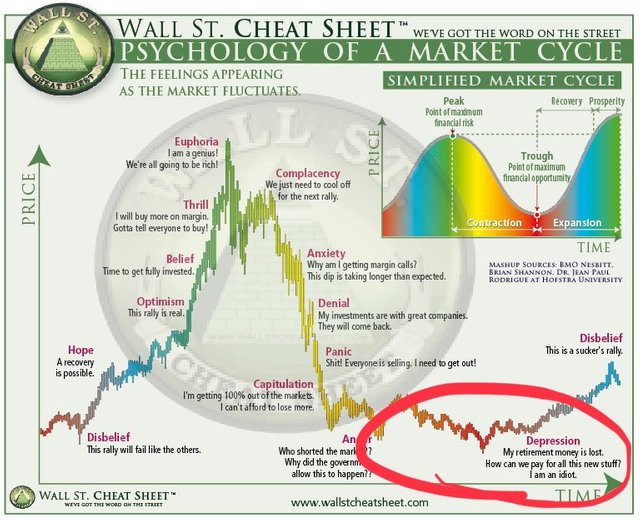

I read it twice and twice I stopped in the middle and spent 5 minutes looking at this animated gif with the articulated red line drawing pseudo-randomly :D

Q1 will be a great opportunity to average down, let’s not miss this opportunity.

Posted Using LeoFinance Beta

What do you think will be the actual inflation (USD) in 2021? I just thought about your Numbers and you measure in $ which might drop 10-20% until 2022...

Happy New 2021 !

More info why you see this.

Posted Using LeoFinance Beta

Yes indeed, a great writ and we will wait for the Hive bottom to increase our holdings.

There's greed always, but then there are those that are on Hive not for for personal gain, but rather to strengten their much needed efforts to help others.

I think that you are close to spot on here and let's see what happens.

Shouldn´t your doubling curve be at least inflation-adjusted? The USD from 2013 is not the same as the one from 2021. The real inflation is also much higher than the fake reported numbers, I guess at least app. 5% per year or so. If you add this per year, you end up with much higher values.

I'm really a big fan of your writing . I hope what you wrote about Hive gonna be happening in near future.

I put all my remaining BTC now in the Dark Energy Crystal pool that started yesterday, with a similar geyser model as the WLEO. Otherwise I would have averaged out but I was greedy and didn't want to miss the opportunity to earn the coin I need for the game I play for over two years now (apparently you can somewhat sympathize with my move as a WoW player and trader who sits on worthless gold). I made great gains with the current bull run and am happy where I am right now. My next move is to gather as much FIAT money over the next couple of weeks and park it in a stable coin or directly on Coinbase and wait for the HIVE bottom to show its crusty face. I need 45,000 Hive for Orca status, which is $3,600 USD at $0.08 cents. So cheap!

I plan on converting a part of my coins to a stable coin during January and then buy back a lot more when that dip comes. The one thing holding me back now is the hope that it will keep increasing more. I know it's greedy but I'm up to wait a few more days.

Posted Using LeoFinance Beta

Lol me too....I feel there's a bit more run up before the run down

Posted Using LeoFinance Beta

This is kinda funny, crypto Apathy is a real nuisance trigger. With the price of Bitcoin I honestly don't care if it increases more than that, it is currently at a very good price and no one should expect a bigger one. $29k is millions in most countries so that's a life changing cash.

Posted Using LeoFinance Beta

Great post, and you were right again on bitcoin!

Thinking back that doubling curve makes perfect sense

Posted Using LeoFinance Beta

A few hours later and it's ready to cross $32K...insanity

Posted Using LeoFinance Beta

Your $37,000 first target seems to be quite easily achievable. I doubt many were expecting for BTC to blast through $30,000 and beyond as it did.

I hope you're right about HIVE and it will replicate what STEEM's done in 2017.

Posted Using LeoFinance Beta

I give up making any kind of prediction about Bitcoin, haha!

Great post, @edicted.

Posted Using LeoFinance Beta

I'd love to pick up some hive at $0.08. I was actually looking for moral support to stack some HIVE right now, lol.

Posted Using LeoFinance Beta

That's funny, I actually think bitcoin isn't going to be as volatile this time around. There were 8 corrections of 24% or more back in 2017. While I think we will have corrections this time around for sure, I don't think there will be as many severe ones this time around. For example, a couple 30 percentage corrections as opposed to 8... and this is due to the types of holders involved this time around versus the last time.

In order for volatility to be muted these strong-handed institutions need to be trading the market... selling the tops. We both think that isn't happening. They are buying Bitcoin and locking it away in cold storage for years.

Waves are bigger when the tide is coming in... at least in the ocean.

They are buying on the bid, putting large orders percentages below the current market price. So, any dumps get absorbed by them and doesn't allow for cascading sell offs like we've seen in the past where retail stop loss after retail stop loss gets liquidated. That's what institutional buyers bring.

There may be a couple along the way, but I highly doubt there will be 8 of them. We be in one of those right not actually, though currently it's barely over 15%.

greed to fear :)

Posted Using LeoFinance Beta

Thanks for the advices

Posted Using LeoFinance Beta

The world of trading fascinates me a lot but I am totally inexperienced and have a lot to study.

I had to read your post several times to understand some concepts but one thing I have clear and I understood immediately: I like the way you write and the reasoning you do and I will not miss a single one of your posts.

Thanks

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @libertycrypto27 for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Very interesting analysis!

Main thing I see that will help Hive bounce HARD off its lows is that there is SO much more "back room" development and projects happening here than there were on Steem at the corresponding point in the cycle. I think the fact that "there is something here" (compared to Steem) will manifest as a smaller pullback from a future ATH... people's perception of "fair value" will be higher than it was with Steem.

=^..^=

Posted Using LeoFinance Beta

great analysis although I have heard it's a double bubble mimicking 2013.. what do I know it's pretty unprecedented territory. That's why I always choose to guess what the second place will do.

Posted Using LeoFinance Beta

I am worried about the double bubble scenario.

One bubble for the halving

one bubble for Bitcoin performing well during a bear market and institutional adoption.

Everyone is looking to 2017 to the answer, but this thing will probably look totally unique.