Market Watch: October 18th (Beware the BLOOD MOON)

Lots happening in the month of October.

And it seems that October 18th might be a crux of sorts.

- 2 retrogrades ending

- ETF decision

- USA debt resolution

- full moon 2 days later

The ProShares Bitcoin Strategy ETF

Lot's of people out there say this ETF has a very high chance of being approved by the SEC because quote:

A futures ETF would allow investors to buy shares that represent futures contracts (which bet on the price of Bitcoin going up and down), rather than the digital asset itself.

A 75% chance of being approved?

Clearly a bogus number pulled out of thin air. I doubt it will be approved, because the sentiment regarding whether it should be approved or not comes from the idea that the SEC actually exists to protect investors. They do not.

I've been predicting for YEARS that a major ETF will be approved when the SEC is actually looking to crash the market and let the cronies insider trade off of that outcome. Happened with CME futures in 2017, why not try it again?

However, if it does get approved, bullish news like this is essentially perfectly timed to flow right into the Q4 Mega-bubble. Don't forget that the news only acts as a catalyst for price movements. When we are in bearish territory no amount of good news is going to spike the price upward. When we are in bullish territory bad news has very little affect on the market. We are in bullish territory now, and an ETF approval would almost certainly be blamed for quite possibly the entire run we were going to get anyway in Q4 2021.

At the same time there are so many ETF requests nothing is really stopping this one from being approved now and like a dozen others being approved at the end of the year for the ultimate FOMO. Something to think about.

Retro No!

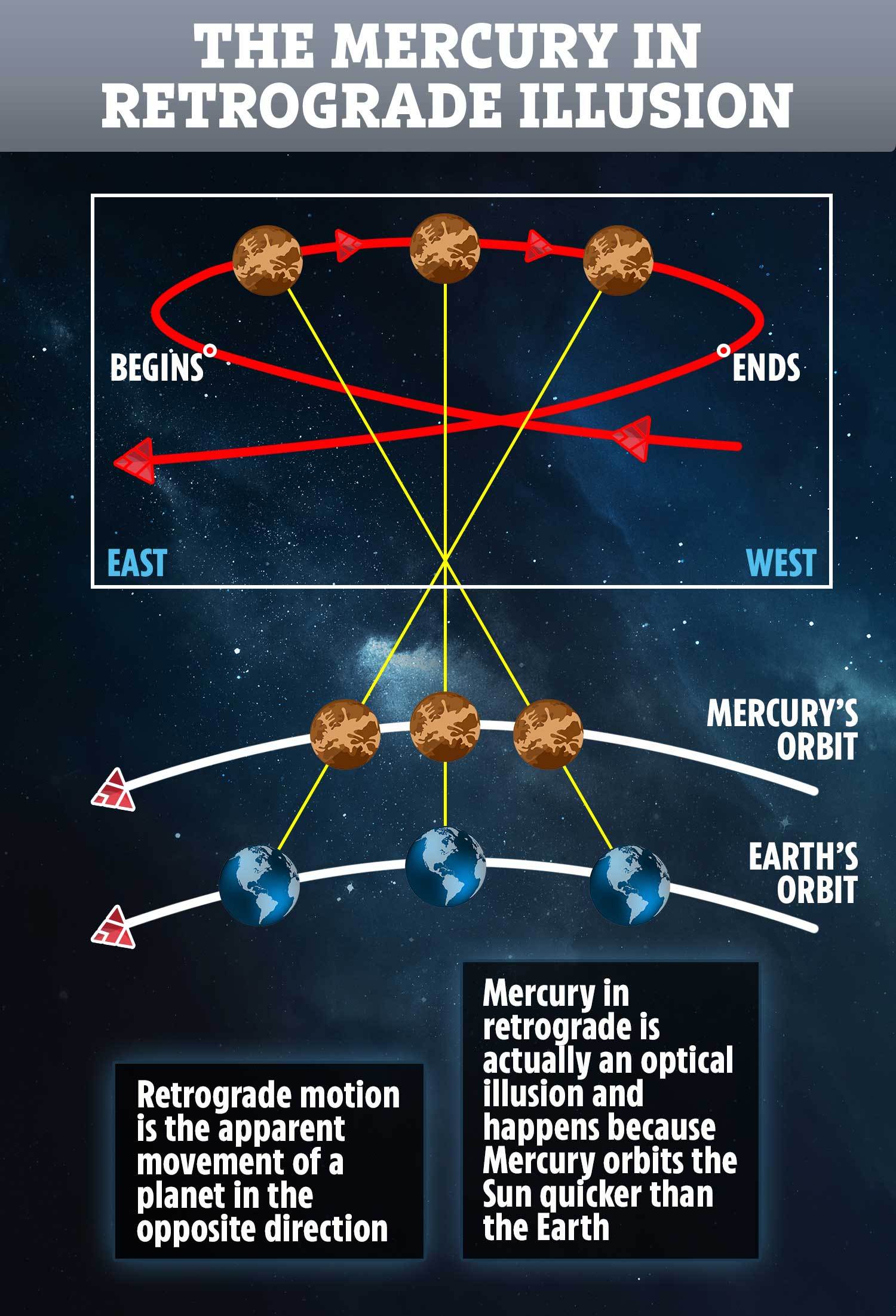

On the Astrological witchcraft side of things, both Mercury and Jupiter's retrograde movement will be ending on the 18th. Then, two days later, we get a bullish full moon. As 'luck' would have it this full moon is actually called the Blood Moon (last one was called Harvest Moon). Will the Blood Moon live up to its name and bleed the market before turning bullish? That's certainly what I would expect should an ETF get rejected and the debt crisis not get resolved all on the same day.

Debt Crisis

Congress is staring down a potential financial catastrophe with no clear resolution in sight.

The debt limit must be either raised or suspended soon with Treasury Secretary Janet Yellen warning lawmakers that the federal government will likely run out of cash by October 18 unless Congress raises the debt ceiling.

I've heard all kinds of crazy rumors about this situation, with one of the "solutions" printing a physical coin worth $1T. These people are clowns. Unfortunately, there's no real why to get any information on topics like this because of the constant and rampant misinformation and willful manipulation of data. Once again, we see that the Blood Moon has the opportunity to live up to its name and crash the economy a bit.

Price prediction.

I think Bitcoin will need to come back and test $55k or even $54k before the Blood Moon hits. Bitcoin is gaining dominance and alts will take a bit of a beating. Nothing too serious, but with how people are acting all ready I'm sure they will act like it's the end of the world.

Obvious increase in dominance

Bitcoin is gaining dominance, which is good and clearly expected. This pattern has played out before in 2017. When institutional money pumps Bitcoin the alts get left out to dry until Bitcoin stabilizes. Don't be surprised if it happens again.

Ripple Lawsuit

This looming lawsuit has also been very enlightening. I never thought Ripple would make it this far. I think most people assumed they'd just get railroaded by the SEC, but they are putting up quite a fight.

If Ripple wins this lawsuit it will send the entire market into an uproar of FOMO and insanity. Even if they settle on good terms the same thing will happen. Why? Because it creates a huge shield for the entire cryptosphere and makes it exponentially more difficult for the SEC to attack any project. Doesn't matter if that project is centralized or not. Look at XRP... very centralized but still won a lawsuit against the regulators? Not only is that comical, it's madly bullish for the entire metaverse.

Conclusion

Need I remind everyone that I'm very good at predicting volatility. Not so good at guessing which direction that volatility is going to lead. My extremely short-term prediction is bearish. I can't imagine the SEC approving an ETF, and I can't imagine the government pulling their heads out of their own asses. Call me crazy.

The Blood Moon is calling!

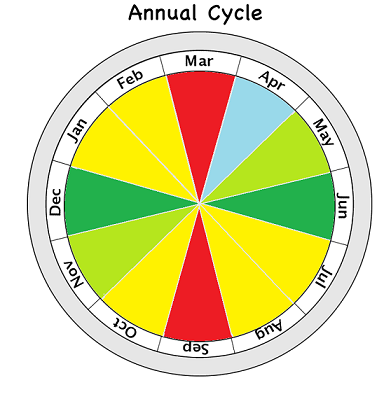

Historically October is a slightly bullish month, but it's nothing compared to no-dip November and volcano December.

However, my personal prediction is targeting the $17k level for November. Sounds like a lot, but that's less than a 25% gain from where we are today.

lol wasn't 2020 adorable?

2021 is going to put 2020 to shame.

We finally made it 4 years to the next cycle.

Probably doesn't even matter what moves we make.

Only one more Blood Moon to go.

Posted Using LeoFinance Beta

I'll be hoping the volatility is downward then, because I finally have some assets to invest. Interesting times!

I know very little of what you're talking about though. Little old lady here. Trying to not be a dope too. I have friends who have never heard of bitcoin, or cryptocurrency.

Love the astrological analysis.

This coming 2 months will be worth the 4 year wait

Posted using Dapplr

Isn’t this absurd? Why can’t they just buy the asset itself. Why create something that represents it? What am I missing?

They say it's because the market can get manipulated and they are protecting investors.

What they actually want is a derivative asset they can manipulate and control.

Exactly. Because if the bitcoin market gets manipulated, it’s going to affect the ETF also right? Since it depicts the price of bitcoin

Big fan of Volcano December over here. Let's melt some snow!

Haha, that was a very awesome read. I don't think any of us know what is going to happen. No matter how much we try! I am just happy to be along for the ride. That is what I keep telling myself.

Posted Using LeoFinance Beta

I don't have high hopes for the ETF either. I would give it a 50% chance but I feel like they still want to delay things.

As for the debt limit, they will increase it. They will never really default as it would impact the dollar's status as the world's reserve currency.

Posted Using LeoFinance Beta

Of you haven't noticed, this current administration does not seem to care about the country very much

It's been the case for a long time. You can't really trust the politicians in power since they only want to continue the system and maintain their power.

Posted Using LeoFinance Beta

Sad but true 🤬

Bought some extra packs of bandages, we'll be fine.

LOL ...

I will bring some super glue too...just in case.

Posted Using LeoFinance Beta

I don't buy until the astrology stuff either, BUT, many times the "elites" will use these signals and have cover for their actions

Yeah, it doesn't really matter what you do and don't believe... you just have to recognize what the market makers believe.

👍

I learned this following the Silver markets for the last 12 years or so... it's the playbook of the "elites" or

VAMPIRE SQUID SQUAD

so that means they raise the debt ceiling again?

Just to be pedantic... The XRP Ledger is super decentralized. I think Ripple only runs 3 of the 91 validators - and because there absolutely tiny fees to use XRP, the validators don't make a profit... they're essentially volunteers who want the network to run securely. It's kind of incredible.

Of course, the executives plus Ripple the company hold a huge amount of XRP... but Ripple has been funding lots of projects and developers to grow the ecosystem... so it's only a matter of time before it's a super decentralized blockchain.

Ripple could have settled this case, but they're fighting it to try and force the SEC to make a ruling one way or another. It's an absolutely fascinating legal fight and I totally agree that the entire cryptosphere is keeping an eye on the outcome.

This is a great point.

On top of this there will only ever be 100B XRP or whatever, so the distribution should keep getting better for the next 20 years.

In addition, the XRP community is very strong, albeit toxic, but it doesn't matter that they are toxic. What matters is that they are strong and they aren't going anywhere and they will fight for their network.

Posted Using LeoFinance Beta

SEC have limited power as do governments unfortunately to enact constitutional rights costs money and most people don't have that level of finances to take on governments.

Ripple however does and can pursue self determination which includes freedom of participation and financial freedoms.

No doubt ripple will emerge Victorious and it depends on the angle the SEC takes. But it looks like they too are warming to crypto and if they could do it again they probably wouldn't be taking Ripple to court. It's amazing how rapid things can change.

The US sees significant benefits in crypto now so any negative impacts on Ripple will also flow onto future plans. I just don't know why they don't drop the case entirely. Waste of tax payer cash.

If Ripple wins though it will probably send their token mooning.

Posted Using LeoFinance Beta

good point of view friend but honestly with the little experience I have in this environment I must wait to see what happens, there is always something that surprises me ...

It's quite the show in Washington, and always comes down to the last minute. Who knew... LOL

I agree that a positive ETF announcement would be just the official stamp of approval stock and institutional investors need to allow them to crash through the door and stampede into Bitcoin, 100K here we come LOL

Posted Using LeoFinance Beta

Indeed it was!!! Despite everything disguised as negative that happened.

I think more positive things happened to Bitcoin this year than negatives, China ban being the top, look at all the big corporations that invested in Bitcoin, then countries legalizing Bitcoin as legal tender. Mining became super energy efficient...remember the Bitcoin talk organized by Jack Dorsey and Elon Musk with Cathie Wood of Ark investment? It was the Biggest PR for Bitcoin for institutional investors....

Quite adorable happenings indeed. It will be interesting to see what 2022 is like.

Based on what I have read from your post, I will very careful with my trade on that day, but if the Bitcoin ETF is approved that will be a huge bullish news, because i feel the institutional investors are waiting for the outcome of the Bitcoin ETF new before pumping money into the market.

Astrology and crypto sounds fascinating

hm yeah it's pretty weird that it actually seems to work.

ya ive seen people make charts that follow price where every new moon it dump and every full moon it pumps