It's going to be nice to be able to buy HBD on the next Hive run up.

Before the most recent hardfork (25), it was legitimately impossible to buy HBD for a fair price after Hive spiked. Every time Hive/Steem spiked, HBD/SBD would also spike up in tandem, making our stable asset completely worthless for its intended purpose: Going bearish and storing value.

Literally the only reason to turn Hive into HBD is the fear that the price of Hive might drop sharply. Meanwhile, HBD is guaranteed to lose value at the same rate as USD, so it's always a long-term losing bet that gives the benefit of short-term stability.

This creates a very interesting dynamic for Hive, because HBD derives its value from Hive but gains the properties of USD. When we think about HDB as Hive's debt (not always appropriate) this means that as USD loses value over time Hive owes less debt back to those who hold the stable coin. Pretty weird.

There are a ton of regulatory concerns about stable coins, and they are surprisingly all valid concerns. The regulators should indeed be worried. I have talked about this multiple times. Stable coins can and will collapse the economy if left unchecked. Give a greedy corporation the power of currency and they won't be able to handle it like the central banks have been doing for generations.

This sentiment is especially relevant when we consider this house of cards we've built up over the decades. Even Central Banks have to follow the rules. They have a very defined toolkit. They are governed by politics and are confined by their own limited scope. This is the legacy economy, and they can't just do whatever they want, even if they can get away with quite a bit.

Compare that with stable coins.

Anyone in the world can create a token and label it a stable coin. There are many ways to create stable coins, but all of those tactics boil down into two separate camps:

- Hold USD collateral in a secure location (bank).

- Create the peg algorithmically via smart-contract.

In all cases, stable-coins become pegged using collateral. Traditional stable-coins like Tether, Cloud, Gemini, and BUSD just transfer USD into a bank account to be used in the event that the peg drops to the downside. The USD is then used to bump the price back up to the peg.

Price breaking to the upside (high demand) ends up being free money for the stable-coin issuer. They have the power to print coins on demand and dump them on the market until the peg is once again reached. The principal of these sales is put into the bank account to add to their collateral, while the leftover becomes profit.

This effectively turns every single stable-coin operator into a market-making arbitrage bot service. This is also why I never buy into the FUD surrounding Tether. Tether is doing quite well, and even if they don't have $62.7B in the bank it doesn't matter very much. It takes a lot less than sixty billion dollars to keep Tether pegged to the dollar, even in the event of an epic "bank run" (users dumping Tether).

However, even though everything is fine right now, give it ten years and see what happens. These stable-coin operators will continue to pop up and provide this service, because this service is profitable. When we look at Binance and BUSD we see that some of these stable coins are necessary and easy to incorporate into new projects like Binance Smart Chain.

The only real point we need to focus on here is that stable coin operators have the power to print their coin to infinity if they so choose. No one can really stop them. They have the power. This is why the regulators are freaking out and trying to put a lid on things.

Literally any stable coin operator could theoretically exit scam and not only steal all the collateral in the bank account, but also all the liquidity provided on every exchange pair (think flash-loan attack on Ethereum). If the economy in question was big enough, this meltdown would chain reaction into other markets and crash them as well.

Algorithmic stable coins.

Unlike traditional stable coins, algorithmic stable coins are 100% transparent because all collateral is stored on chain. The complications arise because the collateral being used to maintain the peg is an extremely volatile cryptocurrency. Frequent liquidations of collateral must occur in order for bad debt to be avoided. As we saw with Iron Finance on BSC, this leads to a host of potentially crippling attack vectors that could instantly kill the project.

However, there are other less risky algorithmic stable coins like DAI that have a much better track record than these new up and comers. For the most part, DAI uses Ethereum as collateral and allows users to give themselves loans using the protocol. Very powerful stuff.

In terms of maintaining the peg, HBD has had the worst track record of any stable coin I have ever seen by a huge margin. Even with the peg to the upside at $1.05, it's still pretty bad at maintaining the peg compared to others like DAI who usually stay within +/- 2 cents of the peg .

Still, HBD is on-chain, and atomic swaps can occur on the base layer from Hive to HBD and vice versa. This is a powerful feature.

How to further stabilize HBD?

Hive has a very unique way of maintaining the peg, and this unique strategy doesn't work very well, but it does have some interesting advantages. Unlike DAI, where every user has their own CDP (collateralized debt position) with collateral locked in the contract, rather on Hive the entire network shoulders the brunt of the risk together.

If HBD never gets converted back into Hive this creates a positive feedback loop of free money for the entire Hive network. The higher the demand for HBD gets, the more free money we will receive. As I've already stated, this free debt is diminishing in value alongside of USD, so a big HBD stack on Hive means lots of free debt that just keeps losing value over time. It's when that debt gets cashed in that we have to worry about price collapse.

And what causes users to cash in their HBD and convert it to Hive? This happens when the market value of HBD is lower than $1 and users can trade in their HBD on-chain for more than it's worth off-chain. Not an ideal situation to be sure but we have to maintain the peg somehow.

The HBD haircut

If we assume that HBD = $1 and HBD's market cap ends up surpassing 10% of Hive's market cap, the haircutting begins. For example, if Hive's market cap was $50M but 10M HBD had been printed (20% of Hive's cap) then we would haircut the conversion down to 50 cents instead of a $1.

This haircut exists to prevent a "death spiral", but it is ironically the exact mechanic that creates a death spiral in the first place. Unfortunately, the big players on Hive haven't come to realize this yet.

@theycallmedan did a very interesting post yesterday about Game Theory vs Practice that made me realize just how much this all applies to the haircut. In theory, the haircut prevents this dreaded "death spiral" but in practice it actually creates a complete lack of faith in our stable token, which in turn vastly lowers the demand and creates even more dumping and conversions.

Luckily, with the $1.05 cap to the upside that's been imposed, we may not have to worry about the haircut coming into play for quite a while, as it was the SBD spike up to $13 that truly caused the fishtail back to 60 cents multiple times. We clearly have a lot better stability in both directions, but it could be better.

How to improve HBD?

Implementing CDP contracts is a strategy I've been pushing for quite a while now. However, this is a lot of work and a lot of added attack vectors that would need to be plugged. Probably won't get anything like that until a token on Hive does it and has great success. Tokens on Hive act as the testnet for Hive.

If we are talking about the immediate future there is one thing we absolutely need to do to bolster HBD: scrap the internal market's order book in exchange for Automated Market Making.

The Crux of AMM is yield.

It would be quite trivial for Hive to print inflation in order to incentivize AMM.

When we look at the order book what do we see? I see a ridiculously thin liquidity market where no one could ever dream of acquiring any significant amount of Hive or HBD short of using a bot over long periods of time and waiting for other users to arbitrage the exchanges.

AMM fixes this.

Turning the internal marketplace into a yield farm is so obvious a solution it's honestly hard to believe that half of this network isn't demanding it like... right now. Doing so will increase liquidity there 100x and provide a new place for users to go for passive income rather than trying to play the blogging social media game. It will extract users from the reward pool area that don't belong there and put them into the liquidity market-making passive-income game (the area they wanted to be in the first place).

There are many users on Hive who got downvoted off the platform that would come back if they had an option like this. Yield farmers don't have to worry about downvotes or reward disagreements. You provided liquidity: you get the reward. There are no downvotes. This feature would have a lot of appeal to a lot of users.

Even though HBD has now been soft-capped at $1.05 it still takes 3.5 days to make the $1.05 HIVE >> HBD conversion. That's clearly not good enough. Liquidity needs to be instant on demand, and that means AMM is the way to go, as it is a superior form of market making with the proper yield incentive.

Until it's possible for anyone to buy 10,000+ HBD with a trivial amount of slippage, we obviously don't have near the liquidity we need in order for the world to take us seriously. Deep liquidity is a killer dapp that benefits everyone, especially those with deep pockets looking to invest. Gee, wouldn't it be nice if they also had access to an on chain stable asset that can't even be regulated. One would think.

The supreme advantage of stable coins collateralized by crypto is that it is literally impossible for them to be regulated. There is no central authority in the matter who's arm can be bent into submission. On top of that fact, there's no need to even attempt to regulate algorithmic stable coins, because all of the data is on-chain and fully transparent for all to see. That's where the trust comes from: the code. Not some centralized regulatory arbiter, but the network itself (which doubles as the governance structure).

So while all these stable-coins pegged to dollars in the bank get slapped over and over again, the ones pegged to crypto won't have to deal with any of that nonsense. This creates a frictionless system that can continue developing and expanding at lightning speeds without all the corporate red tape involved.

There is no competition here, crypto already won. That fact will only become more and more evident over time as crypto becomes more mainstream. Don't forget, we are still at the "Internet in the 90's" Phase.

We are still in the opening act where people are saying the Internet is a fad and that "http://www." is way too complicated and no one will ever get it. We are still at the stage where Email is considered complicated and frustrating. The next ten years are going to be wild. Guaranteed.

10% yield and the competition.

HBD has bumped up the savings account yield to 10%, which is great. We are printing more money, and more money printing is almost always better (unless you allocate it somewhere unnecessary or corrupt: see fiat currency).

However, this yield is only incentivizing holding static HBD. Yes, that will increase the price of Hive. However, allocating even more yield to a Hive/HBD AMM pair on-chain actually provides the deep liquidity we so desperately need. It also provides that epic utility of a yield farm paired to half stable coin: logarithmic volatility protection.

Even more interesting is that blog posts intrinsically pay out 50/50 Hive/HBD, meaning there could be an option to automatically roll rewards into the AMM without even having to claim them. Simple is better, and that's the kind of synergy that would give this economy an even bigger boost.

The "competition"

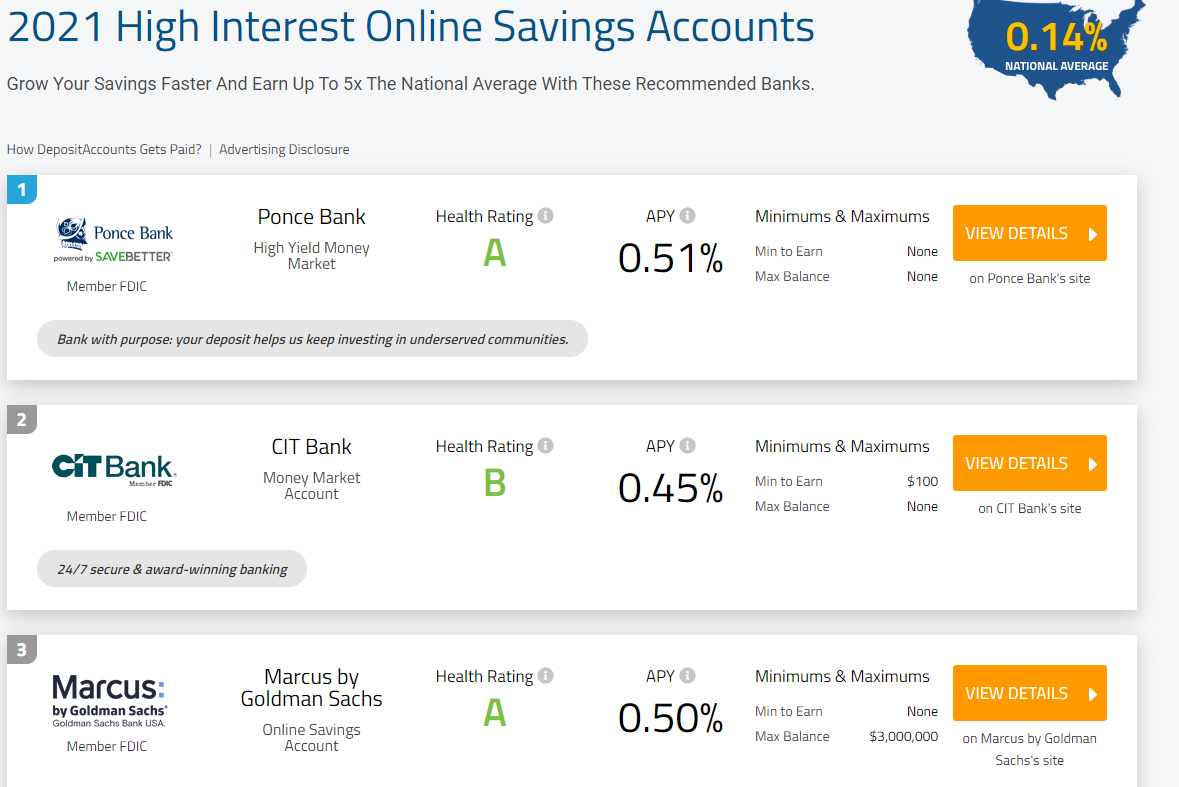

It's hard to even view these new tokens as even competition to Hive, because all of them offer completely unsustainable yields right out of the gate. Talk to me later when they hit 4 years old and lets see how they did. That being said, a 10% yield for HBD is a FANTASITC unit bias level. Wow, two entire digits of APR. That's legendary for a "savings account". You can't even beat inflation at a legacy bank anymore.

The national average yield for savings accounts is 0.14% APY? LOL, get out of here with that insult. You're done, banks. Goodbye. We offer 10%, x20 higher than the highest offered by this random website. Pathetic really. But I guess that's how the cookie crumbles as the legacy system falls apart at the seams.

Conclusion

So yeah, the next time Hive is spiking up to $2 or whatnot, we'll actually have the option of turning bearish with the native token. HBD will still be soft capped at $1.05, so that will actually be an option in order to preserve wealth around here. That's a big deal, as this has never been an option before. The next time Hive spikes will be the first time HBD didn't spike up with it.

Many see HBD as a complete failure and want nothing more than to get rid of it. Unfortunately, that's not really and option. On-chain stability is a prerequisite for many many applications. Sure, we've been struggling with it since inception, but there are myriad ways to upgrade that will further stabilize what we have going here.

My ultimate goal for Hive going forward is at least one AMM pairing (Hive/HBD) combined with CDP loans and a full fledged futures market (being able to print Hive on demand in order to short the market using collateralized HBD). Even if it took us 10 years to get there from here it would still be worth it. However, I think we'll get there in a few short years. Time to stop asking 'wen' and actually participate.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

Same thing I said. While we wait to see if we would develop the yield farming model you propose, this decision is a step in the direction of increasing liquidity and getting more interested in saving on the platform

Not always. The Fed has no legal mandate to prop up the stock market, but they do just that all the time.

Posted Using LeoFinance Beta

the rules for central banking involve keeping the system afloat so that maximum profits can be extracted from it. When the system collapses everyone loses.

https://www.chicagofed.org/research/dual-mandate/dual-mandate

The Fed’s Dual Mandate (interest rates and employment) says nothing about the stock market.

That is so motivating to buy and save HBD, I hope it will continue it stability

Take some speculative profits and park them in HBD instead of having to go elsewhere.

That will be novel since, as you stated, in the past, if Hive ran up, HBD mooned also. Of course, we still do not know how HBD will act in a bull market. We will see if the new additions keep things tight.

Posted Using LeoFinance Beta

@klye is on the loans.

I haven't seen a report for a few days, maybe he will update us on that.

I asked bt for a amm bot like the dswap.trade bot.

I hope you have to stake some hive to get access to it.

Not alot, but something to incentivize powering up rather than dumping right away.

HBD will always fill the blank.

HBD exists for a reason, why not put it

to work and find out what it can actually

do in the long run.

10%? 20%?

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Central banks have to follow rules...lol...whose rules?

How many people control a central bank?

One?

Every central bank has a governance structure.

Every central bank has a limited toolkit as to what they can actually do.

yes one...

the one at the top

I do remember you starting your actual project so would this be a part of your project?

Posted Using LeoFinance Beta

the AMM feature shouldn't be too hard with tribaldex already having achieved it? I think this would be a great idea; is anyone working on it?

HBD is awesome for an stable coin, BUT we have the 5% converting fee. So it will not work on demand.

Nobody buys for Millions Hive and converts it to HBD with a 5% fee. This is something I pointed out multiple times before the HF. Time penalty + Fee is stupid.

It also destroys the sense of a stablecoin being on-demand and scalable.

IMO hive random numbers block again something good ( like onboarding random fee in Hive)

I don't think you've looked into it enough to better understand it. There is no time penalty, you get the converted HBD right away. And the fee is there as a precaution against short-term price manipulations that can take advantage of the blockchain. The fee also burns Hive which acts as a counterbalance to the increased HBD inflation. And finally, the 5% fee means that when HBD goes up to $1.05, people can start converting en masse and prevent the price from rising more.

With that said, for sure it can be improved.

you get 50% instant and 50% after 3 days as far I know. And 5% are not really competitive.

5% also is a really random number. There is no risk for the chain at all. There is a haircut rule in place. It doesn't matter someone prints 1000 bazillion HBD. It has no influence on inflation.

With this said, any other manipulation can also happen with other currency like BTC or Tether/ Busd to whatever. So why we make HBD less dynamic without any reason?

The only thing that could happen is a close to haircut converting thing, this is only a very low risk attack vector, that can only affect the chain with low market cap.

The goal is to get big, so we need to think big.

When you convert Hive to HBD, you get 50% of your Hive instantly converted to HBD at the current Hive price. The other 50% is held. Then after 3.5 days, you get back your Hive (not HBD), but how much you get back is determined by the median Hive price during those 3.5 days. So this is the actual price that is used for the conversion, not the current price at the moment you decide to convert. In my understanding, this prevents a kind of attack where someone might manipulate the price (e.g. do a short Hive pump in order to get more HBD) and then make a conversion at that moment. It would be easy to do this. But since the price is staggered over 3.5 days, you can't really manipulate the price like that.

I questioned the 5% conversion fee too, but it does seem to have its function, and the whole conversion operation is a starting point and it is intended that we keep improving upon it. You can read a more in-depth discussion here.

if the fee should be there for protection, I would be more in favor of a 7 days median price. last 3,5 days + future 3,5 days.

This makes manipulation super difficult and expensive. The 5% looks to me like a random number. Why not 3% or 1% or 0,3%?

1000$ = 50$ fee

10k = 500$ fee

100k = 5000$ fee

IMO this fee is not competitive with any other stable coin in crypto or regular fiat money.

No value here

Value = Benefit - cost.

Very interesting idea. So there'd be an internal liquidity pool and you can park your money there for a yield? And the liquidity pool is at the first-layer blockchain level?

I am also wondering if the 10% APR is actually a higher APY. From what I understood, the HBD interest is paid once a month (provided there is an incoming or outgoing HBD savings transaction) so there is compounding happening. So the APY might be more than 10%. If so, we're probably doing it wrong by advertising the APR.

By the way, there is no 3.5 waiting period when converting in order to get your HBD. You convert the Hive to HBD, then half the Hive is held and Hive is instantly converted to HBD. Then after 3.5 days you get your remaining Hive based on the median Hive price during the 3.5 days. So there's instant liquidity but the actual conversion ratio is determined over 3.5 days.

This was incredibly informative...thanks @edicted.

HBD is sooner or later will show some spike like how SBD did in 2017 . its a sleepy giant ,just hive need to wake him up with little bull run.