How to pay zero crypto taxes this year.

Just don't pay them, amirite?!

Seriously though, because crypto is such an explosive new technology, there are like a million loopholes people can go through to avoid taxes. Some of them involve breaking the law, but a lot of them don't; that's what I'd like to focus on here.

Investopedia: Capital Gains Tax 101

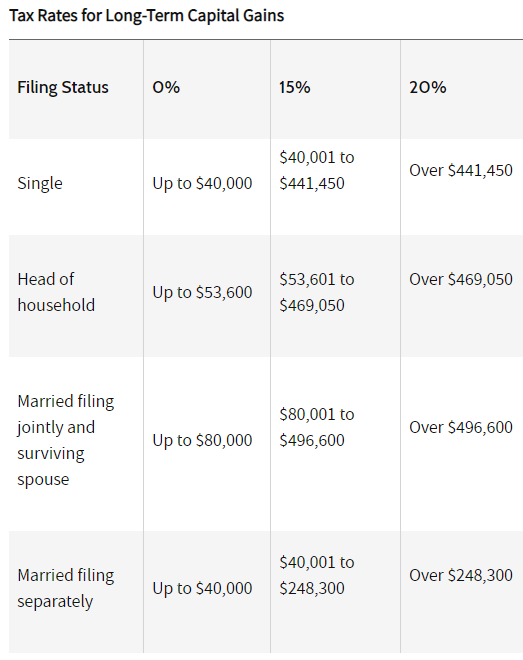

The last time we talked about this we learned something very important: you can actually legally pay 0% capital gains tax in certain situations.

https://www.investopedia.com/terms/c/capital_gains_tax.asp

If, like me, you are filing single, that means you can legally pay 0% tax on long-term capital gains if you are making less than $40k a year.

A long-term capital gain is when you hold an asset for a year or more and it gains value and you sell it for a profit. That money can not be considered income, so theoretically you've already paid income tax on it when you bought the asset (or perhaps you got the money by paying taxes on another long-term capital gain). I wanted to confirm this with someone who actually knows what they are talking about.

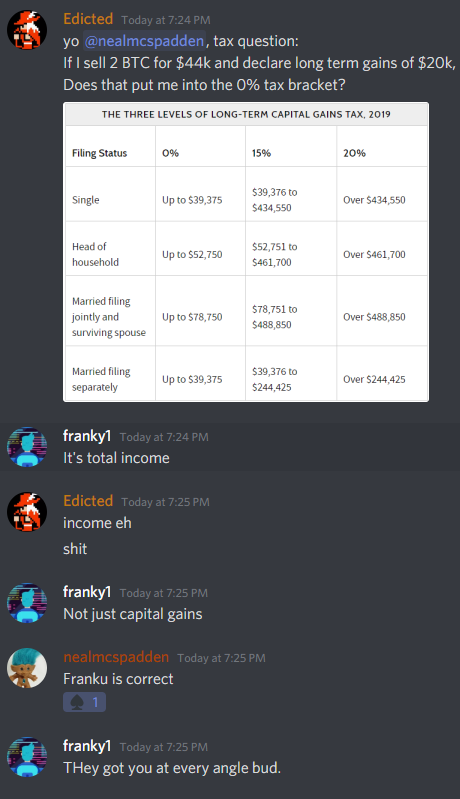

@nealmcspadden (tax guy & Excel guru)

Funny story

Even if I declared $20k capital gainz this year I'd still be under $40k income. I personally can pay 0% capital gains this year no matter how much I sell off (as long as I've held the assets for a year or more). I went on this little crusade because @geekgirl was asking me some tax questions in Discord and I realized I'm a noob.

But the conversation continued

And this is where it gets interesting.

Because apparently the IRS is defining crypto as "property", which is obviously ridiculous. It would be great to know why all these governments refuse to classify "cryptocurrency" as "currency". Currency must have some pretty nice loopholes and regulations people could jump through, so they are trying to avoid that. Perhaps @nealmcspadden can clarify.

https://dc.law.utah.edu/cgi/viewcontent.cgi?article=1018&context=ulr

Good information in this link but too lazy to read right now.

Property

From what I'm hearing, because crypto is legally property, that means you can wash trade your losses because the same regulations don't apply as stocks or commodities.

If I recall correctly, in order to declare a loss with stocks or commodities you must keep that money out of the market for at least 3 months. With property there is no limit, because property normally has extremely high overhead costs to trade and bad liquidity. Obviously crypto is the exact opposite of that. This is a tax exploit that everyone should be aware of.

Therefore, for everyone who's salty that they lost money on their Hive investment, there's a silver lining. You can leverage that loss (or any other crypto loss) into paying no taxes.

All you have to do it sell the asset and then buy it back immediately. You sold the asset at a loss, you can record that loss to offset taxes. You can then buy back the asset immediately because the wash-trading laws do not apply to property. Of course I'm not a professional so you can't take my word for it, and would have to confirm for yourself that this is true. I'm not taking any responsibility here.

Example

You bought one BTC for $10k in 2019 and you sold it here for $23k. You made $13k in capital gains, and your total income pushes you up above $40k, meaning you have to pay 15% capital gains tax on the $13k ($1950). Not cool!

However, you also bought 50000 Hive at 40 cents and now Hive is worth only 13 cents. You can sell the 50k Hive, declare a loss of $13500, and then buy the Hive back, paying a 0.1% fee twice on Binance in the process ($13). Instead of declaring a capital gain of $13k, you can actually declare a loss and pay nothing.

It's important to note in this scenario that because no gains were made the assets in question don't even have to be held for a year.

So you pay $13 in exchange fees to save $1950 in taxes. Pretty sweet deal.

And if you notice in the Discord conversation, we could be creating tokens to evade taxes legally like this on purpose. You put your money into a fake token, your colluding friend dumps on you. You declare the loss and then get your money back from your friend. You can then do the same thing for him, and with crypto this could be set up in a permissionless way where you wouldn't even have to trust each other.

This is the definition of disruption.

This is exactly why I have requested multiple times for core devs (currently @blocktrades) to add an optional feature to the network. This would allow anyone on Hive to transfer liquid coins and they would become permanently powered up at the destination.

Now I've received a lot of pushback from this idea. "Why would you do that?" "That's stupid." "That's a bad idea." Which is obviously ridiculous. If you don't want to use an OPTIONAL FEATURE then don't use it. Duh. You don't get to tell me which features have value. This is opt-in governance and the feature doesn't affect you unless you opt-into it.

However, after this post I would hope that this feature's worth has been showcased. First of all it would function as a way to give people stake knowing that said stake would never hit the market ever again, and second there are likely tax implications here.

How is the IRS going to tax you on "property" that is impossible to transfer?

Is that even "property" by definition?

Say I start a business, and part of my business-model is to support the community by powering up every coin. Now, imagining crypto as property, I started at ground zero here. My account was worth zero dollars and has zero Hive in it.

Property tax.

When you buy a house, how do you know how much taxes you need to pay on it? Does someone come along to appraise the value of the house every year so that you know how much it's worth and then pay your property tax?

No

The value of your property is decided the day you bought the house, until you die or sell the house. That's how it works. Which is why a family member dying and the question of inheritance can be such a nightmare with property, as the property tax often skyrockets due to the value of the house being appraised at a much higher number.

In the context of my Hive account, what was the initial cost again? Oh right, zero. So if the government wants me to pay property tax on my account, whatever percent of zero is still zero, as that was the value of the property when I acquired it. This may come into play later.

So now I build up my business and coins start flowing into my account. Is this income? The government thinks so, and they want to tax it. However, perhaps with a kickass lawyer the argument could be made that my "property" (aka Hive account) is simply gaining value over time just like real estate would, and my taxes owed are zero because I bought the property for zero.

This argument becomes even more relevant with powered up stake and other smart contracts. The IRS might look at my account and say:

IRS

Hey I see you have all this Hive Power here,

why haven't you paid taxes on it?

Me

Actually that is a common misconception. Hive Power is an illusion. I don't own any "Hive Power", we just call it that so that noobs don't get confused. What I really own are something called VESTS, and VESTS have no value because they are untradeable and there is no possible market for them.

IRS:

Okay, but now you're being ridiculous, because you can "power down" the VESTS into this exact amount of HIVE which is worth this much money, so you obviously owe us. Stop dicking around.

And they might be right and they might be wrong. The argument can continue from there for quite a while in court. They might win or lose depending on how good the lawyer is and any kind of precedence that's been set. Although there is very little precedence in crypto because it's so unique, so that leaves these opportunities open to be won.

However, what happens if those VESTS COULD NOT BE powered down? Then what could the IRS say? What if I received the VESTS as VESTS and I never had control of any Hive ever? The value of vests is... what?

You wouldn't know the answer to that question unless you tried to sell the "property" (aka my business' account), so my lawyer would then claim that the value of my property is either technically ZERO or completely unknown because, again, there is no market for such a thing. The value would have to be determined at the time of sale.

And then there is the issue of inflation/curation. The IRS sees my business account is distributing inflation to the users, and may even claim that some of those users are myself by proxy. Yeah? Prove it...

Thus we enter the realm were big Hive users create mafioso type strategies (like Binance) to protect themselves in these situations. Because even if you aren't trying to break the law, the law is going to be broken because crypto is so explosive it can do nothing but flip this idiotic jumbled system on its ear.

What happens if the asset has no USD value?

What if your community creates a coin that has no link to USD on purpose? How will they tax you if the crypto has value, but there is no way to determine that value in USD? If you can't get the crypto into USD, how can anyone pay taxes? Will the government open an account and demand taxes be paid in the native currency to their government account? What is to stop the community from blacklisting that account so the government can never spend the money?

You see? These scenarios are endless and we are still sitting on square one.

Conclusion

These are the kinds of examples going forward that are just going to absolutely wreck the regulators and the tax collectors. Government is a lumbering beast, and the agility of crypto is going to outmaneuver them at every turn. By the time the laws are changed to plug the exploit, ten new exploits will be discovered and utilized.

Again, I take no responsibility here. If you blindly take this advice and just assume it's true and then proceed to get destroyed by an audit, don't come crying to me. Do your own research or hire a professional. This is one of the few times I would unironically say "not financial advice".

Posted Using LeoFinance Beta

Great post. This is what happens when I'm up late. I start spilling secrets :)

For US purposes, a wash sale is buying a stock back within 30 days of sale. https://www.investopedia.com/terms/w/washsalerule.asp

Technically this could apply even if it's a different stock/ETF/whatever. Like if you sell one S&P 500 ETF and buy another, those are "substantially similar."

In a wash sale, the sale effectively never happens. Buy stock XYZ for 100, sell it for 70, buy it back within 30 days for 65, sell it for 120. Your taxable trade is 100 -> 120. The middle part "never happened."

I've thought a lot about this and came to the same conclusion. HP isn't yours until you power down. Liquid rewards that are paid out are taxable and are ordinary income rather than capital gains.

Posted Using LeoFinance Beta

Thanks for the comment I really appreciate it coming from someone who has a lot of experience in this area.

Kind of crazy, what if we never take anything out and keep it entirely on chain? Seems bogus to pay anything on it.

Yea, good question, sooner or later it would need to be converted to Fiat I suppose.

Posted Using LeoFinance Beta

yeah things get weird when you actually use it for what it is:

currency.

the tax topic is really interesting but I believe that the regulations change from country to country.

In Europe it is not yet clear how to behave in this regard, in Italy even more confused.

It would be much easier for everyone to outline a single guide but I think it will take time, hopefully not years

Posted Using LeoFinance Beta

Thanks @edicted & @nealmcspadden for bring this early awareness. If this is in Asset class how the Value evaluation going to happen - its not like real estate or any other similar ones to baseline a rate for a period . Within a day it can cross 30-50 Up or Down . Getting crazy. Thank God - i am in a country where not to worry much about it.

Posted Using LeoFinance Beta

Damn, I have to read this again when I'm sober, good post though!

I really want to hear more about taxes, I'm serious because nobody breaks it down for the average user.

Posted Using LeoFinance Beta

All of the above AND the percentage of filers who actually get audited has been dropping like a rock over the last decade because the IRS has been trimming their workforce. Anyone left there who still knows COBOL or FORTRAN to upgrade their software?

I must be a bit dyslexic. I first read that as

What if the USD has no value?

Posted Using LeoFinance Beta

Well, first off, capital gains are only made when you sell the property.

But there is weird middle instances where you have technically sold, but really haven't.

If you buy a house and then trade your house for another house, you did create any capital gains.

If you buy a house, and then sell that house, and buy another house, you created capital gains.

However, you are allowed to roll over money made from housing investments if done in a certain amount of time, and as long as you owned the first house for a certain amount of time.

Further, the opposite can be true.

The Infernal Revolting Syndicate can assess the value of any of your assets, and say that any trade is actually a disguised sale. This is to make sure people don't sidestep taxes by, like, selling a house for $1 to a friend.

Sooooo, the Infernal Revolting Syndicate can say you owe any amount.

And no amount of "law abiding" will save you.

Now, selling you crypto is a weird thing. Trading into USDT can count as a sale.

And then, at that point, you need all the records of all the trades that led up to that sale.

Also, the Infernal Revolting Syndicate has never made any rulings on what crypto is.

It is right now... a property, but they are trying to tax it like a stock, and what will be in the future is that crypto is a money, and there is no taxes on that.

I suggest just keeping your large holdings out of sight, and tenuously connected to you.

Two things will happen in the future.

Paying taxes is immoral? A good case can be made for YES

Living in Brazil, avoiding taxes is one of the things I need the most.

Amazing post, @edicted.

Posted Using LeoFinance Beta

There's so much to take from this, and the top on my list is that your government goes hard in this taxation of a thing.

Secondly, you asked a question:

Judging by how hard they go to get that Tax money, I'd say the answer is yes.

I think the idea where you wash trade with a dud token seems like a nice idea because that way you won't go to jail alone if things to work out :p

Posted Using LeoFinance Beta

Damn this is some pretty crazy thoughts, and now I am gunna be on the look out for this type of talks. I have been a stay at home dad for the past 2 years so I have been off the grid for a minute. Starting a remote job, going to be a self contractor of some sort, a first for me. Another comment I read as well on this post gunna have me meditating and doing some research upon

He put this in a very easy way to digest, just need the time to understand it enough to feel comfortable about it. Thank you for sharing this post and stirring up such informative comments. \m/

Posted Using LeoFinance Beta

Luckily German taxation still does not get crypto and simply regards it as things.

So as long as you had it in a wallet for 12 months it's tax free to sell :D

Posted Using LeoFinance Beta

I need to move to Germany!

Meant to say 12 months instead of 12 hours, which is a bit of a difference, but still better than paying tax :D

I have been running over some ideas in my head and plan to talk with a specialist crypto tax person in the new year. There are loopholes that we can access and I am hoping my theory is correct so we can build an app for it. Good post and glad you are thinking this way as we all need to learn this stuff whether we like it or not. Crypto is only going to go up in value creating more shit for all of us. Good shit though as it tells you that you are making money.

Posted Using LeoFinance Beta

By the IRS's own definition, HIVE power or STEEM power etc are not taxable income. The definition for paying taxes on a virtual currency are to pay the dollar value of the currency when received, but also by definition, HP/SP/etc. have/has no dollar value and are not traded on any exchange. Once they are powered down they are 'converted' into something that has a dollar value and can be traded on an exchange. Therefore based on my understanding HP/SP is not taxable income.

That is so crazy... and you can choose to covert rewards 100% into power so... sweet deal.

Bingo... been trying to do that on hive.blog for how long now... also perhaps LeoFinance should have that option?

On my country, probably, writing comments here could be considered freelancing and because of that I have to pay taxes for working even if I lose money or my profit is 0€ (why do we pay taxes for working? That’s stupid)

Posted Using LeoFinance Beta

Oh, what a tangled web we weave.

Which is apparently exactly what we want.

Posted Using LeoFinance Beta