CUB Bridge Fees

As the LEO/CUB devs grind out more code, we have to ask ourselves how viable some of these products will be. I've already gone into the bridge a little bit:

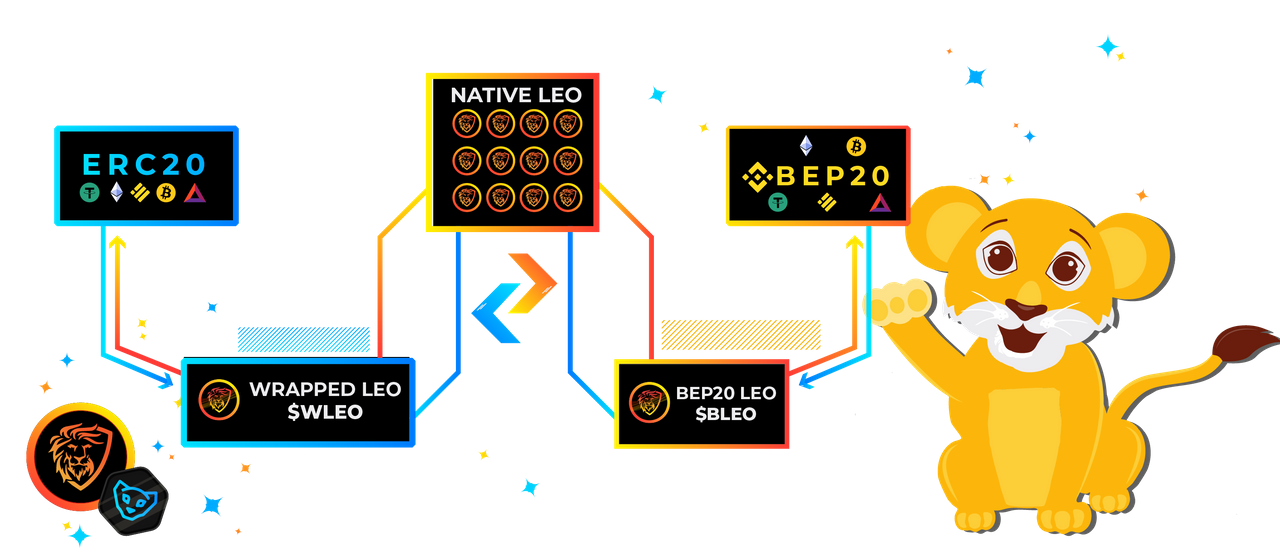

ERC20 : BEP20 Bridge

Interestingly enough, the bridge already exists. This is what will allow us to bring it to market so quickly. We already have the infrastructure to make all these moves manually. The frontend of the bridge will simply simplify the process to a one-click solution that anyone can use.

As it stands now, anyone can use what we've created here to transport value from the Ethereum main-net to Binance Smart Chain. The problem is that there are a lot of steps involved, and anyone that doesn't know about LEO cannot participate. Not only do users need to have knowledge of LEO to use the bridge, they also have to have a Hive account to unwrap/wrap LEO to the new chain. These barriers to entry are unacceptable, and that's why the bridge is being streamlined in this way.

How many steps are involved?

Trade ERC-20 for wLEO.

This involves multiple trades on Uniswap due to liquidity issues. LEO's main source of liquidity on Ethereum lies in the wLEO/ETH pair, so the only way to get wLEO with an ERC-20 token is to first trade that token for ETH. That requires at least two trades (three if the ERC-20 token in question doesn't have a direct pair to ETH).Unwrap wLEO to LEO

Again, this requires a Hive account and costs yet another ETH fee. Anyone who doesn't have a Hive account and doesn't know how this all works gets cut out from the service.Wrap LEO to bLEO (same logic as above)

Trade bLEO for BEP-20 (again, multiple routes)

Wow, that's a lot of fees :(

Yes, so so many fees:

- 0.25% fee just to use the bridge (burns LEO/CUB)

- 0.3% Uniswap fee for ERC-20 >> ETH

- One ETH transaction fee

- One slippage fee

- 0.3% Uniswap fee for ETH >> wLEO

- One ETH transaction fee

- One slippage fee

- One more ETH transaction fee to unwrap wLEO to LEO

- Another BSC transaction fee to wrap LEO to bLEO

- 0.2% Pancakeswap fee for bLEO >> BNB

- One BSC transaction fee

- One slippage fee

- 0.2% Pancakeswap fee for BNB >> BEP-20

- One BSC transaction fee

- One slippage fee

Holy shit! 15 fees!

In fact, I just realized we have to add two fees:

- One Eth transaction to send ERC-20 to the bot.

- One BSC transaction for the bot to send BEP-20 to the user.

In order for this to be a one-click solution a bot has to be in charge of the money the entire time to automate the process. That brings the total number of fees of the bridge to 17. Yikes!

YEP! It will costs hundreds of dollars to use the bridge one time.

Who the fuck would ever use this?

Hm, yes, I was thinking the same thing, except it already costs hundreds of dollars to do anything on ETH right now. Want to compound the gains of a yield farm? Well you have to harvest the farm, sell half, enter the LP, and then enter the farm. That's already at least 4 Ethereum transactions right there. Even though the CUB bridge is going to be expensive as hell it's going to provide an exit off of the Ethereum mainnet so users can finally get x100 cheaper fees every day on BSC. I call this the "Ragequit Effect".

The bridge allows us to utilize our current infrastructure in a new and interesting way while providing a service in dire need. One of the main reasons the bridge needs to exist is due to regulations that tie one arm behind Binance's back. They are being forced to IP-block Americans by the regulators.

It's quite obvious that no matter how many times I tell people just to use a VPN, this problem is only going to get worse. I can see it in the chatrooms, social media, and on-chain over and over again: How do I get funds onto BSC. This bridge is the key for a lot of people.

Paying for convenience

In the world of crypto, convenience and user experience (UX) are treasured assets. It could seriously take someone hours just to figure out how to move funds from ETH to BSC, and there are multiple ways in which users can screw up and lose all their money. By automating the process we provide a lot of value to users and save a lot of time, hassle, and fear.

What happens if Cub gets slapped by regulators?

If the bridge gets big enough, what stops the SEC from coming after us just like they do with all the other centralized exchanges? That's the magic of open-source code. Theoretically the code for this bridge bot could be accessible to all, and if Khal was ordered to stop providing the service he could just get someone else to do it in another country. Once dozens of nodes are all providing the same service it will become obvious to regulators that oops, this thing can't be regulated. That's decentralization for ya.

Liquidity is key

In order for the bridge to have less slippage costs we need to have a lot of liquidity. That means the wLEO/ETH pool and the bLEO/BNB pool are going to be very important moving forward.

Users migrating from ETH to BSC will be buying wLEO and unwrapping it, while selling that bLEO on BSC to get their original token back. This will push up the price of wLEO and drive down the price of bLEO, creating many arbitrage opportunities.

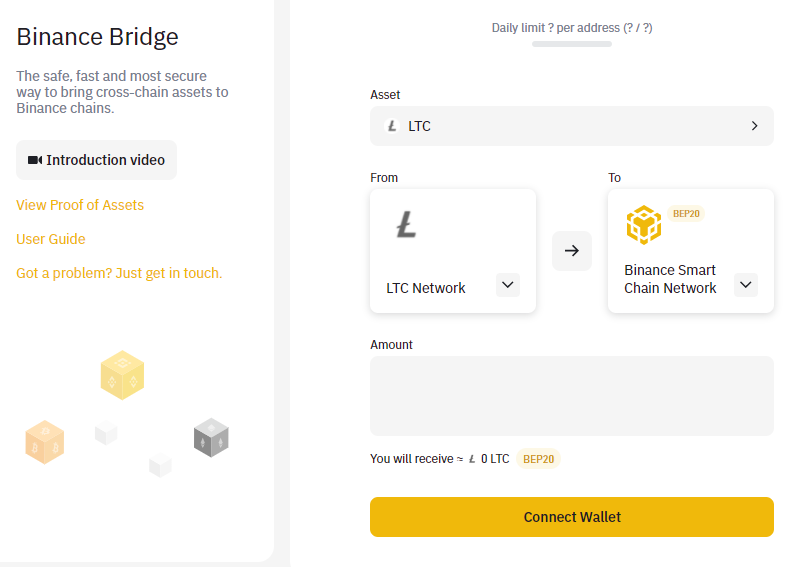

Binance bridge

Essentially the Binance bridge and the CUB bridge will look very similar on the front-end, but work completely differently on the backend. On the frontend, both send value to a bot that wraps it to the new chain. On the backend, Binance pegs tokens using hot/cold wallets. The fees are much cheaper, but there is one important distinction:

Honestly when I read this message it get offended. What am I? A child? Is my country the victim of sanctions? Nope, just out-of-touch regulators flexing their muscles when they shouldn't be. It's hilarious and sad that this can all be avoided with a VPN, but most users feel like this is breaking the law when it very clearly isn't. Remember, it's not against the law for citizens to make transactions like this: it's against the law for the centralized institution to provide you with the service. Regulations come from the top-down 90% of the time. It's the institutions/corporations that get slapped with demands, not the individual consumer.

Again, it feels so weird to be "the best country in the world" and then get lumped into a list like this with Albania, Bosnia, Cuba, Iraq, Iran, Syria, and North Korea. Funny how many of the countries on this list are countries that the United States itself imposes sanctions against, but we are on it as well. In essence, the USA is sanctioning itself against crypto. Smart move politicians, I can see you have a firm grip on reality.

Conclusion

The bridge is going to be very expensive, but that's just because ETH is super expensive. Ironically the high cost of the Bridge is going to be exactly why people use it: to escape the blackhole of ETH fees once and for all, and to start farming on a network who's operation costs are x100 less.

Posted Using LeoFinance Beta

So I saw @taskmaster4450le's post about it and I thought there could be some savings for the team if they had some spare bLEO and wLEO tokens to use.

They will still have to do everything between ERC-20 to wLEO and bLEO to BEP-20 but the internal process of wrapping and unwrapping both wLEO and bLEO can be done in bulk. How do they do so? They need to have a reserve of wLEO and bLEO to use when people want to exchange. By doing so, they can combine multiple wrapping and unwrapping operations into one.

Will this change the fact that it is expensive? No but it will drop down the fees by a small amount.

Posted Using LeoFinance Beta

Yeah there are a lot of things they could do. For example both bots could hold massive reserves of ETH and BNB on both sides. That way you could trade ETH directly for BNB in one swoop. However that requires a lot of overhead collateral to get started.

The reason the bridge is being created this way is because it's very little work to get it up and running, as all the functions already exist and have already been tested: they just need to be automated.

Posted Using LeoFinance Beta

You are right. It would require a lot of collateral and it would be much easier to just use the functions as is. Thanks for the clarification.

Posted Using LeoFinance Beta

Everyone can earn $ 250 + per day ........ You can earn 7000-14000 or even more if you work a full-time job ... It's easy, just follow the instructions on this page, read it carefully from Start to finish ... It's a flexible job but a good opportunity. For more information,

visit the site ......>>> https://lst.to/pvick

I think you are right, the LEO bridge will be an exit strategy for many to get off ETH the fees are just unsustainable.

That does appear quite expensive, what's the difference between just doing it manually? Is it cheaper? Like sell erc20 for cash and then use cash buy bsc?

I'm excited about the bridge and more people will use it as you said to escape Eth

Posted Using LeoFinance Beta

Easier to just send the ERC-20 to Binance and then cash out to BSC network.

Posted Using LeoFinance Beta

When this bridge is up and running got to give it a try.

It may not be that bad since you mention 17 fees totaled or more.

This will be something good for folks who can provide LP

for both chains.

Posted Using LeoFinance Beta

I had no idea how expensive it could be, I don't know whether to think that using Trust Wallet to have a little Cub was a great idea, but given this bridge and having all these protocols, it is very obvious that it will be unattractive!

Posted Using LeoFinance Beta

The vast majority of expense comes from Ethereum being clogged, which is exactly why the bridge should get usage in the first place. There are a lot of developments coming out for CUB. The bridge is small potatoes.

Yes, and I think that for a few experienced people like me, the bridge is still a bit far from understanding, to that I add the little content in Spanish that I could find to get a bit of Cub with Trust Wallet, I think there is a good market for cover there!

Posted Using LeoFinance Beta

I have a hard time wrapping my head around all of this but if a bridge still has to use ETH isn't it going to be just as expensive? Is it slightly cheaper and if so how? Why use a bridge and not just use ETH if its expensive anyways?

Posted Using LeoFinance Beta

All the is stuff you post about every day is often beyond me. I'm not into crypto in a big way but I did used to use Eth until the fees became ridiculous. The question for you Sir is, who is making all the money paid in fees?

Anyway, the point of this post was just to give you a pat on the back. When you write about something so well that it makes people like me who aren't particularly interested in the subject matter, read it. You are doing something right!

The miners are making bank, and god bless them for keeping Eth nodes running during the crypto winter that was the 2 year bear market.

Posted Using LeoFinance Beta

17, shiiiiit! Fees out the bunghole.

In any case I'm going to have to wait for the simplification of this simplification. I took too much biology in college.

that is indeed quite ironic

An interesting read, thank you.

Yes, the fees. In this food chain, the middlemen take the cream :)

For now, I will avoid anything ETH/ERC-20 related for as long as I can.

@tipu curate

Posted Using LeoFinance Beta

Upvoted 👌 (Mana: 0/22) Liquid rewards.

wouldn't it be easier to code, and with lower fees if they made connected liquidity pools on eth and bsc chains and connected them with a multichain bot? essentially just two "wallets" with enough money on both sides of a bridge

Posted Using LeoFinance Beta

It wouldn't be easier to code: the code already exists and has been tested.

It would have have lower fees.

It would cost a ton of overhead: where does that money come from?

That money then becomes a honeypot for hackers.

Exactly

I agree 100%. The cost of ETH transactions will stimulate the movement of capitol to BSC and the complexity and chance for loss of crypto will stimulate the use of the Leobridge.

The beauty of this is that ETH fees stimulate use of the Leobridge, Use of the Leo bridge creates an arbitrage opportunity, the arbitrage opportunity stimulates more use of the bridge, more use of the bridge increases the arbitrage opportunity...rinse and repeat...theres a post in there somewhere.

Posted Using LeoFinance Beta

Great update sir.

I'm starting to realize just how this project can have a profound impact on crypto. It will be useful for many users. Thanks and have a !PIZZA. :)

Posted Using LeoFinance Beta

@edicted! I sent you a slice of $PIZZA on behalf of @juanvegetarian.

Learn more about $PIZZA Token at hive.pizza

This was an awesome post. Especially your little rant at the end. I totally agree with that! It is so stupid that we have our hands tied so much for as free as we were supposed to be. It reminds me of some comedy skit I saw a while ago where they were talking about the US and saying "wait, you guys are supposed to be the crazy ones". What happened to that cutting edge spirit of exploration we used to have. Thanks for the advice on Discord the other day by the way! I appreciate it.

Posted Using LeoFinance Beta

Explain it to me like I am grandpop.

You did just that! For that, I thank you greatly!

Posted Using LeoFinance Beta

Even though the LeoFinance bridge would be cool, I think Thorchain will provide a much much better bridge in the very near future. I think it's already working to bridge ETH to BNB on the Binance Chain (BEP-2) which can then be converted to BEP-20 more easily, but I expect that soon it will be straight to BSC and services like Shapeshift have already integrated Thorchain native swaps and TrustWallet and many others will be following suit soon.

yeah things are moving pretty fast.

This sounds pretty cool. I remember reading about how atomic swaps facilitate cross blockchains trading with wrapping. I didn’t know it’s had reached this point of, functionality. The press releases I read recently were to opaque for me to determine what was going on, so thanks for clarifying.

Posted Using LeoFinance Beta

This was an awesome post)

Posted Using LeoFinance Beta

BLOCKCHAIN AND THE CONSTRUCTION OF WEB 3.0

https://leofinance.io/@aggregator/blockchain-and-the-construction-of-web-3-0

Posted Using LeoFinance Beta

Well put Mr. Edicted! Will share this with my normies as this will make it easier for them to grasp. Thanks!

Posted Using LeoFinance Beta

Read how this all have started with Toruk

Posted Using LeoFinance Beta

@edicted I love your posts and have been following you for some time! This topic has been on my mind and you answered so many of the questions I've had! The Leo Bridge is going to be worth the cost and it create so much more value for the CUB finance platform! Reducing the barrier to entry is the key to making this platform more user friendly and I love the progress the team is making!

Posted Using LeoFinance Beta

This sounds pretty cool.Reading about how atomic swaps facilitate cross blockchains trading with wrapping. The press releases I read recently were to opaque.This was an awesome post.

Posted Using LeoFinance Beta

I’m glad to see an open review of the bridge and I totally get the cost involved but with so much cash always looking for any yield I think trades will take the knock when it makes sense!

I think I’m going to have to start securing a bigger bleo position before this launches so we can feed the beast

Posted Using LeoFinance Beta

Wow, it seems as if this will be something that I would not use as well as I now skip UNISWAP due to the same reason (fees) (while today was a good day to use ETH lol, I had no liquids so too bad for me)

Thanks for looking into this, curious to see if they have a solution for this (I wonder how but ok, who knows)..

Just going to keep farming CUBS :)

Posted Using LeoFinance Beta