Binance makes the obvious BUSD play.

https://www.binance.com/en/support/announcement/e62f703604a94538a1f1bc803b2d579f

For those of you that haven't heard, Binance recently accounted that they are halting all trades for stable coins. All except BUSD.

- Binance will remove and cease trading on the following spot trading pairs at 2022-09-26 03:00 (UTC): USDC/BUSD, USDC/USDT, USDP/BUSD, USDP/USDT, TUSD/BUSD, TUSD/USDT.

- Binance will remove and cease trading on the following spot trading pairs at 2022-09-29 03:00 (UTC):

ADA/USDC, ATOM/USDC, AUD/USDC, BCH/USDC, BNB/USDC, BTC/USDC, BTTC/USDC, EOS/USDC, ETH/USDC, LINK/USDC, LTC/USDC, SOL/USDC, TRX/USDC, WIN/USDC, XRP/USDC, ZEC/USDC, BNB/USDP, BTC/USDP, ETH/USDP, ADA/TUSD, BNB/TUSD, BTC/TUSD, ETH/TUSD, TRX/TUSD, XRP/TUSD.

Okay perhaps I have misspoke, it looks like they are keeping USDT.

BUSD Auto- Conversion for users' existing balances and new deposits of USDC, USDP and TUSD stablecoins at a 1:1 ratio.

In any case, why would they do this?

In order to enhance liquidity and capital-efficiency for users,

As is always the case, centralized exchanges spin everything they do into a favor for their users. Don't worry, we're removing all these trading pairs that you use all the time, but we're doing you a favor. Like, it's comical. I remember when Coinbase jacked up their trading/withdrawal fees and claimed it was a good thing for users. Like, shut up. You're dumb. Not fooling anyone with that shit.

To be fair, consolidating liquidity on a massive platform like Binance is not a terrible idea, but at the same time anyone can see that this didn't actually need to happen. Binance trading pairs are massive and slippage is always low compared to other options. So why completely get rid of three very popular stable coins?

The conspiracy theory side of the equation is pretty obvious. By converting all stable-coins into BUSD, this gives Binance a lot more power over a derivative dollar that they control. Essentially they are funneling money into their own bank account. If BSUD is backed by dollars in a bank, they are basically just selling off the stable coins they control into dollars and then shoving them into their own bank account. Nice move.

The higher the liquidity is of BUSD, the easier it becomes to "print money out of thin air" and do all the shady stuff that banks are constantly getting away with. The peg of a stable-coin can easily be maintained with a small fraction of the collateral 99% of the time. Do I think that's what's going to happen? No, not really. I actually think there is another reason why this is happening.

Binance can see the writing on the wall.

They know that stables like USDC, USDP, and TUSD are not nearly as safe and foolproof as the marketing leads us to believe. UST collapsing to zero was a massive wake up call. There's no reason that one of these other stable coins wouldn't do exactly the same thing. They are all centrally controlled by corrupt/greedy institutions.

From this perspective, the move to consolidate stables into BUSD is a pretty prudent one. Binance can't control what these other stable coin issuers are doing, but they can control what happens with BUSD, thus they can ensure that if and when shit hits the fan that BUSD stands tall above the rest. That would be a pretty huge victory for CZ.

USDT not nearly as bad as people think.

For all the shit that Bitfinex gets for "printing money out of thin air" and all that, there's a reason they are at the top of the market cap. They know what they are doing and they aren't looking to rock the boat. The accusation that they can print money out of thin air and then dump it for Bitcoin without breaking the peg is completely asinine. That's not how markets work. Anyone that thinks this is possible is living is LaLa Land.

It doesn't matter if USDT is pegged 1:1 with USD. In fact the way that Bitfinex does it is probably better than a 1:1 peg. Wouldn't you rather have some of that collateral stored in a more decentralized way? People get caught up and don't realize that storing 100% of the money inside of the fractional reserve banking system is not a smart option.

For example, if the peg in question is a BTC/USDT pair, then the only way to maintain the peg when USDT goes under a dollar is to pump BTC into it. See the problem here? If they only have USD in a bank, how are they going to maintain the pegs of actual liquidity pools? Sell USD into BTC and then dump the BTC? That extra jump has a lot of negative consequences. Better to just store 1% of the collateral in BTC for day to day operations. It's obvious, but no one cares and they just want to call foul on a legitimate business.

Also USDT has the highest liquidity/usage, so it makes sense that Binance wouldn't just give it the axe immediately.

But at the same time we have to wonder if Binance is struggling and this is a sign of that strain. Considering they were buying out a bunch of companies going under during the crash I kinda doubt it, but you never know.

Conclusion

Binance, like all other exchanges and corporations, are liars and spinsters. When they attacked Steem with customer funds did they admit they fucked up and were insolvent? No, "we're having wallet issues". Did they help the situation? "No, we have a corporate policy of non-involvement". LOL, what a joke.

So when they liquidate three different stable-coins into BUSD (an asset they control) should we really accept the explanation blindly at face value? That would be extremely foolish. Like every corporation, Binance wants more money and power. This is a blanket reason for everything they do. 'Good' and 'Bad' are irrelevant. Capitalism is true neutral opportunist.

Unfortunately, I think this bodes very ill for any kind of possible HBD listing in the future. No way to get HBD listed on Binance now with something like this happening. Too bad. There's always the chance that enough dapps get created that use HBD and that demand gets us some free listings, but that's a years-away type deal.

Like I said earlier, I think Binance actually has legitimate concerns that one of these coins will crash to zero just like UST did. Is consolidating liquidity pools also a smart idea while bolstering the BUSD coffers? Sure. Decisions can have multiple reasons attached to them. But at the same time corporate public relations will only officially announce the most justified one. This is definitely a situation we should be keeping an eye on.

Posted Using LeoFinance Beta

CZ slowly but surely getting to complete his bond villain arch, and he just keeps getting away with it.

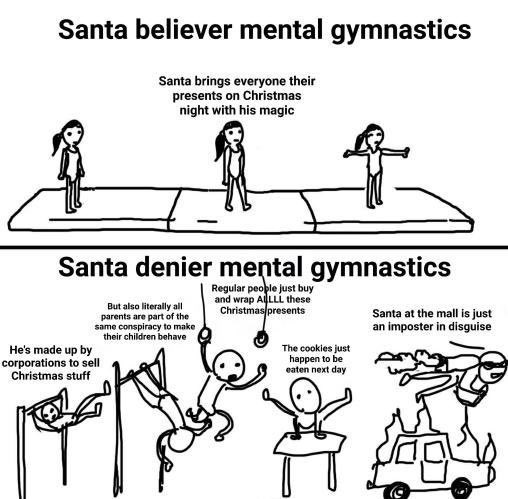

Also rofl at the santa mental gyms XD

Posted Using LeoFinance Beta

I enjoyed that one quite a bit myself.

Posted Using LeoFinance Beta

I don't think so, CZ is doing what a CEX should be doing. They had to leave China because of politics, went to malta, and simultaneously created binance.us for USA. After that, the EU got stupidly greedy starting to talk about next-level crypto grifts and they had to flee to the Cayman Islands with Binance.com.

They are troublesome good at what they do. Yap, I said it. People should know better than using them for custody, but their APP is really nice. After listening to hours of interviews and looking at CZs vita, I concluded that he's not a villain. He just doesn't give a frik while playing the global economy monopoly being part of the bank while being a player as well.

All those incidents with all kinds of chains POS or not should be below his level of attention discrimination on a usual day. Big and young companies are always troubled with constant recruiting and unclear power distribution. My bet is that rough mid-level managers are to blame for some of those crazy moves that we've seen on Binance and others might even have been internal affairs on an administrative level.

Posted Using LeoFinance Beta

Binance’s USDC balances cannot be frozen if Binance holds no USDC.

facts

True.

Posted Using LeoFinance Beta

This is something that nobody considered. I believe people trust the Binance Fund that they have for emergencies.

HBD is closer to be a stablecoin used by dApps rather than a stablecoin listed on top-tier exchanges IMHO. As the peg scaffolded, we may see better adoption of it on Hive and WAX blockchain-based projects ✌🏼

Posted Using LeoFinance Beta

The importance of being listed on centralized exchanges is diminishing. With regulation, the primary targets will be exchanges.

I prefer we keep expanding HBD (the derivatives) liquidity pools. That is where we can really provide liquidity and accessibility for people. There is always something to swap into that can be run through an exchange to get to/from fiat.

Posted Using LeoFinance Beta

Agreed. The future is all about DeFi. Who said that? 😀

Posted Using LeoFinance Beta

I would prefer that HBD stays mostly internal to Hive for now. Not forever mind you, but for now.

Let it grow and mature at home before going out into the wild world :-)

Posted Using LeoFinance Beta

very good analysis...very bad developments in binance 😐

!PIZZA

!PGM

!LUV

!BEER

PIZZA Holders sent $PIZZA tips in this post's comments:

@dirolls(1/15) tipped @edicted (x1)

Join us in Discord!

Binance has been one of the best exchanges and trust are trying to protect them selves as regulations is preparing to hit the cryptocurrency sphere, binance have been collaborating with various developing countries too launch their CBDC and as such with only BUSD and Usdt as their stables most of the users have no option than too option out too any of them.

I have to give CZ credit. He does his best to flip governments and regulators the bird. One this point I applaud him. That said, there is no reason to trust him since he is no different than any of the other centralized heads out there.

Posted Using LeoFinance Beta

True I don't trust him any bit,i bet he is the richest man in cryptocurrency on code

Corporations will be corporations...nothing surprising here

Truth

I would do the same if I were Binance... I'm a scum, I know...

There is another angle on this: the network effect.

Buy pushing the other stablecoins off the platform, people are also pushed into BUSD. This is going to grow the usage, spread out the holdings, providing the token with a more powerful place within the crypto world. After all, are people going to stop using Binance because of this decision? Some might but most will simply look to sell stuff and hold BUSD instead of USDC. The majority will not really care.

As for your assertion of being liars, cheats, and thieves, cant argue that point. Most of these centralized crypto companies are nothing more than bankers without the nice suits.

Posted Using LeoFinance Beta

Agreed, this is like a nuisance raise in real estate, when the landlord raises your rent $15 per month. It’s annoying, but not enough for you to move out.

Posted Using LeoFinance Beta

I’m moving out.

LOL!

🤣

Posted Using LeoFinance Beta

Thus more centralized token. I think this is shady frankly.

Thank you for sharing this news, I had completely missed this.

Posted Using LeoFinance Beta

Agreeed

Good for Binance profitability, and good for Binance stability. In the end, the only business Binance completely controls is Binance.

Agree this also makes an HBD listing unlikely for the near future. But HBD can star in its liquidity role on Binance and Polygon. Leofinance got the ball rolling, now it’s up to the Hive community to invest in those pools and make HBD famous.

Posted Using LeoFinance Beta

P.S.

I loved the Santa Claus conspiracy story.

Big Smile 👍

Posted Using LeoFinance Beta

unfortunately I would say that the chances of seeing HBD on BINANCE are now very few. Binance tries to push, who knows what will happen! Some users may leave BINANACE in the short term, but in the long term who knows what will happen. Thanks for information

Posted Using LeoFinance Beta

HBD was never going to be added there. It’s just the truth. But this move is frankly shady. I won’t use them again. Just my humble take.

Maybe when HBD has a bigger market cap.

Posted Using LeoFinance Beta

No chance, and it’s a good thing.

This move is so shady.