Binance Caves in to Regulators

Today is a dark day!

Binance is reducing their daily withdraw limits from 2 BTC to 0.06 BTC. It was really only a matter of time but this is a huge reduction right before a potential mega-bubble: not great.

https://twitter.com/binance/status/1420047670798807041

To support the ongoing security of all Binance users, new withdrawal limits will be established for those who have completed only Basic Account Verification.

Of course they could have done this without blatantly lying through their teeth and acting like they are doing their customers a favor. This is clearly caving in to regulatory pressure and limiting the ease at which one can shadow-bank and move large quantities on funds around on Binance.

@khaleelkazi so upset he turned on auto-correct.

If I'm being honest this change probably isn't going to affect me much. Sure, there have been times where I've moved significantly more than 0.06 BTC off of Binance. Currently a USD value of around $2300, 0.06 BTC per day is obviously exponentially less than 2 BTC per day.

However, that's still over $2000 a day, which is obviously quite a bit. For most people in the world that's more than an entire month's salary moved in a single day. The funniest part is how they are still measuring this limit in BTC, so when BTC goes x10 it will magically become a $20,000 limit. I wonder when they still stop measuring this limit with such a volatile asset (if ever).

Competition

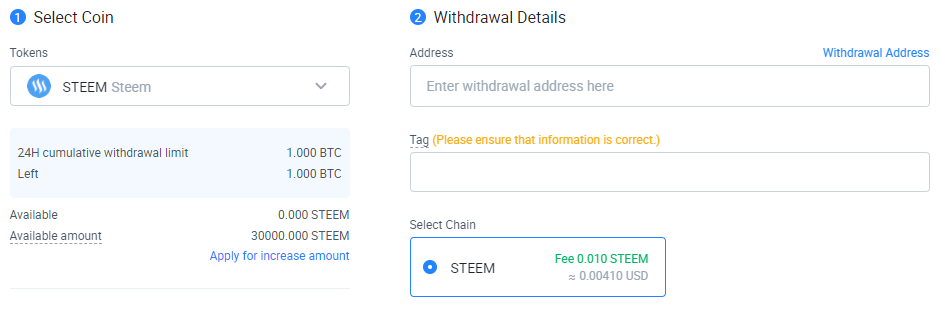

There are still some other very good non-KYC exchanges out there. Best one is Huobi Global in my opinion. I logged into my account for the first time since the hostile takeover, and it appears that they still allow a full 1 BTC to be transferred in a 24 hour period, which again, is obviously a massive amount considering only an email address is required.

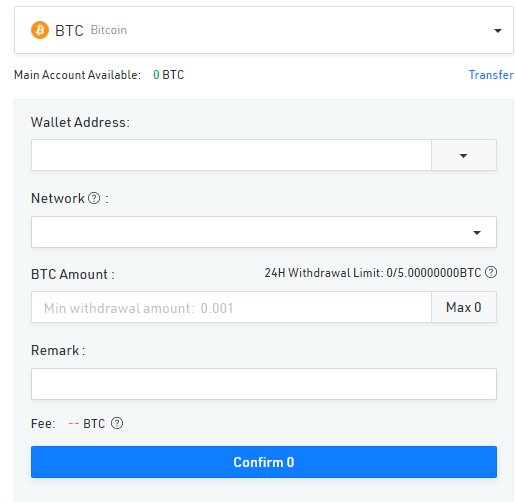

There's also KuCoin, which is a bit behind Binance and Huobi, but still pretty good. Let's log in and find out...

Wow, am I reading that right?

Kucoin allows 5 BTC per day.

Pretty wild.

So there are still plenty of options out there for those looking to move around money without overreaching KYC limits standing in the way. However, this is a perfect example of how the most popular centralized tech solutions will automatically get slapped by the regulators first. Binance is number 1, and this latest crackdown pretty much plays into that.

The interesting thing about regulations is that they can't stop crypto. We cannot be boxed in. We take the paths of least resistance, but when those paths become more resistant we find other paths. These limitations are only little bumps in the road in the long term.

DEX technology will continue to advance at exponential levels. More bridges to fiat will be discovered. Many of them will be peer to peer and impossible to stop. The ability to trade crypto for goods/services will completely undermine regulations altogether. At that point they'll have to regulate the vendors, but as I've said before it will be impossible to regulate the vendors once crypto city states start popping up: flailing around and they declare autonomy at their own peril.

Another ironic thing about pricing the withdrawal limit in BTC is that users won't want to use BTC to withdraw. The withdrawal fee on Binance for BTC is 0.0005 (~$20). Who wants to spend 1% on fees just to move money around. This will make other options like LTC much more attractive, because trading fees are only 0.1% maximum (less if you have BNB), and fees on LTC are x100 times less.

Conclusion

It's not great that CZ is caving to regulators. This is a big hit to Binance Mafia, and I'm sure he's not happy about the decision. I'm sure for them it will be worth it though to get the regulators off their backs.

Expect these crackdowns to continue. The more mainstream crypto gets the more these dinosaurs will demand control of it. However, the lumbering beast of crypto can't be tamed so easily. When one door closes, another opens. It's impossible to corner the market when the market is open source. Crypto finds a way.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

Not terrible. 😂

KuCoin will not allow withdrawals/sends without submitting KYC to retrieve a "6 digit trading password" required before executing any withdrawals/sends.

I keep meaning to stop by Huobi.

Shit yeah I did KYC on Kucoin.

I was thinking I just forgot what the 6 digit password was and needed to reset.

Man I found that shit out after I received! Friend of mine told me about the trading bots, unfortunately he left out a pretty serious detail. I've gone back and forth with KuCoin about 30 times the past few months. They won't return my 0.011 BTC.

Ah yeah I guess Kucoin is canceled then.

What a pain in the ass.

This is rough, especially for those accustomed to using Binance. Luckily there are other options and like you said more will continue to be created as needed. I love the peer to peer option. I look forward to that being perfected with something such as FIO behind it to make user error close to nonexistent.

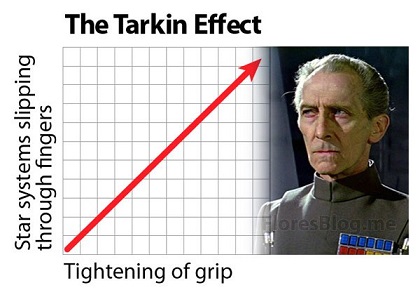

I love that you mentioned Grand Moff Tarkin 😂🤣

This is a great move for Cyptocurrency. It is time for that entity to lose a little of its power.

As you stated, it is only a matter of time before CEX is rather unimportant. DEX are advancing rapidly and with more money in the form of crypto, we are seeing a greater number of transactions operate in the crypto-to-crypto form.

Posted Using LeoFinance Beta

It's all about interoperability, that's why I'm so bullish on the LEO/CUB ecosystem.

These are interesting times. Am expecting even tougher clampdowns over the next year. It is somewhat assuring to me that Crypto is definitely being watched with attention and its potential is beginning to be understood

The big thing I forgot to mention is the zero affect on price.

This should be pushing the price down.

Fully back in a bull market.

You could come add to the liquidity in the tribaldex and leodex,...there's a bot for that.

Simpleswap is a great option for getting around the KYC stuff. It is an exchange aggregate and finds the best rates for the exchange. We have a Simpleswap widget on https://coin-Logic.com, which is where this post will be reblogged to, ;)!

Reblogged

When spending crypto around with ease will become normal, such withdrawals won't even matter anymore. Why would anyone use Binance at that point?

Posted Using LeoFinance Beta

Regular spending is only viable with bch, dash or custodial LN solutions

Posted using Dapplr

Or Litecoin or a few dozen others but Monero is my fav super easy. But far more then three.

Perfect timing (coincidental), I just removed all assets from Binance yesterday. I am done with them. Will try out Huobi.

Imagine using binance lol or any cex. If all u fucks started using hive-engine more and tswaps.com and alcor.exchange where anyone can list free on the swaps, we wouldn't need scammers like chinker face cz fuck his fake diamond Yello nigga ass haha binance can go die in a fire a lil bit and so can bitter and polomoex hahaha and who else? I forgot the names of exchanges because I never ever use them

On telos and eos and ethereum We have PBTC and PETH and PLINK and the lost goes on https://ptokens.io

Posted using Dapplr

This is probably not going to affect me for now because I hold only a little bit of BTC and it's mostly out of Binance but I think I should explore other options just in case.

Posted Using LeoFinance Beta

This tends to back up the point, "Not your Keys not your Coins." Meaning that if you have a large amount of bitcoin holdings put them on your personal wallet(s) don't leave them on exchanges. I know Binance claimed to be different but many companies back down to serious threats.

They talked soooo much crap lol but when it came to it they caved like everyone else. They are one of the most centralized exchanges though. When they started having a stable coin and then introduced stocks you knew it was all over and they where going to be on their A$$

Posted Using LeoFinance Beta

What good use is it to have it decentralized when it's in the hands of the majority, especially if this majority is in itself most of its members a majority of people who are easily made to submit. The majority still believe through fear indoctrination to obey. That's an issue that has to change if blockchain technology has any fighting chance. Otherwise they can just do what Justin Sun did with hive. server takeover. They make it illegal for anyone but them to mine and alter its code. Bitcoin and other alt coins pegged to BTC will suffer.

I rather much sell my assets before then and invest into my own security and self sustainable system while teaching others how to do it themselves. One neighbor at a time.

yeah, you called it that it should have pulled the price down. ... perhaps not a coincidence that it was announced after the price pump

I wish CZ will focus his resources into building a DEX, but you know...if only wishes were horses.

Posted Using LeoFinance Beta

for what i see, the moment cub.finance make something like send to paypal or bank, it will grow more than pancake. Is something like that even possible? a way to circumvent the data collection?

Peer to peer has been my saving grace since direct fiat bridge was cut in my country, but I believe that more withdrawal option will be found as said.

Ah, that is shit. Time to start moving out.

So practicality wins again and Binance lives to fight another day. As Khal said over $2000 per day is still over over $2000 per day. I have had only positive experiences with Binance, so I will contemplate the full effect of this first. Binance is quite the innovative place and we should weigh all its positives too.

Posted Using LeoFinance Beta

Well I expected them to cave since they kept getting hit almost every single day. I think I also saw an article about their CEO or some executive position stepping down also. We need some more decentralized exchanges so they can't target it as much.

Posted Using LeoFinance Beta

This is why Thorchain is so important.

Exactly. But the problem remains that, ultimately, one must be able to trade crypto for goods and services either via fiat or directly.

Posted Using LeoFinance Beta

hope somebody has a smart idea to address this, but I guess it will come down to vendors accepting cryptos

hope somebody has a smart idea to address this, but I guess it will come down to vendors accepting cryptos

I think one problem is that lawmakers may begin to force vendors to ask for KYC details if cryptocurrencies were used as means of payment. Until then, paying with crypto is a good solution. Just remember not to use any of your loyalty cards when at the checkout. :D In online payments, at least when buying physical goods that need to be mailed, not giving your physical address is difficult.

It might be possible to use gift cards that can be topped up with crypto. p2p crypto-fiat exit and onramps are a possibility. But those come with issues like trust.

Posted Using LeoFinance Beta

good points; looks like many cryptotards might only be rich with internetmoneyz 😅

The more mainstream crypto gets the easier it becomes to trade it for cash peer to peer with zero KYC. It will be interesting to see how that situation plays out.

Yeah, that is likely true.

Centralized exchanges are pretty disgusting anyway. DeFi platforms keep cropping up where one can exchange crypto for other crypto. As for fiat bridges, p2p is always an option but not without problems. Crypto city states are an interesting proposition. Physical entities like that are even easier to attack than jurisdiction hopping corporations like Binance.

I think it is actually a good thing that Hive keeps flying under the radar. The last thing we need is close regulatory scrutiny.

Posted Using LeoFinance Beta

Papa CZ seems to be cornered and things will only get worse from here. He also said something about being ready to step down as CEO so I expect a few changes to be made in the near future.

No one can make as much money as he did doing shady stuff almost all the time and get away without a scratch.

Posted Using LeoFinance Beta

it's literally a race against time in terms of still being able to cash out some money from the exchanges before they are too heavily regulated. Is there any hope that we will have some dex for fiat withdrawals? 😅 I guess the only real option is being able to pay with crypto one day from an anonymous wallet?...

Exactly

It’s always been the only option. The ease at which people store on exchanges in scary to me.

It’s always been the only option. The ease at which people store on exchanges in scary to me.

Centralized exchange..need I say more.

Posted Using LeoFinance Beta

no

Regulators trying to squash crypto transactions is equivalent to eating soup with a fork.

Amazing article as always! Thanks for the info and positive outlook for the future!

Posted Using LeoFinance Beta

Good info on the Huobi Global tip. I’ll be trying out.