CUBDEFI | Becoming a Liquidity Provider and How You Can Be One Too!

On Monday this week, I went to bed a boy and emerged a DeFi scrub after going over the documentation section on CubDeFi.

I have always been a visual learner so the fact that I was able to grasp and implement the docs in under an hour, that means the LeoFinance team did an incredible job on that.

However, this is not my first time coming across DeFi and its various branches including becoming a liquidity provider. In fact, the WLEO Uniswap project was one of the projects that got me interested in becoming an LP but the fees were too gaaddamn high.

It was clearly not for me.

Several months later, CubFinance gets announced and it is being launched on the Binance Smart chain Network. I have heard enough about BSC to know that it is entry-level friendly with incredibly low fees.

My excitement was palpable however capped with a bit of anxiety.

You know, in crypto sending money to the wrong address let alone the wrong network doesn't go unpunished. That was my main source of nerves.

I hate reading documentations, which is probably why I am such a shitty casual coder, but I had to go through each page of the cubdefi docs carefully and I would recommend that to anybody else getting into this DeFi game.

The other thing I would highly recommend if you are starting and you are not sure about yourself, send small amounts first and wait till they reflect so you don't end up flushing your wealth down into the cold, dark crypto abyss. Nothing comes out of that hole.

Becoming a Liquidity Provider

For some weird reason, I had this idea in the back of my head that this was probably the most daunting aspect of DeFi. I believe that is probably the same for many other people.

I am here to tell you, it is not!

At the risk of turning this post into a tutorial, becoming an LP is as simple as following these easy steps while taking the example of CUB-BUSD LP:

This part will assume you have the basics of MetaMask and the BSC Network.

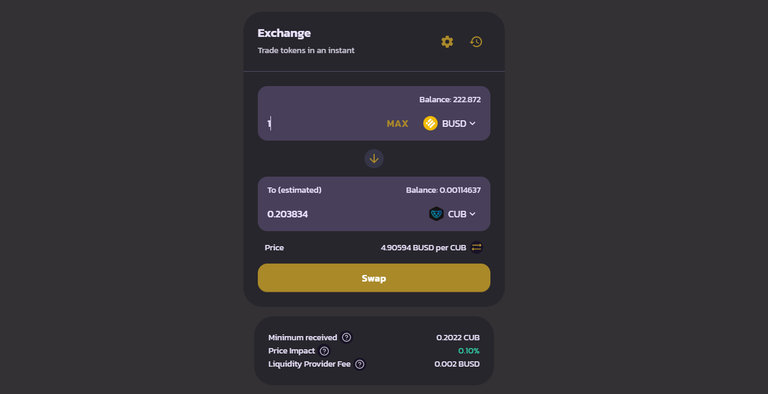

1: Assuming you have $500 worth of BUSD in MetaMask, go to the Exchange on CubDefi and swap at least $250 into $CUB.

When providing Liquidity into a pool, you deposit 50/50 of each token. So 50% of CUB and 50% of BUSD are based on the dollar value.

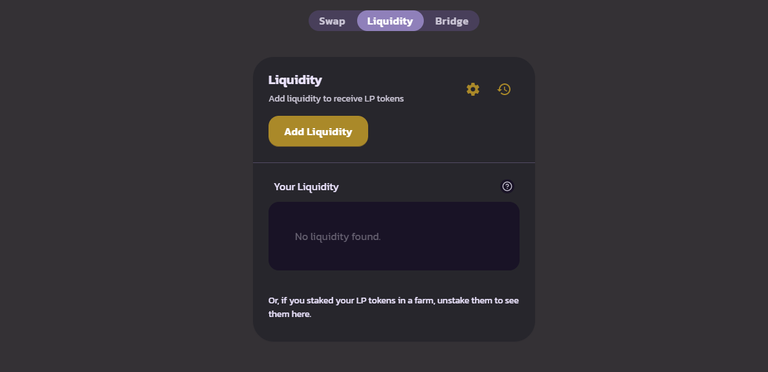

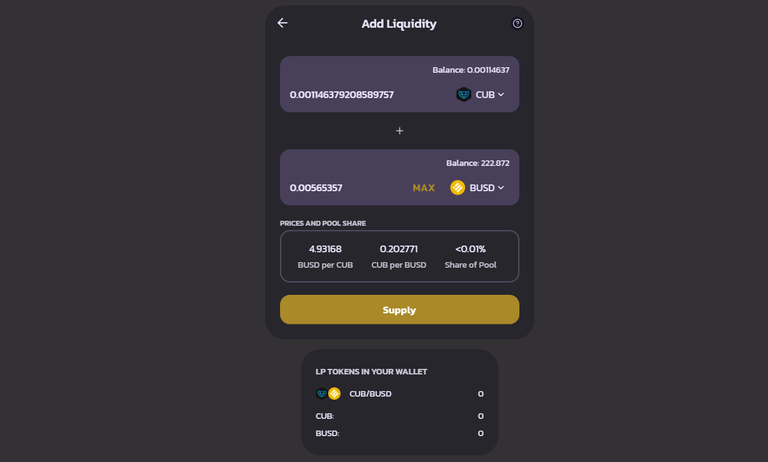

2: Once you do that, head over to the liquidity section and click on 'Add Liquidity'.

3: Since we are going for the CUB-BUSD LP, we want to choose those two tokens in this section. Fill either field with the amount you want to stake and it will automatically fill the other field with the exact amount to match 50/50.

If you have the funds available in your MetaMask wallet, the app will then allow you to 'Supply' that liquidity.

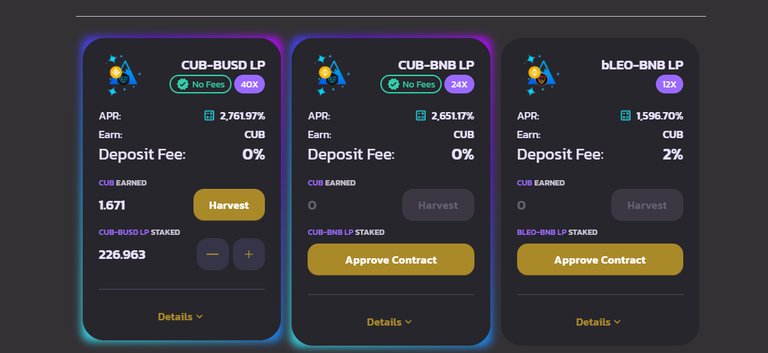

4: Once you Supply liquidity, you will receive CUB-BUSD LP tokens specific to that pool. These tokens represent a percentage share of the Liquidity Pool. Head over to the Farms section where you will find the CUB-BUSD LP pool.

If this is the first time you are interacting with a pool, it will ask you to 'Approve Contract'. That costs some fees so have at least $5 worth of BNB sitting in your MetaMask wallet.

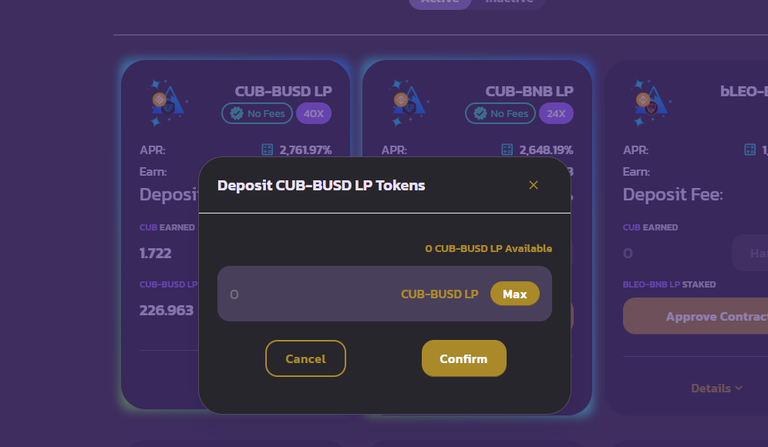

5: The next step is to click on the '+' sign to add your LP tokens into the pool.

Click on 'Max' and then click on 'Confirm'.

There you have it.

You are now a Liquidity Provider and every few hours you can harvest your $CUB tokens into your MetaMask wallet or compound them in the Dens to increase your daily rewards.

Posted Using LeoFinance Beta

https://twitter.com/denis_jk1/status/1370698388254167044

That is what I did

I heard video about pancake swap and emitate it

Really good explanation

Posted Using LeoFinance Beta

Most of these LP's are the same. It is very easy to transfer knowledge from one to the other. I hope other people struggling find this tutorial easy to understand.

Posted using Dapplr