Update On Ethereum 2.0! | April 2021

Ethereum is experiencing a real congestion issues during this bull run. Simple transfers going for 20$ in fees, swaps more than 50$ and some other smart contract transactions as harvest rewards, mint NFTs more than 100$. These fees are of course changing a lot on a day to day basis, depending on the market conditions. During the dip, I tested a claim/harvest transaction, and it was more than 400$.

With fees like this Ethereum is becoming more and more a whale’s chain at it current state. Competition like BSC is catching up. ETH2 can’t come fast enough!

I have posted about the state of ETH 2.0 a few months back:

Time to revisit this now and check the current state of the Ethereum 2.0 update.

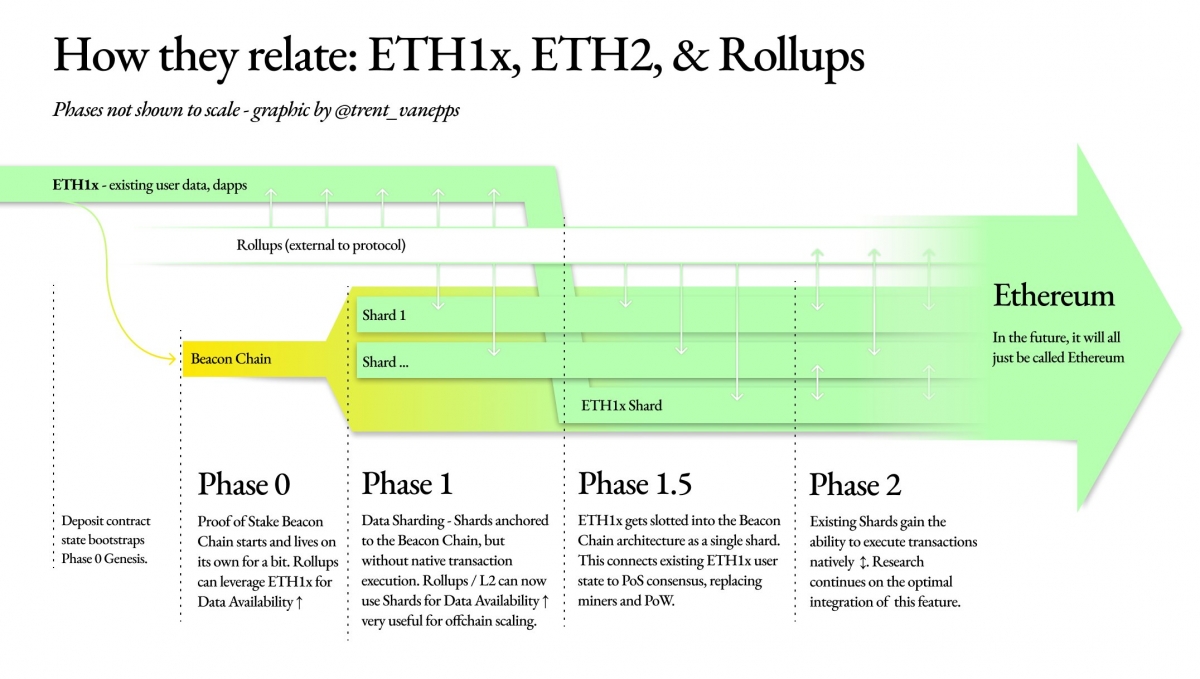

Ethereum 2.0 will be deployed phases in what should be less than two years time. Not a quick fix!

The three phases are:

- Phase 0, Beacon chain

- Phase 1, Shards

- Phase 2, Smart contracts in shards and docking

This chart illustrates the Ethereum transition quite well.

source

In the process described above the current state of the Ethereum network and the new Proof of stake Ethereum network will run in parallel until the final switch happens and everything is transferred on the new chain.

This update of the Ethereum network is quite a big operation, while billions of dollars are stored and transferred on the chain. This is way the transition will last long and with more steps in between.

At the moment we are in phase zero, Beacon chain which main role is to create a registry of validators and deploy a proof of stake consensus mechanism.

Phase 0 | Beacon Chain

Status: Live since December 1st 2020.

Yes, the beacon chain is already live and it made some news in December 2020. Prior to the launch of the beacon chain there was a period where a minimum of 16,384 registered validators set, each with 32 ETH staked. This condition was met and the beacon chain went live on December 1st.

As already mentioned, this doesn’t affect the current Ethereum network in any way. The beacon chain runs in parallel with the Ethereum mainnet.

What Does The Beacon Chain Do?

In short, the role of the Beacon chain can be summarized in the following:

- Introduce staking

- Establish validators

- Setting up for shards

Unlike some other PoS or DPoS chains that have somewhere around 20 block producers, Ethereum has went for a lot more block producers or validators as they are called for ETH2. The only barrier is the staked ETH and the hardware of course that is a lot less then all the mining rigs now. There is no voting or other mechanism to put in place a small number of trusted nodes, but a lot of nodes put in place that will be hard to collude against some form of chain data manipulation. This model put its security in the large numbers of validators.

Setting up such a big number of validators (16k) is needed for the security of the chain. Proof of stake does sacrifice decentralization and maybe some security (up to debate

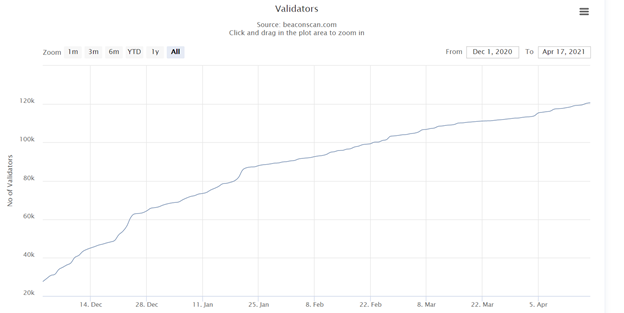

We will be using the Beacon chain explorer https://beaconscan.com/ to get some data. You can look at this explorer as an equivalent to the https://etherscan.io/.

source

More than 120k validators as of April 18th. A lot more than the minimum of 16k. There was more than 70k validators registered in the first month only (December 2020) and then the numbers slowed down a bit but still somewhere between 10k to 20k monthly new validators has been registered.

The ETH staked is locked up until the ETH2 network is launched. Meaning a long term commitment from the validators above. A 120k validators means that somewhere around 3.8M ETH has been locked by validators.

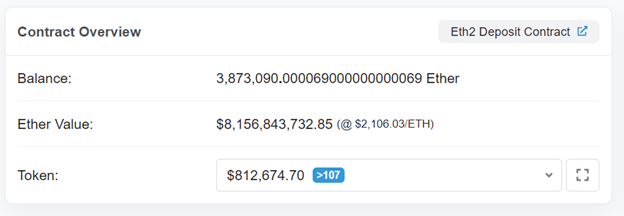

At the moment here is how the deposits looks like in the contract address.

source

As mentioned More than 3.8M Ether locked. At the current value of around 2k USD that is 8 billions in USD value. Quite an achievement. This shows the support, and the trust people have in the Ethereum network.

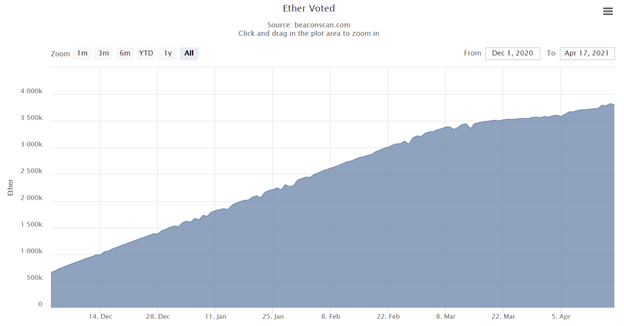

If we take a look at the Ether voted chart on the Beacon chain, we have this.

source

This is the number of ether staked in the participation on the Beacon Chain.

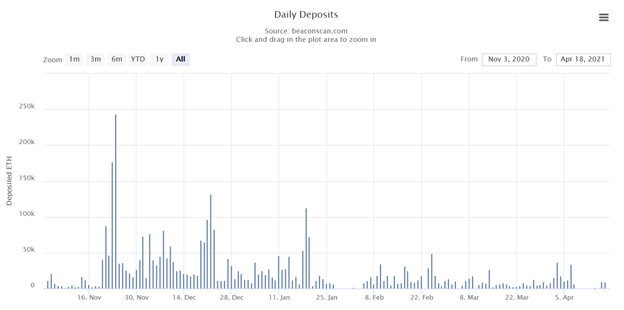

The daily deposits charts looks like this.

source

We can see the spike in the last few days.

Also, around November 24th and 25th, there was a huge amount of Ethereum deposited just before the launch on December 1st.

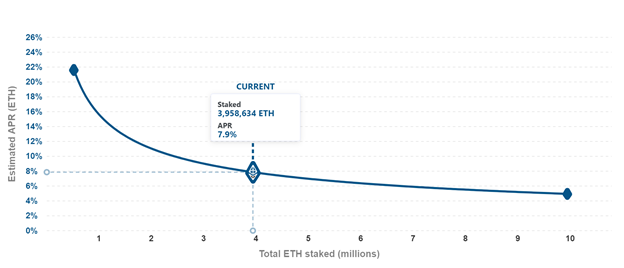

At the end a chart about the staking rewards.

source

This one comes from the lauchpad.ethereum.org web.

What this chart is showing is basically as the amount of ETH staked increases the rewards for the validators goes down. At current levels these rewards are at 7.9% APR. As we have seen from the above the amount of ETH staked has stated to flatten out, so this APR of around 7% seems to be the balance for now.

Phase 1 | Beacon Chain

Status: Expected to launch in 2021.

The proof of stake consensus mechanism will speed the chain by itself as there will be less nodes to sync with each other unlike the mining and the Proof of Work (PoW).

But the aim of ETH 2.0 is to go beyond this with the introduction of shards. If you are not aware sharing is a process of splitting up the blockchain in multiple blockchain that runs in parallel with each other. Each blockchain is called a shard. Random validators are chosen to sigh a different shard to avoid collusion. A total of 64 shards will be launched and in theory this should make Ethereum 2.0 easy to run even on your home computer.

At one point the current version of Ethereum should be launched to the ETH2 network as one shard and run in parallel.

I personally will be glad if this phase comes somewhere at the end of 2021.

Phase 2 | Smart Contracts In Shards and Docking

Status: Expected to launch in 2022.

At first shards will serve only as a data storage with now smart contract capabilities. The thing with the blockchains is when they serve only as a data storage, they are pretty easy to run, but once smart contracts are introduced this requires logic and processing and it put burden on the chain. There is an ongoing discussion how will the smart contracts be implemented in the shards, and should each shard have this capability or only a few of them. Some other options like Zero Knowledge (ZK) snarks are also mentioned, but these are still in development.

At the end, the proof of work Ethereum mainnet will dock in the new beacon chain as a shard. The proof of work ETH will then stop to operate, and the miners will no longer need to secure that network. Only the validators on the new chain will be active.

Since the launch of the Beacon Chain in December 2020, we haven’t seen any new info about the next phase, the shards. Meanwhile the numbers of validators and ETH staked on the beacon chain has grow with more than 120k validators and 3.8M ETH staked.

Its still a long road for ETH2 and we have a bull market going on, making the PoW version congested and keeping small accounts unable to use it.

Hope to hear some news on the shards in the following months and launch that phase in 2021. At the end time will pass and the final version of the chain will be here. Hopefully without any serious issues on the way 😊.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1383777166408634368

Posted Using LeoFinance Beta

Ether is playing with fire. The costs make the chain prohibitive for the common user. There are many other chains besides BSC that are making it competition. However, if people migrate to other chains, the transaction costs of ether will become competitive again. We'll see what happens.

I agree!

I hate eth and I'm glad that his own management don't do nothing to rescue it. Well deserve death

Salty!

Posted Using LeoFinance Beta

I was called worst =P

A lot is going on to get Ethereum from POW

to POS. It seems the transition does not

shake the value of ether yet.

From what you know what gives ether value this days?

!BEER

Posted Using LeoFinance Beta

Not so simple question :) But basically all the new stuff and development happening there.... lets not forget ETH is one of the most innovative chains .... DeFi come on ETH first

Posted Using LeoFinance Beta

View or trade

BEER.Hey @dalz, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.thank you for this information on ETH 2.0. So if I understand correctly we still have to wait until 2022. Ethereum could lose market shares.

Yes 2022 for ETH2 ... and this is an optimistic timeline :)

Posted Using LeoFinance Beta

wow! I didn't know it was an optimistic date. I believe that in the meantime many ETH users will move to other blockchains

This was really helpful! Thank you for breaking it down in a manner I could understand.

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 79000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

End of 2021 until the next upgrade?

It's a funny one because I'm inclined to think that other chains like BSC,ALGO,FLARE will have ramped up quite a lot already.

But then again, I thought the same thing about ETH scalability in 2018, and look where we are now 3 years later...

Somehow the rapid changes in the cryptocurrency prices don't really reflect a similarly rapidly advancing development across the board ;).

So perhaps 1-2 years from now is not too late for ETH. Time will tell...

Posted Using LeoFinance Beta

Will Ethereum's proof of stake allow for the same apps as Hive?

I'm very curious how well this is going to go. Sharding is rather newish and a complicated process to pull off. Going POS though is seriously awesome for some passive income and Ethereum will SKY ROCKET.

Think about it. A faster blockchain, lower fees, burning tokens from miners and staking a ton of Ethereum for POS will reduce liquidity by a lot. The price of it at least in theory will simply blow the freak up in my expert opinion lol

Posted Using LeoFinance Beta

If done correctly without any bad side effects it can be amazing!

Posted Using LeoFinance Beta

Sounds like there are quite a bit of work to be done. If it comes out towards the end of 2021, BSC might be able to take more of the market share. The high fees make it appealing to large users but not really for the common retail trader.

Posted Using LeoFinance Beta

This explains the roadmap really well. the problem with such an extended timeline, is that Ethereum lets other blockchains into their space like BSC, so they need keep pushing forward before BSC becomes more dominant. I think the cyrptosphere will be better off having BSC and ETH2 both being viable and heavily utilized as we all know in business competition drives innovation.

Posted Using LeoFinance Beta

Excellent, @dalz.

I'll pass your article to one of my good friends who is into ETH payments but never keeps an eye on the market changes.

Thank you!

@regenerette

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

I'll see you around

Thanks for the breakdown of the entire process. They have some major milestones ahead, before ETH 2.0.

Posted Using LeoFinance Beta

Seems like the dynamic of Ethereum being for the rich and Binance being for non-rich isn't going to change any time soon. Sigh. Wouldn't surprise me if the scaling can gets kicked again two years from now...

Posted Using LeoFinance Beta