The Trading Volume On Crypto Exchanges Is Up | How is the most popular DEX Uniswap doing?

Apart from the price, the trading volume is a one of the fundamental parameters in crypto. It shows how true the price is. The bigger the volume the better the price discovery for an asset. Although sometimes there are exceptions 😊.

As Bitcoin hit all time high with price above 40k the trading volume in USD numbers has been growing on all of the exchanges. Unlike 2017 there is now more established exchanges and better infrastructure for trading crypto overall. But even these are struggling at times with the massive volume. Coinbase is down is something that we keep hearing in the last period. Some look at it as the ultimate sign for a bull market.

Another different thing from 2017 is that we now have more established and usable DEXs (decentralized exchanges). Uniswap is leading on this front, so lets take a look how are the numbers there.

One very important thing to keep in mind is that a lot of the exchanges are faking the volume with wash trading. This happens on the CEXs, since they just “trade” on internal servers. On the DEXs however the trading is on the blockchain directly. Because of this each trade has a fees with it. Having in mind the fees on the ETH network, wash trading is not happening on the DEXs and the volumes are more real than on CEXs. There is exceptions here as well, but wash trading on ETH DEX is very very expensive.

With this said lets take a look at the data.

Overall Trading Volume On Uniswap

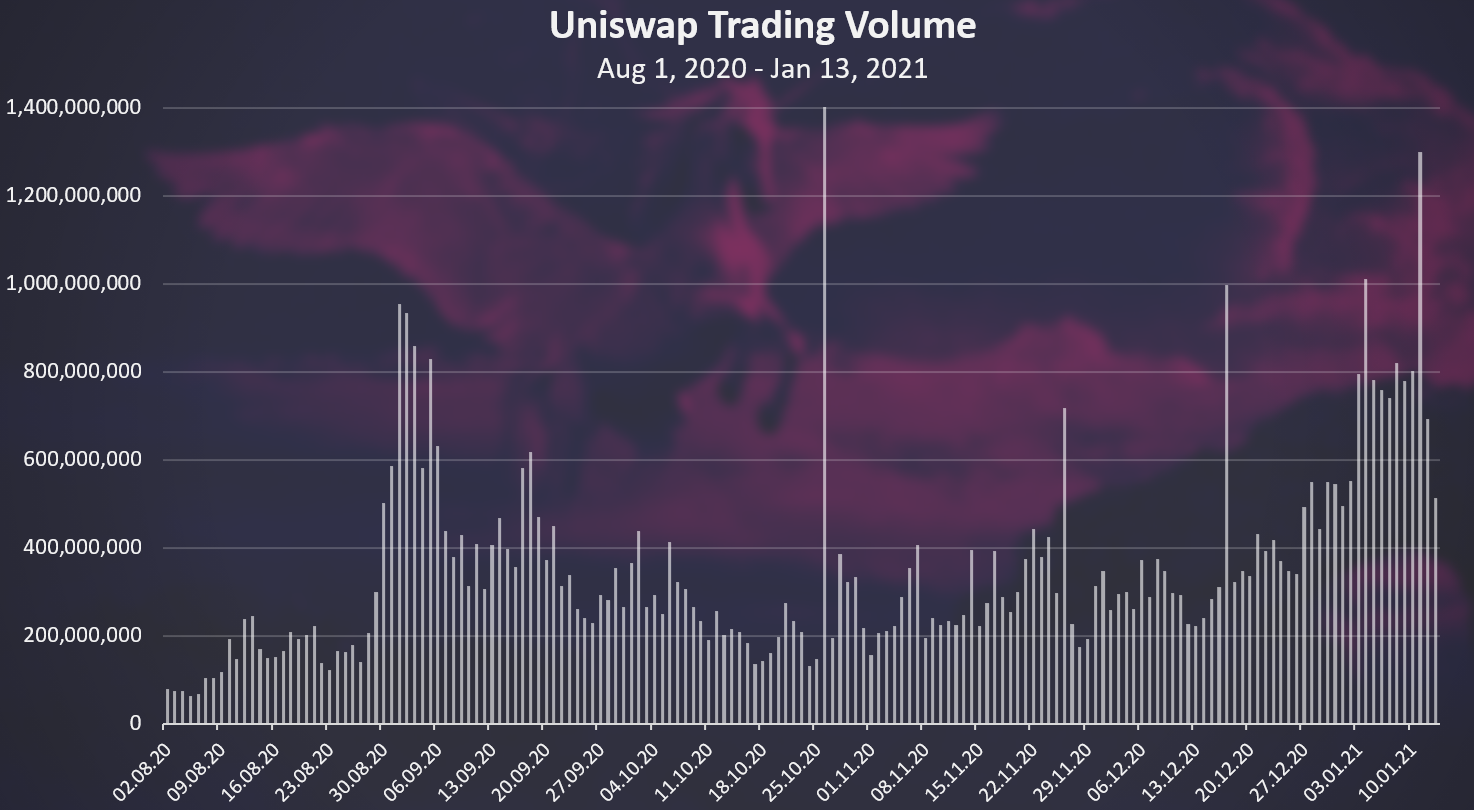

Here is the chart for trading volume on Uniswap starting from August 2020.

Uniswap has been in the making years before 2020, but it really took of in the summer of 2020. Because of this we will be looking at the data since August 2020.

As we can see there is a sharp increase in the volume in the mid of September 2020. This is when the airdrop of the UNI token happened. A down trends since then with few spikes up until the end of December 2020 when we can see that the trend start to go up again and the volume increases.

It is interesting that there was a incitive program in the beginning for providing liquidity on Uniswap with UNI tokens rewarded. But this time the volume grow without any incentives, but just from market driven activities.

January 11, 2020 has been a day with especially high trading volume, reaching more than 1.3B on that single day.

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

In the last period there is around 10 exchanges with daily volume more than 1B.

An example for the last 24 hours:

- Binance 13.7B

- Huobi 5.2B

- OKEx 3.1

- Coinbase 2B

- Kraken 1.6B

As we can see this is the big boys club. Uniswap reaching trading volumes into billion per day is now qualified for this club. Also, a reminder that there is no certainty in the numbers above, although these are some of the best CEXs and the numbers shouldn’t be that far from the truth.

The Uniswap type of DEXs (swap), have just started their journey. In a few years time it should be interesting to see how will the DEXs VS CEX picture look like.

Top trading pairs on Uniswap

Here is the chart for the top trading pairs in the last seven days.

The ETH vs stablecoins are on the top here. Interesting the USDC-ETH pair is on the top, better than the Tether. Tether is usually the most used stablecoin on CEXs, but we can see here that USDC is doing better. DAI is on the third place, very close to Tether. Would have been nice if DAI was actualy on the top, since it is a stablecoin created from smart contract and not from a company, same as Uniswap but it is what it is. Hope it will come on top in time.

Next let’s take a look a these individual trading pairs trend.

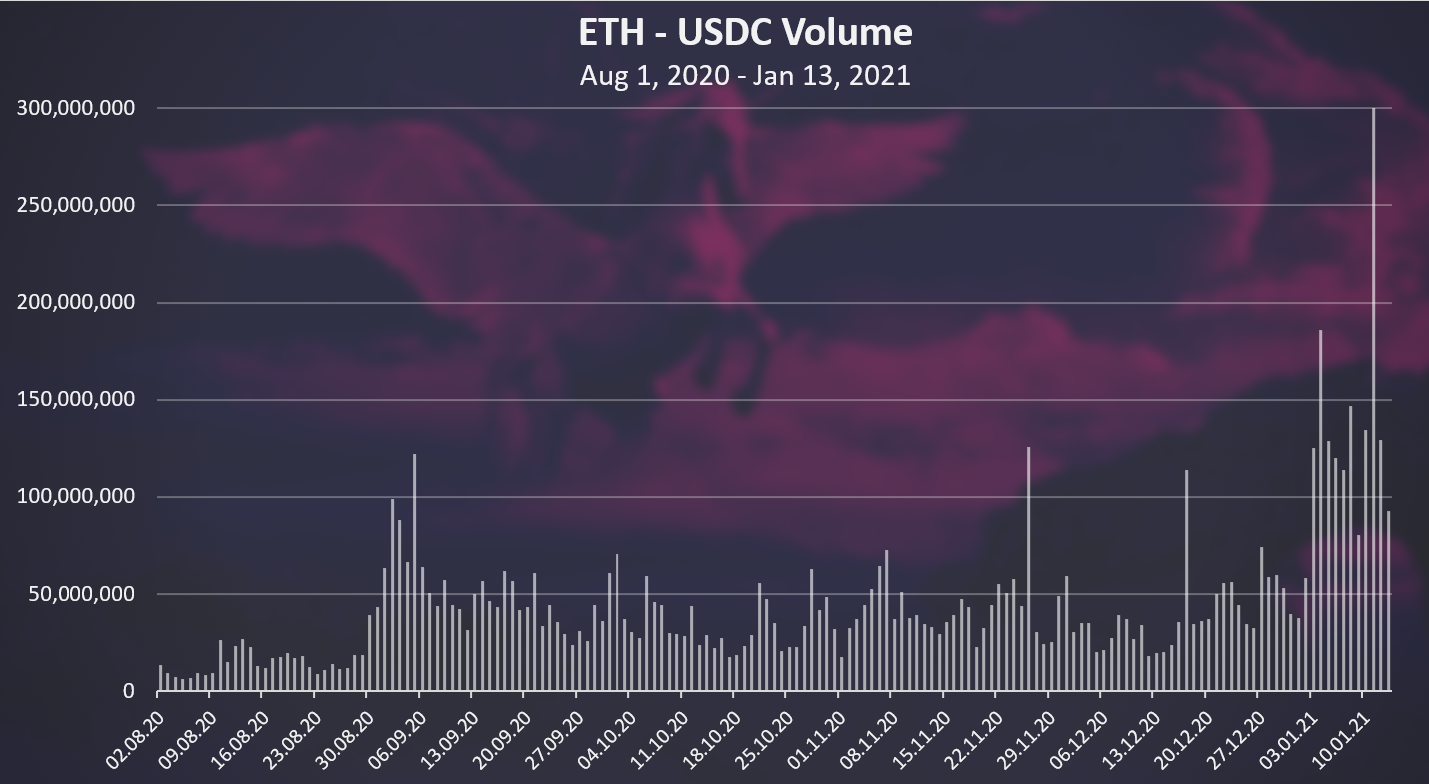

USDC – ETH Trading volume

First the USDC – ETH pair. Here is the chart.

We can notice a similar pattern with the overall trading volume, although for USDC it looks like this final wave is bigger than the first one in September. On January 11, 2021 there was more than 300M in trading volume on this pair.

Interesting the liquidity on the pair is just above 200M, meaning the fees for the liquidity providers were more than a 100% for that day. Overall, in the last period the APY for liquidity providers on UNI are amazing. Especially on these top trading pair.

These fees will likely pool in even more capital in the protocol growing it even more.

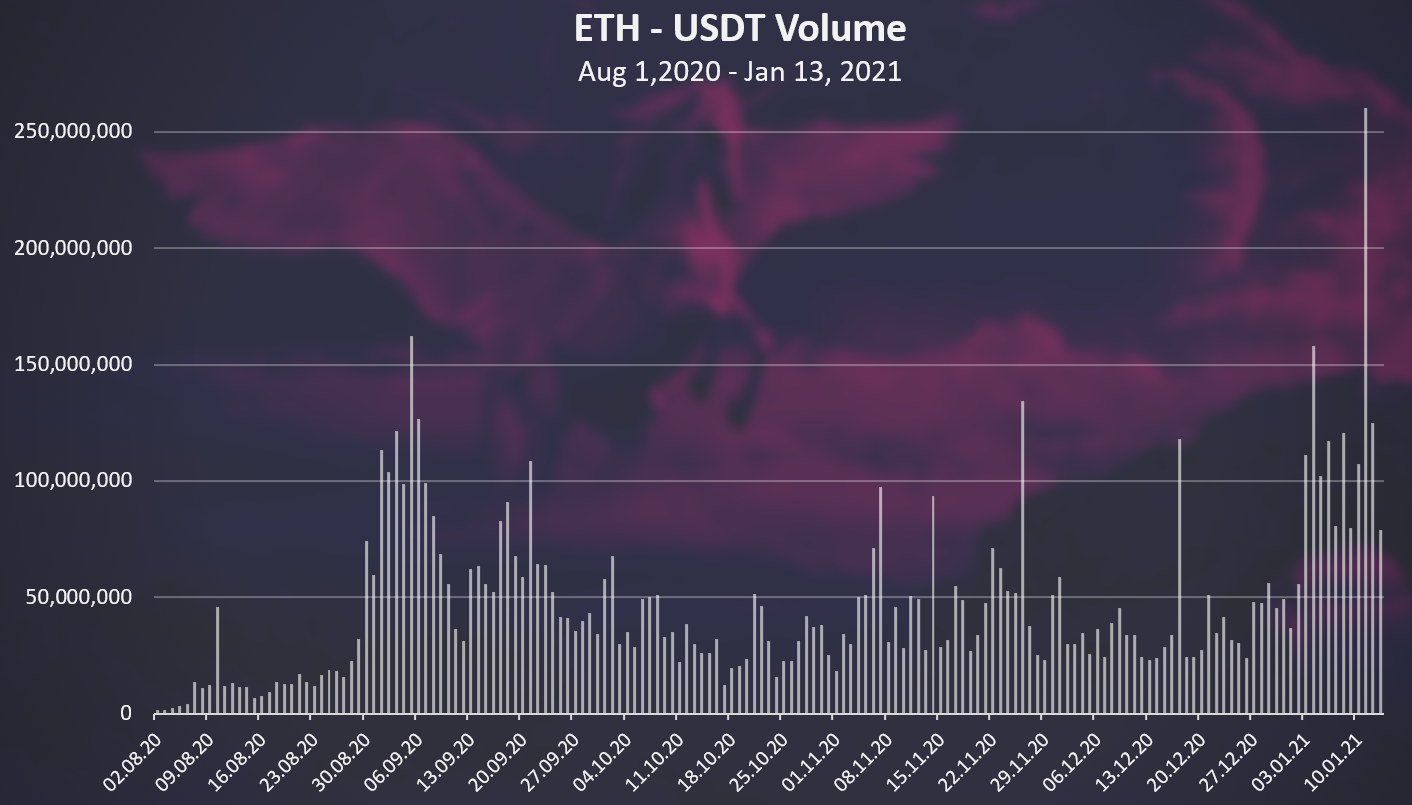

USDT – ETH Trading volume

The Tether- ETH pair looks like this.

Similar pattern as the above. On January 11, 2021 there was 255M in trading volume. The fees for the liquidity providers on this pair are also great in the last days, somewhere in the range of 30% to 100%. Although keep in mind they change on a daily level as the volume and the amount of capital in the liquidity pool changes.

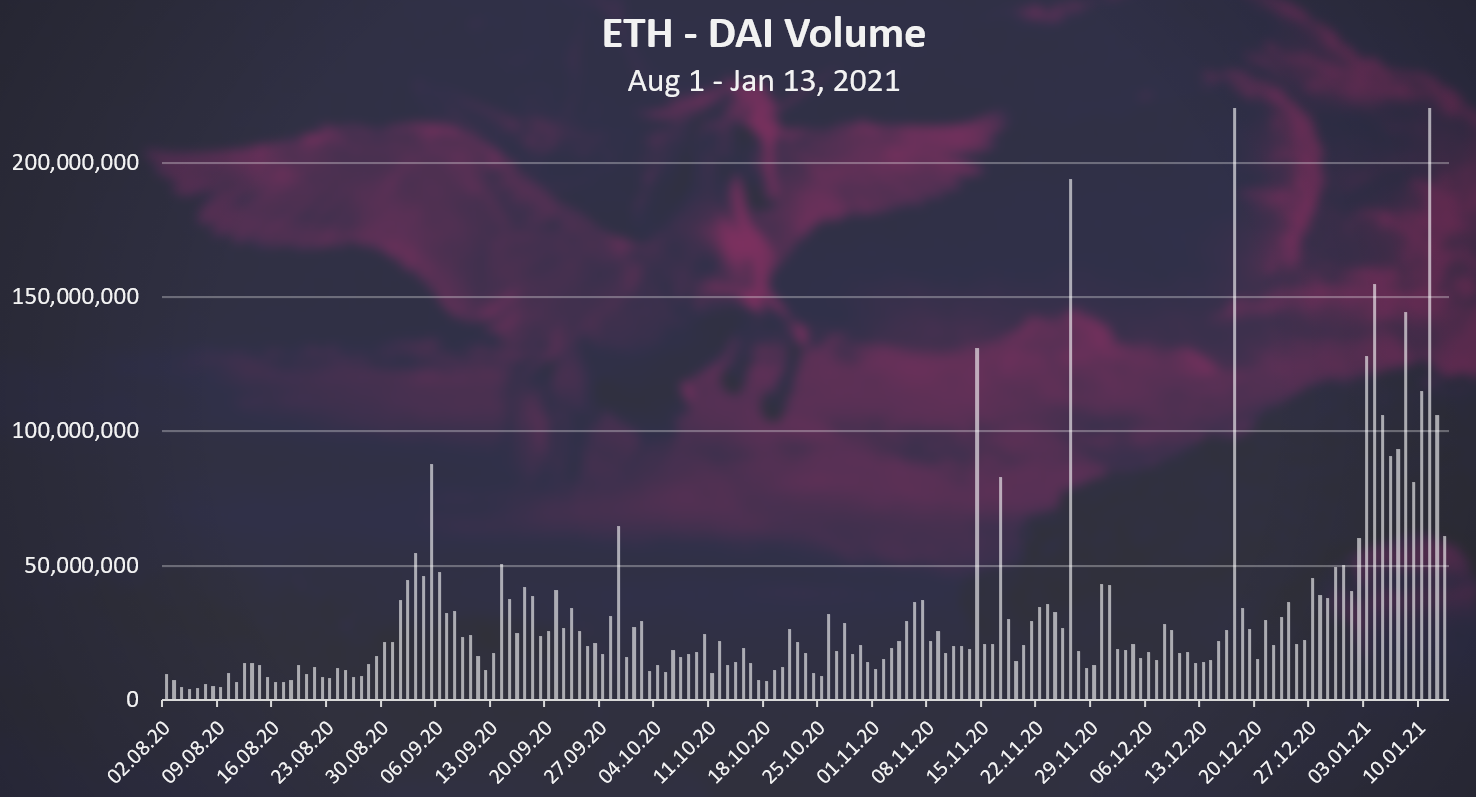

DAI – ETH Trading volume

The chart for DAI – ETH looks like this.

The DAI-ETH pair is experiencing growth in the trading volume as well, with few spikes in between. The first wave for DAI in September 2020 is much smaller than this last one, meaning DAI is establishing itself more with time.

More than 200M achieved in trading volume on Jan 11. Amazing returns for the liquidity providers here as well.

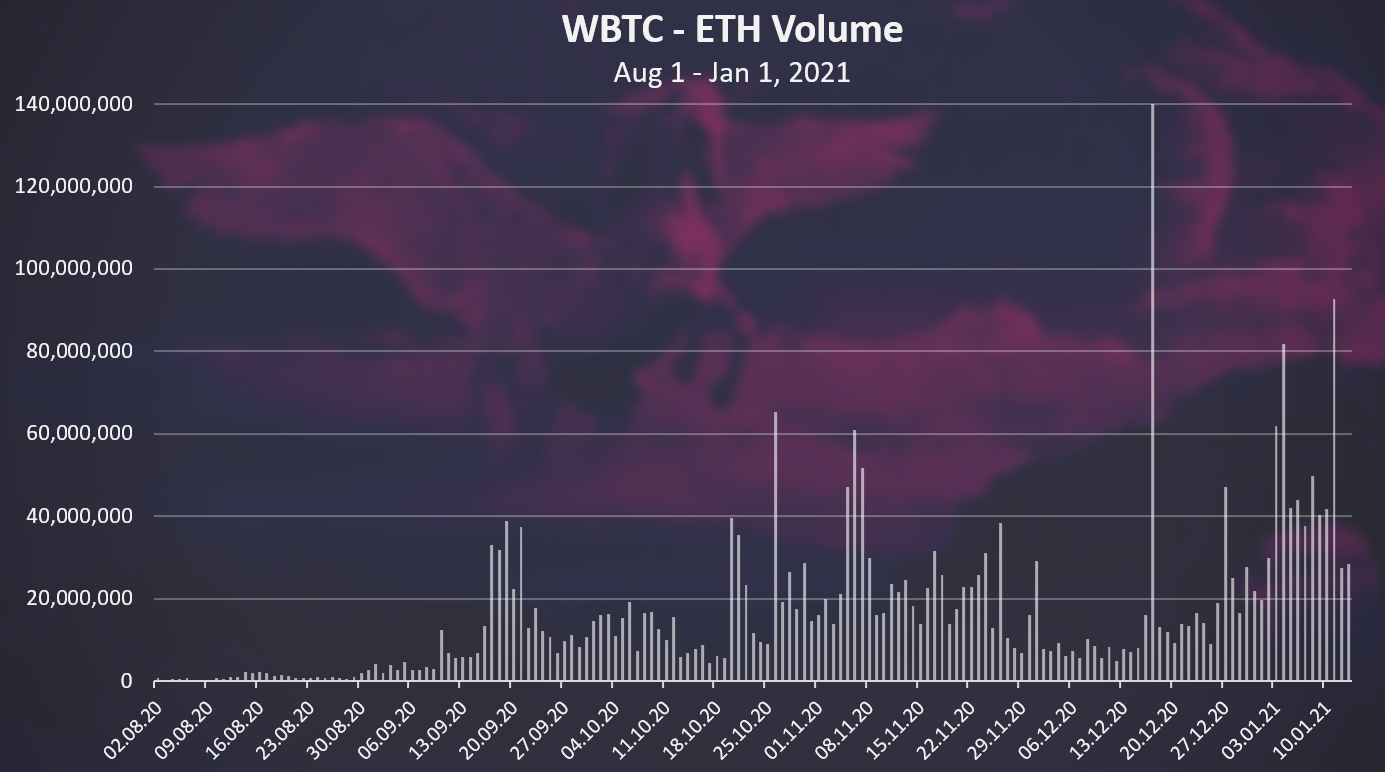

BTC – ETH Trading volume

The Bitcoin – Ethereum pair trading volume looks like this.

Overall the volume for this pair is significantly lower than the one for the top three stablecoins. It’s a bit of surprise. Does this mean ETH is decoupling from BTC? Maybe. DEXs are paving a way.

The record high in a daily trading volume for this pair in the last days is 92M, that compared with the 200M to 300M for the stablecoins is quite a smaller amount.

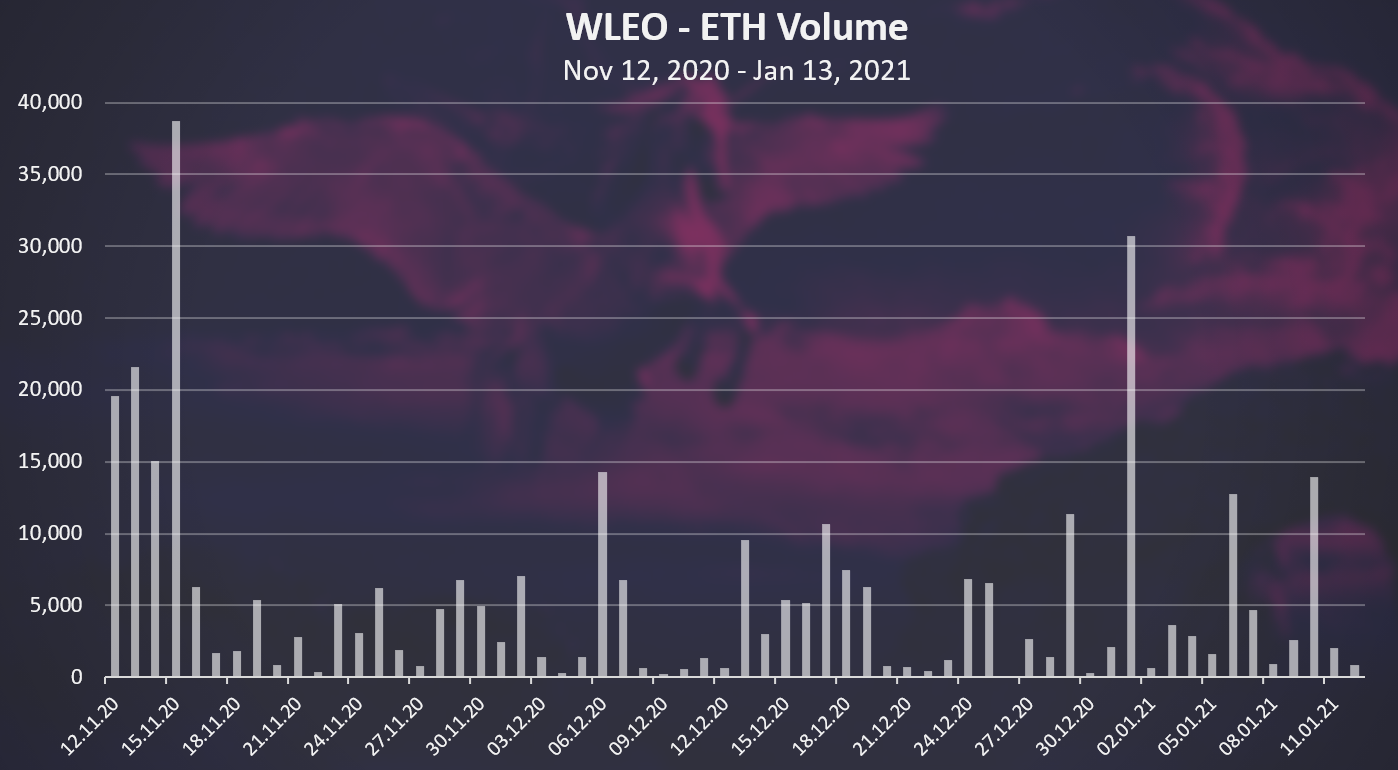

Bonus WLEO

At the end the charts for WLEO. The trading volume.

The trading volume for WLEO has been high in the start, reaching a 40k USD per day. It has dropped afterwards but we are seeing some increase in the last days, reaching more than 30k on January 1st .

The overall trading volume in the period is 344k USD.

If we compare these numbers with the ones on Hive Engine, they are much bigger and some of the transactions would have been impossible to be made, without a significant impact on the price. The liquidity in the pool has reached 1M at times providing a depth for the pair.

Trading volume is going up in this bull market and this time around with DEXs everyone can have a piece of the pie from the fees, not just the centralized exchanges!

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1349700457661427718

https://twitter.com/andrewdev6/status/1349733792894730242

Great job (as usual) with the reports, @dalz.

Posted Using LeoFinance Beta