Stable Coins | Is Tether Losing Against USDC and DAI?

You have made some gains in the bull market and want to take some profit. The question is where did you put your profits? What stable coin do you use? If you are in trading probably it will be the stable coin that has the most pairs on the exchange that you trade on. But if you don’t trade daily and just want to sit on some stable coins for the time and enter the market when you think where do you keep you profits? Tether, DAI, USDC, BUSD?

At the moment Tether is the third crypto by market cap just after the big two Bitcoin and Ethereum. It has been a long time in the crypto world and it’s the oldest stable coin of them all. Just as Bitcoin pioneered the crypto industry Tether pioneered the stable coins back in 2015. Tether has printed more than 20B in 2020 out of its total 24B market cap at the moment.

Ever since its inception Tether has been controversial especially of its dollar reserves in the bank that are backing each of their token. There has been a court cases and it has drawn the attention of legislators and regulators on couple of occasions.

In the last few years more stable coins have emerged, a lot of them created by centralized exchanges and a few in a decentralized manner as DAI.

Stable Coins Rank By Market Cap

Here is the rank of the top stable coins by market cap on January 24th, 2021.

Note there are more stable coin than the above, these are just the top four.

If we take a look at the market cap, Tether is dominating by a lot. A 24B to 5B for USDC and just above 1B for DAI and BUSD. BUSD is the Binance stable coin.

Trading Volume

Here is the chart for the trading volume of the top stable coins.

The data is from coingecko.

Tether is on the number one spot here as well with even bigger lead than the market cap. In fact, Tether is the number one crypto by trading volume in all the industry. It has a bigger trading volume than Bitcoin and Ethereum.

Where is this volume coming from?

Again, if we take a look at the data from coingecko most of it comes from the centralized exchanges, with Binance on the top, followed by Huobi, OKEx and few others.

Well from the numbers above looks like Tether is still dominating the industry by a lot!

A note here that CEX often can tweak the numbers and pump the trading volume for a better representation of themselves (wash trading). Things has improved in the last years with more reputable exchanges but still it is very difficult to tell are these are the right numbers.

Is the above the whole picture? Well no! Enter DEXs.

Decentralized exchanges [DEX]

In 2020 we have seen the rise of decentralized exchanges and protocols with Uniswap leading the way. On occasions Uniswap has outperformed even Coinbase by trading volume with more than one billion trading volume in a day.

How do things stand with stable coins on DEXs?

Here is the chart from Uniswap in the last 24H:

USDC is on the top here with around 115M volume in the day. USDT and DAI are in a close fight for the second spot with just above 60M. On a lot of occasions in the past DAI had larger daily volumes than Tether.

As we can see from the above USDC is enjoying a comfortable first place in trading volume on Uniswap. It has positioned itself on the first spot.

Furthermore if we look at the other DEXs like Sushiswap for example we will se this.

USDC is on the top here as well with 46M, followed by DAI and then USDT.

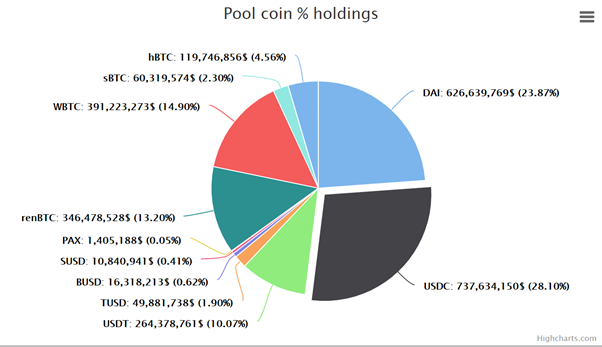

On curve, the stable coins platform we have this:

The above are deposits, but we can see that with 737M, USDC is leading just by small margin compared to DAI with 626M, and then comes Tether with 264M, with significantly lower deposits.

What we can tell from the above the trend in stable coins is quite different from CEXs to DEXs. Tether is still leading by a lot on CEXs with market cap and even more by volume, but on DEXs USDC has emerged as the no.1 stable coin. It’s interesting since USDC is another centralized stable coin vs DAI that is the decentralized version of it. Still DAI is ranking quite high on DEXs as well.

At this moment the overall trading volume in the crypto industry is still on CEX, (more than 90%) but the DEXs are growing more and more. They have just established them self in 2020 and in a few years time we will probably see a more even distribution on the trading volume on CEXs and DEXs.

If these early stages can be some indicator, that is Tether is not the favorite stable coin on DEXs. USDC and DAI are leading the way there.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1353282607459442691

good post, I kind of wonder what would happen if the dollar takes a dump... On some exchanges there are also other fiat currencies to trade, but if the fiat currencies don't hold where do we go? BTC, ETH etc. are too volatile to store any significant amount of wealth; perhaps an option would be to trade cryptos for physical gold?

Then Bitcoin will go up :)

The gold thing has been tried already and I think there are few gold backed tokens outhere just not in the top

IMO this will not take of as crypto is all about digital.... if you have gold backed coins, someone will need to manage the gold, centralized solution etc .... in the end isnt that the puropse of btc .... to replace gold :)

Posted Using LeoFinance Beta

yes, I get what you are saying. But if you really have money in cryptos like 100k+ and bitcoin goes into its bear phase again (which will probably happen in about 2 years). Do you really want to hold bitcoin if it's value gets reduced by 30%, 50%, 80%?

I think the long term plan is for governments to install a digital currency, probably a semi global one (e.g. USA; EUROPE and CHINA/RUSSIA on the other end). You will then be able to convert your old fiat currency into the digital one at a fixed rate until its gone. How will cryptos behave in such a time? Probably very bullish, but they many also be subjected to a lot of regulation.. will one then still be able to trade it for the new digital currency? Probably yes... I guess a lot is just very unclear at this point

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVery informative. I usually hold tether on my finance. I haven't dappled into dex so that explains why I prefer tether. The market cap and trade volume engender confidence.

Posted Using LeoFinance Beta

Tether had many doubters since years ago. What the market now has is alternatives. The concerning part is that central bankers are already getting into the game of their digital currencies. China has already released their digital currency.

Originally shared in this article.

Posted Using LeoFinance Beta

https://twitter.com/shortsegments/status/1353296885826523136

https://twitter.com/RaoulGMI/status/1352397419552657410?s=20

Posted Using LeoFinance Beta

Cool look at Stable coins, thanks for this. I'm really fascinated by stable coins now that I'm day trading, and part profits in USDT. A big part of it is all the highly traded pairs on Binance for USDT. If other stable coins had the volume on Binance I would certainly consider using them. Until then I stick with USDT.

Posted Using LeoFinance Beta

I'm pretty happy with DAI because it's the least used you can take advantage of bonus rewards on some DeFi platforms. The only enemy is USD and inflation which I think is going to be bad this year, sadly.

Posted Using LeoFinance Beta

Test1

Posted Using LeoFinance Beta

Test2

Posted Using LeoFinance Beta

All the time, I've used only USDT because I've done it on DEX's, as you mentioned. I wonder if there's a EURO stable coin?

Posted Using LeoFinance Beta

There was some talks about some euro coin, but I cant remember it :)

I use USDC myself.

I find it easier and accepted in more places.

I also use USDC on BlockFi for annual APR.

Posted Using LeoFinance Beta

Yep USDC seems to be growing!

https://twitter.com/shortsegments/status/1354739164097331201