HBD Printing And Conversions | Plus some thoughts on HBD

The second Hive token HBD has been a bit controversial in its existence. It supposed to be a pegged token to the USD and provide a method of stable payments on the Hive blockchain.

HBD is rewarded to authors (printed) when the debt ratio of the blockchain is bellow 10%. Meaning if the Hive market cap is 50M, HBD will be printed until there is less than 5M HBD in circulation. Ones this is higher than the 10% it stops being printed and authors are rewarded in Hive only.

Another source of HBD is the DAO/DHF fund.

Currently there is 4.5M HBD in circulation and the Hive market cap is 48M according to https://hiveblocks.com/. The thing is since the last hardfork the HBD in the DAO is not calculated as debt. There is around 800k HBD in the hive.fund now and growing, so the base HBD for calculating the debt at the moment is around 3.7M.

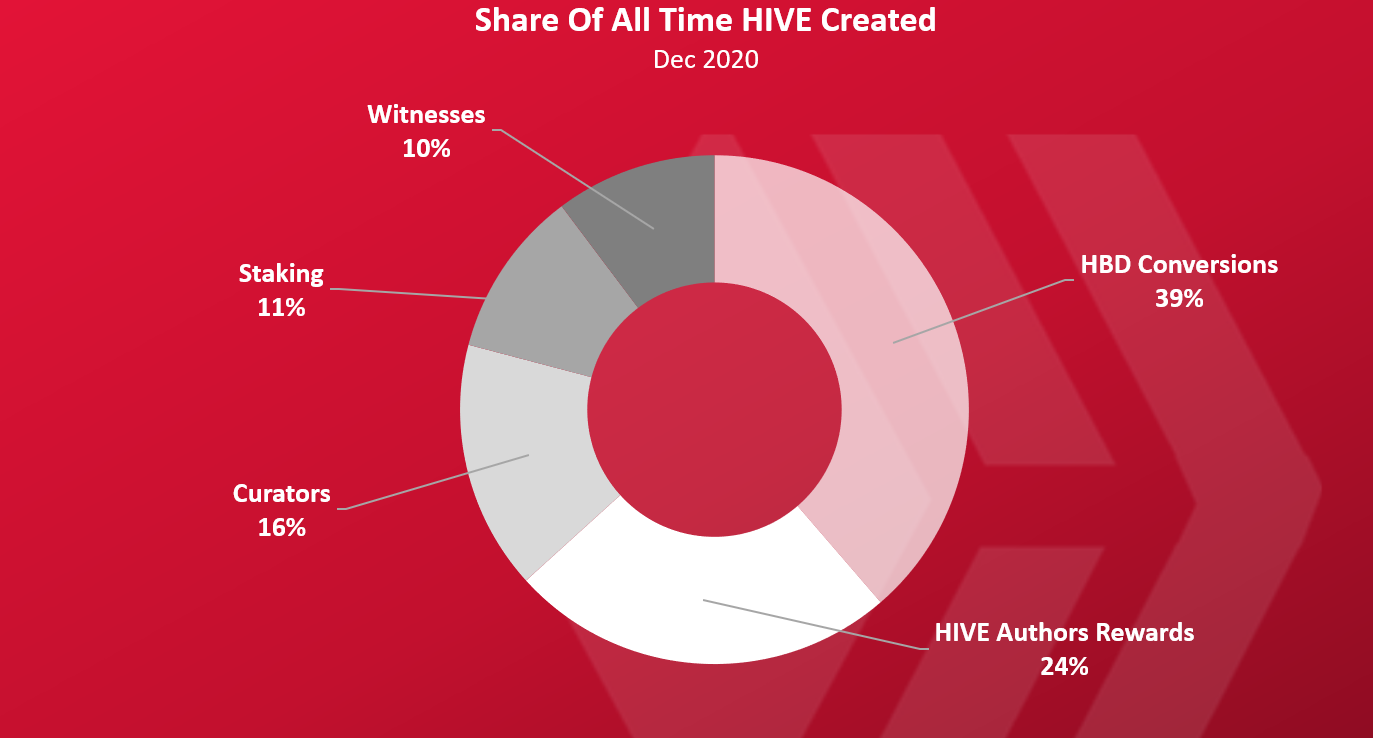

To get a better perspective on the HBD and the HIVE created from it lets take a look at this chart.

This is the share of HIVE being created since 2016, excluding the premine. Around 170M HIVE in total added to the initial premined supply.

The largest share of the pie is HIVE created from HBD conversions. A total of 39% of all the inflation comes from HBD conversions. This has pushed the Hive inflation above its nominal one that is around 7.5% atm, to more than 14% in 2019 and 2020. Almost doubling it.

When you have something that doubles your inflation its worth to take a closer look at it.

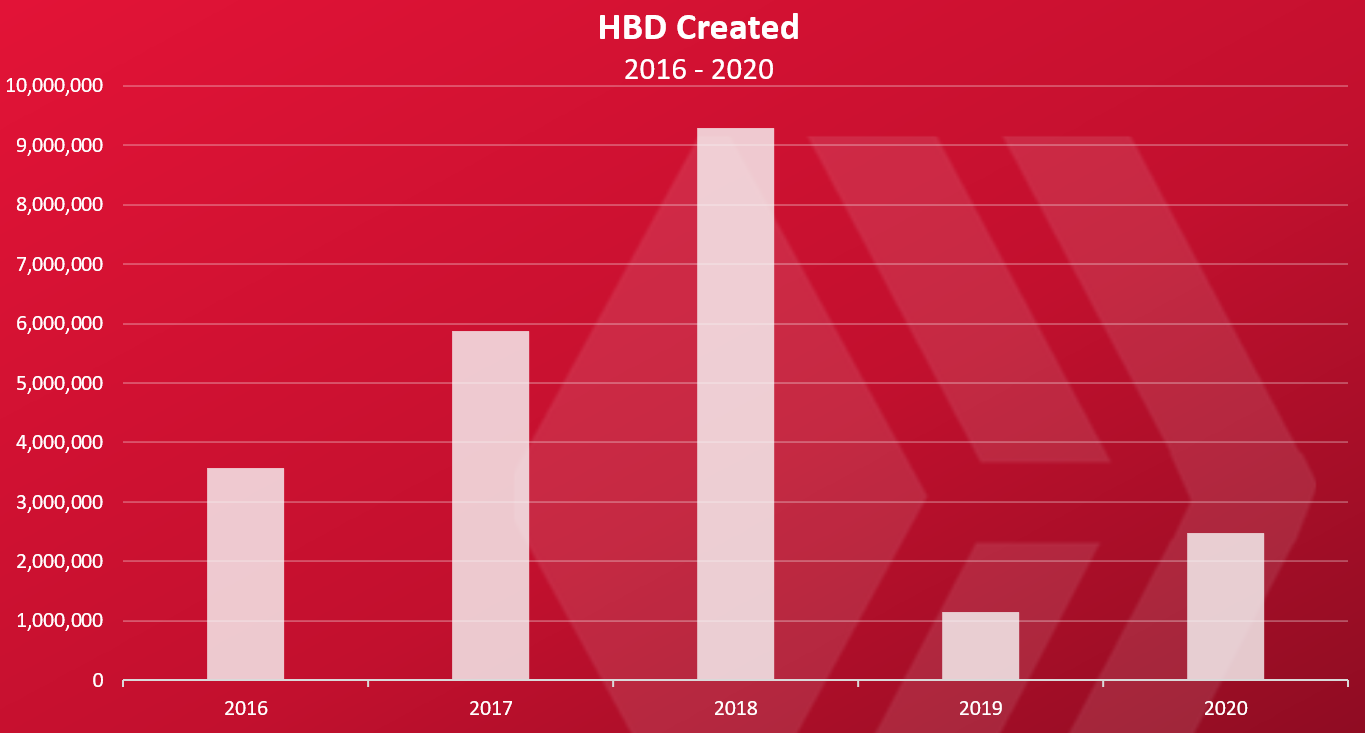

HBD Created

Here is the yearly chart for HBD created. We will take a look at yearly bars here, since we are looking at a longer period and the daily bars can be confusing.

As we can see most of it was created in 2017 and especially in 2018 with more than 9M HBD created in that year. Overall, around 20M HBD was created during the existence of the blockchain, but at the same time it has been destroyed and converted to Hive as well and we now have a 4.5M HBD in circulation.

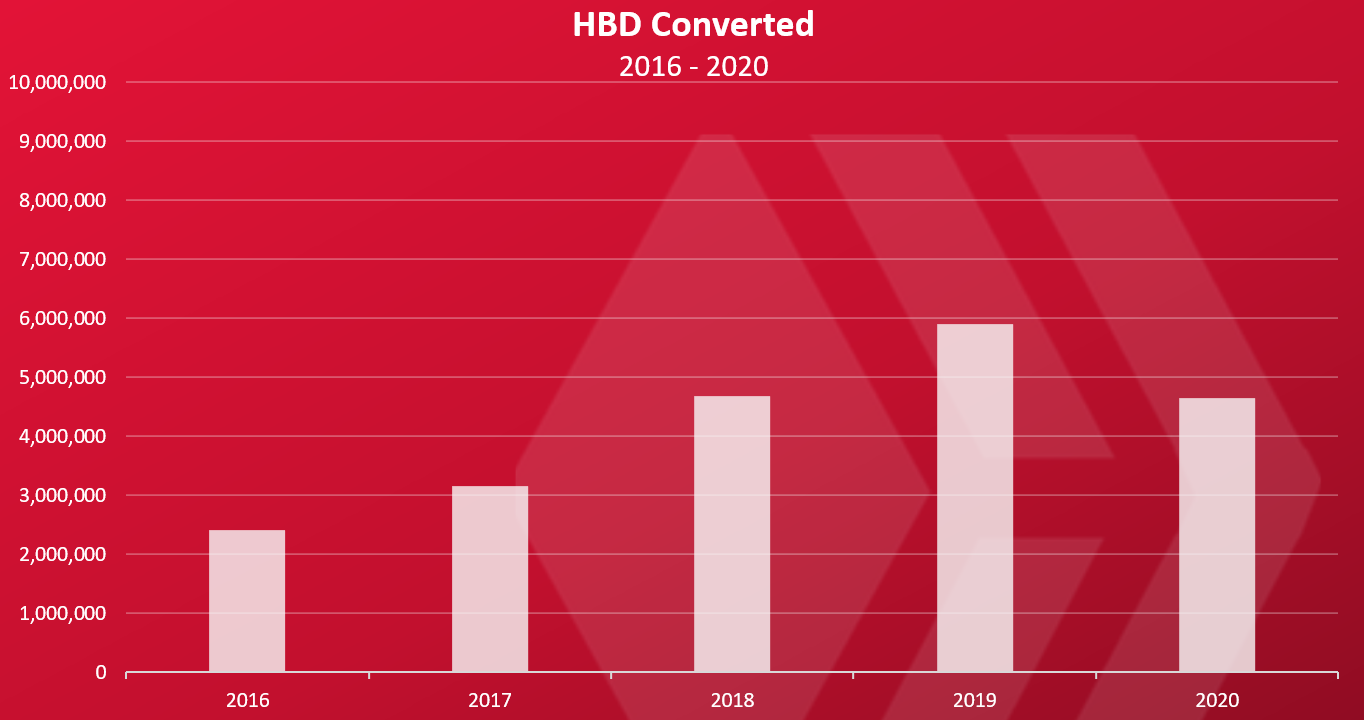

HBD Conversions

Here is the chart for the HBD conversions.

We can see that up until 2019 the conversions kept growing every year with almost 6M HBD converted to HIVE in 2019. In 2020 we have 4.6M HBD converted.

At first look it seems that the HBD conversions have dropped and less HIVE is created but have in mind that how much HIVE is created from HBD conversions depends on the HIVE price. If the price is low, more HIVE will be created from smaller amounts of HBD. We will take a look at the HIVE created from HBD conversions bellow as that is the main point of this post.

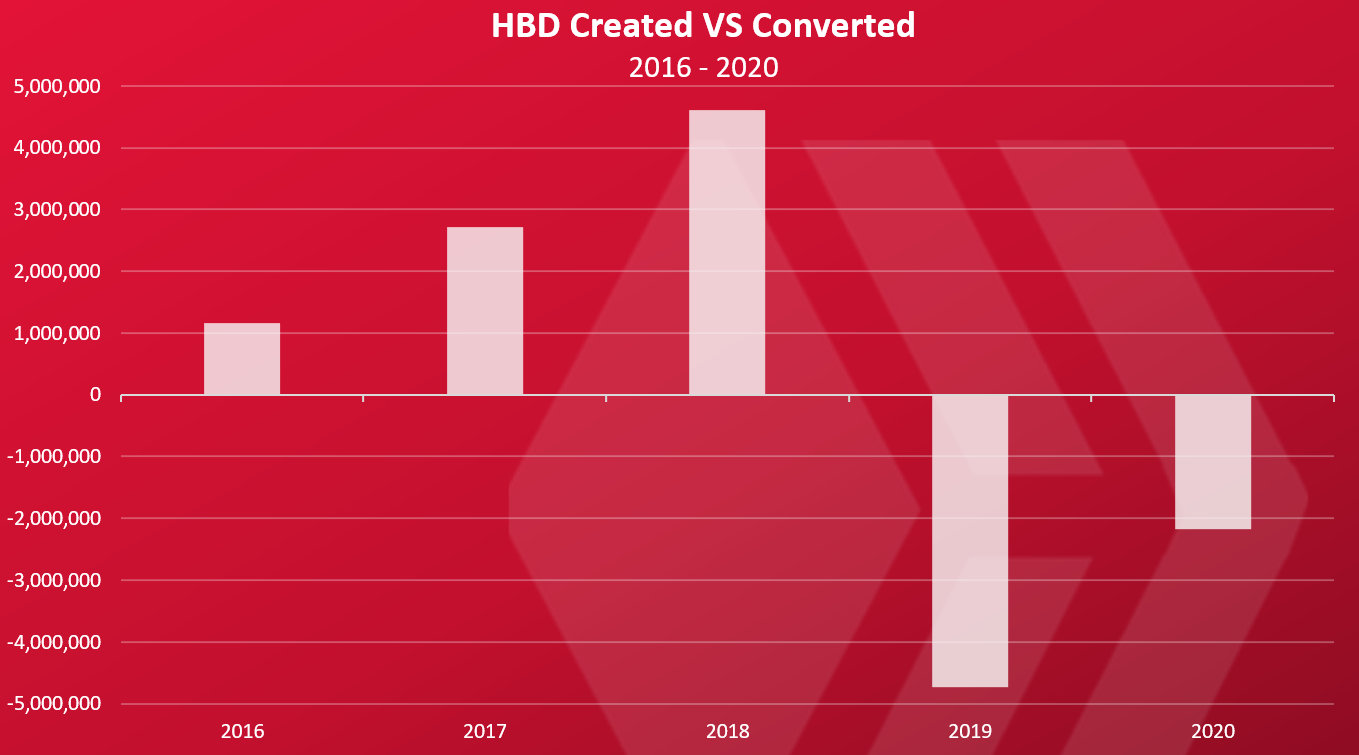

HBD Created VS Converted

When we put the two charts from above against each other we get this.

This is basically the difference between printed and converted HBD on a yearly basis. When bars are positive it means that in that year, more HBD was created then destroyed. When they are negative it means HBD is destroyed, reducing the supply.

We can notice a clear pattern here. A lot more HBD was created in the past during the bull run, and in the last two years a lot of it was destroyed through conversions.

2018 has the most net positive HBD created with around 4.6M HBD in positive. A large amount of HBD was converted in 2019, a total of -4.7M HBD, and 2020 has -2.1M HBD converted to HIVE.

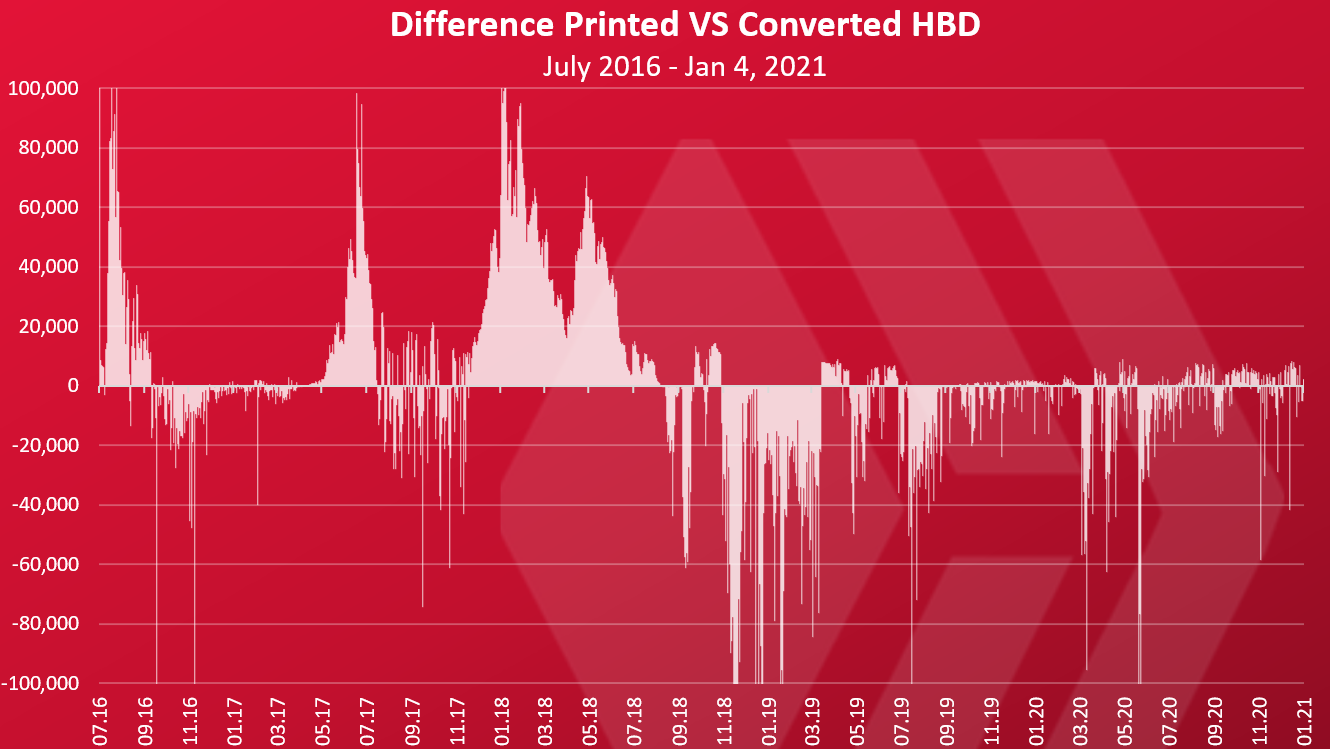

Just for illustration the daily chart looks like this.

We can see that a lot of HBD created at the end of 2017 and the begging of 2018. On few days there was more than 100k HBD created daily meaning that the overall payouts were double than that.

Then a large amount of HBD conversions started at the end of 2018 and continued in 2019. Since then more HBD is being converted than created.

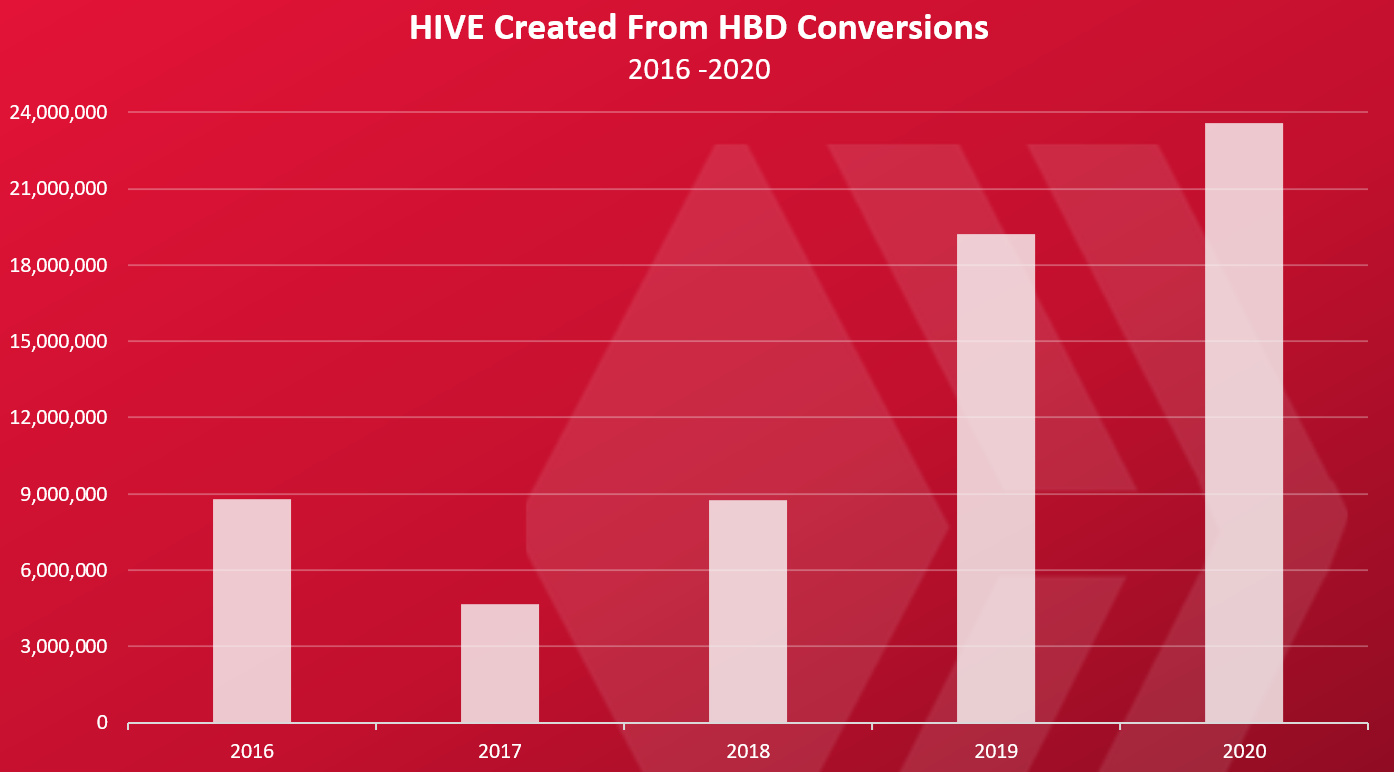

HIVE Created From HBD Conversions

The important thing is how much HIVE was created from the HBD conversions. Here is the chart.

2020 has been a record year in HIVE created from HBD conversions. Almost 24M HIVE was created from conversions. If we take into account that around 2M HIVE is created per month this is basically doubling the inflation.

Even with smaller amounts of HBD converted in 2020 then in 2019, there is still more HIVE created from conversions in 2020 then in 2019. This is basically because of the HIVE price. On average it has been lower than in 2019 and more HIVE is created because of this.

HBD conversions are acting in the totally different direction that we want. Lower price and increased supply. Usually you want the other way around. But this is the weight from a pump that happened two years ago.

A bit higher HIVE prices will help a lot in reducing the inflation from these conversions.

Thoughts on HBD

Having a stablecoin on the chain is not a bad thing, when done properly. The thing is HBD is accumulating when the prices are high constraining the supply in bull market, and then it gets converted during a bear market inflating the supply. Its not the best solution for a stablecoin.

The other major thing with the HBD conversion. They are acting as OTC trades and are not going trough the open market but bypass it with the internal blockchain conversion according to a price that is signaled from the witnesses. If the conversions from HBD to HIVE was going through the exchanges (or internal exchange) then we would have a buy pressure on HIVE. The way its done now its just skips the market with some internal blockchain math and add more HIVE supply without any positive effect on the market.

But if there is no HBD conversions and the exchange for HIVE is done trough and internal market, the HBD supply will just keep going up. Their needs to be a way to destroy HBD.

Well how does the other blockchains do it. Like DAI for example. You mint a stablecoin by putting a collateral in. In the case of HIVE the “collateral” is the whole market cap of the blockchain. The thing is this leads to a shared collateral where individuals don’t take responsibility for the debt, and we have these imbalances later. There needs to be a mechanics for putting in place an individual collateral if the authors want to paid in stablecoin. Also expose these conversions to the open market. If an author want to receive HBD as reward to his posts he will need to lock HIVE as collateral to be able to do this. Usually the ratio is 3:1 or 2:1 at least.

For example, an author receives a 100 HBD payouts per month. He will need to have a 200 to 300 USD equivalent in HIVE locked in order to do this. At the current prices this is somewhere above 2000 HIVE. As the author receives HBD as rewards this is calculated in his debt. If the HIVE price dropped the author will need to add more HIVE to his collateral to keep the HBD, or pay out the debt by destroying HBD and putting it in his collateral. If these things are not met then a penalty will be put in place, the collateral will be realised but with smaller amounts of HIVE. This can even create demand for HIVE if authors want to be paid in stablecoin. They will need to have collateral and balance their position as payouts come in.

The above might sounds complicated but it's one of the ways to be paid in a stablecoin on a blockchain that has its token that goes up and down in price. You need to put in some sort of individual collateral and open market forces. The other option is just taking the token as payment, no stablecoin. The current setup basically forces the authors to take stablecoin as payment with a shared collateral.

This is just some brainstorming and there are more ways to do this. What is your opinion?

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1346643474809053186

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

The MakerDAO template is one that Hive can expand on and even dominate this market. The huge advantage of HBD vs DAI is that HBD is more than comfortable breaking the peg and getting haircut to a lesser value than $1. This allows us to do many things that MakerDAO can never do: like allow bad debt to sit on the platform until the market recovers.

Hive can also create credit score NFTs attached to every account that incentivize paying back bad debt even though it is not otherwise profitable to do so.

My idea has always been pretty simple: get rid of the 15% inflation allocated to stakeholders and apply to the savings accounts. A flood of capital will enter these accounts because they now provide passive income. Then, allow the stake locked in these accounts to double as collateral for HBD loans. Anyone will be able to create or destroy HBD as long as they have enough collateral in the account.

The other big advantage of HBD over DAI is that the system that liquidates bad debt (Ethereum) on DAI uses the same variable to create debt as it does to liquidate it (150% collateral). This is a huge mistake.

With HBD we can make it so users are required to collateralize by a much higher percent than the liquidation percent, creating a huge gap that will make the system far far more stable. For example, we might require 1000% collateral, but the liquidation percent might only be 110%. And because the savings account is already doubling as a source of passive income... this is really just icing on the cake and users will use the system no matter what the collateral requirement is.

https://peakd.com/hivedev/@edicted/more-on-stabilizing-hbd-sbd

Posted Using LeoFinance Beta

Ill will need to take a closer look at this :)

This.

Posted Using LeoFinance Beta

Ok ... I think I get where you are going with this, basically pay interest for holding a stablecoin ... that's great. Take the inflation out of the staking rewards and put it in for paying interest for HBD.

I see this as two different things.

What I'm referring in the post above is more focused on the second.

How to pay authors in stablecoin. Well they will need to put in some collateral on their own to be eligible for this.

Say a new author comes now with zero balance. Will we pay him in stablecoin?

The payout option for 100% HP and 50/50 is now available and we put it by default 50/50.

Immo it should be a default HIVE, and optional HBD .... and you need to setup a vault for the second one.

Also Ill give it a more detailed read on your posts on HBD .... and give some feedback ... I need some time to process these crazy ideas of yours :)

How do you get played for a retail sucker? Believing stronger than those with larger stakes.

How low does it have to go before structural changes are performed? TBD.

Fixing HBD sounds a lot safer than destroying HBD. I don’t know enough to have an opinion about how to do this but your idea sounds like a start...

I honestly didn't know about that 50M mark. I thought it was just printed on demand in order to keep the price at or as close to $1 at all times. I wonder if it will be subject to crazy swings just like steem though? Are there systems in place to help keep it at $1?

Posted Using LeoFinance Beta

The system is to print out more... that is maximum 50% of authors rewards. This obviously is not enough at times.

Posted Using LeoFinance Beta

Great post! the data is presented really well.

it seems to me that HBD has done more damage than improvement. HBD is used to pay developers, and I can understand that, but building HIVE out of control is ultimately deleterious. Perhaps using just Hive would bring extra benefits to the coin.

Thank you for articulating the issue. Indeed, during a bull market HBD conversions further reduce the supply of HIVE (driving price up), while during a bear phase of the market it increases the supply of HIVE (further driving the price down). This is a known effect of a stablecoin pegged to an asset.

The good news is that HBD can go below $1 and postpone HIVE supply increase during bear market until it recovers.

But how much of the 2020 problem (increase in HIVE inflation from HBD conversions) can be attributed to the ninja stake being converted to HBD for distribution via the development fund?

At the moment not much ... probably less than 100k HBD is paid from the DAO ... but going forward can be a lot

Posted Using LeoFinance Beta

"The way its done now its just skips the market with some internal blockchain math and add more HIVE supply without any positive effect on the market."

Insane that this has been happening for 4 years on Steem and now Hive. Some people still think we have fixed inflation, when in fact our "pegged" asset is creating more inflation until infinity. I don't see any signs of Hive price moving higher to stop the conversions. Everything is so broken.

In the crypto world, a pegged asset is absurd to begin with, unless you're doing what Tether does. And now there's a bunch of those too. And with more and more direct USD-crypto trading, even those are going to be obsolete. I say we just get rid of it. It makes no sense and just screws things up. There's no historical positive to even argue otherwise!

A small pump can go a long way :)

Posted Using LeoFinance Beta

I like the idea, but I think it would result in a bad user experience, especially during the bull run. New users would be placed in a bad spot and it would look like they have to buy in, in order to sell their earnings.

But yeah, like where you're heading with this. We need to change how HBD is created and utilizing HP as a collateral would be a great start.

Posted Using LeoFinance Beta

Being paid in stablecoin should be an advanced option IMO.

The default option should be just HIVE.

Posted Using LeoFinance Beta

Oh, make sense now! Not a bad approach

Can you give us a technical description about how the "conversion" process works?

I'm very interested in knowing where the "new" HIVE comes from (the rewards pool?) and where the "old converted" HBD goes (is it burned?).

When HBD is being converted to HIVE, it creates totally new HIVE outside of the reward pool.... that's why I'm saying that it increase the overall inflation.

The converter HBD is destroyed/burned and taken out of circulation.

Posted Using LeoFinance Beta

Thank you for that. This somehow slipped by my notifications and I've just now seen it. (Right now I'm looking for where you talked about important HIVE selling in Korea . . .) And, yes, if HIVE is "created out of the blue", independent of the reward pool, I agree with you 100%, it's a very bad idea.

Its not all that bad :)

But if you thnk about it ... its only in one direction. Only Hive can be created from HBD, and not the opposite HBD from HIVE. This will reduce the HIVE supply.

This is one of the reasons why we have spike in the HBD/SBD price ... its circulation is capped and new HBD cannot be created on demand, only destroyed. Imagen if we created more HBD in a bull market .... how much HIVE that will take out of circulation

Keep those ideas posted, been reading 3 post now about inflation and hbd atm.

Thanks!

Posted Using LeoFinance Beta

This is one of your best posts I've read. I love the insights provided. I think a bull market will wipe out much of the issues we are currently facing. But another bear market and we'll be facing similar issues again. It'll be really complex to pull off. But it's so much better than getting rid of HBD which is super valuable even though it occasionally break the peg. I have loved the times SBD broke the peg :)

Posted Using LeoFinance Beta

Thanks!

I think paying authors in stablecoin should be a bit more advanced option.

Make the default the native token, 100 HIVE, not like now 50/50.

Posted Using LeoFinance Beta

A bull market will not get rid of the problem. You must love pre-existing conditions.

The market has caught on. The structure of Hive "tokenomics" is complete and utter trash.

HBD may be cause more damage than good things.

Posted Using LeoFinance Beta

Imagine if HBD would have become as popular as Tether, I still can't believe we missed that opportunity.

Posted Using LeoFinance Beta

There is a lot to unpack in your post. One minor correction:

The 10% is calculated based on the virtual supply not the marketcap (which may depend on how data aggregators like coinmarketcap or coingecko estimate it).

So lets say that the total supply is 380 million. The maximum virtual supply would be 380m/9 + 380m = ~42.2m + 380 = ~422m. With a median price feed of 0.115 the HBD supply could grow in theory to 42.2m x 0.115 = 4.8m.

This correction does not take away anything from your analysis.

One point that I do want to make is that the incentive to make conversions is fueled when the price of HBD goes below 1 USD. Specifically when the price goes below 0.95 we start to see them ramp up as the risk of losing out on the transaction goes down.

There is another factor that comes into play...HBD is "priced" in BTC and not the other way around on the exchanges. Usually you do not see that with the other stablecoins like USDT or DAI. Psicologically for traders this means that they do not see it as being worth 1 USD in spite of the fact that it is backed by the virtual supply of HIVE.

So when most traders dump it for less then the actual value the savy ones on Upbit take advantage and make a profit since they know there is very little risk when the conversions finalize.

Hey ... thanks for the clarification on the MC and the virtual supply ... the numbers were just as an example but your addiction is welcomed :)

My mind is blown. I knew it was bad, but I had no idea to the extent. Yikes! :-(

Posted Using LeoFinance Beta

That seems like some pretty sound reasoning there. I have always been a bit confused about the whole HBD/HIVE thing, but this breaks it down pretty well. I have been using the market more lately as opposed to conversions because I don't want to wait the three days for the funds. It feels like it has been a race to power up and buy LEO before the price goes up more!

Posted Using LeoFinance Beta

Thanks for a detailed post. I will read it -23 times more to get the understanding.

I had the opinion that the rewards we get are from inflation. Just take an Example if there 1M Hive with Inflation of 10% means, 0.1M of Hive will be distributed in a year. Now 65% of the inflation goes to proof of brain and rest goes to DHF, witnesses and Power up reward. So 65% of 0.1M is 0.065M. This amount needs to be distributed depending upon hive powered up and voting. So if a post is voted with 1% staked hive Power for 1 year (considering 1 year for simplicity). It means that post is eligible for 1% of total reward pool which is 0.065M, which turns out to be 0.0065M or 6.5k Hive. So 50/50 of that reward would be distributed to author and curators. So when author receives reward, it should be 6.5K/2 = 3.25K Hive. half of it is powered up and half is paid in HBD. I thought that half hive (3.25K) isn't printed but equivalent amount ho HBD is printed. So if author converts it into hive, it is still the original inflation.

So I don't understand how HBD brings addition inflation when Already HBD is coming from inflation? Considering price is stable for the moment. I know it is complex, but that's what my mind thinks how rewards are/should be distributed.