I have Invested in Debt fund

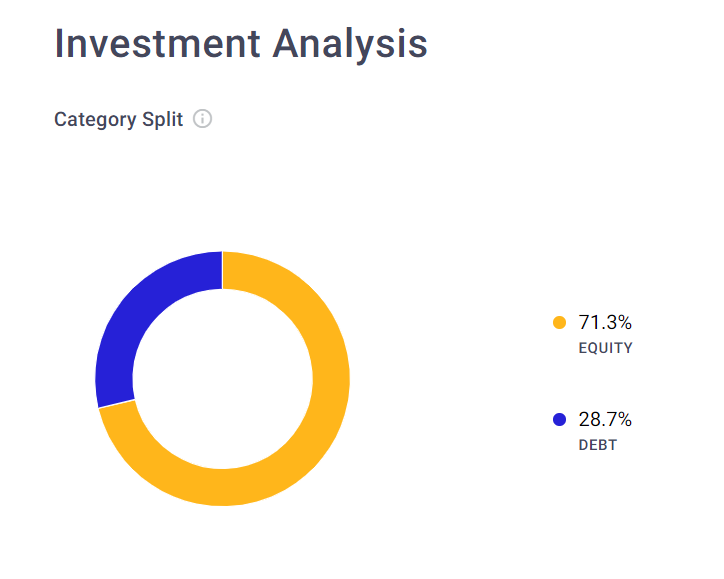

As a conservative investor, I always try to keep my investment in 70:30 ratio, like 70% in equity and 30% in debt. This is just for mutual fund investment and does not include the Fixed Deposit.

PC: Pixabay.com

I feel fixed Deposit is just like an emergency fund where if you lose your job, you can have 6 to 9 months of money to survive. With this pandemic, we are already seeing so many job losses so thus emergency fund is the need of the hour. If you don't have emergency money I would suggest to have it as soon as possible. Your investment can wait but not the emergency fund.

So this was about emergency funds. As I was talking about debt funds, I wanted to keep the ratio of debt funds at 70:30 as of now because I am in the 30s. What I recommend is to keep the debt fund as per your age. If your age is below 25 then it should be 75:25 i.e. 75% equity and 25% debt whereas if your age is 45, then 55% equity and 45% debt. But I think it totally depends on you and in my case, I always wanted to keep 70:30 ratio.

This ratio has come down recently and my investment was like around 75% equity and 25% debt. I wanted to keep the equity exposure to 70% itself. So I have invested in debt funds to keep that ratio. After investment my ratio is around 71.3:28.7, still not 70% but it's still ok.

PC: Groww.in

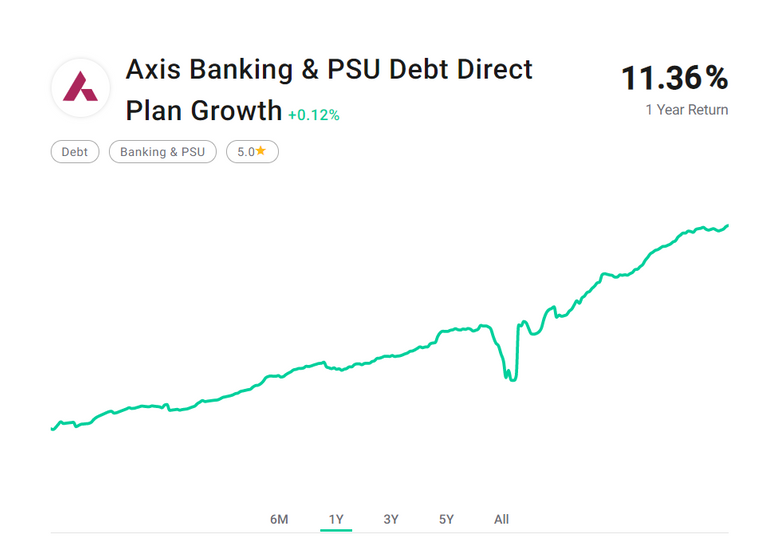

This time, I have invested in Banking and PSU, I think this has come down when we had lockdown imposed and then after that its steadily rising. The 1 year chart shows:

PC: Groww.in

11.36% return in 1 year is not bad for a debt fund, though I don't expect anything above 10% though. So even if it gives me 10% year to year returns, I would be more than happy.

Why I have invested in this fund?

- It has lower expense ratio i.e. around 0.31% and it's a good factor to count on.

- Exit load is zero, though almost all debt funds have exit load almost nil, still, I check that before investing.

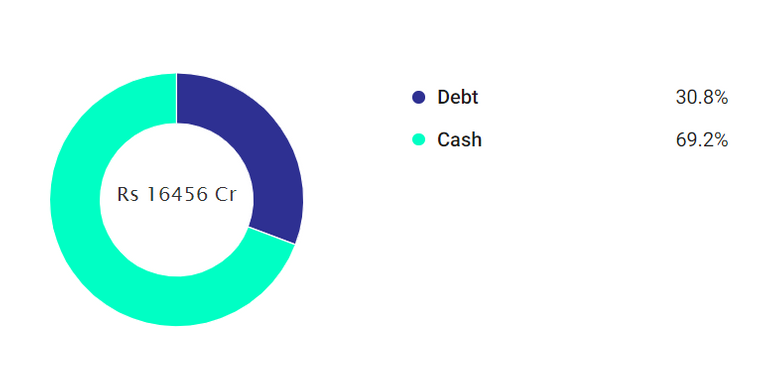

- It has around 70% cash, that actually a very good indicator of being a debt fund.

PC: Groww.in

I think I don't look much into debt funds, the deb fund looked good and I have invested around 150$ in it, might be will invest more in future too.

Your current Rank (140) in the battle Arena of Holybread has granted you an Upvote of 7%

Hi. 70% equity is very agressive where I come from. I have a corporate global pension background and only people in HK and USA had such high equity allocations. But reward in the end might be higher I agree. As my name suggests I am 20% in gold which is not wrong nowadays!

Yes it is aggressive, but the age I am in I can take little bit of risk. Gold is gold, and having that in the portfolio is always good.