DeFi is the future of finance, and YFI is the future of DeFi?

The pace of life is quite fast. If you don't stop and take a look occasionally, you might miss it. -Skyscraper

The world has never seen an industry whose development speed can reach the level of DeFi. The reason why DeFi innovation can develop at the fastest speed is that DeFi is composable. In other words, you can combine other people's innovations, like Lego bricks, with other codes, and then you get something completely new.

In these three years, yearn is the most interesting and influential project I have seen.

Yearn is impressive because it gives DeFi greater opportunities, while making complex DeFi simple and usable, and it deeply integrates with leading DeFi protocols (such as Uniswap & Curve) and uses the community as a powerful Of the moat.

Since its launch on July 17, the yearn asset management platform has grown to more than $1.2 billion in crypto asset management.

TVL As Of 9/20/20

This article does not delve into the yearn. In other words, when you finish reading it, you won't know yearn well, but you will better understand its origin and ambition. If you understand this and you are curious, you will want to learn more.

It all started with iearn.finance

On January 26, 2020, Andre Cronje (yearn's founder) launched iearn.finance to optimize the return of loan assets to platforms such as Compound and Aave, and to provide liquidity on Uniswap. Andre's first update on February 7 revealed that he is already making rapid innovations. But with the development of the year, it soon encountered problems, mainly related to its continuous expansion.

On July 15, Andre wrote that the liquidity mining boom that started when Compound launched its governance token in June made it obvious that "simple incentives can no longer meet demand." He wrote that what is needed is—

"A new product is not trying to choose between these options, but can use these options for liquidity mining."

In the following days, he published a series of articles detailing the required components. The first is an AMM showing the rate of return, a stable currency as a transfer mechanism, and yswap.exchange, which allows users to pool the AMM Inject unilateral fluidity without impermanent loss.

On July 17, YEARN issued an announcement-Don't buy it, earn it!

The announcement of yearn/YFI laid out a series of upcoming products. To earn YFI tokens, users only need to provide liquidity to one of the platforms, bet the produced tokens in the issuance contract, and earn an amount (controlled by governance) every day."

Later that day, Year announced that its first product was online, the curve.fi/y pool (currently more than $750 million). On July 19th, Year announced two new pools. The first new pool will acquire Balancer tokens by providing liquidity to the whitelist pool. The second new pool will combine the ability to obtain the best interest from stablecoin deposits, as well as the functions of the curve.fi/y pool and the Balancer pool.

Each of the three pools has been allocated 10,000 YFI governance tokens, which are earned by community members over a period of time. Incidentally, on September 12, Andre officially decided to limit the number of YFI tokens to 30,000 minted coins by submitting a proposal to "permanently burn YFI minting capacity".

On July 24, Andre announced yearn V2, which includes three new elements, yVaults, a Controller that enables the governance layer to manage each pool to optimize the rate of return strategy, and the simplified container of Strategies to use in a non-destructive manner. Maximize the return on a particular asset, no matter what. The reward is shared by the governance ecosystem, miners and strategy creators.

On August 24, year announced yinsure.finance, a new insurance project, which is booming. On August 29, Andre announced the entrusted financing of DAO Vaults to provide funding for team building in the yearn ecosystem.

Similarly, as of August, the speed of innovation is truly shocking.

StableCredit, a protocol for decentralized lending, stablecoins and AMM

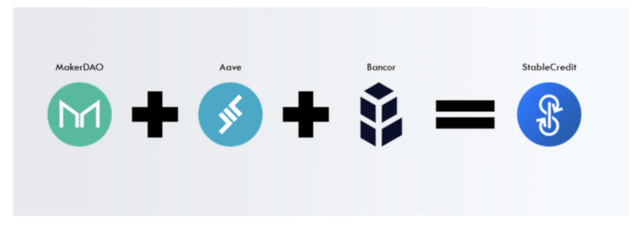

On September 10, Andre announced StableCredit, which is the most ambitious and innovative project of the year so far. By combining the functions of lending, stablecoins and decentralized exchanges, Yearn is creating a new DeFi primitive, a unilateral decentralized lending protocol.

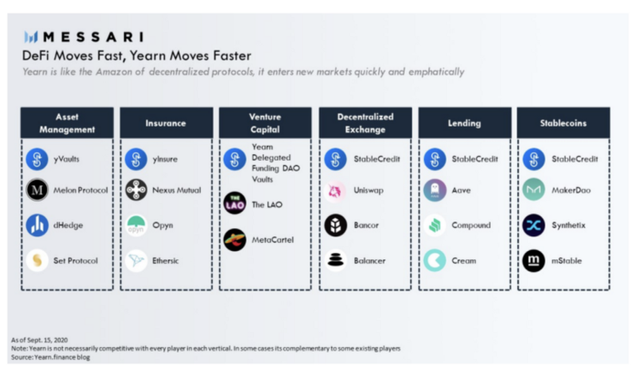

Messari graphically shows how it combines stablecoins, lending and decentralized exchanges.

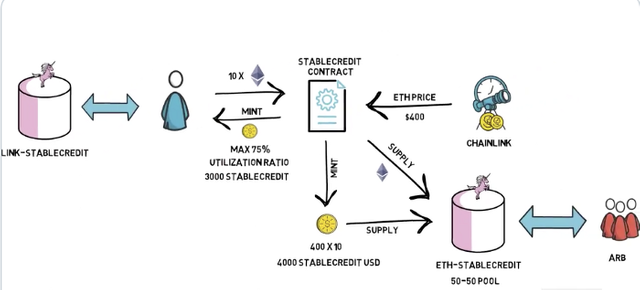

Users can provide any asset (such as ETH) to StableCredit and issue an equivalent amount of tokens in the form of StableCredit USD according to the value of the asset (price is fed by Chainlink). Then, ETH and StableCredit USD will be put into the 50:50 pool on Uniswap. By using Uniswap, StableCredit can instantly access the projects in Uniswaps, maintain the balance of funds through arbing, and ensure that StableCredit USD remains at its anchor point.

StableCredit USD will become the most scalable decentralized stable currency in the world.

According to the usage rate, the asset provider can use up to 75% of the StableCredit USD issuance to purchase other assets in the StableCredit pool (such as LINK). AMM defines the premium for asset borrowing and repayment.

StableCredit will create more liquidity for the year pool, help the year pool expand the year scale faster, and create more liquidity. In a virtuous circle, all YFI holders will benefit.

On September 17, the last "announcement" of the year was that the project was SyntheticRebaseDollar, which is an automatic rebase index that tracks the dollar value of collateral created. Although Andre pointed out, "We are not yet sure what we want to do with this...", the post emphasized the fact that when SyntheticRebaseDollar was created, it was the work of the prototype part of another ecosystem. This ecosystem is called SyntheticTrader, which is an unauthorised USD settlement leveraged long/short synthetic derivatives agreement based on StableCredit. SyntheticTrader once again highlights the versatility of StableCredit and its yearn ambition.

If StableCredit can execute its plan effectively, it will change the rules of the game. Its impact on DeFi today and the entire financial industry in the near future is huge.

yearn will be difficult to fork effectively

Assuming that the upper limit is 30,000 YFI, Year has passed its inflation liquidity mining stage, which is the stage where the project is most vulnerable to malicious forks. Yearn has now entered the stage where users pay service fees to YFI holders.

However, many people still think that Year is just playing with the defi composability and economies of scale about gas and that these elements are easy to replicate. However, they were wrong.

First, in order to effectively utilize the composability of DeFi, Yearn has implemented a large and growing set of integrations. The early yearn fork project still uses the yearn yCRV pool, which is beneficial to yearn.

But I believe that the strongest guarantee is Yearn’s vibrant community. They deeply believe in Yearn’s mission, that is, through decentralized governance, to innovate at an extremely fast speed and optimize asset returns. It is by far the fairest distributed DeFi token. The top five addresses have less than 10% of the circulating tokens, while the other head DeFi tokens are 20%-40%.

I like yearn for the vaults functionality - nice APY on DAI and other stablecoins.

I think we'll see more of these index fund type projects coming out in the crypto space looking to deploy capital across projects and trying to find yield while hedging against the entire market. I don't know what productive use there is for this capital but the concept is very cool

Posted Using LeoFinance Beta

To know the benefits of the YFI project, we can see their proposal:

https://gov.yearn.finance/