MEV The Less Talked About Tax On Shitcoins

I often find myself stupified at how people can advocate for technologies, that they have absolutely no idea how it works. Now you can play games with that narrative and say I don't know the inner workings of a car, but I know what it does has value.

But there are very few people going around and telling you how your car works are stupid, for very good reason. As for cryptocurrency oh man, the is an endless list of red flags that people seem to ignore.

In fact, I've seen very little about the topic I am going to discuss. If you've traded tokens on so-called DEX's and doing your trading or DEFI transactions on-chain, then you've probably been paying an unknown tax in the form of MEV slippage or Miner Extracted Value/Maximum Extracted Value.

What is MEV?

In Ethereum, miners are responsible for selecting and aggregating transactions that are placed into blocks. Crucially, the miners have full autonomy in deciding which transactions sitting in the mempool—an off-chain space where pending transactions await confirmation—they’ll include in the blocks they mine.

Like bitcoin miners, validators, and sequencers optimized for profit, they have an economic bias to select and order transactions by the highest gas price or transaction fees, so when a block is secured they receive the block reward and the fees attached.

However, the protocol does not require transactions to be ordered according to fees. So miners have begun to use this discretionary ability to reorder transactions to extract additional profits from users.

How mev works

To give you an example of how MEV works, ill use the most popular method known as front-running. MEV bots scour the transaction lists of the mempool looking for large orders on decentralized exchanges.

Once they find one worthwhile they submit competing transactions with higher gas fees and prioritize their transaction to get them mined before the victim’s transaction.

So when your transaction goes through you're paying a higher price and buying their recently bought liquiity.

Popular attacks include:

- Sandwich Attacks

- Back-Running

- Liquidations

- Time-Bandit Attacks

MEV taxes gaining ground

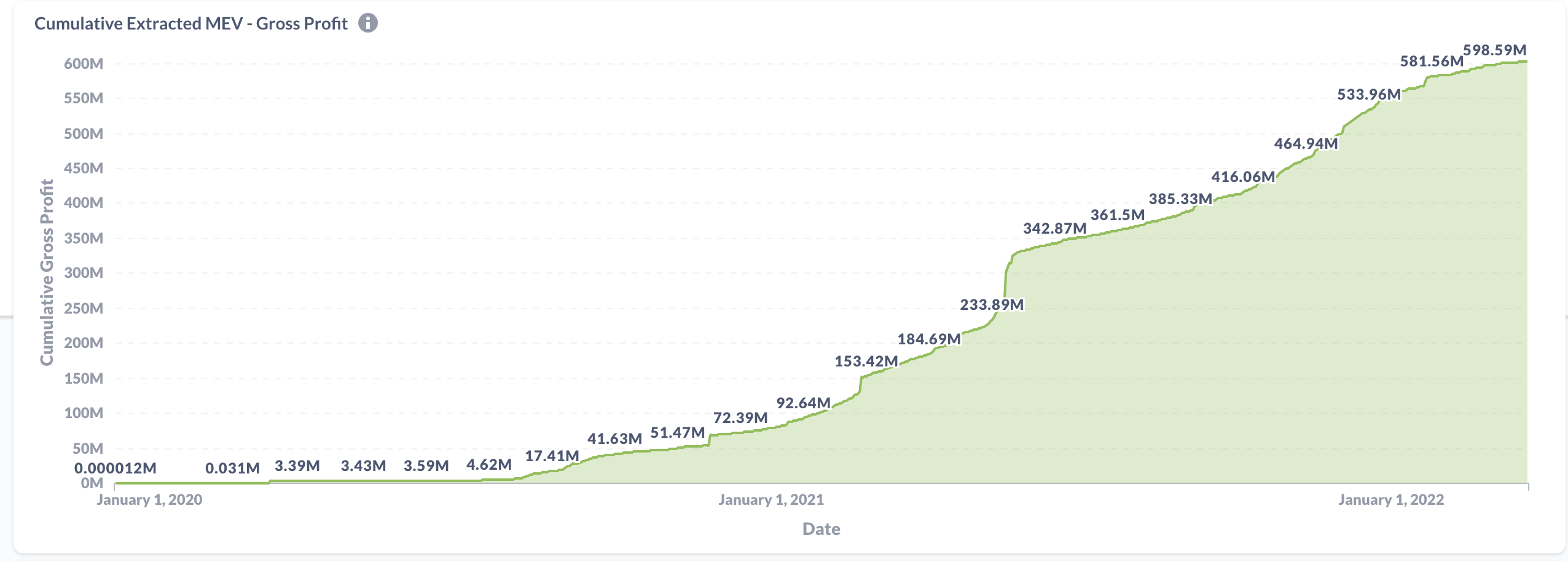

MEV is no small issue on Ethereum alone it has secured $689 million extracted from users of the network from Jan 1 2021 to Aug 27, 2021. If it continues on at that rate it would cost the ETH chain users well over $1 billion in unseen taxes for the year.

The data provided below include only:

- Aave

- Balancer V1

- Bancor

- Compound V2

- Curve

- Uniswap V2

- Uniswap V3

So we're really underestimating how bad MEV revenue is with 7 platforms' data.

MEV Gross Profit: Source: explore.flashbots.net

So you can imagine how much has been extracted each year and how much more will be extracted as more participants try to trade more frequently, especially those trying to chase yield on DEFI DINOs.

But I can use other chains

MEV may be associated with miners using Proof-of-Work but it applies to validators on proof of stake too. MEV exists on all smart contract-enabled blockchains with a party responsible for transaction ordering in blocks. This includes Ethereum 2.0 and rollup solutions like Optimistic Rollups.

So, no, you can't beat it by leaving ETH for another mining chain or a validator chain with POS. All these EVM chains like BSC, MATIC, SmartCash, and the list goes on, all have the same method back in on how transactions can be organized.

So you're paying this tax regardless of which chain you're using and it should be factored into your trades, before you place them.

Sources:

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

Hive fixes this?

I don't know how hives block ordering works so I can't say

I don't think there are any fees involved to be had.

No shenanigans there.

Hive's main problem is that less than 50 people control way, way too much of the consensus.

For massive network effects to take place, that will have to be spread out.

No right thinker sets up that small of an oligarchy to rule a major share of the world's wealth, imo.