If Bitcoin Becomes The Worlds Pristine Collateral

Hey Jessinvestors

I think it's safe to say that investing has become a complex topic, I feel like it's become a full-time job, you need to do so much research and pick out the right stocks at the right time, or get into bonds before others see it or look at international markets and who wants to do all that work?

As someone who still trades their time and labour for money I don't have the strength for in-depth analysis and the little that I do commit is not enough to be able to make the most of the markets we have, you need large sums of capital, inside information and to be constantly vigilant to really give it a go.

Savers are suffering

The days of being rewarded for your prudence is long gone, there was a time when you could save your money in a bank and get a positive return. There was a time where you could buy government or corporate bonds and hold them to maturity, take your return and reinvest it.

Believe it or not, but the world used to run on savings, I know that's no longer the case and hasn't been the case for many years, but it is and was true.

Now that we have artificially low-interest rates and every one up to their ears in debt, investors need to go further out the risk curve to get a return which seems unfair to savers.

Not only do you not get rewarded for saving you now have to put that savings into riskier and riskier assets to get a return, so what does that tell savers? That you're better off spending it and taking out debt to finance your life.

Bitcoin as the new bond

Bitcoin looks to change the game, its rather boring if you think about it but what another financial asset encourages you to buy and hold it for as long as possible, apart from precious metals and dividend-paying stocks, very few assets I would say, its all about buying and flipping to a greater fool these days and not about value.

I've spoken before about the collateral potential of Bitcoin, and now that DE-FI is in full swing it's really got me thinking that Bitcoin could have the potential to become the new bond, should it be seen as a reserve asset.

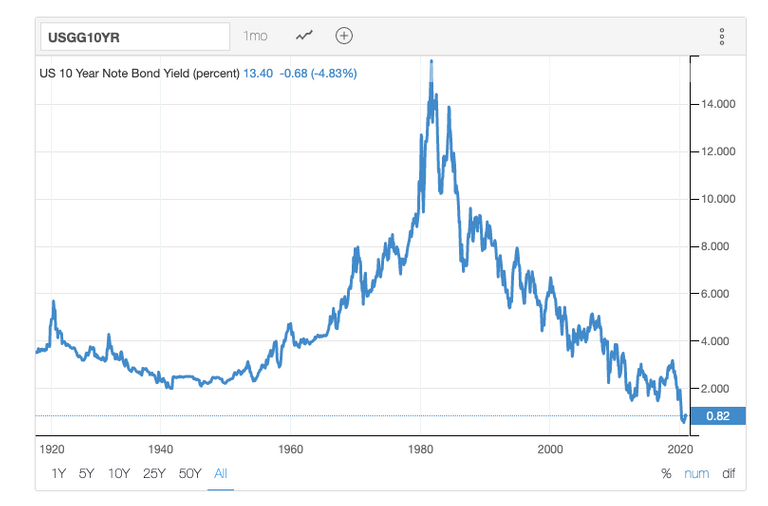

If we look at the rate of return on some of the developed nations Bonds, you can see it has been on a downward trend for the last few decades without exception. I've pulled the most popular bonds such as the US, German Bund, Canada, Australia and the UK.

US Bond Yield - 10 Year

German Bond Yield - 10 Year

Canadian Bond Yield - 10 Year

Australian Bond Yield - 10 Year

UK Bond Yield - 10 Year

source: - tradingeconomics.com

The germans are already into negative returns while the rest are all well below 1%. Who in their right mind is buying something that yields 1% and pays out in something that doesn't hold its value, fiat currency, it makes zero sense.

This is how far we've fallen.

The crazy part is there was a time when bonds would net you a healthy 10 - 14% return over the "10 year" and you as an investor didn't have to do much or think about much.

People buy bonds because it's seen as a promise, you give them capital and the issuer promises to pay you interest on the money you have invested, along with the return of your investment at some future date.

Governments, corporations, municipalities and other issuers sell bonds to raise money for various capital purposes, such as road building or plant expansion. Advantages for investors range from income and portfolio diversification to capital appreciation and inflation protection.

As the need for better collateral is evidently needed, we can see a shift to the equity-based debt over issuing of new debt.

DE-FI Bond market

As Bitcoin continues to rise in price, it's going to create many wealthy individuals who will be sitting with large amounts of capital to invest. Governments and corporate would want to tap into that capital, and I don't think it's crazy to think that we could have bonds issued on the blockchain in a non-custodial service.

Imagine if you will, a Uniswap, but with corporate and government bonds, you can lock in your capital and purchase a bond for a rate of return you are happy with. The institution uses the capital to fund their goals while paying you back a fee.

Bonds are often seen as the risk-free rate of capital, and with Bitcoin, normally over collateralized for loans, it reduces the risk even further for both parties.

I can see it happening that one day when Bitcoin's lost a lot of its volatility, and we figure out the cost of capital with a yield curve with the help fo DE-FI that a Bitcoin bond could net you a return of say 5%. %5 is just a thumb suck since I've seen between 4 - 6% ROI on Bitcoin savings accounts with CE-FI apps, so let's say that were the case with Bonds too.

We can't say what it could be since the products don't exist and the market is not established for it, I imagine if Bitcoin is well within the 10's of Trillions getting people to commit it to projects would be a full-time job for many looking to raise capital.

As a HODL'r, Wouldn't that be lovely?

You could then safely lend out your Bitcoin, get a return on investment and sit back and allow your BTC to work for you.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

what's the deal with the jessie joke? i dont get it :D

I am a jessie.

Posted Using LeoFinance Beta

It started a while back, just calling people that who would comment on my posts and I sort of continued to run with it

Posted Using LeoFinance Beta

I like it. It is a way of saying - I was here and have read your post but have nothting special to say more than my cat is hungry. Keep on!

Ok jessie

"I can see it happening that one day when Bitcoin's lost a lot of its volatility," What do you think? In 5 years or more?

I’m thinking make 10 years but with the way things are accelerating 5 years is sounding less and less crazy

then I guess 15.

LOL i'd like to still be young to enjoy my wealth please

Posted Using LeoFinance Beta

Maybe it is now you build your wealth. When Bitcoin still goes up. After 10-15 years it is a stablecoin

I am counting on it becoming a stable coin in that same time frame. I would agree with you and then when it's stable you don't get big movements and if you want a bigger return on your BTC than they yearly appreciation which gets smaller and smaller you can use DE-FI apps for better interest rates

thats is what I think too. But I also think that you not will get some high roi from it . More a real stable that not been affected by some national inflation. Lets see in 14 years if we right.

In 14 years you and I can sit down for a cold !BEER and be old men arguing over who was right

Deal!

View or trade

BEER.Hey @minimining, here is a little bit of

BEERfrom @chekohler for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.The volatility will settle down at about $5 trillion in market cap. Before that, it is just too small to not have big moves.

How long until we get there?

Anyone's guess.

Posted Using LeoFinance Beta

LOL well then as long as we're under $5 trill I better be throwing fiat at it, like a stripper

Hard to argue with that from my perspective.

Portfolio balancing is always important but I think Bitcoin will be a major winner and those buying, anywhere below $100K will do exception.

Posted Using LeoFinance Beta

As a long time observer, one of the discrepancies that I often wrapped my brain around is the deflationary aspect of crypto (especially Bitcoin) that contrasts its use as a currency. Who will spend BTC today if everyone is believing that it will buy you more tomorrow? De-Fi and collateralized loans seem to be a way out of this dilemma. If you can hold your crypo and but use it as collateral for a loan that you use to spend for other investments or even for consuming that may be a way work. The value is not frozen in your crypto-wallet but can be used in the economy. On the other hand, you don´t lose your upside opportunity for an increasing BTC price, as you only have to pay back your individual loan to get back access to your crypto. It seems that the term "be your own bank" is much more true than I initially expected.

Posted Using LeoFinance Beta

Yes that is correct but that's only a time value issue now, if Bitcoin reaches the 10 trillion dollar market cap it will take way too much capital for it to move up massive percentage points and while it will still continue to increase it won't be at a point that people will feel the relative value increase is worth HODL'ing as much as it is now.

Also time and life value means you're going to spend it you only have so much time on the planet you can;t take that shit with you so you going to spend it on things you value higher than your BTC like a home, a car, education for your kids, or food, that's just the time value of money at play.

Very few people are going tho HODL for a 5% gain just to starve.

Posted Using LeoFinance Beta

Interesting idea and I see your point. However, with the fixed supply, and the loss of keys over time, combined with the worlds value creation, I don’t see the priceincrease slowing down to 5%. But who knows, maybe you are right and people get used to spend their BTC directly over time despite its deflationary aspect.

Absolutely. Bitcoin will not be a currency for the points you mentioned.

Bitcoin is not just deflationary, it is hyber-deflationary. To go from hyper-deflationary to even level is going to require a massive market cap, more than people anticipate.

Posted Using LeoFinance Beta

I will openly admit I don't look at the Bitcoin we have today as the Bitcoin we will have in the future, narratives will change, new applications and layers come on board and it's all expands from there. The way I see it, may not be right, but as BTC hits larger and larger values, we won't focus on its price but the buying power of a Satoshi, what can a Satoshi get me today vs tomorrow, and if that doesn't move too much I spend it.

Lets say I earn 5000 Sats for a job I can keep it and get an increase in purchasing power or spend it and get the new PS5 and enjoy that experience or book a ticket on holiday.

I am not here to tell people what to do wit their money or their Bitcoin, but I do think there are certain things people will want over appreciation or purchasing power

People do it with stocks and other investments all the time. They hodl until they pass it on to their kids.

And the market provides a return of roughly 7% yet people have held there for decades. Even worse, some hold onto dividend stocks paying 4% forever.

So I think you are going against what people showed they will do.

Posted Using LeoFinance Beta

I wouldn't say I am going against what I say, everyone has their own time value and life and time is worth far more than any monetary value. If you want something to better your life that money can buy, you're going to spend it

Not every stockholder holds forever, many liquidate go into Bonds and then spend that on their retirement. I am pretty confident there will be people who don't want to pass it on to kids or an estate and blow it. I honestly couldn't care much what others do with their Bitcoin.

It's interesting if people are still buying these bonds. If I am not wrong Govt. might be taxing that 1% income also.

With so many corporate sectors stashing the Bitcoins, I am feeling volatility might get solved earlier.

Posted Using LeoFinance Beta

Yes people still own bonds many don't own it for the yield but to be able to flip it to the next person. Governments naturally always have the ability to pay you back just with weaker currency and as for corporate bonds, Bond holders get first preference on cash generated from any assets if a company goes bust where as an equity holder gets fuckall.

So there's always a reason to hold bonds, not a good reason at the moment, but this is only a brief time period we're going throw of low vol kept down by money printing

Governments all over the world are going to have an issue in the next few years as confidence in them dwindles as the sovereign debt crisis starts to hit.

So I dont think we see them in the "crypto" bond game. That will be run by other organizations.

This shows how much was in the realm of governments and central banks is going to be replaced with other options.

Posted Using LeoFinance Beta

That's a good point, I honestly don't know how the transition will look but I have a funny feeling its going this way. If it gets this big and it becomes a Bitcoin bond market type all it does is provides the risk-free rate of money and forces corporates and governments to spend within their means to provide a return that is fair to investors or they can just hodl Bitcoin

I think that sort of balancing act will be super powerful for keeping power and manipulation and misallocation of capital in cheque

I dont think there is much debate that the more value bitcoin gets, the more we will see derivative products based upon it. That only makes sense.

As governments become less of a part of our lives (I know seems crazy with the power push of late but as we go digital and virtual, it will likely happen), we will see other entities step in.

I think a lot of it ends in the hands of private entities.

Posted Using LeoFinance Beta