DeFi’s “locked total value” indicator is a curved mirror

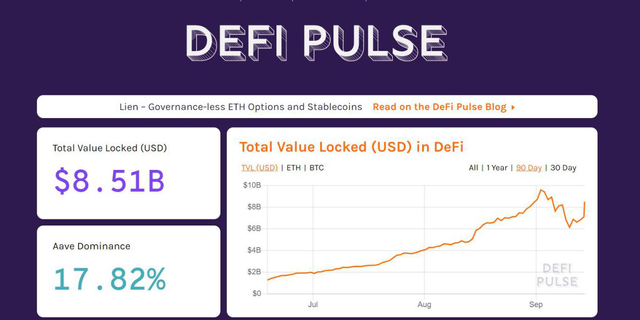

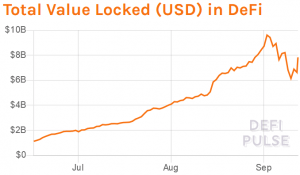

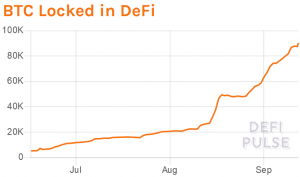

As of early June, the total value of DeFi (decentralized finance) may only be $1 billion. However, by September 2nd, this number had increased by 860% to $9.6 billion.

Of course, these numbers have not escaped the scrutiny they deserve. Through the data analysis of DEFI Pulse, people in the industry have been questioning that the total value locked (TVL, total value locked) is repeatedly calculated, twice, three times or even more than four times.

TVL does not always mean the same indicator in DeFi

DeFi Pulse defines the "total value locked in" as follows: "DeFi Pulse monitors the smart contracts of each protocol on the Ethereum blockchain. Ether (ETH) and ERC-20 tokens held by these smart contracts are withdrawn every hour. Refresh the chart. TVL (USD) is obtained by multiplying these balances by the price."

This sounds simple, but due to many complex factors, TVL may not be able to transparently measure the total amount of funds already invested in the DeFi ecosystem.

The first problem involves double counting. DappRadar project manager Ilya Abugov said: “Actually, if a user deposits some ETH in dapp A, retrieves xETH tokens, and then deposits xETH in dapp B, both A and B will count their ETH into their TVL. But the user actually only deposited a sum of Ethereum."

Dr. Omri Ross, chief blockchain scientist at eToro, said that another risk of TVL is that both synthetic tokens and governance tokens may be used as collateral assets that represent another digital asset.

He said: "Compound's cToken may be the case, but it may also be suitable for distributing governance tokens to users who store assets in smart contracts." "Before the governance token balance is announced, it is usually retained by the agreement, so it can It is counted in TVL depending on the method used."

At the same time, Scott Lewis, the founder of DeFi Pulse, claimed that the company "worked very hard to remove double-counting assets from [DeFi Pulse] to avoid this problem completely."

In recent weeks, DeFi Pulse may have received a lot of criticism, but in many cases, at least compared to the DeFi platform itself, it provides a more conservative estimate of the total locked value.

According to Ross, the difference in TVL indicators of major platforms is usually between 10% and 50%, which indicates that there are big differences in statistical methods.

USD value VS total assets

Remember that the total value of TVL may only increase because the price of digital assets rises relative to the US dollar.

Ilya Abugov said: "Throughout the summer, TVL has almost become synonymous with DeFi growth and has become the main indicator of growth. This is not accurate. For example, one can imagine a situation where the number of assets on smart contracts has decreased, but these The price of the asset has risen enough to cause TVL to grow."

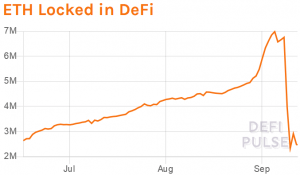

There is no doubt that this drove the growth of TVL, because between June and September, ETH rose by about 100%, while the amount of ETH locked in DeFi more than doubled.

Short-termism may crash the system

Short-termism may crash the system

No matter how big it is, the growth of DeFi seems to be driven by more capable and experienced users.

ConsenSys Chief Technology Officer Igor Lilic said: "Broadly speaking, DeFi users are not large organizations, but individuals or groups. We call them'retail decentralized financial users'.'Small' is relative, and some of them manage projects. Billions of dollars in assets."

For Ilya Abugov, the DeFi ecosystem is dominated by "giant whale liquid miners." He pointed out: "Currently, many activities are focused on short-term benefits, rather than the actual function/utility of the project."

However, due to the interconnectivity of the entire ecosystem and the way users can extract tokens from one platform and deposit them on another platform, this short-term profit may be dangerous, and it may result from a single system to the entire system. The impact.

@tipu curate :)

Upvoted 👌 (Mana: 0/7) Liquid rewards.