Pickin' and Choosin'

I have a strong (and probably unhealthy) relationship with statistics and probabilities. I see the world through a filter of what is happening and what might happen because of it. I think in percentages of likelihood. It is not always pretty.

Nate Silver of FiveThirtyEight fame is a hero of mine. He doesn’t just run numbers and make predictions, he spends considerable time and effort analyzing why predictions succeed or fail. His presidential predictions are epic and more accurate than anybody else. His book “The Signal and the Noise” is really good reading for a stats freak. He shows why weathermen are wrong so frequently and why economists have an even worse prediction record.

Richard Thaler won the Nobel Prize for Economics in 2017, the year I read his book “Misbehaving”. It is entirely based on the faulty assumptions in Keynesian Economics, such as the constant In every instance of choice the consumer will always do what is in his best interest. It simply is not true but is still an honored tenenet in Economic Theory.

Understand that Thaler is not listed as an economist. He is known as a behaviorist because he has spent his entire career debunking the assumed behavior of humans. He is really the first Economist that has brought the variables of human behavior into the equation.

So here is where this is going, I think. We have to be very cautious when we choose who we listen to. I read a lot here on Hive and I see advice ranging from sell yesterday to buy all you can today. It’s no wonder there is a lot of Fear, Uncertainty and Despair here in our little corner of heaven.

Who Do You Listen To?

It’s not a rhetorical question. It’s the start of making an informed choice about accepting advice.

In my case, I’ll guarantee it’s not a guy publishing daily or even weekly charts to bolster his point and predictions. I’ll further guarantee it’s not that guy that says “When Bitcoin is $100,000” at the start of his prediction.

Daily (or even weekly) charts do not, repeat not show a trend. They show reactions of buyers and sellers that may know even less than the daily charts guy.

It’s not that I think BTC won’t go to $100,000, I do. I also think it will be more than a little ways in the future.

Find a Person That Has Been Right Before.

While past performances are not an indication of future success, consistent failure might be an indicator of future failure.

Do you see somebody making a prediction that intrigues you? Check them out a little and see how they’ve done in the past. Particularly watch for people that predict both sides of an issue or problem. That is done to guarantee a usable quote in the future.

Do Your Due Diligence

Do research, learn as much as you can before you chose your Guru or one time advisor. See if they show how they came to their conclusion. It’s probably good advice to just run away from somebody that can’t (or won’t) show their work. It’s brutally important when my money is at stake.

Listen To Your Heart

Or your gut or your left big toe-where ever your common sense resides. In the end, it really is about taking responsibility for your decisions right or wrong. Know as much as you can, then trust your judgement when picking an advisor. It’ll pay huge dividends in the end.

DISCLAIMER: This is absolutely meant to be financial advice. Please treat it as such and protect yourself to the best of your ability.

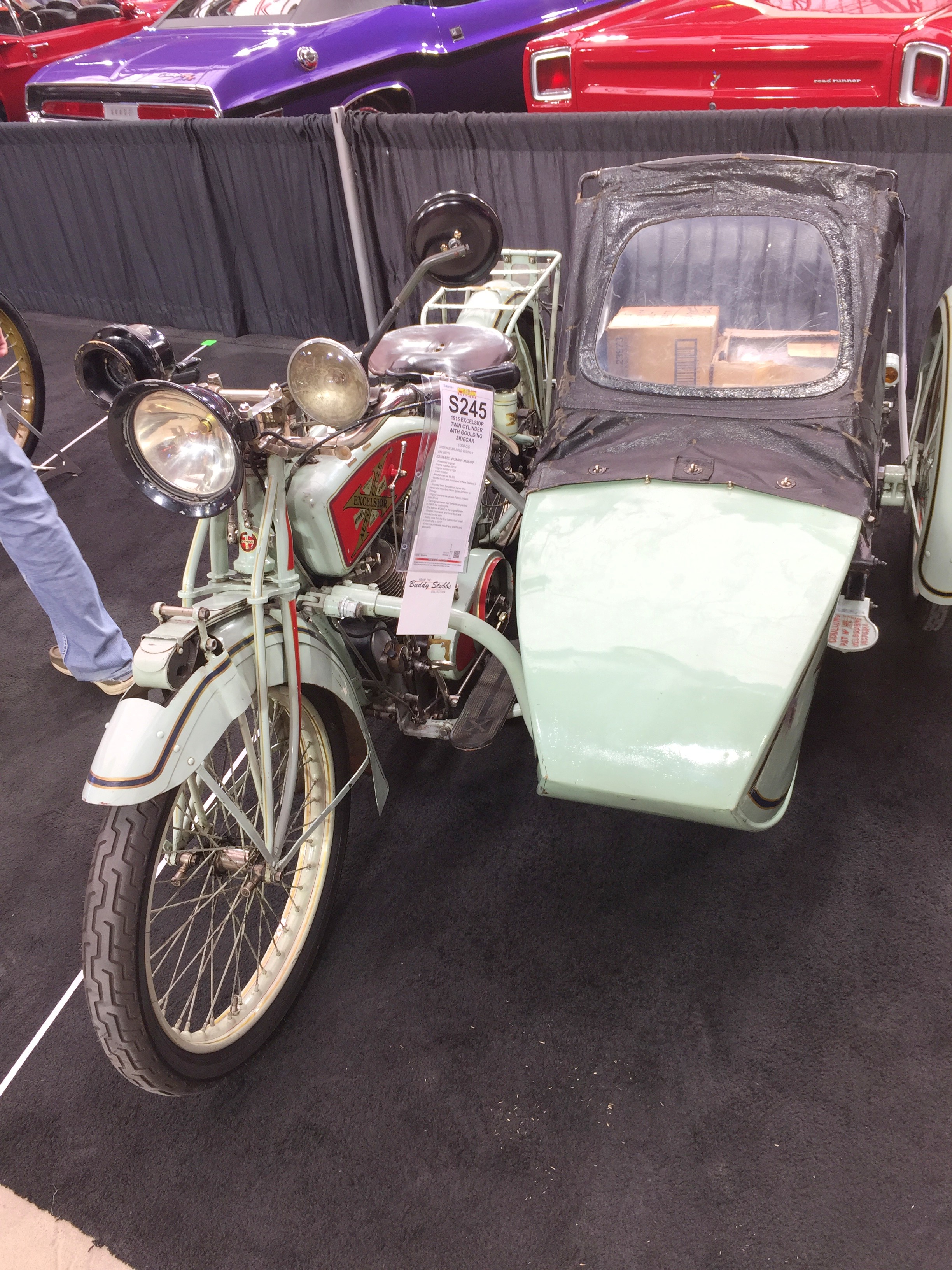

All words and photographs in this post are mine. For better or worse. The photographs in this case have nothing to do with this post, are only used to break up a mountain of text and provide some attractiveness to an otherwise bleak publication.

Thanks for reading this all the way to the end. Anything can happen and often does.

You want some really cool stuff? Check these authors, they will not disappoint.

@bozz: Good stuff every day.

@soyrosa Great Photographs and Insights for us All.

@sultnpapper Truth Teller and Poker Player.

@jangle Because Jangle A great writer and serious hustler.

@tarazkp Great writing and lots of it!

@galenkp Most engaging guy on Hive.

Posted Using LeoFinance Beta

Hello friend @ bigtom13 Good day

Excellent post. It is very true what you say, both in hive and on the web, there are thousands of people making suggestions even giving advice, the truth is that what works for one does not mean that it has to work for everyone, each situation is particular and requires of a good analysis. I like the idea of studying the forecasters' past. I really appreciate this information.

I take this opportunity to wish you a splendid week

Ah, my friend. How do you do?

There are a lot more experts than there are situations to warrant them. The only requirement for expert on the internet is the willingness to share their knowledge. Whether or not they know anything at all.

I hope you have a wonderful day.

Posted Using LeoFinance Beta

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.So many Guru's blowing off hot air, one really has to do a lot of research.

Since 2015 and currently I keep an eye open for what Charlie Schrem has to say, level headed approach that I do enjoy. He does not write as often, this was the last articles I noticed on Coin Telegraph

Regularly share William Suberg's articles from Coin Telegraph, working from stats along with current events swaying markets. Another level approach without having to do the statistics on your own.

Keeping grounded, try read Seth Godin's blog once a week when able, golden nuggets of knowledge in there too.

Before moving into any cryptocurrency, do your own research, if/when you burn your fingers you can only hold yourself to blame.

I absolutely love Seth Godin, I save every blog post (it started out because I was certain that his blog would go to a 'for profit' situation and wanted to keep them forever. I have over 10 years worth) I read the whole weeks worth every Sunday.

Keeping current with what's going on is with out question the very best way to make good decisions.

Thanks for the great comment. Always appreciate it.

Posted Using LeoFinance Beta

Seth Godin rocks, no fluff!

Finding a couple of people to follow always good, I feel more comfortable understanding their terminology and reasoning. Definitely keeping an eye on a few projects, some from many years ago, only beginning to find their feet now.

Have an awesome day!

I am watching Jon Olsen's CTP project from a distance. I was once a part of his project and still consider him a friend. I am not involved in any way, but I genuinely hope he makes me say "Damn. If only I'd have gotten into the CTP deal when Jon asked me."

I have a couple of other things I pay attention to also. But for now, I am basically all hive all the time.

Posted Using LeoFinance Beta

Other than Hive and obviously BTC, I have watched HLIX @hlix which is not starting to show signs of growing.

Right from start invested, watch/wait patiently knowing developer @nathansenn is trustworthy keeping to his word. Much like Steem/Hive move this coin too had bumps in the road.

If it goes too smooth with a new coin I worry about a scam. I've seen a couple of those, fortunately without too much money lost...

I'm going to look into hlix. Might could be I learn something new.

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.I was horrible in the one statistics class I took in college. It was really hard for me. I could see myself having gone into accounting if I wasn't doing what I am today. I agree with you though, I was reading some posts and Tweets the other day trying to see if there is another altcoin I should be investing in. Everyone has an opinion and everyone's opinion is the right one it seems!

Statistics was one of the few classes that actually made sense to me in college. :)

Everybody is an expert and most have no portfolio to back it up. It just makes me crazy that they actually influence people without any possibility of knowing what they are talking about.

Thank you for the wonderful comment.

Posted Using LeoFinance Beta

Yeah, it is definitely frustrating to know what to do and who to listen to. I think it is important to look past the pump and dumps that you might get lucky on and focus on the core projects that are just doing really good things. BTC, ETH, HIVE, EOS. What do I know though! 😁

Hard to go wrong with those four, I think. I'm going to be watching community coins pretty carefully going forward, whether it be HiveEngine or something else. LEO frankly surprised me, and I'm thinking that sort of community will drive Hive in the future.

I know what I think but not what I know

I think Leo surprised a lot of people. Even the ones that were smart enough to buy in when it was cheap. It is a good community and they have some great stuff in place to help you grow your stake.

I really do think LEO is the beacon for every other community to follow. You and I have seen a few come and go, and it looks to me like Leo is a big time keeper.

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.Glad to read something about finance from you. Agree 100% that predictions are just something like guessing, as there are so many variables a long the way. A very good example with Mr. Thaler. Here we can say that behavior has a lot to do with economics, more maybe than we think. And you are again right, we might better predict failures than success, based on the past experience.

P.S.: Love the pictures as clickbait :)

Posted Using LeoFinance Beta

I read Silver and Thaler back to back in the summer of 2017 when I had way more time than I had things to do. I actually took notes through Silver's book, I was so impressed. Then Thaler told me WHY so many predictions didn't work.

The pictures were all taken at a Meecham Auto Auction in Phoenix. It was one of the best car and motorcycle shows of the year besides all the excitement!

Thanks Alex! Always good to see you.

Posted Using LeoFinance Beta

Need to read both, as I did not read any of them.

Some real cool history in those images.

It is my pleasure!

Have a !BEER from my side! :)

Posted Using LeoFinance Beta

Those three bikes are significant in the motorcycle time line.

A 1910 Harley Davidson

The first Indian V twin

A Henderson Excelsior 4 cylinder.

It was really cool to see them all in one place. There are probably more that will end up as 'line breaks' in future posts :)

Posted Using LeoFinance Beta

View or trade

BEER.Hey @bigtom13, here is a little bit of

BEERfrom @alexvan for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.There are two things I want to say here.

Firstly, I will take the Roadrunner in the background of the second shot.

Secondly, I will also take the charger.

I like that you are posting this kind of thing in LEO, as I believe that the mindset considerations and how to approach decision making are far more important than which coin is going to pump. It is much like giving a fish or teaching to fish.

Those photos were taken at a Meecham's Auto Auction. It was not only exciting but just a terrific car show. I have a few hundred photos from there, I'll use more as line breaks as time goes along.

I'm not a financial expert in any sense of the word, but I do have some experience in the ins and outs of business and particularly internet business. It's my first post on LEO and I wanted to do it right.

Thanks for the comment. I always appreciate it.

Posted Using LeoFinance Beta

I haven't been to a car show in many, many years. Perhaps one day I will do one of the big ones in Germany - different cars for sure, but there is an atmosphere about them.

I don't think expertise in finance are required in this kind of thing - but life experience definitely matters.

Posted Using LeoFinance Beta

I've never done one of the big 'dog and pony' shows like Detroit, New York or LA. I probably should one day.

I HAVE done some really large vintage/antique shows. Too many people and actually too much to see. But a lot of fun.

Posted Using LeoFinance Beta

It is also nice to see you up in Trending ;)

Posted Using LeoFinance Beta

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.Congratulations @bigtom13! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Wow

What wowed you?

Posted Using LeoFinance Beta

What???

@bigtom13, I have to admit I have come late to your posts because of some silly ignorance. I didn't know where to look for them. Ha, ha, ha. Talk about being hard-headed. It is fine advice. Economics tend to bend toward tendencies rather than luck of the draw.

I think the pictures are worth something. I mean, investing in memorabilia will become something of high revenue once everything goes digital or 3-D printed. At least, that's my educated guess about the matter.

I have been reading about cryptos and that kind of thing, but I still find myself not understanding things that go as far as selling seeing it peak or go down. This is because I don't understand the thing in itself. But here I am delving into it little by little every day. Maybe one day it will reach this hard brain of mine.

Thanks for the advice. We certainly need to triple check the things that we trust. A little epistemic responsibility doesn't hurt anybody.

I really think the best way is to mostly do it yourself. Learn everything you can, and pick your own comfort level to go forward with. I like to read all the junk that's written to 'pick and choose' what I need.

I pay relatively close attention to the collectible car and motorcycle market. During the pandemic the very premium cars and motorcycles have really held their value well, but the 'second level' has slumped some. It will be interesting to see how this shakes out. I wish I had the money to invest in that second level, I think it will really come back well at some point in the future.

Thanks for stopping by. I really appreciate it.

Posted Using LeoFinance Beta

It's the least I can do after so much support.

Hey, I would also like to have the money and invest in some kind of commodity. One can never be too sure about ways to generate wealth and what to hold back.

And definitely, one can get as informed as possible, but decisions are a matter of personal preferences.

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.I guess I better not say Wow here!

That Indian bike is a stunner Sir Tom. I can't remember who made the 4 square, was it Indian or Arial?

As far as finances and those things go, I happen to know very little about it, as I work with poor people and not with finances,

But here's the thing, people that support charity work are naturally good people and among them are many financial experts. So when I get a gut, or a right ear feel, I simply ask them for advice.

Blessings!

Ariel made the square 4. What a beautiful motor that actually worked pretty good after they got all the kinks worked out of it, mostly being able to cool the valves on the two cylinders that weren't in the wind...

Indian made an inline 4 that ran the long way. Exhaust on one side, carbs on the other. It was a pretty cool project but they never picked it back up after WWII. I'd really like to own one of either one. Distinctive.

It's good that you have people you trust. It makes it easier that they've trusted you and your charity.

Ah yes, it was the Ariel 4square that he had in his collection.

The guy was a master in re-building old bikes, all on his own in his spare time.

I don't know what happened to the bikes after his death.

Yep! Always good to have trusted friends.

Ariel built some seriously beautiful motorcycles. I certainly understand rescuing one of them from the 'heap'.

Here, we seem to see auctions of after death motorcycles. The family doesn't have the passion and would rather have the money. The new owners are usually really happy to get a new old friend...

Yeah, I have only seen that one Ariel, but it was a beaut.

Always the case when one dies my friend. People spend a lifetime building things and when they pass away, the children squander it. Soon the money runs out and there is nothing left.

I looked at one, and really agonized over buying it. It had been modified (professionally) into sort of a chopper style (not the huge front rake, but some). But it had a hydraulic front brake, an oil cooler and a 12 volt generator and electrical system. Would have made a gorgeous rider to take to the local coffee shop, but the 'sit' would have not been conducive to long rides. I ended up passing on the bike. It would have looked really good on my veranda...

Ah, the choppers are indeed great lookers. Ape hangers, extention forks and peanut tanks.

They were declared illegal over here and one still battle with the traffic department to get one licensed.

Real lookers though!

Remember the old Buick Special?

Oh, boy do I remember the old Buick Special.

My friend Ray (who I inherited my house from) was in the Army in North Carolina in '55 and bought a brand new special order Buick Special with a 3 speed transmission on the floor.

He drove it to Acropolis, North Carolina and rolled up to Lee Petty's yard and asked him to help him tune his Buick. Lee Petty is Richard Petty's father and a NASCAR Hall of Fame member in his own right. Lee Petty told him he wouldn't get his hands dirty but that Ray could do the work right there using Lee's tools.

It worked. I have a newspaper article that mentioned my friend Ray being arrested and jailed for street racing against a Jaguar XKE. The article also stated that the Buick clearly won the race :)

Ray said that race cost him a stripe (from Sargent back to Corporal) but it was damn sure worth it!

Wow, you certainly have a great story here about that Buick and it deserved a mention.

Now have you ever seen a Buick 8?

Very plain and primitive inside.

A pity that Hive does not have a pumping old car community, as there is nowhere to post these beauties and I have many of them.

I am sure that you also have many!