Don't let your cryptocurrency sleep and at least stake it

We all have a spread portfolio of cryptocurrencies and we hold those either in cold wallets or on the exchanges. We check the balance from time to time, we are checking the price for it and maybe use some application to see how the price evolves for the cryptocurrency portfolio. There are days when the portfolio will be up and when it will go down as there is no bigger volatility than on the cryptocurrency markets. Maybe in these times also the stocks markets show increased volatility as there is uncertainty in that space as well.

But in all of this there is a constant and that is the number of cryptocurrency that we hold. And this is quite a pity as those tokens can be put at work for us. One option with high risk, but also high reward is to get into DeFi schemes where we can see great returns. But there are others amongst such high-risk appetite investors which look at a smaller risk. And the simplest one is to STAKE them as we are well accustomed with it even from the HIVE blockchain and also from some second layer tokens from here.

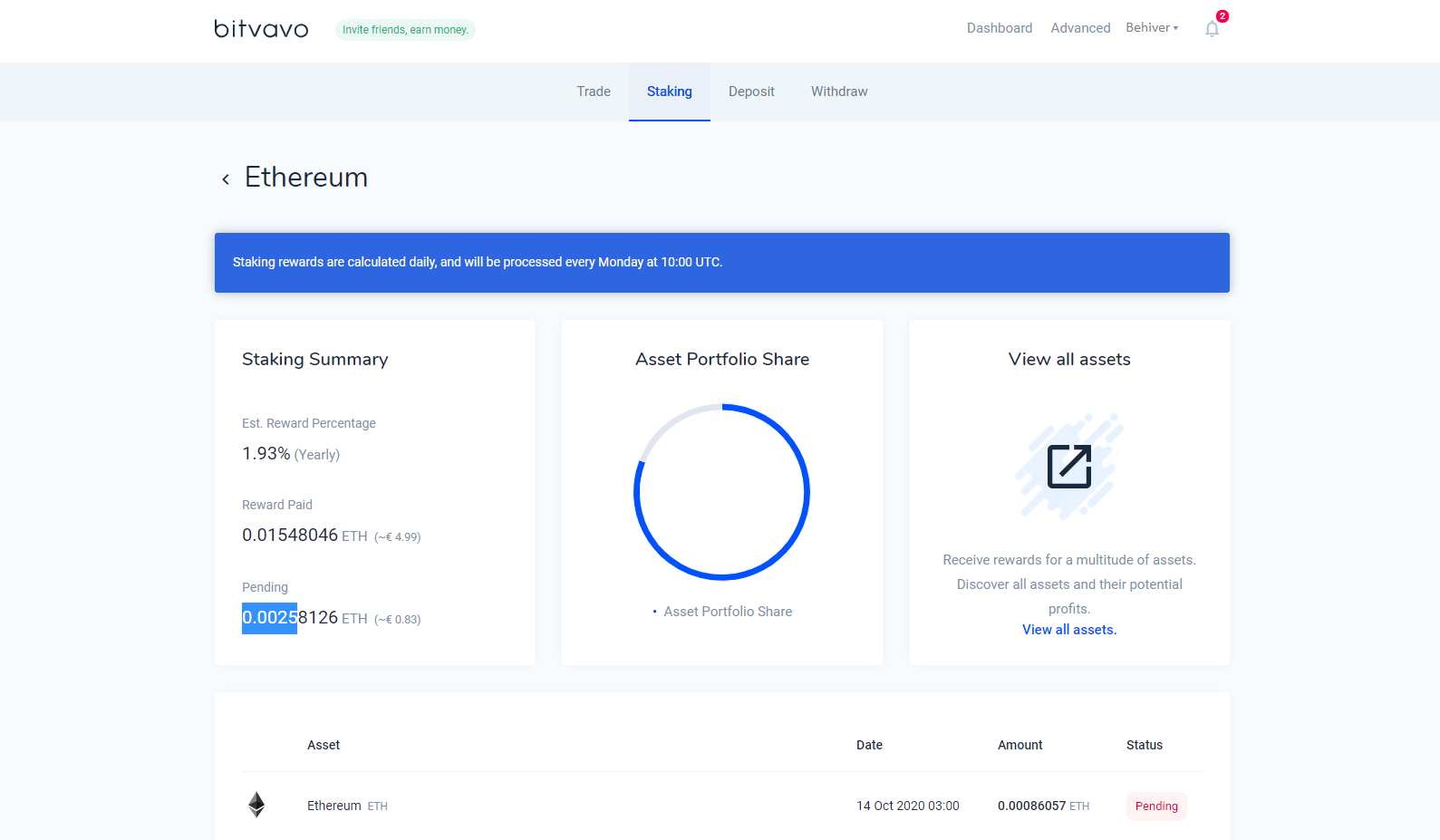

Staking features are now more and more common with bigger exchanges and while you are not trading your cryptocurrencies you can stake them. The returns are calculated on a daily basis so you can passively earn from them and in the same time you are able to act fast on the market if you need so, by simply un-staking on the spot. This is a great difference from HIVE or second layer tokens that we are used with where the un-staking requires 4-12 weeks, while on exchanges it is on the spot and maybe just nullifying the rewards from that date. And to show proof this I am sharing the rewards from staking my Ethereum tokens on an European exchange - Bitvavo.

As you can see the APR(%) for Ethereum is at the moment 1.93% and for staking them I've got so far 0.015 Ethereum which translates at about ~5 Euros. In the same time there is a pending balance which is paid weekly of 0.0025 Ethereum which means about ~0.83 Euro. This is small money, but considering that I don't use the Ethereum at the moment in any way I consider it a good channel for passive income.

Posted Using LeoFinance Beta

https://twitter.com/behiver1/status/1316825327671402505

Yes thank you

I think staking is popular now as many of these chains are trying to attract investment and paying users in inflation but eventually, as more people come it it arbitrages down those returns and then its going to become interesting. When staking is not only paid from new inflation but from active fees and movement of currency on chain, productive lending and such, then we can see what the actual yield curve is and if its worth it.

Chains will compete with one another for capital based on the returns they can provide and source capital to attract dapps etc. Staking and yield farming are going to be a big part of crypto in the next few years

Posted Using LeoFinance Beta

Indeed and that is one simple instrument that we can all use, without the adversity of a high risk. Staking which might take sometimes the form of lending I believe is something that allows for every crypto holder to act like a "bank".

Posted Using LeoFinance Beta

The space is so crowded these days, every other platform and exchanges are inviting users to stake their crypto. It is better to compare and analyse before deciding. Think about admin fees, gas fees and other related costs.

Posted Using LeoFinance Beta

Competition is always good as it might favor the end user. Picking one exchange or the other (or platform) depends either of the returns promised or on the trust you have in that. And these things are not always going hand in hand as some might prefer a trusted exchange which gives lower staking percentage.

Posted Using LeoFinance Beta

Agree. Users need that right balance where they want high yield with security. Chasing higher yields may increase the associated risks.