Major Cause Of Crypto Downtrend Boils Down to Currency Devaluation

It's been months since we last experienced any true signs of a bullish market. It's all been a two minute green candle and then boom, it's all the way back to the grave, down below, thousands of feets, yeah, close to hell or probably down to it. People have been raising the question like "is the bear market here" or perhaps if it's already here, when will it be over?

No one can quite tell if it's a bear market that would prolong, but it's surely a speculative one. Added to all the FUDs that's been all up in our shoes, if we're to head back to the reality of life, the weather doesn't quite look nor feel safe out there.

Note: this is not financial advice and it shouldn't in any way trigger your emotions unless you're a d…

Crypto Is Money - So people will spend it!

I looked up some data so I could come to a conclusion on what really is causing the prolonged downtrend in crypto prices. It is rather not an expected one considering the bull season that was readily anticipated, sadly that has become something no one can predict if it's still coming anytime soon. However, FUDs have never been that powerful to keep the markets down below, so definitely something else was in place.

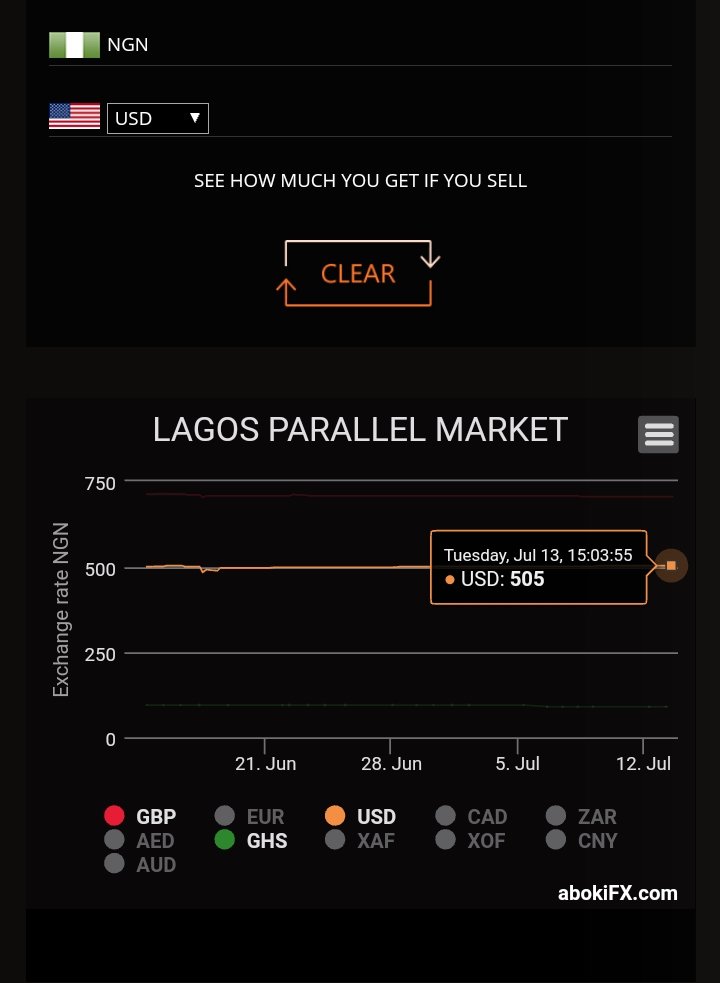

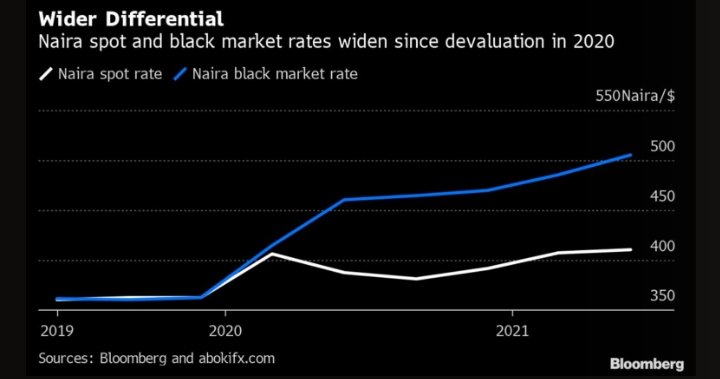

While the spot exchange rate of Naira against the dollar had hovered above 380 steadily taking its lazy ass to 400. Black market prices have been one juicy strike point. 500 naira per dollar is one crazy rate and considering a terrible market, it ranges even higher. The state of economy has been a let down in Nigeria. Coupled with insecurities, lack of employment, the constant devaluation of the native currency has been a total turn off. Added headache is the results in prices of commodities going sky high.

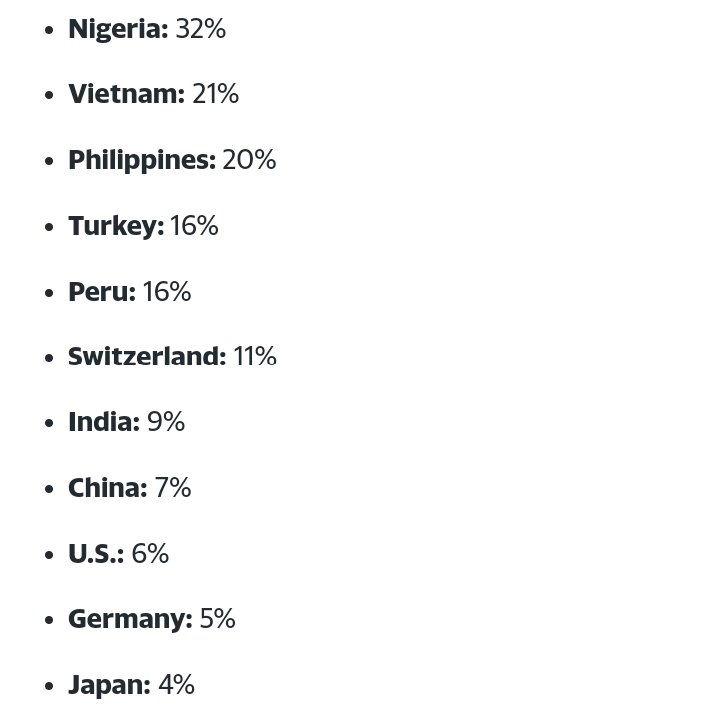

If the data below stands a few grounds on countries that utilize crypto the most, then reasons for the prolonged downtrend isn't far from our fingertips.

Nigeria is known to have 1 out of 3 persons invested in cryptocurrency. This is one big advantage to the Nation. Usdt being pegged to the dollar is the first point of consideration. This is where black market rates kick in. Not many are aware of how much money they throw away selling off coins without comparing exchange rates. 1 Usdt equals 1 dollar and 1 dollar equals 500 naira and 500 naira is a shit note people could literally kill for.

With the state of the nation, a country where 32% over 200 million in population are invested in crypto. Considering the recent spike in prices of goods, more money is dependent on survival. So as such, it is clear that most of the selling pressure is all from retail traders, mostly in Nigeria and other poor economy Nations.

My guess, now can we hear yours?

Posted Using LeoFinance Beta

Nice post. I think the truth is much simpler. Its a coordinated dump. Pump and dump are part of the game and now is the dump. It will continue untill the big players will decide to pump again. Nigeria might have many crypto users but their market share is low due to their weak currency.

Uhm, good point.

However, what goes on in the market is something a bit hard to attain. Nigeria holds more wealth than you think, ignore the currency, the same reason they invested is the same reason they may be pulling out.

The weather is currently bad, so it's some retail shits cashing for Fiat to survive.

Posted Using LeoFinance Beta

Maybe...

Congratulations @badbitch! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 1000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP