CIMB SG mortgage floor rate hike

These few days , Business Times Singapore repeatedly headline reported that CIMB Singapore is having some issues with their mortgage loan custmomers.

Source: https://www.businesstimes.com.sg/

CIMB is the second largest banking group in Malaysia , but sadly its appearance in Singapore is very very limited , only 2 branches , 1 at the financial hub Raffles Place , another 1 at the Shopping Heaven- Orchard Road. But comparing their number of branches in Thailand and Indonesia, CIMB Singapore foot print is super rare- Many locals don't even know its existence.

So the conflict CIMB SG is having with its customers is they try to exercise their legal rights to secure their loan profit margin via the floor rate.

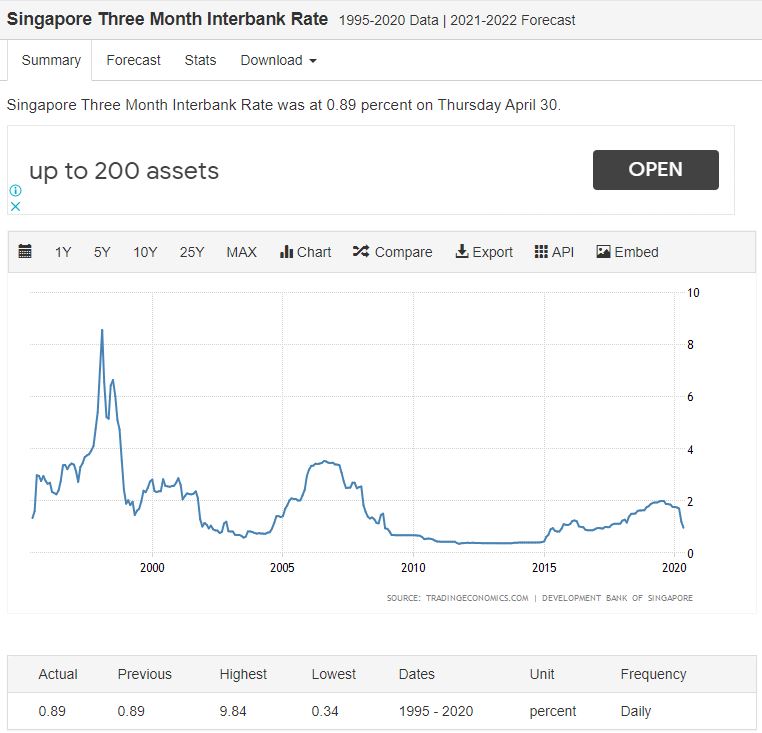

Supposingly , since the mortgage packages were signed rate floating with the 3-month SIBOR rate, the contract should be respected regardless if the Sibor rate goes negative zone- The bank's actuary should have taken into account the possibility and risk associated before they launched the mortage products !

And seeing the long term sibor rate the last 25 years, the worst was during 2012-2013 period, where Sibor =0.35%. The profit margin still there .

So I guess CIMB SG is making the wrong move to taint their reputation of disrespectful of the contracts .

If this is not stopped, will set a bad example for other banks to smell the loopholes and bite on their loan customers!

Source: https://tradingeconomics.com/singapore/interbank-rate

Posted Using LeoFinance

Yea I have roughly heard about this. Ooo wow. Especially also another issue it's facing is the u collectable loans. I forgot what term is that. Yea. It's a pity right, Malaysia being such a big country have banks that only have small footprints in Singapore.