Bitcoin Volatility - Is it Good or Bad?

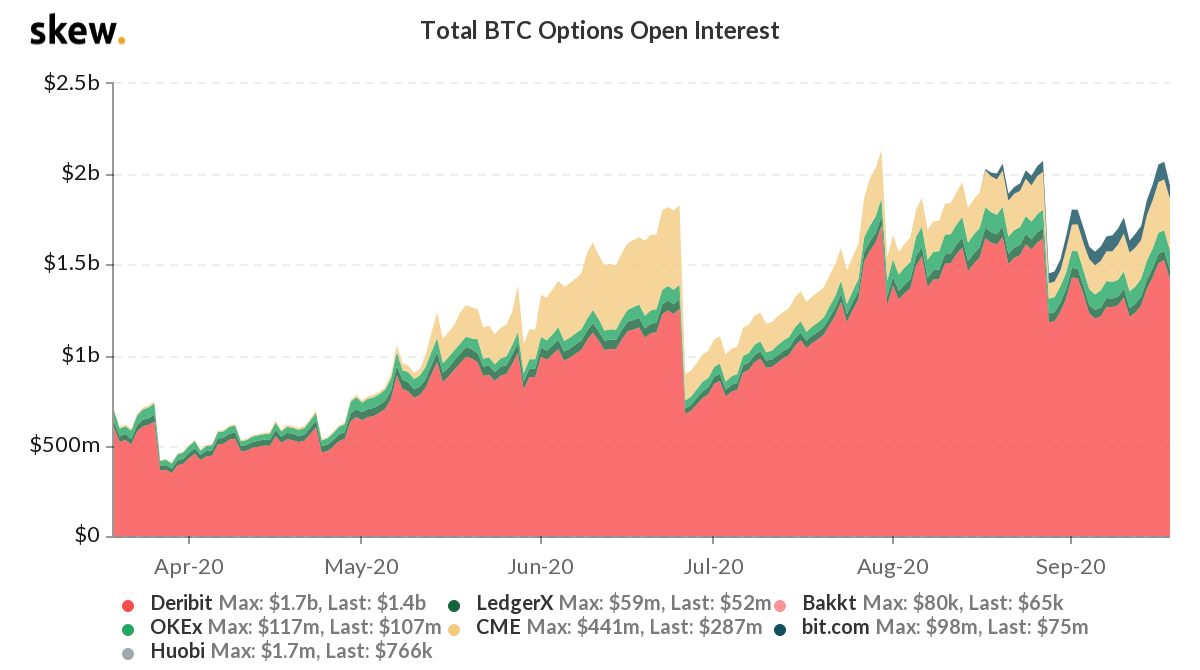

A lot of Bitcoin options are about to expire. Some say we should expect above average volatility in the Bitcoin price.

Volatility is an interesting question. People talking about this in BTC circles got me to thinking:

How much do we really like volatility in our favorite asset?

I spoke with someone the other day about volatility; they said that BTC is an interesting asset, but they could not stomach volatile swings up and down.

I explained that volatility is one of the reasons why people get into crypto in the first place.

Volatility can work for you or against you.

If you hold an asset with no volatility, then that asset won't go up or down in price. It will be a flat line.

If, however, you buy a volatile asset at a relatively cheap price - relative to the rest of the market - then you may come out the end a wealthier person.

With Bitcoin, price averaging and dollar cost averaging are the key. If you want low volatility, then all you have to do is buy small amounts over large periods of time.

If you want to speculate, you can do that by trying to time the market and buy dips and sell tops.

There are problems with every approach but there are also solutions and more importantly; opportunities.

Posted Using LeoFinance Beta

The volatility is just a line between good and bad in my opinion. The bitcoin trend has been pretty predictable for a while. A quick sell off which leads to a slight dump, weakhand dumps and then it comes up again. Personally I've been riding the wave though. It gives me enough opportunity to buy btc with my Visa card on Changenow so I can keep stacking my sats. Haha