A Must Read Article about Tether Fraud as Trigger to a Huge Collapse

(Edited)

TLDR - This article details investigation about Tether that concludes no backup for the coin and for 70% of cryptos trading volume.

Here is a link to the article:

https://crypto-anonymous-2021.medium.com/the-bit-short-inside-cryptos-doomsday-machine-f8dcf78a64d3

To summerise this dude claims that in all Bahamas banks there is not enough usd to cover Tether sales.

This short of USD can collapse the coin and huge leverage that is built upon this.

What do you think leo friends?

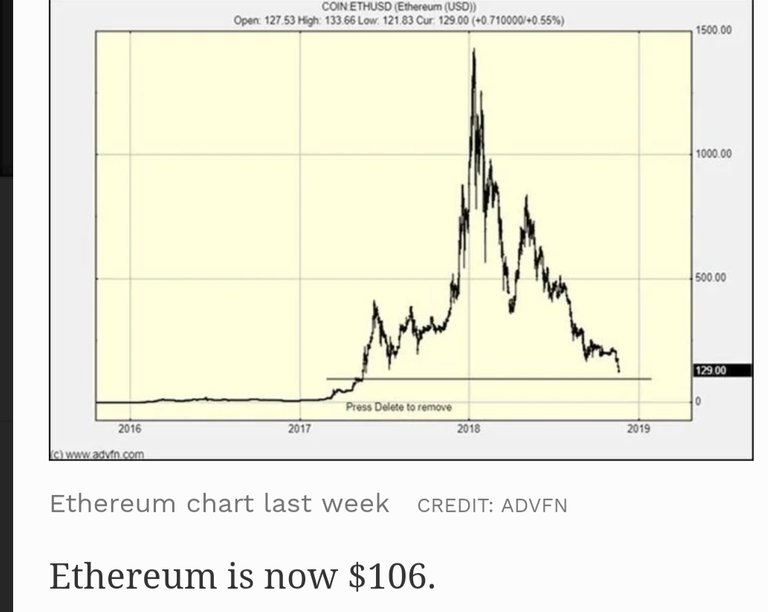

Here is a reminder of the 2019 collapse in ETH

Posted Using LeoFinance Beta

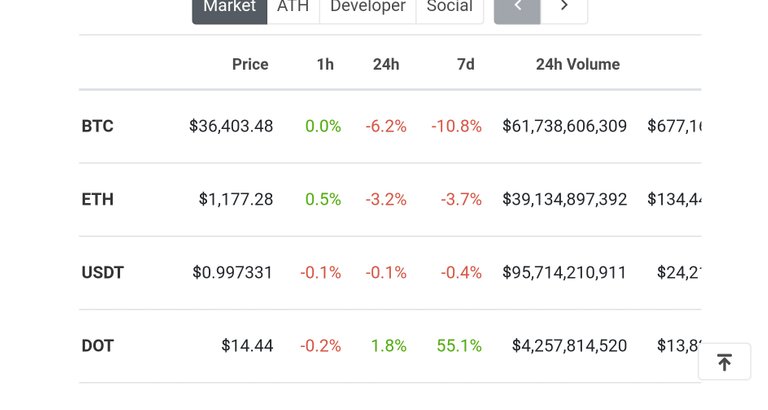

Here is a current snapshot. Lets enjoy the movie:

0

0

0.000

This guy is clearly a crypto newbie and doesn't understand that all the things he is saying MAY be wrong with Tether ARE definitely wrong with the US Dollar itself and the current banking system.

Also he misrepresents the nature of the BTC-UST trade.

He presents it as a one-way trade UST buying BTC but it is also BTC buying UST on a one for one basis.

Most of the trade volume on BTC-UST is driven by traders not investors.

It is investors going into or out of BTC that drives the price long term. Only short term moves are driven by traders who are just arbitrating and speculating.

Even if Tether is his worst case scenario fraudulent it means nothing other than a short term blip for BTC.

Hi chart of the increase in the amount of UST issued is also misleading because it doesn't start at zero.

It merely shows a 12.5% increase in 2 years.

Compare this to the chart of USD issuance which has a 35% increase in total issuance in 9 months since March 2020.

The scale of any fraud by Tether is miniscule compared to the scale of the Ponzi scheme being run by the US Federal Reserve!

Thank you for this.

I felt this article is a bit amature but well written and persuesive.

I am very glad to read your comment and more glad this issue is addressed.

Here are my thoughts:

Ostensibly a dollar behind every token gives stability. But once people believe that a token is worth a dollar and always buy when it goes down and sell that it goes up it gives very strong stability. By the way, the value of the dollar itself is not backed by any asset. It can be said that digital assets are currently volatile in relation to the dollar, the question is how they will be in relation to sustainable assets like real estate, energy and commodities.