The most crypto-friendly countries

As a Bitcoin user or enthusiast, you have probably realized the advantages and benefits of using it. A deflationary currency, which provides freedom and privacy, is universally accepted and which, along with the internet, has broken geographical barriers, transformed the world into a true global village, tends to attract more and more users.

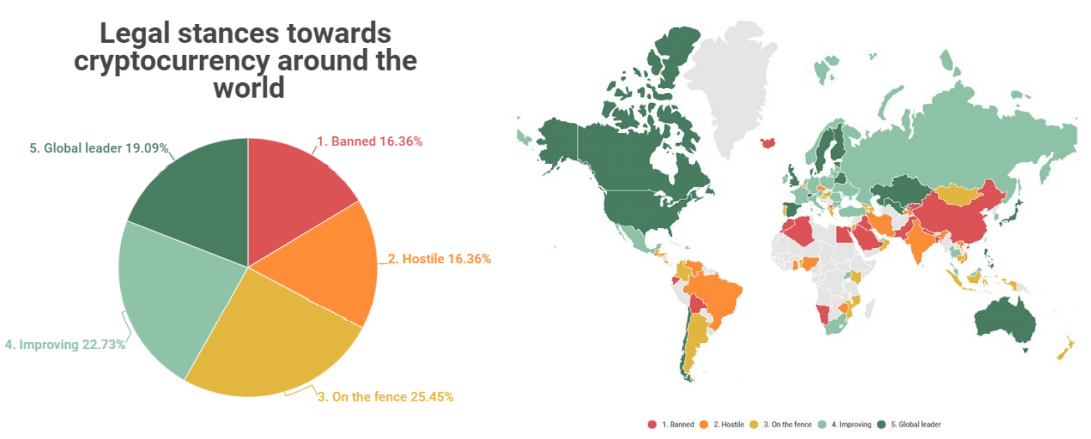

Although some countries have closed themselves off to innovation, others are rushing to develop guidelines, corresponding to increased adoption by the population, thus opening their arms to receive the opportunities generated by blockchain technology and Bitcoin.

What characterizes a crypto-friendly country?

The treatment they give to digital assets varies according to specific financial regulations and procedures, but basically it should be a country that promotes the development and use of cryptocurrencies, whether on a daily basis or as an investment and that has favorable jurisdiction for companies that provide solutions based on blockchain technology. There are exclusive ATMs, the possibility of paying bills, public transport and a tax situation favorable to cryptocurrencies.

What other points to watch out for when choosing a cryptocurrency friendly country

In the region, it is also important that there are more investors and companies linked to the blockchain, where there is an environment conducive to networking and new business opportunities. Political stability, quality of life, communication infrastructure and internet bandwidth are also crucial factors to take into account.

If you are thinking of moving to a place like this one day, it is worth considering the possibility of trying to win another passport and doing a good research on the subject, to find out in detail what is the approach of Organs regulatory bodies in relation to the Bitcoin in the country of interest. Therefore, we have brought a study on the most friendly countries to cryptocurrencies and how they have seen their use by their citizens.

With a population of 5.6 million, Singapore is a region characterized by its political stability and known as a financial and economic center in the Asia-Pacific region. The country has a highly developed market economy, classified as one of the most innovative, free and favorable to business, in addition to having the 3rd highest per capita income in the world.

Bitcoin and other cryptocurrencies are viewed by legal authorities as commodities, not money. This means that any company that operates with BTC or altcoins pays only 7% in taxes. In addition, the Singapore Monetary Authority allows some cryptocurrency companies to operate without a license, within a six-month grace period. All of this has made the region attract more and more companies and fintechs. According to the FinTech Times Blockchain Map, 234 blockchain companies are now operating in the country, 91 of which are newcomers in 2020.

Many businesses accept Bitcoin and other cryptocurrencies, and there are currently 12 Bitcoin ATMs spread across the country in different locations, mainly in shopping malls.

It is also among the few jurisdictions that support zero capital gains tax on revenue from cryptocurrencies.

In addition to all this, the country has one of the fastest internet speeds in the world, around 180 megabits per second and hosts a number of important events and conferences, including Singapore Blockchain Week and Singapore FinTech Festival.

Switzerland is synonymous with political neutrality and banking privacy. The country is one of the best in the world when it comes to economic productivity and competitiveness and has an extremely high standard of living. The region is home to hundreds of blockchain startups and most are based in the canton of Zug, including Shapeshift and Xapo.

For this reason, the place, with about 120,000 inhabitants, became known as “Crypto Valley”.

This nickname is mainly due to the formal establishment of the Crypto Valley Association in the region in 2017, an organization that played an important role in encouraging the adoption of cryptocurrencies and blockchain technology in Switzerland and for passing various laws that regulate the use of cryptocurrencies and related businesses.

The Swiss parliament adopted major financial and corporate law reforms in 2020 and incorporated new legal frameworks for digital and blockchain assets. Among them the possibility that, as of February 2021, companies and individuals residing in Zug could pay up to 100,000 Swiss francs in taxes using cryptocurrencies. In addition, the Swiss state railway accepts BTC for ticket payments and several Swiss banks, such as Falcon Private Bank and Julius Baer, also allow direct cryptocurrency transfers and deposits.

According to Swiss Info, there are more than 900 blockchain and cryptocurrency companies operating in Switzerland, supporting around 4,700 jobs. In relation to taxation, capital gains taxes apply only to those who trade cryptocurrencies professionally and cryptocurrencies received as wages and profits from mining are subject to income tax.

Despite being one of the smallest countries in Europe, Liechtenstein has become one of the most cryptocurrency-friendly in the world. In October 2019, in order to attract blockchain companies, the Token and Trusted Technology Service Provider Act was passed, which became the first comprehensive regulation of its kind, introducing regulatory transparency and allowing the free development of the blockchain industry in the country. .

As Liechtenstein is a member of the European Free Trade Association, companies in the sector have easy access to the common European market and can operate within a legal framework compatible with other neighboring countries.

The speed of broadband internet in the country is well above 100 megabits per second, the political environment is stable and GDP per capita is one of the highest in the world (US $ 165k), with one of the highest salary levels in Europe. As if that were not enough, Liechtenstein occupies a stunning location in the Alps, between Austria and Switzerland, a peaceful place with spectacular mountain scenery.

For many startups, this small country is perfect and the reason why the region has more companies than people is obvious: low taxes and friendly regulation.

With a population of 83 million, Germany is considered the leading European country in terms of technological, industrial and economic development, in addition to having a highly qualified workforce.

Since 2018, Bitcoin has been regarded as the equivalent of a legal currency for tax purposes when it is used as a means of payment and when it is held for a year or more, it is exempt from capital gains taxes when sold.

The friendly attitude towards digital assets was even more evident in 2020, when banks and financial institutions were allowed to manage cryptocurrencies on behalf of customers.

In addition, Bitcoin is also approved as a means of payment by the German National Tourism Council.

Located in Eastern Europe and with about 4 million inhabitants, Georgia has stood out in relation to the adoption of cryptocurrencies.

Georgia's post-Soviet economy is one of the fastest growing in Eastern Europe and thanks to economic reforms and modernization, the country is ranked 14th in the world in terms of ease of doing business and 13th in economic freedom.

The country does not have any legislative restrictions on exchanges and so far does not require any licenses for such activity. In addition, electricity is subsidized, which makes mining activity easier, contributing to it being one of the places where Bitcoin is most mined in the world.

He is also a member of the euro zone and uses Georgian Lari (GEL) as the official currency and unlike Liechtenstein or Switzerland, it is much cheaper to live.

The country still offers the possibility of citizenship for entrepreneurs in a much less bureaucratic way.

Eastern Georgia has always been one of the richest parts of the country, thanks in part to the vineyards of the ancient Georgian tradition. Today, the same valleys are home to Bitcoin mining operations.

The small country in northern Europe, with a small population of 1.3 million people, not only has a history of embracing the latest technological innovations, but its technology-friendly government has shown increasing interest and willingness to implement solutions innovative to serve its citizens, using blockchain technology.

The country is technologically advanced and generally very well ranked in the ranking of economic freedom (4th in the world) and ease of doing business.

The e-resident, developed in Estonia, is an example of the technological pioneering spirit of the region. This electronic residence mechanism makes it easier for foreigners to establish a legal and banking presence in the country. With an e-resident, it is possible to have remote access to various services, public and private.

There are several Bitcoin ATMs and startups with offices and headquarters in the country, such as Paxful and the Brazilian blockchain identity company, Original My.

The country was also the first to put Bitcoin white paper on its official website.

The Asian country, which has a population of 51.54 million and a GDP per capita of US $ 31.36, has a history of being the first to implement the most innovative and sophisticated tools for trading and using cryptocurrencies, in addition to to be favorable to the creation and development of companies linked to cryptocurrencies.

The country trades around 10% of the global Bitcoin trading volume and this is quite considerable, since it is not a country with such a large population.

Regulations have recently been sanctioned, with the objective that exchanges, funds and other industry participants meet certain financial requirements, such as the use of certified information security management systems and KYC.

Some projects based on blockchain technology for public administration have already been implemented, including the replacement of physical driver's licenses with a digital alternative. In August 2020, the president's office released a statement about his efforts to combat the ongoing economic effects of the Covid-19 pandemic. Part of their scheme to reinvigorate their local economy is to promote blockchain technology and the use of cryptocurrencies - with plans to invest more than $ 48.2 billion in blockchain and other Industry 4.0 technologies by 2025.

Four of South Korea's largest banks also plan to offer cryptocurrency custody services. There are also plans to be tax-free transactions, trading, gifts, inheritance, mining and other activities involving cryptocurrencies by the end of 2021.

The country, which has 5.8 million inhabitants and a GDP per capita of US $ 61 thousand, is characterized by having a large number of Bitcoin ATMs operating 24 hours a day, 7 days a week, spread across cities, making trading much easier. easy when using cryptocurrencies.

The region also has a large number of exchanges that operate freely as part of this digitalization trend.

Denmark has always advocated the elimination of cash transactions and the directing of its citizens to a digital economy, so the adoption of Bitcoin is not a surprise.

Regarding taxation, Denmark states that due to the private nature of trading with Bitcoin, taxes are not levied. In addition, the National Tax Assessment Board of Denmark has stated that losses on Bitcoin holdings are not tax-deductible.

Slovenia is a country in Central Europe with a population of around 2 million, a GDP per capita of US $ 26.12 and a strong and advanced economy.

The government and financial institutions are friendly with cryptocurrencies and no capital gains tax is charged to individuals when they sell Bitcoin. However, companies that receive payment in cryptocurrencies or through mining are taxed.

The famous Bitstamp exchange was founded in Slovenia in 2011 and the country has a total of 20 ATMs with cryptocurrencies and 10 of these devices are located in its capital, Ljubljana.

The city of Kranj inaugurated what may be the world's first public monument honoring Bitcoin in March 2018, symbolizing the acceptance of cryptocurrencies by the Slovenian government.

With a population of 37.59 million, Canada recognizes the validity of Bitcoin and has laws regulating cryptocurrencies.

Users have the possibility to use their digital assets in more than 80 commercial establishments that accept cryptocurrencies, in addition to having more than 900 Bitcoin ATMs spread across the country, most of them in Toronto, Montreal and Vancouver.

Cryptocurrencies are taxed as a capital gain and need to be declared in the income tax.

With a population of 328 million inhabitants and a GDP per capita of US $ 62.79, the country has different laws and regulations for each state. The federal government has not yet adopted a universal regulatory framework on the subject, which is why the situation in the US in relation to cryptocurrencies varies from region to region.

The state of California, especially Silicon Valley, undoubtedly stands out for allowing the operation of companies linked to blockchain and cryptocurrencies and for hosting a large number of professionals in this industry, in addition to being home to large companies in the sector, like Coinbase, Kraken and Ripple.

Despite the accusations about Ripple, the U.S. Commodity Futures Trading Commission made it clear that Bitcoin and Ether are not classified as security, but as commodities.

When it comes to Bitcoin trading volume, the U.S. is at the top of the list, in addition to having a large number of Bitcoin ATMs, mainly in San Francisco, New York and Florida.

However, in terms of taxation, all transactions with cryptocurrencies are subject to personal income tax or capital gains tax. Recently, the mayor of Miami has also shown interest in allowing the development of Bitcoin in the city and has considered the possibility of paying the salaries of public officials using Bitcoin.

With a population of 126 million and a GDP per capita of 39.28, Japan is certainly one of the nations at the forefront of Bitcoin adoption, legalization and integration.

The country was home to the first major Bitcoin exchange, Mt. Gox, which was based in Tokyo and the first country in the world to approve Bitcoin as a legal currency.

In addition, it was one of the first to approve broad regulations for its more than 32 cryptocurrency exchanges in order to improve its security. The Japan Financial Services Agency regulates activities related to cryptocurrencies, aiming to provide a stable and safe environment for users, seeking to ward off illegal practices and encourage institutional investment.

Several of the country's largest exchanges also form a self-regulatory body called Japan Virtual and Crypto Assets Exchange Association. According to the organization, 24 exchanges are currently licensed in Japan. At the moment, 430 companies linked to cryptocurrencies and blockchain technology operate in the country, which represented an increase of 30% compared to 2019.

As for taxes, essentially, annual gains are taxed on transactions involving the purchase and sale of cryptocurrencies and when using them for the purchase of goods and services.

THE CRYOTIFINDER WEBSITE SHOWS HOW COUNTRIES HAVE BEEN DEALING WITH THE USE OF CRYPTOMOEDES BY THE POPULATION.

According to the website, the USA is the most crypto-friendly country, based on the following criteria:

- It is possible to legally buy Bitcoins and other cryptocurrencies.

- One of the countries where regulation is more advanced.

- In most states, U.S. citizens can legally access more than 45 cryptocurrency exchanges.

- FinCEN classified cryptocurrency exchanges as "money transmitters", claiming that the "virtual currency" traded "has an equivalent value ... or acts as a substitute for the real currency".

- The IRS classified the cryptocurrency as property and issued tax guidelines in cases of profit.

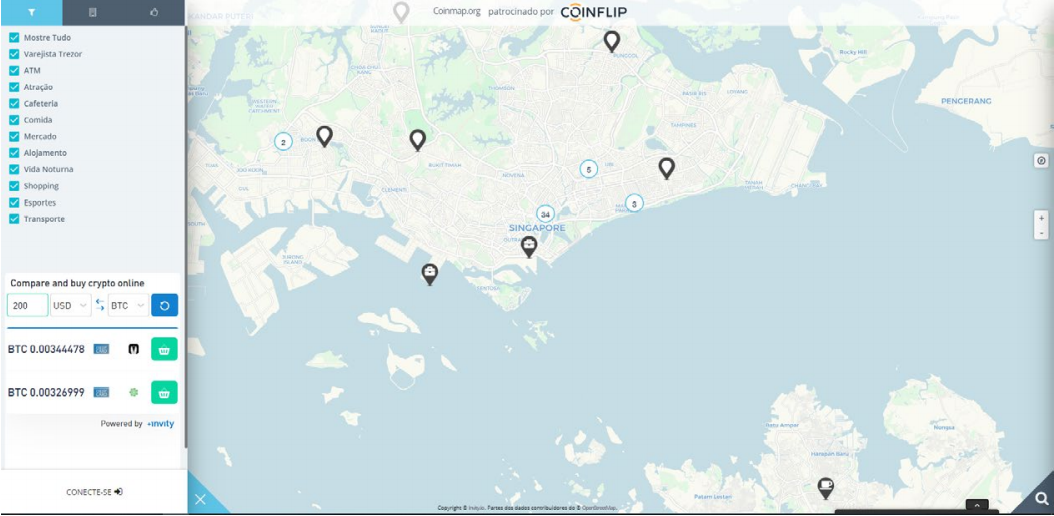

Do you want to find commercial establishments that accept cryptocurrencies in your region? On coinmap.org you can find out who is already accepting crypto as a form of payment for their products and services. Access and check it out!

Even though not all jurisdiction sees the potential benefits of cryptocurrencies, the trend is that more and more countries are taking a more positive approach to cryptocurrencies, given that in recent years governments, legislators and financial regulators have become much more informed about cryptocurrencies and blockchain technology.

Gibraltar, Bermuda, Vanuatu, Malta, Cayman Islands, Sweden, the Netherlands and Luxembourg are also among the crypto-friendly countries.

Let us continue to work and hope that Brazil will follow the same direction and become more friendly to innovation, thus being able to take advantage of the results that technology can provide.

Posted Using LeoFinance Beta

Nice crypto update sir.

I'm glad that you like it.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1376901872636862468

with the US looking for ways to ban crypto at the moment I doubt if they still need to be in the list...but good clean story thanks

Posted Using LeoFinance Beta

Cuurently they don't banned crypt and we everyday have more and more companies joining crpto. So for now tey are crypto friendly.

Posted Using LeoFinance Beta

Crypto environment in Pakistan is improving. A mining plant has also been set up in a province of Pakistan

By the way, Pakistani politicians have started putting their black wealth in bitcoin

Posted Using LeoFinance Beta

We need to wait to see what will happen in Pakistan related with crypto.

Posted Using LeoFinance Beta

This court order tells that No ban on Crypto in Pakistan

Posted Using LeoFinance Beta

You forgot Portugal. Portugal does not tax personal crypto income at all unless it is someone's main source of income. Out of the normal European countries, Portugal is probably the best possible country to live in for a someone who earns supplementary income from crypto.

Andorra is a tax haven in the Pyrenees between France and Spain that does not tax capital gains at all and that only levies income taxes at a rate up to 10%.

If you're a crypto whale, you may want to settle in Monaco.

Outside of Europe, the Cayman Islands along with a few other Caribbean island countries, is a tax haven. The Cayman Islands have no taxes whatsoever.

Posted Using LeoFinance Beta

Don't make too much of a fuss about Portugal because the way I know that the country is managed, crypto taxes should soon appear.

They are just waiting to see the position of the European central bank to know what to do.

Posted Using LeoFinance Beta

Too bad for Portugal. The Portuguese government is dependent on the ECB to buy their bonds. Not much room for negotiate. Then again, the ECB or the EU in general is in no position to allow Portugal or any other EU member to become insolvent.

Interesting. I guess if you're wealthy enough to invest in Andorra to become a permanent resident, that could work out very well.

Posted Using LeoFinance Beta