Synthetix - The world of derivatives within the blockchain

Continuing the DeFi issue, today we will analyze the Synthetix project, a decentralized financial derivative trading and issuance protocol, built on the Ethereum network, which allows users to issue and trade synthetic assets (Synths), which are representations of real assets, such as cryptocurrencies, fiat currencies, stocks, commodities, stock indices and anything that has value and that can be traced to prices.

The platform is maintained by an incentive mechanism that combines staking, guarantees and fees and the proposal is to bring to the world of decentralized finance one of the sectors that most moves the traditional financial market, derivatives.

The project aims to allow any investor, anywhere, to be exposed to a wide range of assets, such as equity

companies from different countries, real estate, commodities, such as oil and precious metals, etc., without having to deal with tedious financial requirements and regulations, which limit these markets to those who have an above average amount of capital.

Basically, if successful, it could channel some of the trillions of dollars of assets that are traded on the markets, bringing them into the Ethereum network, allowing them to be traded in a decentralized manner and without permission.

WHAT IS A DERIVATIVE?

In traditional finance, the three main categories of financial instruments are: debt securities, stocks, foreign exchange and derivatives. Of all categories, derivatives are by far the most traded, with estimates in excess of quadrillions of dollars.

A derivative is a contract between two parties that tracks the underlying price or quantifiable result of an asset (AMZN, TWTR, AAPL), index (NIKKEI), event (loan default, NYC temperature) or interest rate (LIBOR), called “underlying”.

In a derivative contract, two parties agree to place a bet on the movements of the underlying asset, with one part selling and the other buying. Since neither party holds the underlying, the contract needs to be backed by acceptable guarantees (USD, Euros, etc.) for the deal to be settled.

In the case of Synthetix they are guaranteed by the Synthetix Network Token (SNX) which, when blocked in the contract, allows the issuance of synthetic derivatives.

FOUNDER AND HISTORY

Founded by Australian Kain Warwick, who before Synthetix built Blueshyft, Australia's largest crypto payment platform, and launched in September 2017 after a $513,000 private financing round, the project was initially called Havven (HAV) and managed to raise approximately US $30 million through an ICO held in March 2018.

On the executive team is CTO Justin Moses, who was Director of Engineering at MongoDB; senior architect Clinton Ennis, who has 18 years of experience as a software engineer and was the former chief architect of JPMorgan Chase and many other tech-savvy professionals.

HOW THE PLATFORM WORKS

Although Synthetix is a complex protocol with several mechanisms involving stake, creation and burning of synths and governance with respect to SNX holders and Synthetix users, the basic principles of the protocol are very simple and can be divided into three steps.

- LOCK SNX AS COLATERAL - SNX holders lock their SNX as a guarantee.

- MINT SYNTHS - Synthetic assets are minted in the market against the value of the blocked SNX, where they can be used for trading.

- REWARDS FOR HOLD SNX - All Synth trades on Synthetix.Exchange generate fees that are distributed to SNX holders, rewarding them for betting on the system.

At Synthetix, synth holders are betting against SNX stakers, who place guarantees and take responsibility for the potential profits of synth holders in exchange for SNX fees and rewards. If the value of synths drops, stakers make money because they have less obligations to fulfill.

The combined market price in USD of all synths in the Synthetix protocol forms what is known as a “debt pool”.

As the value of all synths combined goes up or down, the debt pool increases or decreases. For SNX stakers it is best when the debt pool decreases, because they are responsible for covering their prorated share of traders' debts.

Traders buy synths at the market price and then place a bet against the stakers, who assume the counterparty risk if the trader makes money, although his potential disadvantage is outweighed by fees and rewards on SNX.

Being a staker is similar to owning an insurance company, where you receive fees and rewards and usually get ahead, but

occasionally you have to pay traders for your earnings.

According to Synthetix's proposal, this mechanism eliminates the need for counterparties and solves the problem of liquidity and slippage.

Example of using a synth

When you purchase a sNikkei, a synthetic of the Japanese stock index, for example, you will not be trading the asset itself, but a synth, which tracks the Nikkei index.

Another example would be if the interest is to be exposed to gold, the investor will acquire a sXAU, which is the synthetic that accompanies the gold quotation.

Native Tokens

The Synthetix platform has two different types of tokens: SNX Tokens AND SYNTHS

SYNTHETIX NETWORK TOKEN (SNX)

It is the native token that powers the Synthetix platform and is used as a guarantee when creating synthetic assets (Synths).

They serve to stabilize and secure the system while its holders receive transaction fees.

Stakers can trade SNX tokens on any exchange and store them in compatible wallets.

SYNTHS

It is synthetic derivatives that track the price of a corresponding asset. They allow holders to obtain exposure to various classes of assets, such as gold, silver, currencies, stock indices, stocks, debt securities, etc., without holding such assets and without relying on a custodian.

They are backed by the Synthetix Network Token (SNX), which is placed as a guarantee in a proportion of 750%.

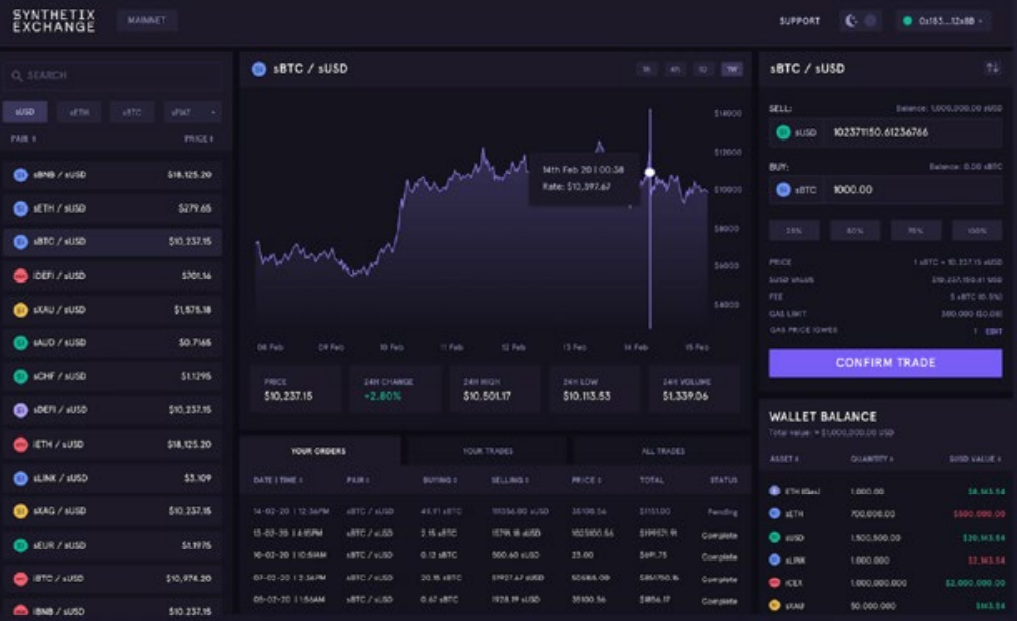

SYNTHETIX EXCHANGE

It is the decentralized trading platform where it is possible to trade synths. It is built on Ethereum and is accessible via a web browser.

To use the Synthetix Exchange, users must simply connect a web3 wallet such as MetaMask, Trezor or Ledger with at least 1 synth. Once connected, the user's balance is shown and he can then convert and trade.

STAKING

Trading fees on the Synthetix Exchange are collected and distributed to SNX stakers and lenders receive these fees on a weekly basis, which occur on Synthetix as a reward for SNX placed on stake.

TYPES OF SYNTHS

- FIAT SYNTHS: sUSD, sEUR, sBRL, sGBP etc.

- CRYPTO SYNTHS: sBTC, sETH, sBNB, etc.

- STOCK SYNTHS: sTSLA (Tesla), sAAPL (Apple) etc.

- COMMODITIES SYNTHS: sAu (gold), sAg (silver) etc.

- INDEX SYNTHS: sDEFI, sIBOV, sS & P500

MINTR

Synths assets are issued when SNX holders are staking (block their SNX as a guarantee). To do this they use the dApp Mintr, where synthetic assets (Synths) are created and burned and where interaction with Synthetix contracts occurs.

When creating Synths, SNX stakers acquire a debt and to unlock SNX they must pay the debt by burning the Synths.

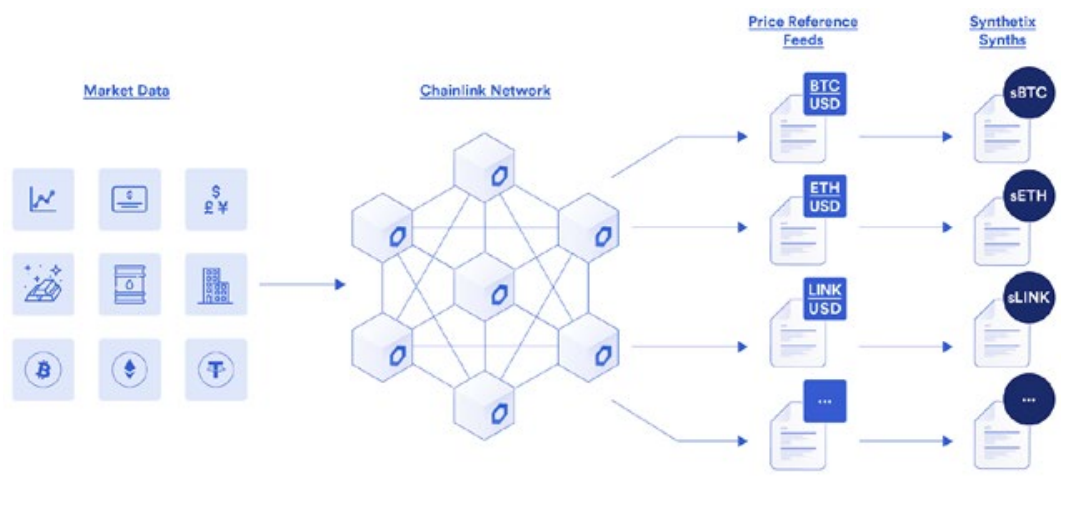

How the underlying asset data is transmitted

Price information is brought to the Synthetix platform through the oracles of Chainlink, one of the oracle mechanisms

most reliable and currently used in the market.

Chainlink oracles obtain quotes from different sources and weighted average to provide more accurately and transparently the price and other information of a given asset.

C-RATIO (COLLATERALIZATION RATIO)

To maintain the balance of operation and liquidity of the platform, the C-Ratio is used, which is the ratio between the SNX placed as collateral and the number of Synths created.

Synths are supported by a 750% guarantee fee, although this can be increased or decreased depending on the moment. Example: To issue 100 sUSD, it is necessary to deposit the equivalent of US $ 750 in SNX tokens. This ensures that the Synths have a sufficient guarantee to absorb large price shocks.

RISKS

Like the vast majority of projects in the DeFi ecosystem, Synthetix is an experimental system, recent and still little tried. Its current architecture can present risks, such as bugs, hacks (which are not uncommon in DeFi today) and other operational failures, in addition to sudden fluctuations in the price of the SNX token.

In June 2019 Synthex suffered an incident in which cybercriminals managed to loot 37 million synthetic ether (sETH) from the platform.

DeFi platforms such as Synthetix are expected to become more secure and better over time as they develop more robust and secure protocol updates, however, before

investing, remember that there is no guarantee that something like this will not happen again.

It is also necessary to pay attention to the issue of governance, since, currently, there are a number of aspects in the protocol that are centralized, with the decisions being implemented by its founder and his team, which requires the trust of its users.

There are plans to change this form of governance, making the

centralization is phased out over time and the community may have more power over the platform.

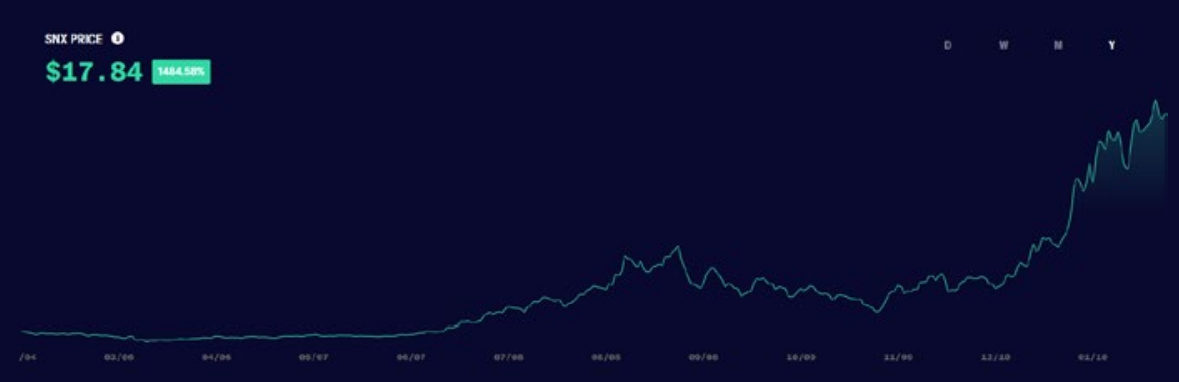

The SNX token had a very strong performance and went up by more than 1,400% in 1 year.

Current lowest price: US $ 17.84

Market capitalization: $ 2.02 billion

Volume in the last 24h: US $ 228.36 million

Maximum delivery: 212.42 million SNX

Circulating supply: 114.84 million SNX

Remembering that past profitability will never guarantee future profitability.

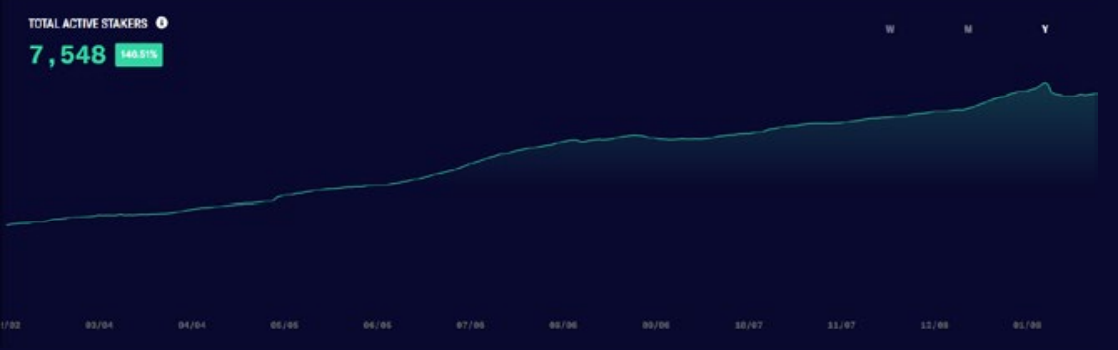

The number of SNX token stakers has also been increasing.

There are currently 7,548 stakers.

SNX's money supply was deflationary until March 2019, when Synthetix implemented an inflationary monetary policy to encourage stakers to create more Synths.

The total amount of SNX issued was changed from the initial 100 million tokens to 250 million tokens in 2025.

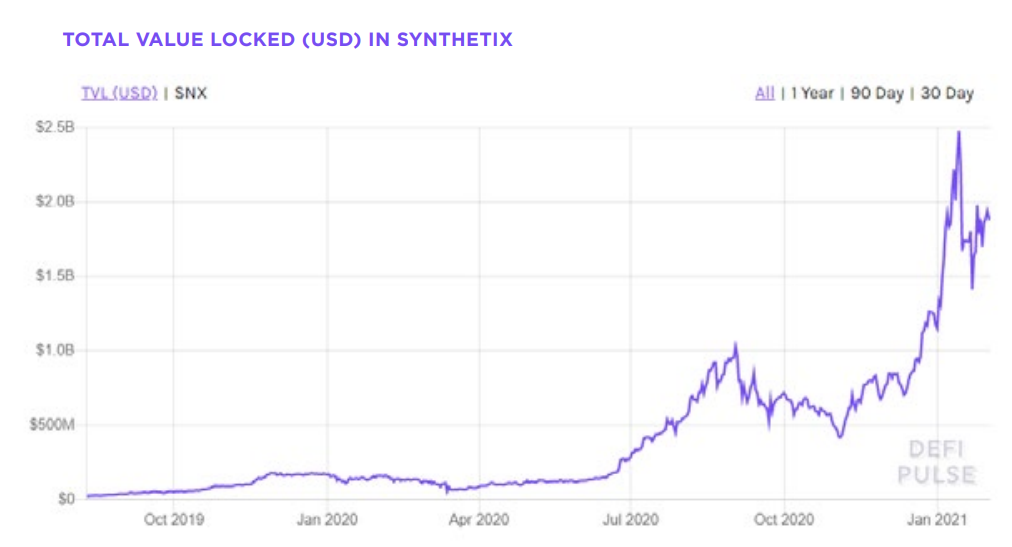

Since its inception in 2018, Synthetix has become one of the leading derivative liquidity protocols in the DeFi space with the highest total blocked value. Today it is in seventh place among the main decentralized finance protocols and has a total of US $ 1,691,033.203 billion locked on its platform.

As for the distribution of Tokens, at launch, the total supply was 100,000,000 SNX.

- 60% were sold at token sale.

- 20% was reserved for the team and consultants.

- 3% went to marketing incentives.

- 5% for partners.

- 12% was reserved for the Synthetix Foundation.

The segment of synthetic derivatives operated in public blockchains seems to be very promising and Synthetix is just one of the projects that exist, among others that should appear soon.

However, such projects still need to undergo additional improvements to be safer, to allow the creation of new synthetics, in addition to becoming increasingly decentralized, thus reducing systemic risks making them viable in the long run.

Despite being a little more complex to understand, Synthetix is a protocol that has real utility and works in an area still unexplored in the market, which is to operate synthetic derivative assets in a decentralized way.

The protocol makes these instruments accessible to anyone around the globe, with just an internet connection and a device, thus excluding the borders and barriers of the traditional financial market.

As the perception of freedom to trade any financial instrument increases, more users may be attracted to solutions of this type. Take all of these points into account before making a decision on your journey to discover this new world called DeFi.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1359559846916476931

More info why you see this.

Posted Using LeoFinance Beta

Thanks a lot for support my post.

Posted Using LeoFinance Beta

Great detail in your work Alberto. Thanks for taking the time to write and publish originals like these on LeoFinance.

This is the type of content that the community should be rewarding and it's great to see the LEO you've earned on this one already reflecting this :)

See you around!

Posted Using LeoFinance Beta

Thanks a lot I'm glad that you like it.

Posted Using LeoFinance Beta

I agree wholeheartedly with @forexbrokr. We really need more content like this. I love reading it and it's a great way to bring in more people from the crypto space with relevant and actionable content.

Keep up the good work! 🦁

Posted Using LeoFinance Beta

Thansk a lot for the feedback.

I will try to keep up to do good posts.

Posted Using LeoFinance Beta

Blockchain is an endless "hole".

Posted Using LeoFinance Beta

is it worth or not??

Posted Using LeoFinance Beta

It depends what you will do.

Some people stakes it and earn a yield others use it to buy synthetix like gold, etc

You need to do your own research

Posted Using LeoFinance Beta