DAPPS - AN FUTURE INCREASINGLY MORE PROMISING

The year 2020, in addition to all the lessons, also contributed to the emphasis on the digital economy.

As people and processes move more and more into the format, cryptoeconomics also strengthens and gains more and more public.

The website DappRadar made a survey of 2020 noting that it was a record year for the blockchain industry, with emphasis on the DeFi, NFT and Games protocols.

Transaction volumes exceeded US $270 billion, with 95% accounted for by the DeFi ecosystem, on Ethereum, and the total blocked value (TVL) among the main dapps reaching levels records of $13 billion.

These data prove that it was an exceptional year for the crypto universe and that there is a lot of potential in this environment that represents the new era of the Internet, more free, with more privacy, countless possibilities, without intermediaries and without concentration of power.

Let's analyze the main data related to the dapps of 2020.

Exclusive active portfolios increased 466% from 58,000 at the end of 2019 to around 200,000 at the end of 2020.

While transaction volume grew an impressive 1178% from $21 billion in 2019 to $270 billion in 2020.

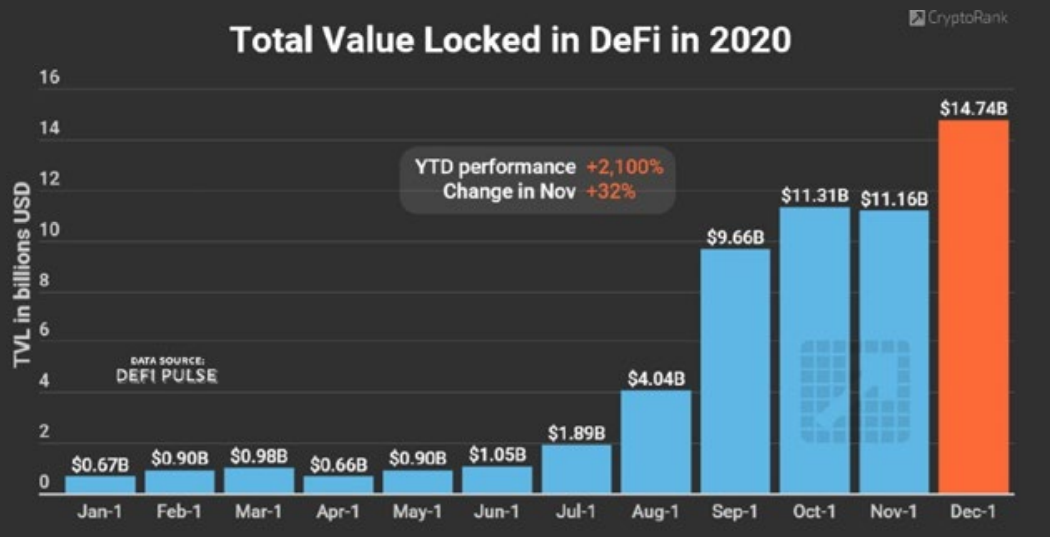

The total value locked in DeFi increased by 2,000% in 2020, from US $0.67 billion in January to the current level of US $14.74 billion.

A strong growth trend for DeFi, which is likely to continue to strengthen over time, as more investors and users become familiar with the industry and protocols.

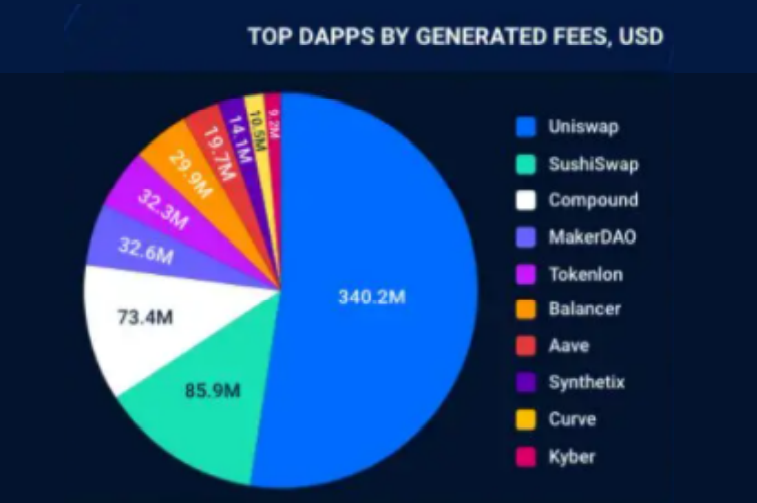

The top 10 DeFi dapps account for 87% of Ethereum's transaction volumes or $223 billion in 2020.

95% of transaction volume growth belongs to Ethereum DeFi dapps.

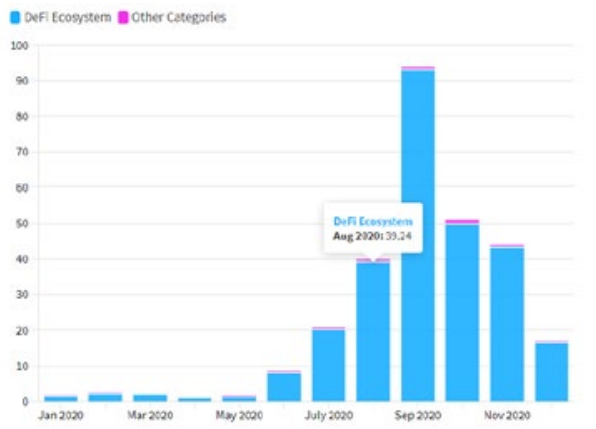

DeFi was the main driver of dapp growth in 2020 and has become the dominant sector in several metrics.

DeFi is really the highlight in terms of dapps.

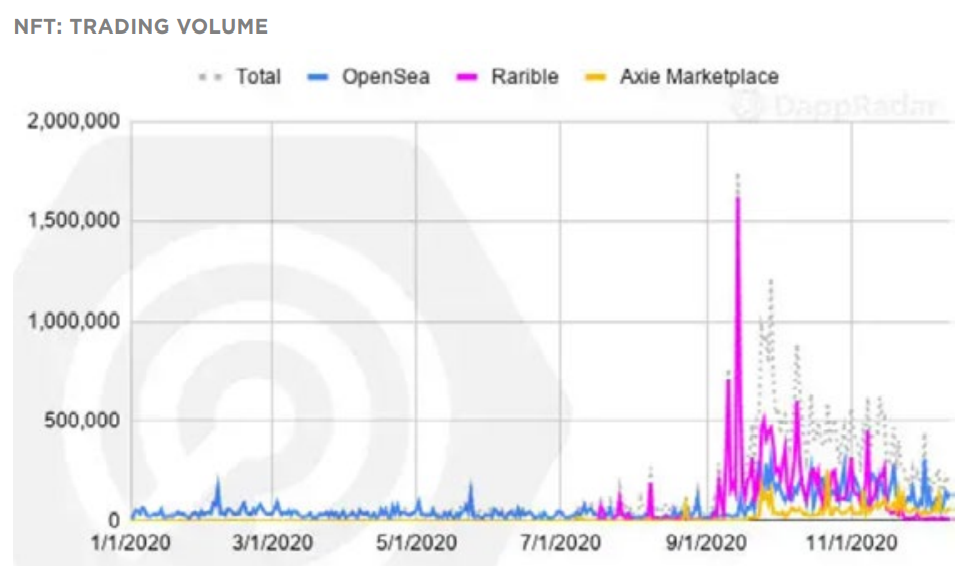

In addition to DeFi, another sector that has shown potential is NFTs, which saw a 57% increase in trading volume, pushing the industry to more than $ 100 million.

NFTs represent a true revolution for art and virtual interactions, linking the digital world to items from the physical world, where users can do everything from renting land and earning interest from other digital tenants to selling works without the need for intermediaries.

For many people, NFTs represent what DeFi represented in 2018-19: a great opportunity that has not yet been fully explored and even understood. An important subject to keep an eye on in 2021.

In October, the famous auction house Christie's sold the NFT “Block 21”, representing Satoshi's vision for $ 131,250 - more than 10 times the estimates of his sale value.

The auction included a physical work of art, but the main thrill was around the digital version.

This was the first blockchain-related artwork sold by the auction house.

Several non-fungible art and game tokens (NFTs) were launched in 2020, which offer different use cases, such as governance or utility.

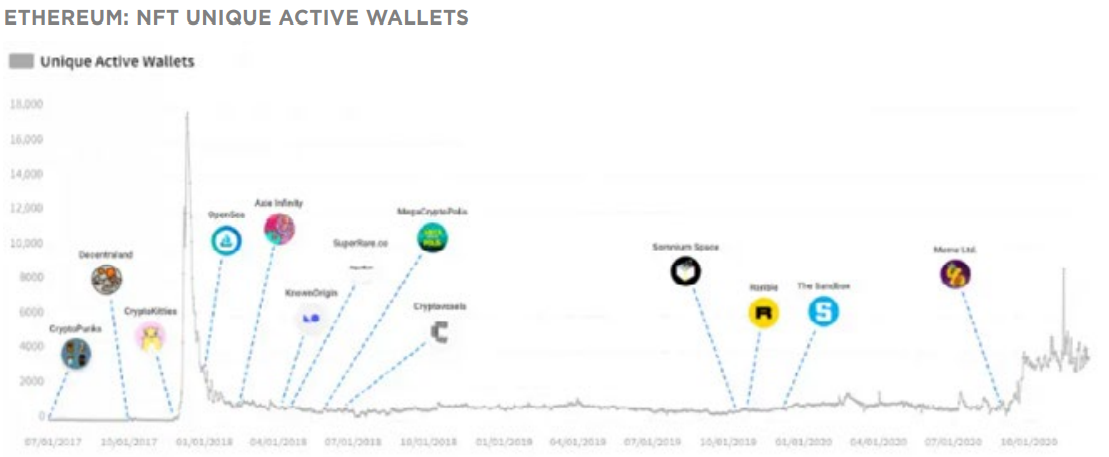

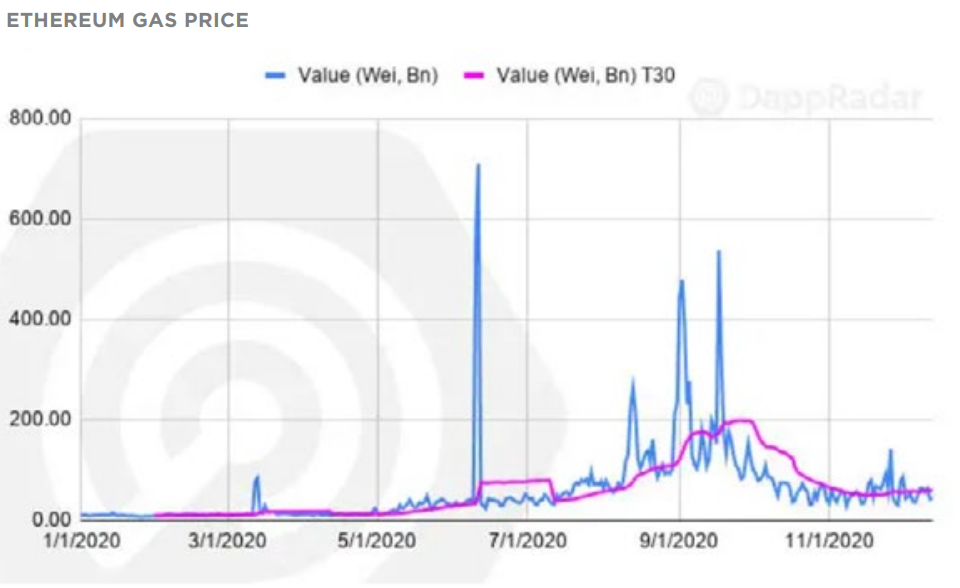

The category of game dapps on Ethereum is also growing, encountered barriers due to rising rates.

In early 2020, the gaming category was the largest in terms of active portfolios, reaching a peak of 10,000 portfolios. The increase in gas prices, due to the demand for DeFi, shrank the category to less than 1,000 active portfolios in August and has now been slowly recovering since then.

Game dapps users were not prepared to pay such a high fee for a normally simple, low-cost transfer.

Scalability is really one of the biggest challenges. The high demand brought consequences, such as moments of great increase in the price of Gas.

The Ethereum network has effectively reached a barrier in terms of scalability and the arrival of Ethereum 2.0 has become even more crucial, not only to guarantee its leadership position, but also its survival.

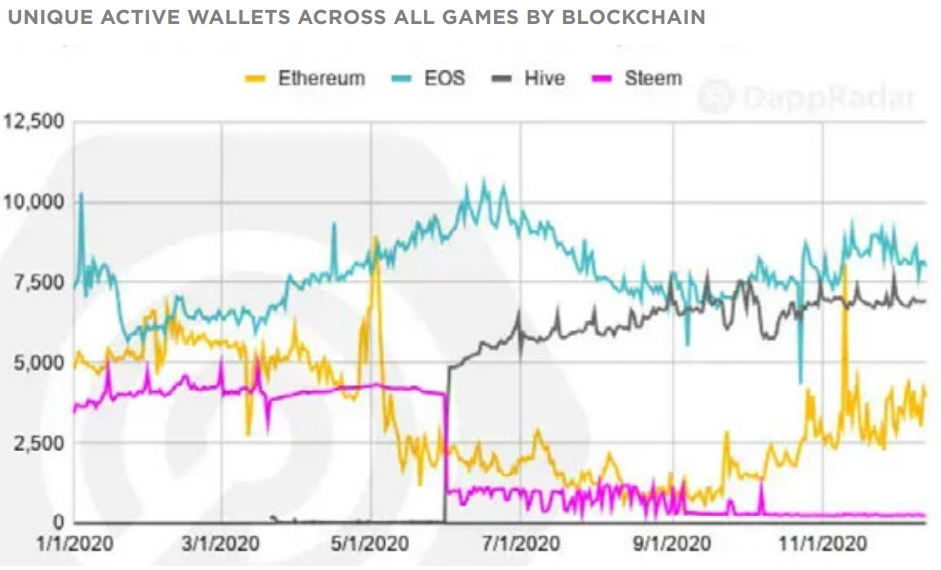

Other blockchains still do not have as much demand in their respective networks and for that reason they still do not face an increase in rates, which makes room for competition and makes the arrival of Ethereum 2.0 even more essential.

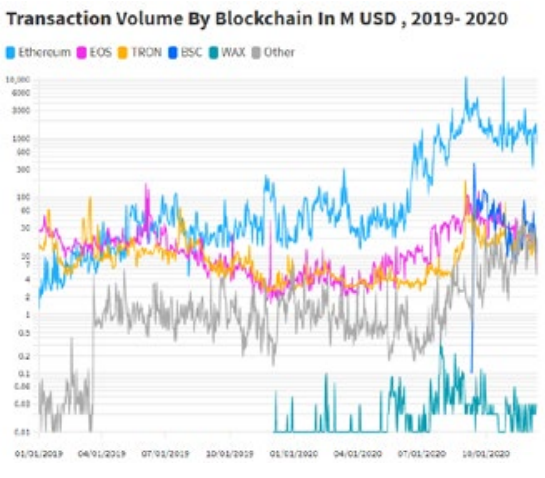

If in 2019 Ethereum's main competitors were EOS and TRON, other projects like Polkadot and Binance Smart Chain (BSC) are beginning to gain prominence.

It is also worth mentioning Cardano, Cosmos, Near and Flow. However, all with few active projects in their blockchains.

VULNERABILITIES:

In addition to scalability, another challenge to be overcome will be fragility in terms of security, which is normal, given the experimental and new environment of the blockchain.

In 2020, the DeFi ecosystem demonstrated some vulnerabilities, having suffered several hacks, exploits and bugs, especially in unaudited smart contracts, but even those audited had problems.

The total value of such events amounts to more than $ 120 million in 2020. This has made insurance products a more important topic in the space, which can make it a critical and necessary component to allow the DeFi sector to expand from healthy way.

Overall, 2020 proved to be an incredible year for blockchain applications. Ethereum remained in the lead and is expected to remain so with the advancement of Ethereum 2.0.

The future seems to reserve an increasingly innovative and competitive scenario for decentralized applications and those who know how to act and position themselves in this environment can witness a great change in terms of internet usability and profit from it.

For 2021, a lot of evolution is expected, as well as a greater role for regulators. In a year marked by the institutional adoption of Bitcoin, especially companies like MicroStrategy and Grayscale, it is inevitable that more regulators will enter this market.

This industry is growing rapidly and expectations are very good, with everything suggesting that the crypto world will continue with all vigor, innovating, experimenting and growing in adoption.

It will be very interesting to follow up to know where we are going from now on.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1351381671657021442