Bitcoin Analysis for 26/02/2021

Today, bitcoin's price had a minor recovery from yesterday; however, the market now shows signs it wants to drop further. In the past 24 hours, bitcoin dropped less than 1% and is currently trading around $49,200 according to CoinGecko.

We expect the price to reach a bottom during the weekend and next week for BTC/USD to go back above $50,000. A similar pattern to the prior drop from $40,000.

Still, we are quite hopeful about bitcoin's long-term price, especially with the exciting news recently. According to Mati Greenspan, in an interview for Forbes, the trader and CEO of Quantum Economics said that

"The main driver lately has been the rush from multinational corporations to diversify out of fiat money and into crypto—a trend that we see as just getting started now."

We couldn't agree more, and as we've been saying since 2021 started, institutional investors and corporations are joining the bitcoin race sign the price will most likely continue to overperform other assets, namely gold.

Still, in the short-term, expect the downwards trend to persist, perhaps until bitcoin goes near, or even below, its 20-day MMA, close to $40,000.

Adding to the above, notice how bitcoin's price almost touched the predicted range's top (blue) and then decreased significantly. A reason could be the declining volume and the fact that sellers are now in control of the market. Hence, we do not expect bitcoin's price to reverse the current downtrend, at least not until the weekend is over. We think there's still blood to be shed and longs to get liquidated.

In sum, even though BTC/USD remaining above $45,000 is a bullish sign, we think today or tomorrow the price will plummet towards $48,000. If it does not hold this level, then the next price point would be near its 20-day MMA, below $41,000.

As a reminder, we are confident that BTC/USD will reverse its downtrend soon and the long-term uptrend to resume right after. We remain bullish on BTC/USD as long as:

- BTC/USD remains above its 20-day MMA (red), 50-day MMA (green), and 200-day MMA

(blue). - BTC/USD doesn't drop below $45,000.

- BTC/USD daily volume goes above its 21-day Moving Average soon.

What Do Traders Think?

This week's first tweet comes from Ki Young Ju, CEO of Crypto Quant.

In his post, Ju shares a vital chart of the "Bitcoin: Coinbase Pro Outflow", and he adds a remarkable comment. Ju wrote that

"13k $BTC flowed out from Coinbase a few hours ago."

Essentially, as the analyst stated, this data point shows that a significant amount of bitcoin is currently being bought up below $50,000.

Despite the market turning bearish during the past week, institutional buyers keep accumulating bitcoin. Should investors and traders be following in their footsteps?

We think they should since we believe bitcoin's price will soon be over $60,000.

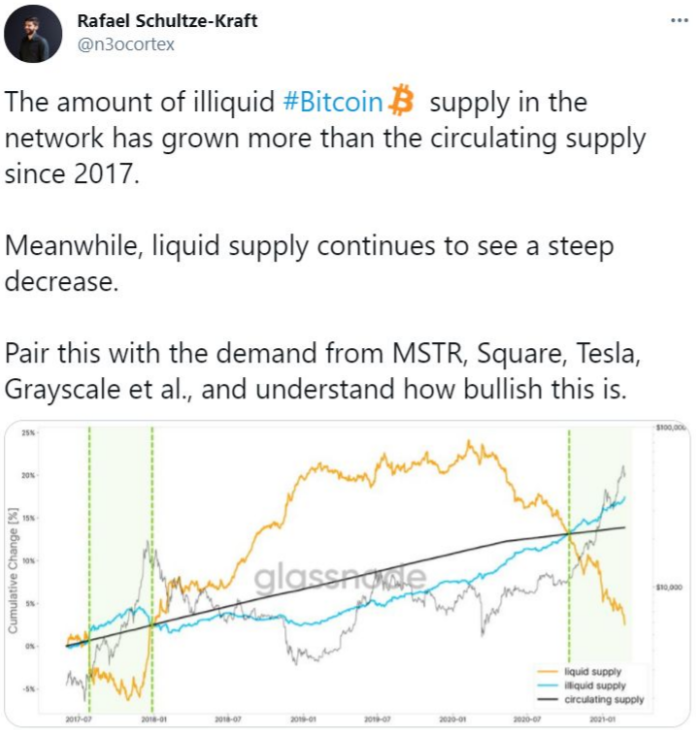

The next post comes from Rafael Schultze-Kraft, whose Twitter profile describes him as a data scientist, on-chain analyst, and CTO at Glassnode.

In his post, Schultze-Kraft shares a brilliant chart from Glassnode, containing the total bitcoin supply movement, split into three categories: liquid supply, illiquid supply, and circulating supply.

Additionally, the on-chain analyst wrote that

“The amount of illiquid #Bitcoin supply in the network has grown more than the circulating supply since 2017. Meanwhile, liquid supply continues to see a steep decrease.”

Essentially, the fact that the bitcoin market is witnessing a supply shock may be the most bullish reason for a speedy price recovery. This chart complements the previous tweet since it shows that institutional investors, corporations and wealthy individuals enter the space for the long-term, not to make a quick buck.

The above means that, as long as buyers hodl their coins, the likelihood those coins will get sold at the cheap is low.

Not only that, but according to the Law of Supply and Demand, the less bitcoin is available at the markets, the more likely it is the price to rise.

Precisely what most investors and traders hope for.

The next tweet comes from Su Zhu, co-founder, CEO, and CIO at Three Arrows Capital.

Zhu made an astute comment regarding the recent $1 billion purchase by MicroStrategy's

Michael Saylor CEO. Even though we just saw the bitcoin supply is highly illiquid, meaning that a significant number of coins are not available at the market, the fact of the matter is that

"Fact that Saylor is already filled and people couldn't even figure out if he was or not, on $1B, is incredibly bullish long-term."

As Zhu concludes,

"Means that for all bidders on the sidelines, the illiquidity arguments of old no

longer apply."

This is a thoughtful comment, and it does show that if a corporation can gobble up $1 billion without the market moving significantly and without people noticing, then this means that

"$BTC is now suitable for storing billions."

The future does look bright!

The last post of the week comes from Vijay Boyapati, a software engineer, analyst and author of the masterpiece, "The Bullish Case for Bitcoin."

In his tweet, Boyapati compares the price of bitcoin to gold's and concludes that for the total bitcoin market cap to reach the same level as gold, then the price of each bitcoin should hover around $500,000.

However, as he states,

"Bitcoin is superior to gold along with all the attributes that make for a good store of value".

We completely agree with his comment in the sense that bitcoin is much easier to store and to transport, plus it represents digital scarcity, something that the world had never seen until bitcoin's creation.

Boyapati makes a brilliant conclusion that

"500k should be viewed as a long term floor, not a long term ceiling."

We agree with the author, and we would like to add that if bitcoin's price continues to follow the current trajectory, we could most likely see a $1 million bitcoin before the end of the 2020s.

Let's discuss how we think bitcoin's price will trade tomorrow and throughout the weekend.

Bitcoin Price Prediction

Today, bitcoin's price did not move much, after dropping nearly 20% early in the week.

At its worst point, it went below $50,000, but it quickly recovered. At the time of this writing, BTC/USD was trading around $49,200.

For now, we don't see a price reversal on the horizon, and we think the drop will only get steeper.

We believe during the weekend, BTC/USD will fall further towards the 20-day MMA. Perhaps next week, we'll see a reversal of the downtrend.

How do we think the price will trade today and during the weekend? As shown in the above chart, we believe that bitcoin could top around $52,200 if new buyers enter the space. Still, that is highly unlikely. We think that short-sellers may continue to push down bitcoin's price.

On the other hand, we don't expect the cryptocurrency to drop much below $41,000 due to the sheer number of buy orders located around this price region. Also, we doubt bitcoin moves below its 20-day Modified Moving Average (MMA).

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $45,000 and $50,000, and then again at $41,000, which means BTC/USD should not go below $40,000, even if things go south.

As a reminder, we believe BTC/USD will most likely return to its uptrend in less than a week.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1365071454639976456