Bitcoin Analysis for 26/01/2021

During this past weekend, the price of bitcoin continued the previous week's downtrend.

However, since yesterday, BTC/USD has had a substantial recovery and grew over 6%, according to CoinGecko.

Since the massive drop that pulled the price of bitcoin towards its 20-day Exponential Moving Average (EMA), we noticed the market has benefited from the entrance of a high number of buyers. We expect the trend to continue throughout the week.

Today, the price of bitcoin has moved back above $32,000, according to CoinGecko, and was sitting at $32,315 at the time of this writing.

As we’ll discuss in the next section, most traders believe bitcoin is in a price consolidation zone; however, they expect bitcoin to have a significant move to the upside shortly, before the end of Q1 2021.

For now, we expect bitcoin to continue trading within the current consolidation range and BTC/USD to keep fluctuating around $32,000. The reason is due to the fact there are still many sellers before bitcoin breaks the critical $35,000 price range.

Once these sellers are exhausted, the missing ingredient, volatility, will come to play.

In an excellent piece by Matthew Di Salvo, Decrypt highlights how volatility will play a major role in the current bull cycle. In the article, Decrypt speaks with Pedro Febrero, an analyst at Quantum Economics:

“The more volatility the price has, the greater the magnitude of the change in the prices of bitcoin. During bull runs, this is to be expected.”

Essentially, as volatility rises, we expect prices to move accordingly.

To conclude our introduction, we think that the horde of new buyers now coming into the market will push the price of bitcoin much above its previous high of $42,000. We’re unsure about the time frame, but we doubt bitcoin will fail to surpass $50,000 by the end of March.

For now, we think BTC/USD might have a few extra bounces between $31,000 and $34,000 before starting to rally toward $40,000. Once the price breaks its previous high, we should see a rapid move toward $50,0000. Our analysis indicates the price of bitcoin will make a significant move closer to the month’s end or early February.

As a reminder, we are confident BTC/USD will continue to move upward if:

- BTC/USD remains above its 20-day EMA (red), 50-day EMA (green) and 200-day EMA

(blue). - BTC/USD doesn’t drop below $30,000.

- BTC/USD daily volume goes back above its 21-day Moving Average.

What Do Traders Think?

The first tweet of the day comes from Raoul Pal, a leading macro analyst and the co-founder & CEO of Real Vision.

In his post, Pal shares the yearly chart of the price of bitcoin. He adds two trendlines, one at the top showing resistance and one at the bottom showing support. Essentially, Pal highlights that BTC/USD is currently trading in a descending channel, but he expects the price action to turn bullish soon.

As he wrote:

“Positive seasonality and a nice wedge give it a good chance to hit $50k by March.”

We agree with Pal’s analysis, since we think the bull cycle is in its infancy. If bitcoin’s price history can teach us something, it is that price usually consolidates before significant swings occur.

Will a single bitcoin be worth $50,000 in March 2021? We’ll soon find out.

The next update builds on Pal’s post and comes from Byzantine General, whose Twitter profile describes him as a technician.

In his post, Byzantine General shares a chart of the price of bitcoin, adding that the current level, close to $35,000, could be a dealbreaker for a continuation of the bullish momentum.

As we have written repeatedly during the past few days, the price of bitcoin is finding significant resistance around $35,000, as there are many sell orders around this price level that are waiting to be filled.

The trader adds that the $35,000 price matched the yearly Time-Weighted Average Price TWAP, Point of Control (POC) and Point of Balance (POB). While the TWAP “is a well-known trading algorithm which is based on the weighted average price and is defined by time criterion,” the POC shows where “the most trading occurred” based in time, meaning that “It is the PRICE at which trading spent the most TIME at,” finally, the POB, “provides a summary of overall portfolio health.”

Essentially, because all the above indicators show the $35,000 price range to be a critical resistance point for BTC/USD, Byzantine General indicated that the digital currency could experience a significant sell-off near this price level.

So far, his analysis has proven to be correct, since bitcoin just broke its upward trend when it touched the $34,900 price range.

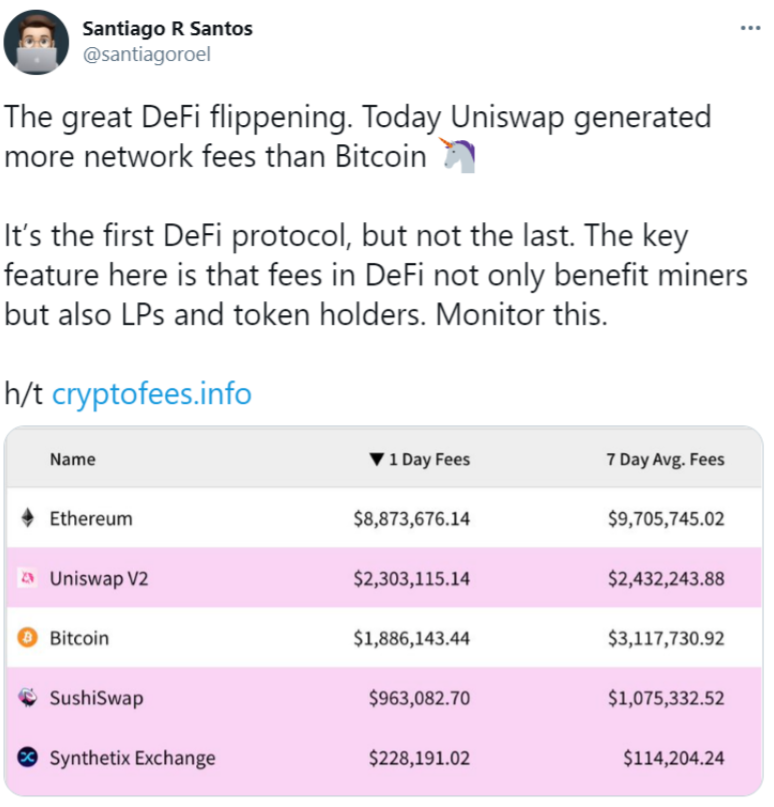

The third post of the day comes from Santiago R Santos, whose Twitter describes him as a partner at ParaFi Capital.

In his post, he shares an extremely relevant statistic about the profitability of the Bitcoin network compared to the Ethereum network.

Santos shares an image courtesy of Crypto Fees, a decentralized exchange built on top of the Ethereum protocol, showing how Ethereum and Uniswap have generated more dollar value in fees than Bitcoin in the past 24 hours.

This is fantastic news, since it proves the market is currently tilting toward Ethereum in terms of adoption. The reason seems to be related to DeFi, a series of protocols (like Uniswap) that help users exchange and store value, as well as access financial tools across the Ethereum ecosystem.

We are strong believers the trend will continue and that Ethereum will continue to accrue more value in fees than Bitcoin.

We also believe that the gap in the market capitalization of ether versus bitcoin could be shortened during the current bull cycle. However, we also think bitcoin will most likely lose less value once the bull run dries up.

In any case, as Santos wrote, the breakthrough of DeFi is that it will “not only benefit miners but also LPs and token holders. Monitor this.”

Therefore, it’s much easier for Ethereum to get adopted when more participants are rewarded for locking up value within the network; and for ether’s price to rise since the protocols and tools living within Ethereum require ether to function properly.

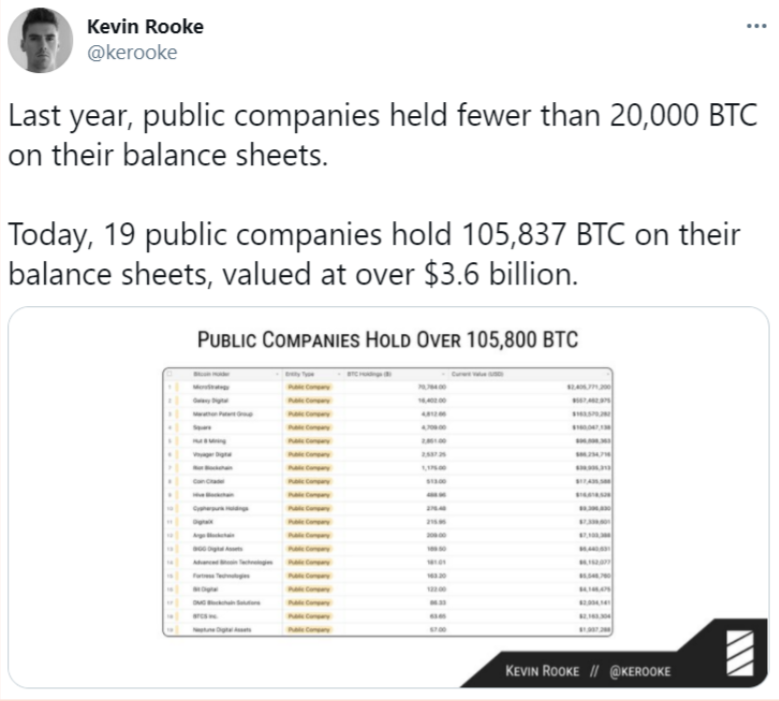

The last tweet of the day comes from Kevin Rooke, whose Twitter describes him as someone who posts about “technology, investing, and more.”

In his post, Rooke shares an image with the bitcoin holdings of 19 public companies, which illustrates how these organizations own more than 105,000 units of bitcoin.

Just like we have been discussing in previous editions of the Daily Roundup, the single greatest reason behind bitcoin’s recent gains is that buyers are purchasing significant amounts of the cryptocurrency.

Even more astonishing is the fact that year to date, this metric has jumped over 400%, as Rooke noted that “last year, public companies held fewer than 20,000 BTC on their balance sheets.”

The more institutions there are that enter the bitcoin space, the more likely the price is to climb.

Hence, this is fantastic news!

Bitcoin Price Prediction

During the past week, bitcoin experienced a pullback of more than 11%, according to CoinGecko.

Yesterday, the market started its recovery and the price of bitcoin jumped over 6%, trading above $32,0000 at the time of this writing.

Adding to that, the price traded within the predicted range, moving between $30,000 and $$37,000, and we also guessed there would be a reversal. At the time of writing, the price of bitcoin was $32,451.

Just like most traders discuss in the previous section, new buyers are entering the space, and the medium- to long-term prediction is that the price of bitcoin will start an epic move toward $50,000. In a short time, analysts urge investors and traders to look out for a possible continuation of the consolidation range.

The reason why most are so bullish on the price of bitcoin is that a significant number of institutional investors are entering the space. Hence, the more smart money buys bitcoin, the more buying pressure will be placed on the price.

Coming back to the topic at hand, how do we think the price will trade today? As shown in the above chart, we think that bitcoin could find a top close to $40,000, but we highly doubt BTC/USD comes close to reaching this target. There are still a high number of sellers until the price reaches this target.

On the other hand, we don’t expect the digital currency to drop much below $30,000 due to the sheer number of buy orders placed between $27,000 and $29,000.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $31,000 and $37,000, and then again between $27,000 and $29,000, which means BTC/USD should not go below $30,000, even if things deteriorate significantly.

As a reminder, we think it’s still possible that BTC/USD will attain a brand new record price around the $50,000 price range, either late this month or in early February. If the consolidation ensues, our prediction may extend to March, depending on the buying volume, volatility and macroeconomic factors.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1353859752502112258