Bitcoin Analysis for 25/01/2021

During this past week, the price of bitcoin dropped substantially. In the past seven days, BTC/USD fell north of 11%, according to CoinGecko.

On Friday, the price of bitcoin dropped below the 20-day EMA (red), but it soon recovered, given the significant number of orders around $30,000. Since then, BTC/USD seems to have stabilized between $31,000 and $33,000.

Today, the price of bitcoin has moved back above $31,000, according to CoinGecko, and was sitting at $31,871 at the time of this writing.

As we’ll discuss in the next section, most traders believe bitcoin is in a price consolidation zone.

Until buyers return in full force, it is unlikely we will see significant upside volatility.

Therefore, we expect bitcoin to continue trading within the current consolidation range and BTC/USD to keep fluctuating below $35,000.

As Charles Bovaird recently wrote in Forbes:

“Bitcoin has been consolidating lately, trading mostly between $30,000 and $40,000 after hitting a record high of nearly $42,000 earlier this month.”

The Forbes Senior Contributor spoke to several key players, and most spoke to the fact that bitcoin was consolidating near $30,000. However, some stated there was little chance that the price would drop much below this critical level due to the sheer number of buy orders around this price range.

To conclude our introduction, we think that before we see BTC/USD move above its record price of $42,200, we need to see sellers become exhausted. Hence, this price consolidation is an opportunity to acquire additional bitcoin on the cheap.

For now, we think BTC/USD might have a few extra bounces between $30,000 and $35,000 before starting to rally toward $40,000. Once the price breaks out of the consolidation zone, we should see a move toward $50,000. Our analysis indicates the price of bitcoin will make a significant move closer to the month’s end or early February.

As a reminder, we are confident BTC/USD will continue to move upward if:

- BTC/USD remains above its 20-day EMA (red), 50-day EMA (green) and 200-day EMA

(blue). - BTC/USD doesn’t drop below $30,000.

- BTC/USD daily volume goes back above its 21-day Moving Average.

What Do Traders Think?

The first tweet we would like to share comes from DonAlt, cryptocurrency trader with over 175,000 followers on Twitter.

DonAlt shares a chart of bitcoin, adding support levels in green at the bottom, and a critical resistance level at the top, near $39,000. When the chart was shared, the price of bitcoin was hovering between $31,000 and $33,000.

He shares his opinion on the short-term price action of BTC/USD. In his view, things are not looking spectacular.

As DonAlt wrote:

“I don't see a good reason to be too aggressively bullish as long as BTC is closing below the previous range low ($34000).”

We agree with DonAlt and expect the road to be quite bumpy until bitcoin comes out of the consolidation range and goes back above $40,000.

Will the price of bitcoin move in that direction? Let’s see if our friend Jack can elucidate the situation for us.

The next update builds on DonAlt’s post and comes from Bitcoin Jack, trader and market analyst.

Bitcoin Jack shares a two-hour chart of the price of bitcoin, drawing a trendline he thinks BTC/USD could follow. Essentially, the line shows how he thinks the price will move up in the next few months.

The trader draws a resistance trendline at the top and a support trendline at the bottom, and we notice how the price went below the descending channel.

He then writes:

“If we reclaim the diagonals, Feb looks glorious.”

We should underline how Bitcoin Jack adds a top around $60,000, where he thinks the next bull run will top before correcting. The question we’re wondering is if bitcoin finds support around $50,000, or if the number of sellers is too great, will the price crash again, falling more than 20%?

To add to the previous tweet, we would like to share this post by Josh Olszewicz, who describes himself as a “professional critical thinker” and has over 123,000 Twitter followers.

In his post, Olszewicz shares a two-day price chart of bitcoin. He adds a multicolor upward-facing channel where he thinks BTC/USD will trade.

Interestingly, he writes that bitcoin will reach $88,000 by July 2021. If the trader’s analysis is correct, bitcoin could rise to $100,000 over the summer, before correcting between 30% to 40% when it drops toward $60,000.

This means there is still a significant upside of more than 100%, in case the price of bitcoin behaves as Olszewicz predicted.

What could be the main driver for this extremely bullish price action?

The last tweet of the day comes from the legendary Max Keiser, whose Twitter profile describes him as a “Bitcoin Pioneer” and co-founder of Heisenberg Capital.

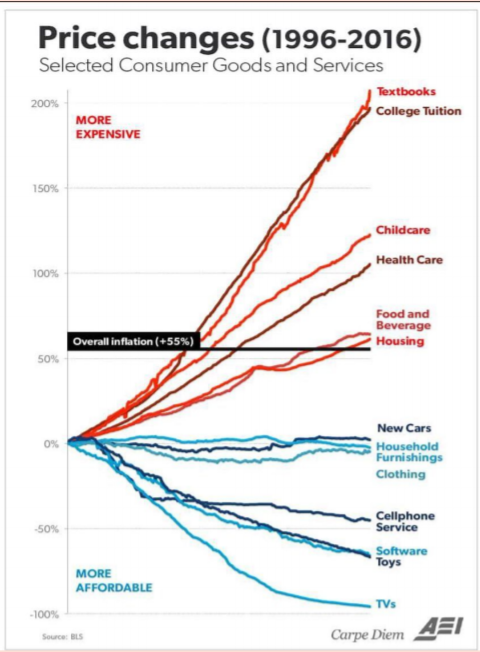

In his post, Keiser tries to answer our earlier question — what is the reason for bitcoin’s recent price appreciation? The trader considers massive inflation to be the most significant reason for price growth.

Pedro Febrero, an analyst at Quantum Economics, wrote an essay on the subject that supports Keiser’s thesis. Bitcoin, being a disinflationary currency, tackles the issue of inflation:

“inflation helps in creating imbalances between those who own financial assets and those who do not.”

Therefore, as long as the world reserve currency keeps losing purchasing power, there is little chance the price of bitcoin will lose value against the U.S. dollar.

As Keiser wrote:

“#Bitcoin up 200% a year for 10 years because inflation is rising 55% a year for 10 years.”

For now, let’s discuss how we think the price of bitcoin will move today and what we expect to happen during the week.

Bitcoin Price Prediction

During the past week, bitcoin had a significant fallback of more than 11%, according to CoinGecko. The downtrend started with a major sell-off last weekend that continued throughout the week.

Over the weekend, the price traded within the predicted price range, moving between $28,000 and $37,000. Adding to that, our educated guess that the price could touch the 20-day EMA and bounce back came to fruition as well.

At the time of writing, the price of bitcoin was above $31,900.

Even though we expected the price to start to recover soon, it seems sellers are taking their time, and buyers are still not ready to come back in full force. Interestingly, as discussed in the sections above, most traders think this price consolidation won’t continue much longer. The vast majority advocate for a speedy recovery above bitcoin’s past all-time highs.

Another important reason is the fact that we expect additional institutional players to join the bitcoin space. Forbes Contributor Billy Bambrough pointed out:

“Now, major bitcoin-buyer MicroStrategy MSTR +10.9%, led by bitcoin evangelist Michael Saylor, is gearing up to host a virtual ‘bitcoin corporate strategy’ summit in the first week of February—designed to help other companies copy MicroStrategy's bitcoin playbook.”

Therefore, if more smart money buys bitcoin, extra buying pressure could kick-start the next bull run cycle.

Coming back to the topic at hand, how do we think the price will trade today? As shown in the above chart, we think that bitcoin could find a top close to $37,500, but we highly doubt BTC/USD comes close to reaching this target. At the moment, sellers have been completely in control.

On the other hand, we don’t expect the digital currency to drop much below $29,000, due to the sheer number of buy orders placed between $27,000 and $29,000.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $31,000 and $37,000, and then again between $27,000 and $29,000, which means BTC/USD should not go below $30,000, even if things deteriorate significantly.

As a reminder, we think it’s still possible that BTC/USD will attain a brand new record price around the $50,000 price range, either late this month or in early February.

This might be the last chance to accumulate vast quantities of bitcoin before price makes a sudden move up.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1353491356572856322