Bitcoin Analysis for 23/02/2021

Today, bitcoin's price took a massive hit. In the past 24 hours, it lost north of 10% and is now trading around $53,100, according to CoinGecko.

There has been a reversal in the price trend, and we think it's here to stay, at least until the week's over.

For now, we expect a continuation of the downtrend, and our target for bitcoin finding a support zone is around $50,000. If this critical level does not hold, then we expect the cryptocurrency to move towards $45,000. In the worst-case scenario, around $41,000 there should be a massive support.

Selling volume grew around 30% since yesterday, and we think more sellers are currently on their way. Hence, do not expect bitcoin's price to resume its uptrend shortly. As we wrote above, it might take a while.

Nevertheless, while bitcoin remains above $50,000, we have every reason to be bullish about the short to medium-term price action. Even with the current price drop, we think the long-term uptrend is intact.

Therefore, we believe many buyers are eagerly awaiting to add to their bitcoin positions, pushing up the price back towards a new all-time high.

As a reminder, we are confident that BTC/USD will continue to move upward if:

- BTC/USD remains above its 20-day EMA (red), 50-day EMA (green), and 200-day EMA

(blue). - BTC/USD doesn't drop below $50,000.

- BTC/USD daily volume goes above its 21-day Moving Average soon.

What Do Traders Think?

This week’s first tweet comes from Rekt Capital, whose Twitter profile describes him as a cryptocurrency trader and analyst, as well as the author of the Rekt Capital Newsletter.

In his post, Rekt Capital highlights an essential point regarding today’s downturn. As he wrote:

“Not a Bear Market, just a healthy pullback”.

After bitcoin lost north of 15%, it soon recovered by about 8%. As Rekt Capital explains, these trend reversals are to be expected. Remember what happened once bitcoin broke its 2017 record price, around $20,000? It moved towards $39,000, and then it had a significant 16% retrace.

Essentially, we remain quite bullish on the long-term price action of bitcoin.

However, the road to $100,000 and above is long and painful, so we advise all investors and traders to pay close attention to these drops in order to add to their portfolios.

Using leverage may also come in handy, despite increasing one’s risk of losing.

The next post comes from Mati Greenspan, one of our favourite analysts, the founder of the cryptocurrency research firm Quantum Economics and a trader, investor, and licensed portfolio manager.

In his post, Greenspan shares a vital piece of information regarding the current chart pattern. As he wrote:

"That is one nasty hanging man."

Greenspan added a link to Investopedia that explains that

"The hanging man represents a potential reversal in an uptrend."

Essentially, Greenspan thinks there is a chance for a price reversal, which we feel may last a few days. Perhaps even up to a week or two.

Hence, we think it may be prudent to keep on adding to one's position as the price of bitcoin drops into key levels, such as $48,000.

The next tweet comes from the legendary macro analyst and futures trader, Peter Brandt, author and publisher of the Factor Report.

Brandt shares a daily chart of bitcoin in his post, and he added the 21-day MA (Moving Average).

The macro analyst highlighted some important key levels investors and traders should pay close attention to.

It seems that Brandt believes the price of bitcoin could go as low as $41,986; however, we do not think the likelihood it will drop by more than 20%.

Hence, we think the logical place to start adding to your position is below $50,000.

Nevertheless, we urge all investors and traders not to let this opportunity go away, as we do not expect the price of bitcoin to trade below this critical range for much longer.

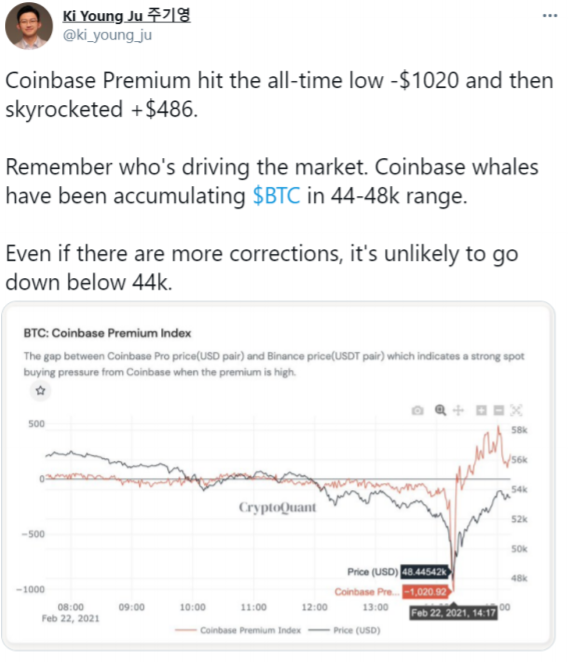

The last post of the week comes from Ki Young Ju, CEO of Crypto Quant.

In his post, Ju shares the "BTC: Coinbase Premium Index" chart, which shows how the price of bitcoin immediately jumped after touching the $48,000 level. Interestingly, Ju offers a solid reason for this behaviour in bitcoin's price.

As the on-chain analyst wrote:

"Coinbase whales have been accumulating $BTC in 44-48k range. Even if there are additional price corrections, it's unlikely to go down below 44k."

Essentially, Ju thinks the odds of the price dropping below $44,000 are slim, and we have to agree with him. In our opinion, there is little chance bitcoin drops over 20% from the most recent top.

Therefore, a significant retrace below $44,000 is highly unlikely, and we do not think the price of bitcoin will reach that price range, perhaps ever again.

If it does, we will most definitely take the opportunity to increase our bitcoin position significantly.

Bitcoin Price Prediction

Today, bitcoin's price dropped substantially. At its worst point, it went below $49,000 but it quickly recovered. At the time of this writing, BTC/USD was trading around $53,100.

Last week, we predicted bitcoin's price would break $50,000 by Sunday and find support above this critical range. That's precisely what happened. Yesterday, we wrote that we expected the price to keep moving upwards until it reached $60,000 before it suffered a significant correction.

Despite that, the correction came sooner rather than later.

However, we do not expect this sudden drop to keep going for much longer. We hope that by the end of the week, bitcoin's price returns to its uptrend.

How do we think the price will trade today? As shown in the above chart, we believe that bitcoin could top around $57,000 if new buyers enter the space. Still, that is highly unlikely. We think that short-sellers may continue to push down bitcoin's price, and it may reach a bottom around $50,000.

On the other hand, we don't expect the cryptocurrency to drop much below $48,000, due to the sheer number of buy orders located around this price region.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $45,000 and $50,000, and then again at $41,000, which means BTC/USD should not go below $40,000, even if things go south.

As a reminder, we believe BTC/USD will most likely return to its uptrend in less than a week's time.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1363981656164597761