Bitcoin Analysis for 22/02/2021

Bitcoin's price grew north of 10% during the weekend, continuing its uptrend, and moved above our predicted range, reaching a new all-time high close to $58,000, just like we predicted on Friday. At the time of this writing, BTC/USD was trading close to $57,500, according to CoinGecko.

Additionally, in the past week, BTC/USD has jumped close to 24%. What a remarkable price performance. Not only that, but the total bitcoin market cap has finally broken the $1 trillion barrier. According to Yahoo's Finance LaToya Harding,

"The market value of all Bitcoin (BTC-USD) in circulation hit $1trn (£710bn) for the first time ever on Friday night after the price of each individual coin surpassed $56,000, data website CoinMarketCap revealed."

In our opinion, while bitcoin remains above $55,000, we have every reason to be bullish on the short-term price action. Therefore, it is likely that BTC/USD will continue to move into higher price ranges before suffering a 20% to 30% correction.

In that regard, we hope the next correction comes once bitcoin breaks the $65,000 or $70,000 price range. As long as buying volume continues to reach the bitcoin market, there is little chance for a sudden reversal.

For now, we expect bitcoin to continue its upward trend and move above $60,000 by the end of the week, the latest. We remain bullish, as bitcoin has found support above $55,000, which is an excellent sign.

As a reminder, we are confident that BTC/USD will continue to move upward if:

- BTC/USD remains above its 20-day EMA (red), 50-day EMA (green), and 200-day EMA

(blue). - BTC/USD doesn't drop below $55,000.

- BTC/USD daily volume goes above its 21-day Moving Average soon.

What Do Traders Think?

This week’s first tweet comes from Michael Saylor, the founder, chairman, and CEO of

MicroStrategy.

In his post, Saylor makes a remarkable commentary on the future behaviour of bitcoin miners.

Essentially, MicroStrategy’s CEO asked an important question:

“What happens when all the publicly traded Bitcoin miners stop selling #bitcoin and start buying it to #hodl using publicly issued equity & debt to cover their expenses?”

As we wrote last week, according to Bitcoin.com,

“MicroStrategy revealed its plans to sell $600 million in convertible senior notes to qualified institutional buyers in order to use the funds for bitcoin.”

Saylor is pointing out that companies operating with bitcoin, especially those mining the cryptocurrency, could simply issue debt based on their bitcoin holdings to pay for business operations instead of selling bitcoin.

Saylor concluded that if this is the case, then the Bitcoin Stock-to-Flow model (S2FX) would go to infinity because far less bitcoin would be available at spot markets.

The S2FX model uses scarcity to quantify bitcoin value.

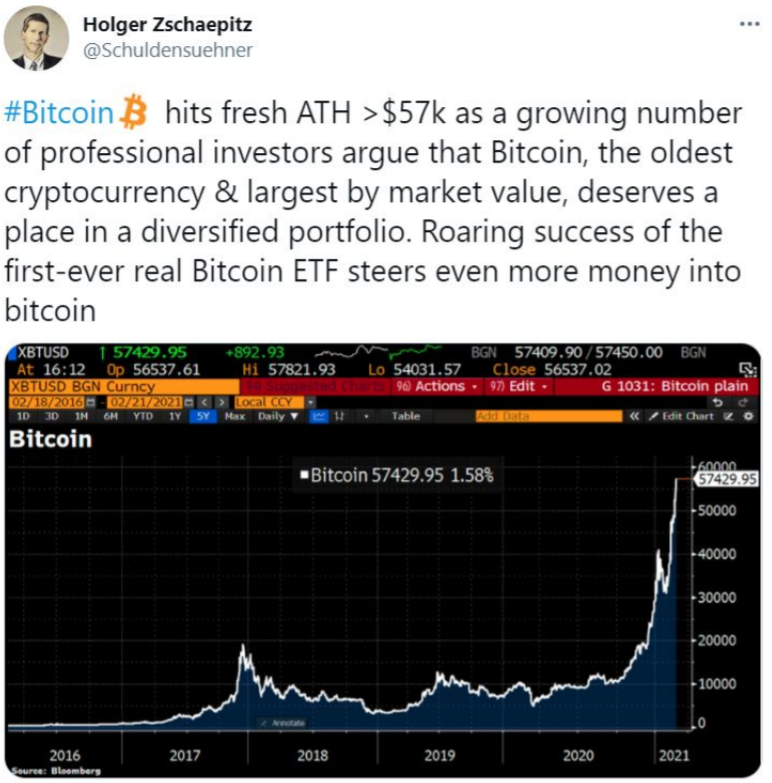

The next post comes from Holger Zschaepitz, whose Twitter profile describes him as the author of "Schulden ohne Sühne?" a book about how states rely too much on debt.

In his post, Zschaepitz highlights the main reason for the recent bullishness around bitcoin's price, that since the start of 2021 already grew close to 100%. Zschaepitz wrote that

"a growing number of professional investors argue that Bitcoin, the oldest cryptocurrency & largest by market value, deserves a place in a diversified portfolio."

Not only that, but the analyst shares a piece of news that is critical to bitcoin's adoption: institutions and wealthy individuals are betting heavily on bitcoin. According to the Financial Times,

"North America's first bitcoin exchange-traded fund attracted a jolt of trading volume as it made its debut on Thursday in Canada, marking the latest sign of the frenzy in cryptocurrencies. Close to 10m shares in the Purpose Investments bitcoin ETF changed hands on the first day of trading in Toronto, according to data from exchange operator TMX Group tracking the Canadian dollar version of the fund."

We agree with Zschaepitz analysis, and we would like to add that the more players adopt bitcoin, the more likely it is the price to continue rising.

The next tweet comes from Su Zhu, who is the CEO & CIO at Three Arrows Capital and a

cryptocurrency researcher and analyst.

Zhu made an interesting comment regarding the possibility of bitcoin entering what is known as a “supercycle”.

The above idea was originally proposed by Dan Held, who argued in this tweetstorm that > “This time is different: COVID, Gold 2.0 narrative, institutional herd, and ease of use have set a new stage. Instead of a normal bull/bear cycle, Bitcoin would break convention and enter a “Supercycle.”

What Zhu and Held refer to is the fact that bitcoin’s price may continue to rise versus fiat currencies and never suffer another significant bear market, at least during the next few years.

Zhu also highlights that a critical data point would be bitcoin flipping gold’s market

capitalization and never flipping back again.

We think this idea is quite entertaining, but we leave a severe warning to all investors and traders: it’s quite dangerous to believe that “this time is different” because, in most cases, it isn’t.

We think that there will most definitely be a bitcoin bear market soon after the price rises above $200,000. Of course, since we believe in probabilities, we would never argue traders should be under-exposed to bitcoin. This means that you may never get it back at such prices if you risk selling all your bitcoin.

The last post of the week comes from CryptoBirb, a well-known trader and Certified Technical Analyst.

In his post, CryptoBirb made a brief commentary that we think every investor and trader should always keep at the back of their minds. He wrote that

“You are the only person responsible for all your wins AND your losses”.

We believe this is an essential reminder for anyone who is betting on bitcoin (and altcoins), especially since sometimes we are tempted to put money into an asset because others are doing it.

As with everything else in life, we need to put our “big boys pants on” and assume the risk ourselves. If we win, great; it’s because we made the right call. However, if we lose, we should never try to blame other people for our own mistakes.

Bitcoin Price Prediction

Today, bitcoin's price continued its uptrend and broke a brand new all-time high, right above $57,900. At the time of this writing, it was trading above $57,500 according to CoinGecko.

Last week, we predicted bitcoin's price would break $60,000 by Sunday and find support above this critical range. We’re not there yet, but quite close to accomplishing this.

Additionally, we also guessed that BTC/USD would discover a new high before the week's end. We are now predicting a continuation of the bull run, with BTC/USD topping around $58,000.

It seems that buying orders continue to arrive; hence we do not expect a sudden reversal.

As long as institutions, corporations, and wealthy individuals keep accumulating bitcoin, there is no telling how high the price may go. In our opinion, it will only aggravate the supply shock we are witnessing. More, however, some analysts are even predicting a flipping between bitcoin and gold's market cap.

How do we think the price will trade today? As shown in the above chart, we believe that bitcoin could top around $64,000 if new buyers enter the space. However, it’s unlikely BTC/USD grows north of 10% in a day. We think that short-sellers may push down bitcoin's price once it goes above this critical level; hence a correction towards $55,000 is not out of the woods just yet.

On the other hand, we don't expect the cryptocurrency to drop much below $51,000 even if there is a significant sell-off. In the worst-case scenario, we see bitcoin finding support around $50,000 and then quickly moving back above $55,000.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $45,000 and $50,000, and then again at $41,000, which means BTC/USD should not go below $40,000, even if things go south.

As a reminder, we believe BTC/USD will most likely break $60,000 soon.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1363620180417478658