Bitcoin Analysis for 17/02/2021

Today, bitcoin's price reached a brand new all time-high when it traded above $50,200, according to CoinGecko. Congratulations to all investors and traders who held during these past few weeks.

The cryptocurrency pushed back above $50,000, after experiencing a dip yesterday.

Additionally, in the past 24 hours, BTC/USD has not moved much.

So far, we have every reason to remain bullish on the short-term price action for bitcoin, especially since BTC/USD held above $48,000.

Adding to the above, our prediction that BTC/USD would meet a new high, came to fruition. We expect the price to fill in the rest of the predicted range (blue), until the end of the week.

In our view, the reason behind this bullish season remains linked to the number of institutional players and large corporations that continue to join the bitcoin and altcoin space. Just today, MicroStrategy, the software company that has already accumulated billions of dollars in bitcoin, released an extremely bullish announcement. According to BusinessInsider’s Matthew Fox, MicroStrategy " plans to raise an additional $600 million from convertible senior notes, of which all the proceeds will be used to buy more bitcoin."

How can the price of bitcoin drop, when demand stays this high? We don’t think it will.

For now, we expect bitcoin to continue its uptrend and move above $50,000 by the end of the week. We remain bullish as bitcoin has found support above $48,000, which is an excellent sign.

As a reminder, we are confident that BTC/USD will continue to move upward if:

- BTC/USD remains above its 20-day EMA (red), 50-day EMA (green), and 200-day EMA

(blue). - BTC/USD doesn't drop below $48,000.

- BTC/USD daily volume goes above its 21-day Moving Average soon.

What Do Traders Think?

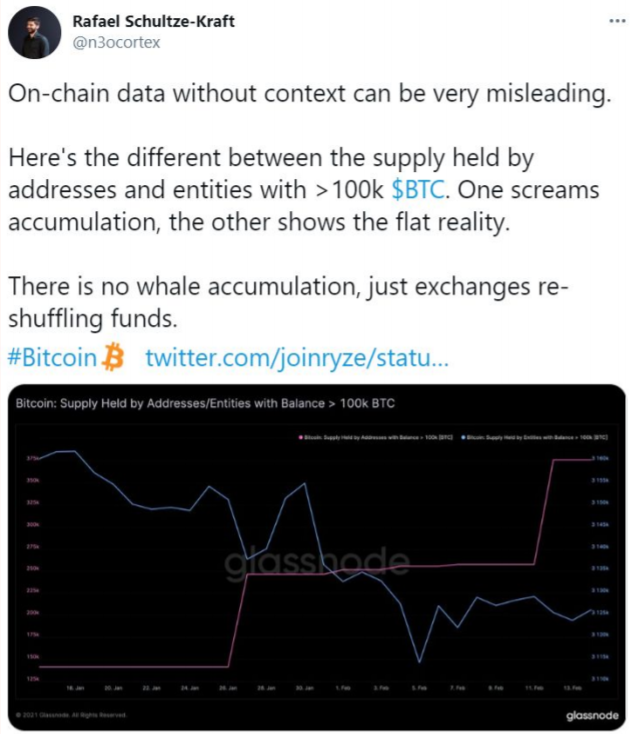

Today's first tweet comes from Rafael Schultze-Kraft, whose Twitter profile describes him as a data scientist, on-chain analyst, and CTO at Glassnode.

Schultze-Kraft shares a chart of the "Bitcoin: Supply Held by Addresses / Entities with Balance > 100k BTC". As the analyst explains, the chart contains the movements of addresses that own over 100,000 bitcoin and highlights, "There is no whale accumulation, just exchanges re-shuffling funds."

Essentially, Schultze-Kraft argues that there is no real accumulation by whales, since the number of entities holding over 100,000 bitcoin is decreasing, even though the number of addresses holding the same amount is increasing.

We think Schultze-Kraft's analysis could be accurate, but investors and traders should remember there's a clear indication that wealthy individuals and corporations are moving a significant amount of cash into bitcoin.

Hence, this could mean whales are accumulating at exchanges.

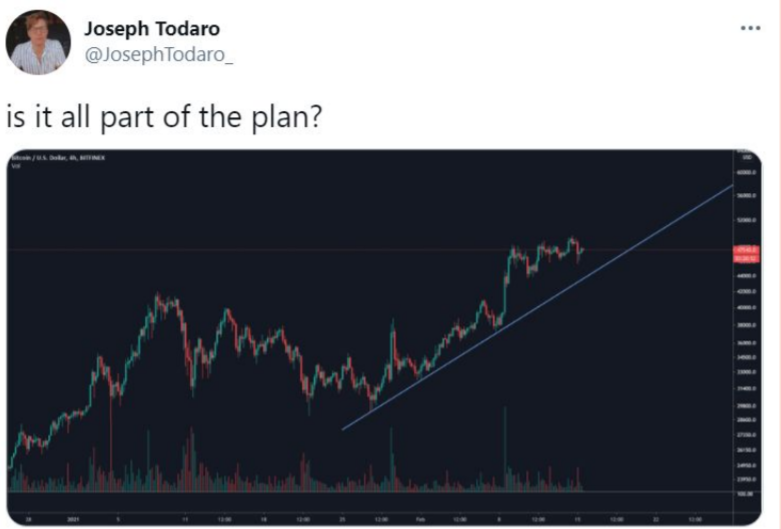

The next post comes from Joseph Todaro, Partner at Greymatter Capital.

In his tweet, Todaro shares the 4-hour chart of the price of bitcoin. He also draws a support line from the most recent bottom, which was just below $30,000.

What the current price trend shows is that bitcoin remains in a bull run, and until the trend reverses, we expect the price to push even higher.

As we wrote above, bitcoin already broke the critical level at $50,000. Therefore, we expect BTC/USD to continue to move above this crucial price range.

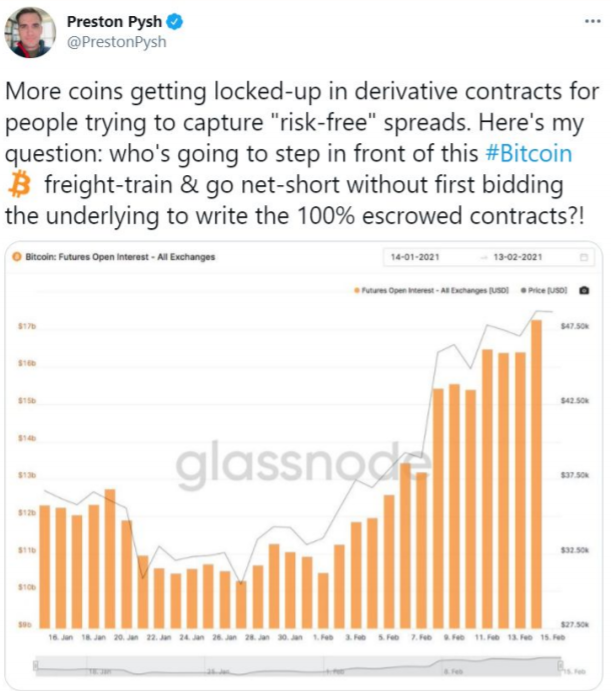

The next tweet comes from Preston Pysh, co-founder of The Investor's Podcast Network.

Pysh shares the "Bitcoin: Futures Open Interest - All Exchanges" chart in his post, which looks bullish. Since the first day of the month, the number of open contracts has increased 54%, from less than $11 billion to a whopping $17 billion.

As Pysh wrote,

"who's going to step in front of this #Bitcoin freight-train & go net-short without first bidding the underlying to write the 100% escrowed contracts?!"

According to Investopedia, open interest can be quite useful for gauging the interest of the market in a particular asset:

"The total open interest does not count, and total every buy and sell contract. Instead, open interest provides a more accurate picture of the options trading activity, and whether money flows into the futures and options market are increasing or decreasing."

We agree entirely with Pysh's analysis, and we also think there is a little chance the price of bitcoin drops much below $48,000. If it does, then we will take the

opportunity to accumulate more.

The last post of the day comes from Bitcoin Jack, a trader and market analyst.

In his post, Bitcoin Jack shares two charts that are commonly known among investors and traders, showing the behaviour of price during a full market cycle and the emotions surrounding the price-action.

Interestingly, Bitcoin Jack also adds a timeline at the bottom of both charts, and he overlays the price of bitcoin. The data points out that the market reaches a new top somewhere between April and June 2021.

We think the overlay of the price on both charts is quite magnificent, and we also believe that a new cycle top for bitcoin’s price in the early summer, is entirely possible.

Investors and traders should not forget the bull market began after the drop in March 2020.

Hence, a new top could be just around the corner!

Bitcoin Price Prediction

Today, bitcoin's price picked up the pace and reached a brand new record price, at $50,200.

In the past 24 hours, bitcoin stalled. At the time of this writing, it was trading close to $48,400 according to CoinGecko.

Last week, we predicted BTC/USD would go above $50,000 and find support above this critical range, soon. Additionally, we guessed that BTC/USD would discover a new high before the week's end. Yesterday, we wrote we expected bitcoin's price to move back above $48,000 and perhaps find a new all-time high. That's precisely what happened.

We're quite bullish on bitcoin's short-term price, and we expect the cryptocurrency to break its previous record in a few days. By the end of the week, it should be trading around $60,000. As long as institutions, corporations and wealthy individuals keep accumulating bitcoin, there is no telling how high the price may go. We're currently witnessing a real supply chock.

Additionally, once price discovery kicks-in, the road for massive daily gains opens up again.

Hence, how do we think the price will trade today? As shown in the above chart, we believe that bitcoin could top around $55,000 if new buyers enter the space. Toward the end of the week, BTC/USD may break the $60,000 range.

On the other hand, we don't expect the cryptocurrency to drop much below $46,000 even if there is a minor selloff. In the worst-case scenario, we see bitcoin finding support around $45,000, and then quickly moving back above $50,000. However, this scenario is improbable. We think BTC/USD will hold the critical support level at $48,000.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $48,000 and $46,000, and then again around $40,000, which means BTC/USD should not go much below $45,000, even if bitcoin's price trend reverses for a short period.

As a reminder, we believe BTC/USD will most likely break $55,000 soon.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1361810055209828352

Nice analysis mate

Posted Using LeoFinance Beta

Thanks a lot

Posted Using LeoFinance Beta