Bitcoin Analysis for 16/02/2021

Today, bitcoin's price dropped below $47,000, but a horde of new buyers came to the rescue and pushed back BTC/USD above this critical price range.

This minor dip was to be expected, considering bitcoin had just broken a new all-time high very close to $50,000 on Sunday, according to CoinGecko. Additionally, in the past 24 hours, BTC/USD retraced less than 1%.

Even though bitcoin's price moved downwards, our prediction was spot on as BTC/USD traded within the blue range and almost touched the predicted bottom. We think today will be a good day for bitcoin's price, as we expect the bull-run to ensue.

In our view, the reason behind this bullish season remains linked to the sheer number of institutional players and large corporations that continue to join the bitcoin and altcoin space.

According to Aljazeera's Lynn Thomasson and Joanna Ossinger:

"There are hints that more Wall Street heavyweights could dip into the crypto market. In an interview with CNBC, JPMorgan Chase & Co."

If central investment banks and other financial institutions join the bitcoin market, we think the next cycle top could be a much higher price-point, that what we previously considered.

For now, we expect bitcoin to continue its uptrend and move above $50,000 by the end of the week. We remain bullish as bitcoin has found support above $45,000, which is an excellent sign.

As a reminder, we are confident that BTC/USD will continue to move upward if:

- BTC/USD remains above its 20-day EMA (red), 50-day EMA (green), and 200-day EMA

(blue). - BTC/USD doesn't drop below $45,000.

- BTC/USD daily volume goes above its 21-day Moving Average soon.

What Do Traders Think?

Today's first tweet comes from Saifedean Ammous (Saifedean.com), author of "The Bitcoin Standard."

In his post, Saifedean highlights how the current environment is incredibly bullish for the price of bitcoin. Not only is the cryptocurrency near $50,000 and its market cap close to $1 trillion, but also institutions are joining the bitcoin space in full force.

Saifedean explains that

"By now almost everyone has heard of bitcoin at a much lower price & seen it rise a lot. Anybody who hasn't gotten in by now isn't an early adopter".

We agree with Saifedean's analysis, and we would like to add that we're extremely bullish on the short-term price of bitcoin. We also think that due to the arrival of institutions and corporations, such as MicroStrategy and PayPal, there is a little chance bitcoin's price won't skyrocket throughout the year.

As long as buyers continue to pour billions of dollars into the bitcoin market, we see absolutely no reason for the reverse price trend.

Let's dig deeper.

The next post builds on what Saifedean wrote, and comes from CryptoBull, a bitcoin trader with nearly 173,000 followers on Twitter.

In his tweet, CryptoBull makes a remarkable claim that we fully support. He wrote that

"$50k - $200k is when people think they've missed out and don't buy".

His analysis takes us back to September 2017, when bitcoin's price was picking up the pace and reached a new high close to $5,000. During that time, many retail investors thought they had missed the boat. Once bitcoin's price corrected, many buy orders came in and pushed the price up towards $7,000, in November 2017.

Once bitcoin broke the $10,000 price level, retail FOMO kicked-in in late November, and it took less than 30 days for bitcoin to reach its cycle top, around $20,000.

As traders usually say, "history does not repeat, but it rhymes". Hence, we think CryptoBull is correct in his analysis since we believe that once the price of bitcoin breaks $100,000, a large number of new buyers, most likely retail and wealthy individuals, will flock into the market.

The next tweet comes from Coiner-Yadox, whose Twitter profile describes him as a

cryptocurrency on-chain analyst with a background in energy engineering.

Coiner-Yadox shares a simple but effective strategy traders can follow in his post, to navigate the market appropriately.

Essentially, as the analyst highlights “Just buy when 4hr RSI < 30 and sell when 4hr RSI > 80”. According to Investopedia, the Relative Strength Index, or RSI, can be quite useful to find price targets to buy and sell bitcoin:

“Traditional interpretation and usage of the RSI are that values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price. An RSI reading of 30 or below indicates an oversold or undervalued condition.”

Therefore, we agree with Coiner-Yadox’s proposed strategy. We also think using simple

indicators typically brings the highest yield for investors and traders.

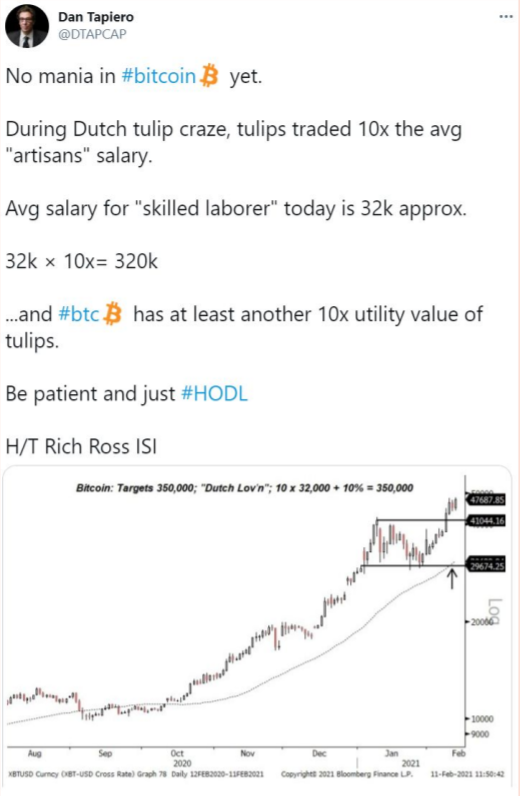

The last post of the day comes from Dan Tapiero, both a legendary global macro investor with over 25 years of experience and the founder of DTAP Capital.

In his post, Tapiero shared a brilliant analysis explaining why bitcoin's price is nowhere near its next cycle top.

Tapiero compares the current growth in bitcoin's price, with the Dutch tulip bubble during the 1600s. He wrote that "During Dutch tulip craze, tulips traded 10x the avg "artisans" salary. Avg salary for "skilled" labourer today is 32k approx. 32k × 10x= 320k”.

Essentially, the macro investor highlights how, during the Dutch tulip bubble, the price of tulips was worth ten times what a skilled labourer would get paid. If we extrapolate to today, that means bitcoin's price could reach $320,000, as the average salary for skilled labour is around $32,000.

Tapiero concludes with a hilarious remark that

"#btc has at least another 10x utility value of tulips."

Could bitcoin's price reach such high valuations? We think it might, depending on the amount of retail FOMO (Fear Of Missing Out) and such an event's duration.

Bitcoin Price Prediction

Today, bitcoin's price had a minor selloff, after reaching a brand new high close to $50,000, on Sunday.

In the past 24 hours, bitcoin declined less than 1%. At the time of this writing, it was trading close to $48,600, according to CoinGecko.

Last week we predicted BTC/USD to go near $50,000 and find support around this critical range.

Additionally, we guessed that BTC/USD would discover a new high before the week's end.

Yesterday we wrote that there could be a minor consolidation and that the price could decline towards $48,000. We couldn't be more accurate than that.

Due to the growing number of wealthy individuals and institutions accumulating bitcoin, we continue to be extremely bullish on its price.

Hence, how do we think the price will trade today? As shown in the above chart, we believe that bitcoin could top around $50,000 if new buyers enter the space. Towards the end of the week, BTC/USD may break the $55,000 price range.

On the other hand, we don't expect the cryptocurrency to drop much below $45,000, even if there is a minor selloff. In the worst-case scenario, we see bitcoin finding support around $45,000, and then quickly moving back above $48,000. However, this scenario is improbable.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $48,000 and $46,000, and then again around $40,000, which means BTC/USD should not go much below $45,000, even if bitcoin's price trend reverses for a short period.

As a reminder, we believe BTC/USD will attain a brand-new record price before the end of the week and that the price of bitcoin will most likely break $50,000 soon.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1361446573146841092