Bitcoin Analysis for 12/04/2021

During the weekend, bitcoin's price regained some of the previous week's losses.

Bitcoin rallied around 3% in the past two days and is currently trading back above $59,900, according to CoinGecko, a critical resistance level now turned into support.

Adding to the above, BTC/USD broke the predicted range to the upside. Buying volume has increased, which points to a continuation of the uptrend, most likely toward its prior all-time high, close to $62,000.

We thought bitcoin's price would continue to dip towards the 21-day Modified Moving Average (red), close to $54,000, but fortunately, the trend reversed.

Our reason came from the fact that every time bitcoin dipped below the 21-day Simple Moving Average (light blue), it moved toward the 21-day MMA before changing direction and starting a new rally. It does seem this time it was different. However, BTC/USD is now back above the 21-day SMA, an excellent sign.

Looking at the Volume Profile Visible Range (VPVR) on the left of the chart, it shows BTC/USD is near the end of the high-order volume price range, which it's currently stuck on. Once it moves closer to its prior all-time high, bitcoin's price should enjoy sudden swings as volatility rises.

In terms of news, Forbes' Billy Brambrough questions whether it wasn't Elon Musk's tweet the cause for the recent bitcoin's price uprise. He wrote,

"The precise cause of the early Saturday morning bitcoin price surge was not immediately clear; however, a cryptic tweet from Tesla TSLA -1% billionaire and bitcoin-buyer Elon Musk has spurred the $2 trillion cryptocurrency market higher."

To conclude, we think BTC/USD will soon break its record price, perhaps in a couple of days. However, we remain bullish on BTC/USD while:

- BTC/USD remains above its 21-day SMA.

- BTC/USD doesn't move below $58,000.

- Buying volume goes above its 21-day SMA.

What Do Traders Think?

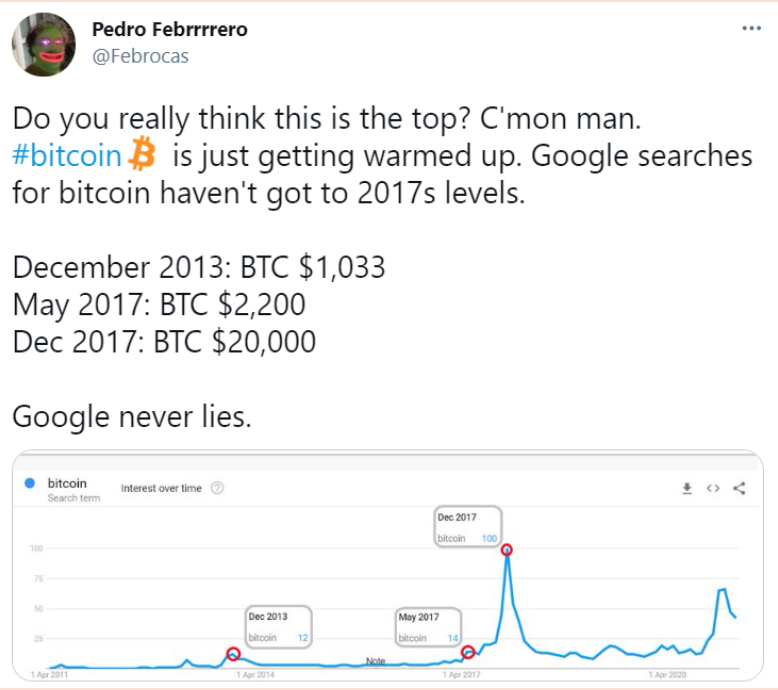

Today's first tweetstorm comes from Pedro Febrero, Head of Blockchain at RealFevr and

Researcher at Quantum Economics.

Febrero shared a chart of Google Trends search term for "bitcoin" since 2011. The analyst highlights the interest over time in December 2013, May 2017 and December 2017 and points out that:

"Google searches for bitcoin haven't got to 2017s levels."

Bitcoin only reached 2013s interest levels during the 2017 bull run, once bitcoin's price doubled its prior all-time high. Febrero identifies the price ranges:

“December 2013: BTC $1,033

May 2017: BTC $2,200

Dec 2017: BTC $20,000”

The analyst concludes that "#bitcoin is just getting warmed up." meaning that its price should have much upside room to grow. The reason is that, at the time of the Tweet, interest over time in bitcoin hadn't reached the 2017 peak, remaining below 50%.

Hence, the buying frenzy should start once google searches for "bitcoin" skyrockets past its prior all-time high.

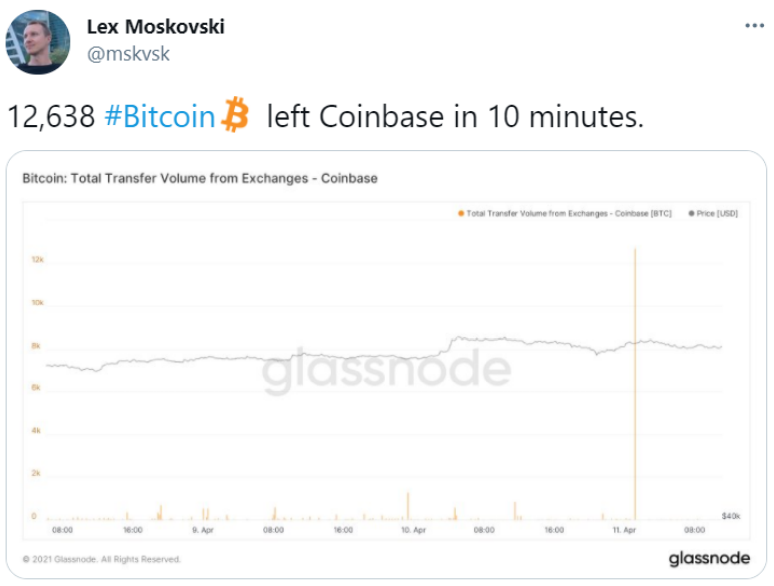

The following post comes from Lex Moskovski, whose Twitter profile describes him as the CIO of Moskovski Capital.

In the post, Moskovski shares the “Bitcoin: Total Transfer Volume from Exchanges - Coinbase” that shows the total number of bitcoin leaving Coinbase.

As Moskovski highlights in the Tweet,

“12,638 #Bitcoin left Coinbase in 10 minutes.”

, which at the current price is over the hefty sum of $745 million.

We think this metric shows the ongoing bitcoin supply shock. The less bitcoin available at exchanges, the more likely is the price of each unit to rise since there’s less supply available.

The following tweet comes from AngeloBTC, a legendary semi-retired trader in the

cryptocurrency space with more than 208,000 Twitter followers.

AngeloBTC shared the bitcoin’s price chart and wrote,

“$BTC short squeeze to $70k has been programmed.”

Essentially, the trader is highly bullish on bitcoin’s short-term price action and thinks that it will soon surpass $70,000. Hence, BTC/USD could grow over 15% shortly if Angelo’s prediction comes to fruition.

We notice that buying volume is slowly picking up, a sign that buyers have returned to the market.

The last post of the day comes from Naval, an early Bitcoin investor and philosopher with one million Twitter followers. His website is Nav.al.

In this post, he wrote a brilliant, razor-sharp message that “Buying Bitcoin is more voting than investing.” which we think means that bitcoin investors are not only making an investment decision when they buy bitcoin, but they’re also casting a vote in an alternative currency system that could, one day, potentially be a contender to fiat currencies, namely the U.S. dollar.

Therefore, we think Naval means bitcoin is both an investment vehicle and a statement against a state-controlled monetary system.

Bitcoin Price Prediction

At the time of this writing, bitcoin is trading close to $60,000, according to CoinGecko. Since yesterday, BTC/USD has remained mostly flat but has increased by over 2% in the past two days.

As we wrote in the introduction, we'll remain bullish on bitcoin's short-term price action while it trades above its 21-day SMA, and buying volume remains strong. We think bitcoin’s new all-time high is near.

How do we think the price will trade today and through the rest of the week? As shown in the above chart, we believe that bitcoin could approach $62,000 in the next few days, as long as buyers return to the bitcoin space. There'sThere's a chance the digital currency breaks this level by the end of the week, but buying volume would need to grow substantially for this to happen.

On the other hand, we don't expect the cryptocurrency to drop much below $58,000. If it fails to hold this level, then we think a drop toward $54,000 near the 21-day MMA could occur. However, we should note that this is highly unlikely.

To finalize, the VPVR shows a high number of buy orders between $46,500 and $50,000.

It also indicates that there are almost no sellers left above $62,000.

Hence, once BTC/USD breaks away from this price range, it should pick up the pace and reach $68,000 in no time.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1381383153034596354