Bitcoin Analysis for 12/02/2021

Today, bitcoin's price enjoyed a significant spike. Since yesterday, it grew over 6%, and at the time of this writing was trading around $47,261, according to CoinGecko. A new record price seems imminent.

Additionally, just like we predicted yesterday, BTC/USD moved above $45,000, even though yesterday it corrected below this critical price range.

In our view, the reason behind this bullish season is because more institutional players and large corporations continue to join the space.

To add to the above, we would like to congratulate all bitcoin holders since bitcoin broke a new all-time high in U.S. dollar terms. As Charles Bovaird, Senior Contributor at Forbes wrote:

"Bitcoin has been flying high today, surpassing $48,000 this morning and soaring to its latest record price. The digital currency reached as much as $48,316.82 at roughly 11 a.m. EST, according to CoinDesk data. At this point, the cryptocurrency was up approximately 67% in 2021, additional CoinDesk figures reveal."

Adding to the above, many of the analysts Bovaird spoke to in his excellent article are of the opinion bitcoin won't suffer a pullback until it goes above $50,000.

In sum, as positive news continues to be released, and more institutions join the bitcoin space, the odds that BTC/USD will continue to appreciate are high.

For now, we expect bitcoin to continue its uptrend and move above $50,000 by the end of the day (EOD). Besides what we wrote above, the main reason for our bullishness relates to the fact that bitcoin has now found support above $45,000, an excellent sign.

As a reminder, we are confident that BTC/USD will continue to move upward if:

- BTC/USD remains above its 20-day EMA (red), 50-day EMA (green) and 200-day EMA

(blue). - BTC/USD doesn't drop below $45,000.

- BTC/USD daily volume remains above its 21-day Moving Average.

What Do Traders Think?

Today's first tweet comes from NebraskanGooner, whose Twitter profile describes him as the founder at LVL and a co-owner of Elevate Trading.

In his post, NebraskanGooner shares a relevant chart of bitcoin's price, and he notes the behavior of the current price trajectory,

“Textbook parabolic move up with 4 bases and price doubling very quickly after base 3."

The trader highlights how BTC/USD was following the "Parabolic Curve Step-Like Formation."

According to Newtraderu

"Many times you will see stocks going up like this near the beginning or end of a bull market advance. This pattern creates short term price range bases before breaking out to new highs and repeating this range pattern multiple times as it keeps going higher."

NebraskaGooner concludes by saying that this pattern may be relevant, and the price of bitcoin may experience a significant dip unless it breaks above the "1.337 fib," or above the 1.337 Fibonacci Retracement level.

According to Investopedia, the Fibonacci Retracement indicator is handy

"because it can be drawn between any two significant price points, such as a high and a low. The indicator will then create the levels between those two points."

Our only disagreement with NebraskanGooner is that we think the price of bitcoin will continue to move upwards, and won't experience a significant reversal until it finally breaks above $50,000.

The next post comes from Pomp (Anthony Pompliano), co-founder of Morgan Creek Digital and author of The Pomp Letter.

In his tweet, Pomp highlights how BNY Mellon announced they would be custody bitcoin for their customers.

This is important news because it shows what we’ve been saying is spot on. We’ve been preaching how we think more and more institutions will continue to join the bitcoin space during the past week. First, Grayscale offered regulated bitcoin to their customers, then MicroStrategy, PayPal and Tesla joined the race, and now, “the oldest bank in America” is also putting some chips in the bitcoin space.

We’re quite thrilled that institutions continue to adopt bitcoin, as we think that will significantly impact the long-term price of bitcoin.

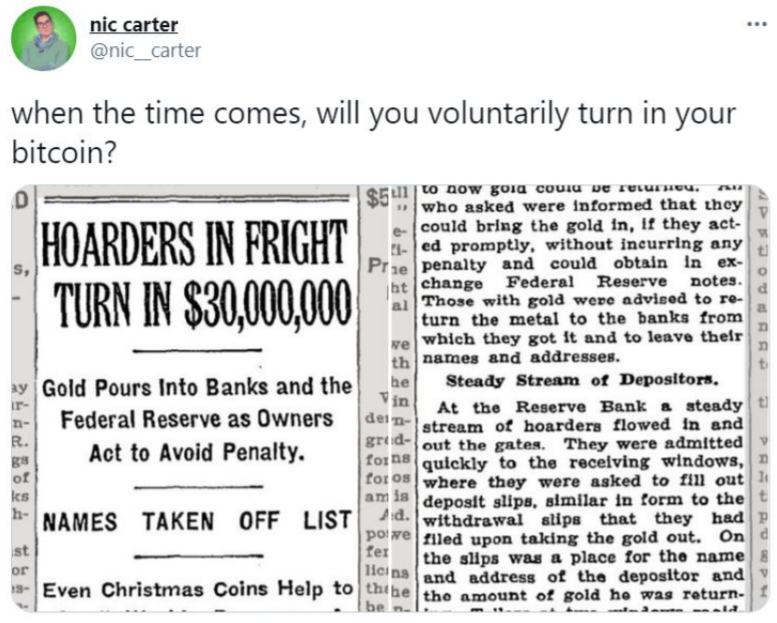

The next tweet comes from Nic Carter, a writer and researcher focused on bitcoin.

We’ve picked up the above tweet as a reminder that there is a dark side to most assets that highly appreciate in value.

In his post, Carter shares an old piece of news relating to Executive Order 6102 that according to Wikipedia had the goal of

“forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.”

The rationale behind the act from President Roosevelt was to improve the economy that was suffering a depression.

n his post, Carter asks a fundamental question that we believe every bitcoiners should

contemplate:

“when the time comes, will you voluntarily turn in your bitcoin?”

We cannot say with certainty bitcoin will suffer a similar fate to gold, but we believe that history rhymes, which means there is a probability, no matter how low, that governments everywhere try to ban and/or confiscate bitcoin.

This is why we think it is essential for bitcoin hodlers to keep some of their coins outside exchanges. You never know what new law or Executive Order gets approved tomorrow.

Better safe than sorry, right?

The last post of the day comes from Ben Kaufman, a software engineer focused on bitcoin.

In his post, Kaufman shares why bitcoin must consume as much energy as it possibly can. As the developer highlights in his tweet:

“#Bitcoin’s security is so strong that even if a country like Argentina was to dedicate all its electricity for that purpose, it would still be unable to successfully attack it.”

For those who think the amount of power consumed by bitcoin is a bug, we would like to remind you that it is not. It is a quality feature that protects the network from adversarial attacks.

The less power the Bitcoin network consumes, the more prone to being attacked it is.

Hence, we hope that mining hardware improves, which means that the Bitcoin protocol will consume even more electricity in the future. Adding to that, the more miners that join the space, the harder it is for a centralized entity (i.e., Argentina), to successfully attack the network.

Bitcoin Price Prediction

Today, bitcoin's price rose over 6%, after a minor sell-off yesterday. Also, BTC/USD is now trading above $45,000, according to CoinGecko.

Like we predicted in yesterday's Daily Roundup, we expected the price to go near $50,000, and that's precisely what happened. Additionally, as you can see in the chart above, we think that a new record price is coming at any second and that BTC/USD will continue to move into higher price ranges, in the next couple of days.

As we wrote in the introduction, as long as institutional buyers pour billions of dollars into the bitcoin market, there is little chance of a price reversal.

Additionally, most analysts are confident in a continuation of the bull-run.

Hence, how do we think the price will trade this Friday, and during the weekend? As shown in the above chart, we believe that bitcoin could top around $55,000 if new buyers enter the space.

Not only that, but there is a little probability it could go even higher than that.

On the other hand, we don't expect the cryptocurrency to drop much below $42,000, even if the downtrend returns. In the worst-case scenario, we see bitcoin finding support around $45,000, which means BTC/USD could get stuck at this price range for a brief period. However, this scenario is improbable.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $41,500 and $38,000, and then again around $35,000, which means BTC/USD should not go much below $40,000, even if there is a sudden trend reversal.

As a reminder, we believe BTC/USD will attain a brand-new record price before EOD, and that the price of bitcoin will most likely break the $55,000, soon.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1359999846137139200