Bitcoin Analysis for 09/02/2021

Today, it is a glorious day for bitcoin. Not only did the cryptocurrency break its prior all-time high, but Tesla, an American electric vehicle and clean energy company, also acquired a large sum of coins.

Congratulations to all investors and traders who held bitcoin until now. You are the real OGs (Original Gangsters).

During the past 24 hours, the price of bitcoin had a massive upswing of almost 14%. At the time of this writing, it was trading very close to $43,000, according to CoinGecko.

Yesterday, we wrote that we expected the price to retest the $35,000 before starting the next leg up. We couldn't be more wrong.

After Elon Musk announced Tesla had acquired over 30,000 bitcoin, the price exploded to the upside. Why? We think because a horde of retail buyers flooded the market after the announcement. Volume speaks for itself, and in the past day, daily volume increased from around $50 billion to over $66 billion.

As Cointelegraph's Daniel Palmer reported:

"The Tesla announcement and subsequent price move in bitcoin apparently triggered such a flurry of trading activity that big cryptocurrency exchanges including Binance, Coinbase, Gemini and Kraken all experienced technical difficulties."

With the current price appreciation, why would one not have some of their reserves in bitcoin?

Hence, we think that the most crucial narrative for 2021, and perhaps the following years, will be the adoption of bitcoin by institutions and corporations.

Adding to that, it seems that bitcoin's price continues to follow various models like the S2F by PlanB and the Rainbow chart by Eric Wall, even though we think price regressions tend to deteriorate from reality slowly. Let's hope we're wrong on that front as well.

Independently, while positive news continues to be released and more institutions join the bitcoin space, the odds that BTC/USD will continue to appreciate are high.

For now, we expect bitcoin to continue its uptrend and move toward $50,000 soon. Currently, we are focusing on the short-term price action and hoping bitcoin finds support above $45,000.

As a reminder, we are confident that BTC/USD will continue to move upward if:

- BTC/USD remains above its 20-day EMA (red), 50-day EMA (green) and 200-day EMA

(blue). - BTC/USD doesn't drop below $40,000.

- BTC/USD daily volume remains above its 21-day Moving Average.

What Do Traders Think?

The week's first tweet comes from Ki Young Ju, CEO at CryptoQuant.com.

In his post, Ju shared the chart "BTC: Coinbase Pro Outflow" and added a speculative guess. He wrote that the "30k $BTC Coinbase outflows went to @Tesla".

According to the above chart, there have been two bitcoin outflow spikes, above 15k bitcoin, that Ju thinks refer to Tesla's purchases. The CEO argues that if we divide the total amount spent by Tesla, $1.5 billion, by an average price of $39,000, results from around 38,000 BTC purchased.

Even though there is no way to prove Ju's point, it's interesting to think that Tesla could have bought over 30,000 bitcoin without having an immediate impact on the price.

The supply-side crisis we spoke of yesterday has just aggravated.

The next post comes from Nunya Bizniz, a bitcoin trader and market analyst.

In her tweet, Bizniz shares a long-term chart of the price of bitcoin since 2011. What the analyst highlights is a spectacular pattern.

As she wrote:

“In the past two cycles, both peaks and lows have been fairly equidistant from the halving.”

Not only that, but Bizniz also wrote that she expected the next peak to form on September 21 2021. In a subsequent post, she added that her next peak target would be at $280,000.

Hence, if the price of bitcoin behaves similarly to previous bull-cycles, there is a chance that Bizniz’s analysis is correct. Still, as the analyst concluded, “Consume with a grain of salt.”

That means this prediction could be incorrect, especially since the current market players are much different than in previous cycles.

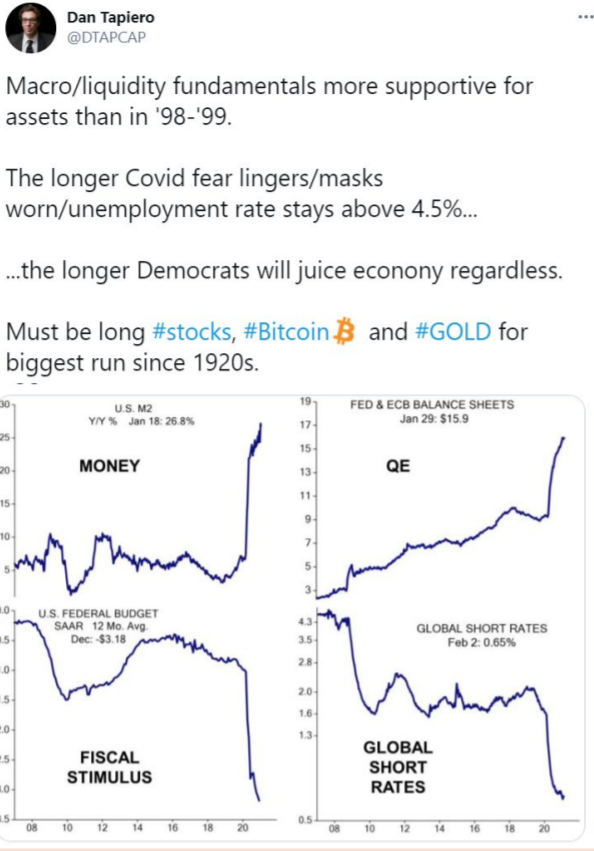

The next tweet comes from Dan Tapiero, a legendary global macro investor with over 25 years of experience and the founder of DTAP Capital.

In his post, Tapiero shared four charts that we would like to discuss. The first chart shows the U.S. M2 money supply. According to Investopedia,

"M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money."

What's quite interesting about the first chart is that we notice a massive spike in the quantity of U.S. dollars available has skyrocketed, compared to the previous years. From January 2020 to January 2021, the total M2 supply has increased by 26%.

The second chart shows Quantitative Easing (Q.E.) measures. According to Investopedia,

"Quantitative easing (Q.E.) is a form of unconventional monetary policy in which a central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment."

To understand the long-term effects of Q.E. on bitcoin's price, we recommend this article by Quantum Economics.

Pedro Febrero concludes that

"If most believe (bitcoin) is a safe haven asset, then Q.E. will eventually push up BTC's price. As currency becomes extremely abundant, assets with strong network effects and limited quantities tend to rise in price."

Hence, the more Q.E., the higher the price of bitcoin should rise.

The third and fourth charts relate to Fiscal Stimulus and Global Short Rates, respectively. Both charts are plummeting, which means that there is little room for fiscal stimulus, meaning taxes won't drop, and due to short-term interest rates being near zero, is a recipe for debt accumulation.

Tapiero concluded:

"Must be long #stocks, #Bitcoin and #GOLD for biggest run since the 1920s."

We agree entirely with Tapiero's analysis, and we also think as less bitcoin is available at exchanges, the higher the price of each remaining unit will go.

The last post of the day comes from AngeloBTC, a legendary semi-retired trader in the

cryptocurrency space with more than 150,000 Twitter followers.

In his post, AngeloBTC shares his view on the current bull-cycle. He wrote that: > "Multi-trillion dollar #Bitcoin market cap is programmed. Conservative target: $100k by 2022."

The semi-retired trader also shared a chart of bitcoin's price and added a green area, where he thinks the price of bitcoin will move towards.

Essentially, just like most of the other traders and analysts, AngeloBTC is quite bullish on the long term price action of bitcoin.

Bitcoin Price Prediction

Today, bitcoin's price broke its previous record price and is now trading above $42,500, according to CoinGecko. Since yesterday the price of bitcoin has grown over 13%.

Like we predicted in previous Daily Roundups, bitcoin's price moved above $40,000, and it seems to have finally found support around this price range. This means that we can expect the bull-run to ensue, and our next price target is above $50,000. Once BTC/USD reaches this level, we expect a minor retracement between $50,000 and $60,000.

As we wrote in the introduction, as long as institutional buyers pour millions of dollars into the bitcoin market, there is little chance for a price reversal. With the sponsor from Elon Musk's Tesla, a horde of new buyers has entered the space, which is now driving the current price appreciation.

How do we think the price will trade throughout the day and during the rest of the day? As shown in the above chart, we believe that bitcoin could finally move to around $50,000. We expect some sellers to enter the bitcoin market once bitcoin is near this price target, which means that it may not reach it just yet.

On the other hand, we don't expect the digital currency to drop much below $38,000, even if the trend suddenly reverses, since there seems to be strong support around this price range.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $33,000 and $36,000, and then again around $29,000 which means BTC/USD should not go below $30,000, even if there is a sudden reversal. In terms of sell orders, there's a significant number of those near $38,000 and then $35,000, which means that if the price drops below $40,000, there is a chance it can go below this range.

Still, the odds favor a continuation of the rally.

As a reminder, we believe BTC/USD will attain a brand-new record price of around $50,000 before the week comes to an end.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1358885289071108100