Bitcoin Analysis for 07/04/2021

Since yesterday, bitcoin's price dropped close to 3%, after recovering during Monday and Tuesday.

At the time of this writing, BTC/USD is attempting to find support above a critical resistance level at $57,600 according to CoinGecko.

Nevertheless, bitcoin's price traded within the predicted range (blue).

Even though bitcoin's price is currently dropping, its long-term trend remains highly bullish.

Essentially, BTC/USD found massive support above the 21-day Simple Moving Average (light blue) around $57,000.

Adding to that, looking at the Volume Profile Visible Range (VPVR) on the left of the chart, it shows BTC/USD will enter a low order volume price range as soon as it moves above $59,000, which means that if buyers come in full force, bitcoin's price may start to rise rapidly.

In terms of news, Callum Jones wrote today at The Times:

"Ark Invest, the vehicle of Cathie Wood, the veteran stockpicker, expects the world's largest cryptocurrency to 'comfortably' eclipse gold's $10 trillion market capitalisation."

If the entire cryptocurrency market capitalization goes above gold's $9 trillion, we expect bitcoin to lead the race and represent between 20% to 40% of the total cryptocurrency market cap. Hence, there's plenty of room for bitcoin's price to grow.

To conclude, we believe bitcoin's price will soon reach a fresh, all-time high, and we remain bullish on BTC/USD as long as:

- BTC/USD remains above its 20-day MMA (red), 50-day MMA (green), and 200-day MMA (blue).

- BTC/USD doesn't drop below $55,000.

- BTC/USD daily volume goes above its 21-day MMA soon.

Traders Thoughts

Today’s first tweet comes from RookieXBT, a cryptocurrency trader with over 150,000 followers on Twitter.

In his post, RookieXBt wrote that

“- Coinbase releasing earnings report today for Q1 2021 - which will beat expectations and make Q1 2020 earnings look like nothing.”

pointing out that Coinbase’s earnings reports should have increased significantly compared to 2020 due to the growing adoption and massive buying volume increase.

The trader also wrote that

“Walmart potentially bought up Bitcoin”, pointing out that Walmart could soon join the bitcoin race."

Hence, we’re pretty bullish on the short-term bitcoin’s price action as we think growing adoption will eventually translate into higher prices.

The following post comes from The Wolf Of All Streets (Scott Melker), whose Twitter describes him as an investor, podcaster, and author of The Wolf Den Newsletter.

In the post, The Wolf Of All Streets wrote that

“Bitcoin sneezes and drops a few hundred dollars, edgy traders panic sell their alts like jabronis and Bitcoin Dominance rises.”

Essentially, the trader explained why bitcoin’s dominance is on the rise: due to the ongoing sell-off of altcoins for bitcoin.

We think that The Wolf Of All Streets’ analysis is spot on since, during most periods, altcoins simply follow bitcoin’s price performance. Therefore, any investor or trader looking to diversify into altcoins should pay close attention to bitcoin’s price.

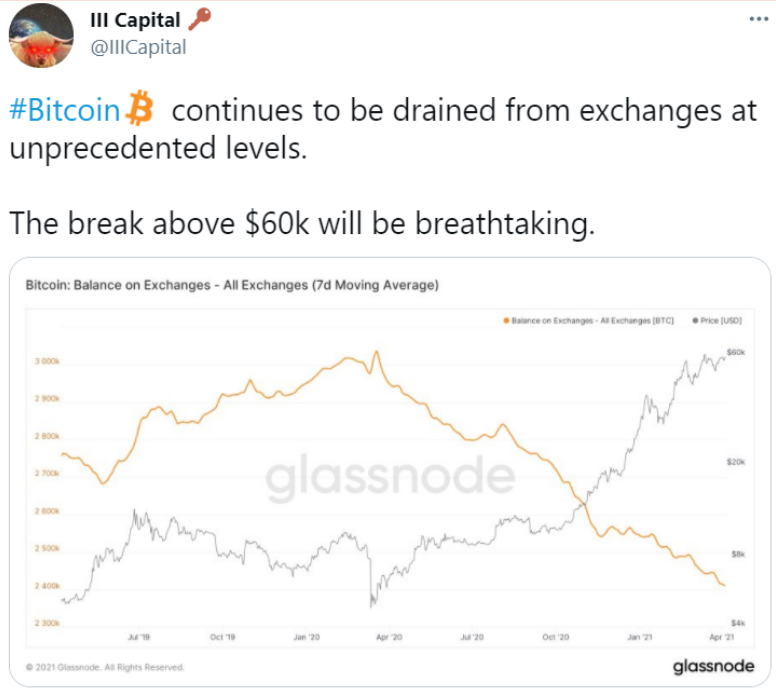

The following tweet comes from III Capital, a bitcoin researcher.

III Capital shared the “Bitcoin: Balance on Exchanges - All Exchanges (7d Moving Average)”, and according to Glassnode, this metric tracks

“The total amount of coins held on exchange addresses.”

Looking at the chart, as III Capital pointed out, we notice bitcoin keeps evaporating from exchanges. He wrote that

“#Bitcoin continues to be drained from exchanges at unprecedented levels.”

This means people are not depositing as much bitcoin to exchanges as in the past, leading to a shortage. If there are not many coins available to buy and demand increases, that could lead to a massive bitcoin’s price appreciation.

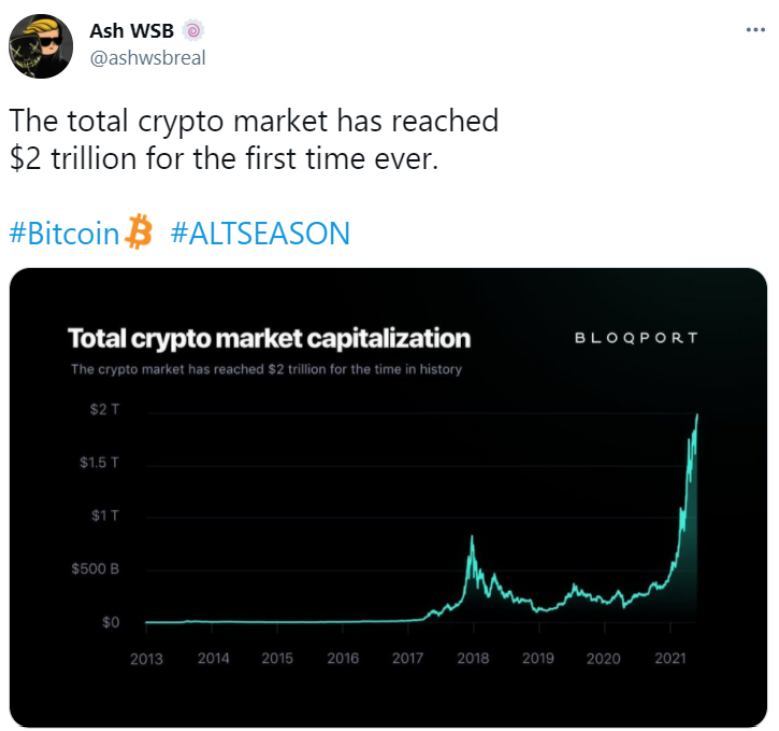

The last post of the day comes from Ash WSB, a Twitter account with over 158,000 followers.

In this post, WSB shared the “Total crypto market capitalization” chart, courtesy of Bloqport. We notice that not only has bitcoin crossed the $1 trillion market cap, but as WSB wrote:

“The total crypto market has reached $2 trillion for the first time ever.”

Hence, we’re not only bullish on bitcoin’s price but also on the cryptocurrency market as a whole.

We think that altcoins may be a bitcoin gateway since investors and traders generally believe bitcoin is the “haven” asset, while altcoins are considerably more speculative, meaning that if history has taught as anything is that commonly profits from altcoins go into bitcoin (and stablecoins).

Therefore, the total cryptocurrency market cap reaching $2 trillion is hugely bullish news for bitcoin as well.

Price Prediction

At the time of this writing, bitcoin is trading close to $57,800, according to CoinGecko. Since yesterday, BTC/USD has lost north of 2%. While bitcoin's price is currently consolidating, we think that bitcoin will soon start a brand new rally that will push it above its record price.

As we wrote in the introduction, we remain incredibly bullish on bitcoin's short-term price if the cryptocurrency holds above the 21-day SMA since on-chain data shows people are not depositing bitcoin into exchanges, which points to a possible upswing.

It all depends if buyers return to the crypto space in full force or not.

How do we think the price will trade today? As shown in the above chart, we believe that bitcoin could approach $61,000 in the next few days, as long as buyers return to the bitcoin space. There's a chance the digital currency breaks this level by the end of the week, but buying volume would need to grow substantially for this to happen.

On the other hand, we don't expect the cryptocurrency to drop much below $57,000, above the 21-day Simple Moving Average. If it fails to hold this level, then we think a drop toward $55,000 could play out; however, this is highly unlikely.

To finalize, the VPVR shows a high number of buy orders between $46,500 and $50,000.

It also indicates that there are almost no sellers left above $62,000.

Posted Using LeoFinance Beta