How To Not Get Wrecked In A Crypto Bloodbath

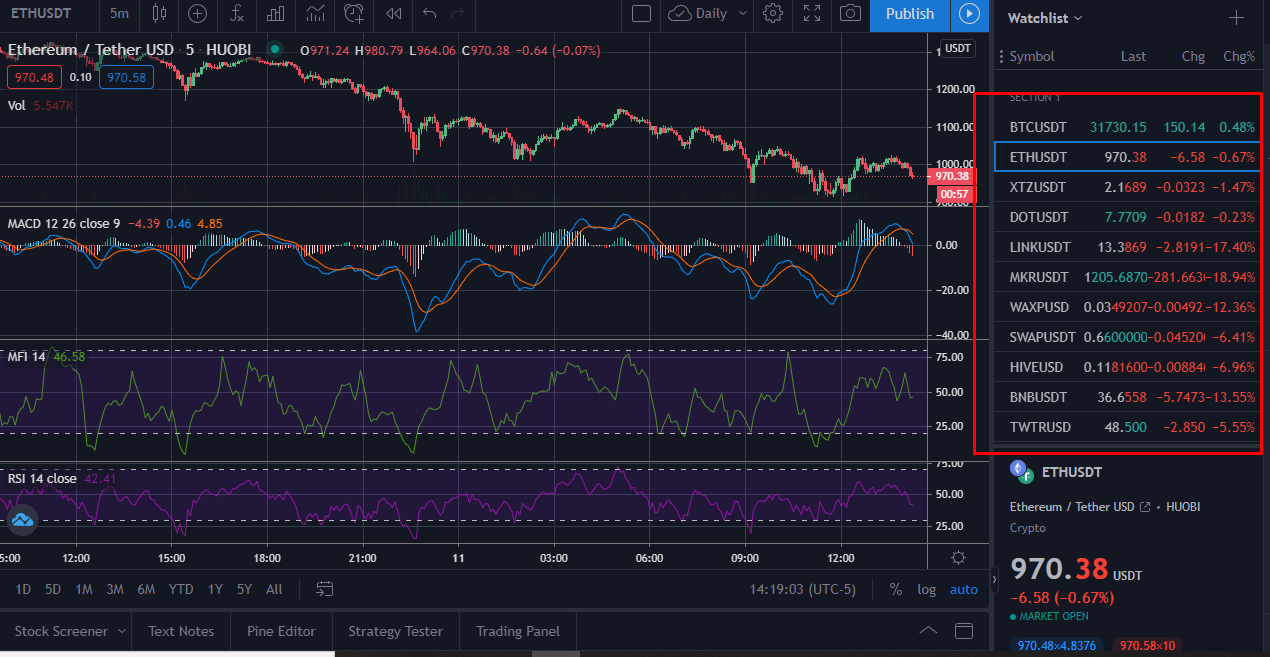

Seeing red across the board is not something I enjoy waking up to, and same goes for many of you I'm sure.

When the market goes crazy with volatility how do you react?

Try to Plan Ahead

Im my experience if you're reacting then you're already behind, so by this logic planning for the worst could help you to stay one step ahead.

Stop-Limit orders

How many times have a I been saved by a stop limit order? a few times that's for sure. I've used stop-limit on traditional securities as well as with crypto.

How does a stop-limit work?

The stop-limit order will be executed at a specified price, or better, after a given stop price has been reached. Once the stop price is reached, the stop-limit order becomes a limit order to buy or sell at the limit price or better. -https://www.investopedia.com/

This is great for not being caught off guard, so set your stops before you walk away. This will allow you exit your position at a point that you're comfortable with, ideally securing some gains and giving you the opportunity to enter the market again at a lower price. Buy low sell high right.

Especially important during times of high volatility, I'll use this when I suspect there could be a drop over night if previous days trading has been touch and go, and I wont be up and around to exit my position and secure gains.

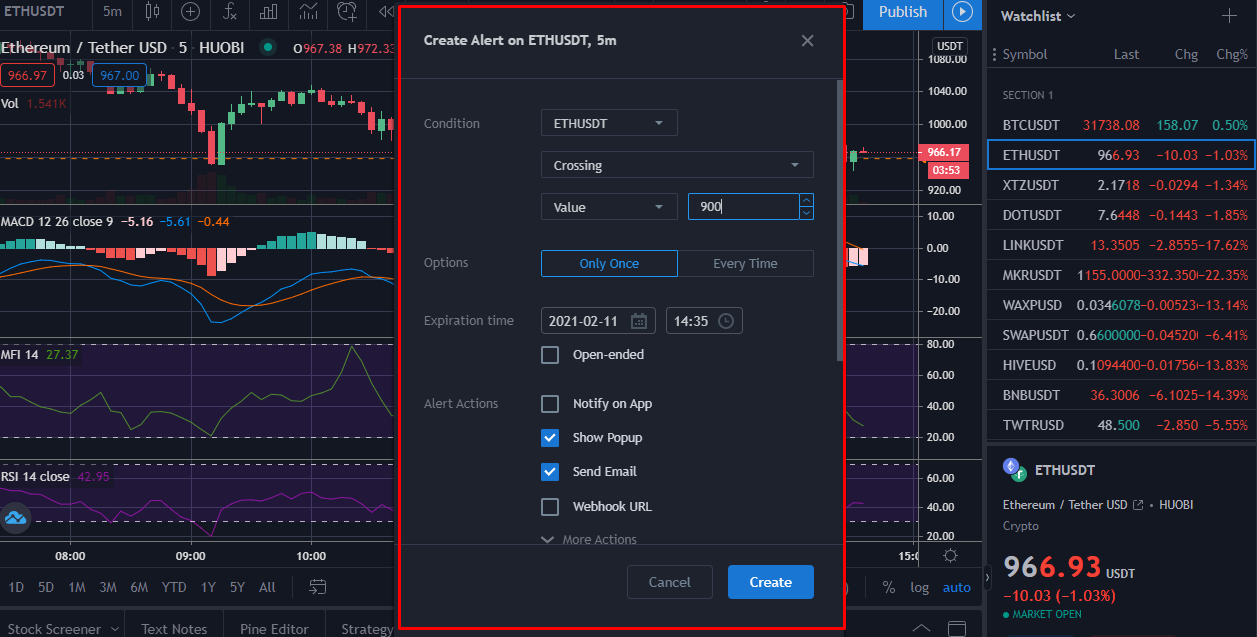

Set Alerts

Through Tradingview and other apps for sure there's a handy option to alert you to the price of an asset crossing a determined line.

This can be used in combination with your stop limit orders. For example set your stop limit and then set an alert to trigger at that the same point your stop is set to trigger.

When it works your stop will be triggered which would otherwise catch you off-guard, this is then followed by an alert, maybe an email to your phone letting you know the price action that's happening on your asset.

Maybe you'll catch the action with an opportunity to buy the dip, one can hope.

Avoid Emotional Trading

This is a big one for me, and I think it's somewhat self explanatory. Easier said than done for me, but using the above two tips can certainly help.

I don't ever want to be panicked and trying to sell at the bottom of a dip only to see the price turn around. It has definitely happened to me, your behind the 8 ball, trying to exit at the wrong time and getting wrecked.

For me sometimes I need to sit back look at the over trend is it moving up or down, and within the overall hourly trend where are the swings up and down on maybe the 5 minute candle. Then I have some data to make a more informed decision if I'm going to trade in a downward trending market.

Feel free to chime in with any tips you have to not get wrecked in a bloodbath.

I'm not great at trading, there's no financial advise her just what has worked for me in the past to help avoid making mistakes when I'm looking across the board and seeing red.

Ciao for now,

Posted Using LeoFinance Beta