Coinbase IPO Fundamentals

To buy or not to buy, that is the question. But first let's look at the fundamentals.

Obviously it's important to make an informed decision when it comes to purchases financial assets, and an IPO is certainly no expectation. Let's take a dive into the inner workings of the upcoming Coinbase IPO.

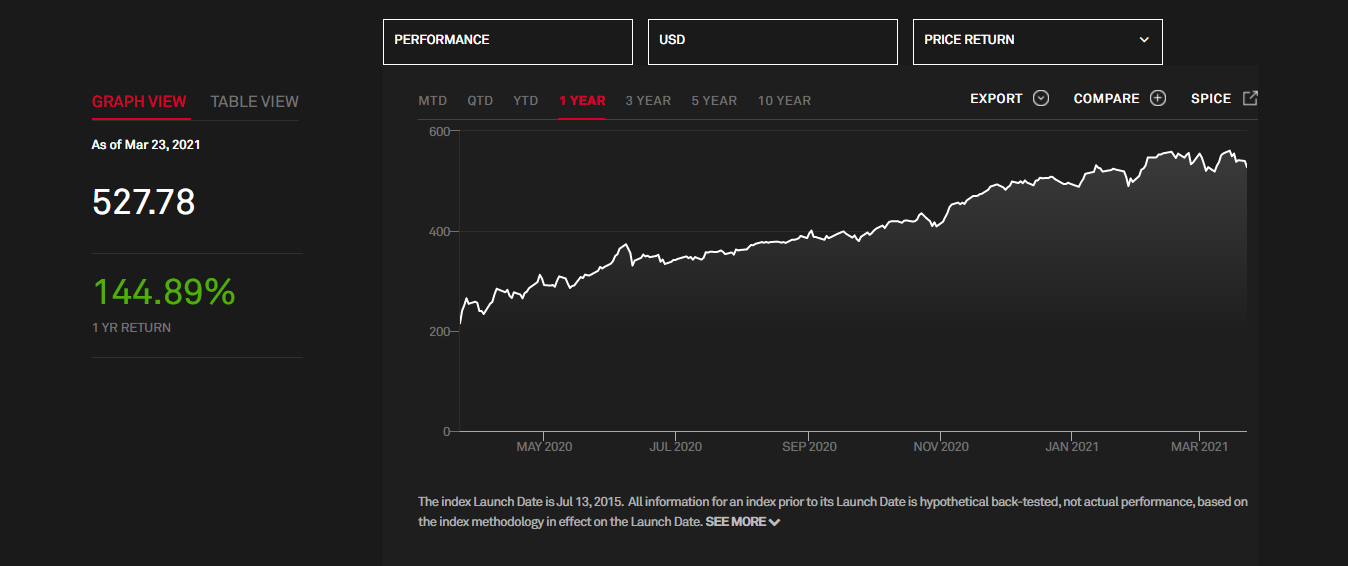

US IPO Market Assessment

The overall stock market continues to move upwards and the market for US IPO's is no expectation.

Show me the data! Let's take a look at the S&P U.S. IPO & Spinoff Index, and we see that the return in the past 1 year is a booming 145%!

All signs point to a hot US IPO market, that in mind the timing for an IPO looks good. Keep in mind that this index tracks across a wide variety of sectors, with 12.4% of the index consisting of Information Technology and another 4.5% Financials.

This index was launched in July of 2015 and has been tracking the US IPO market ever since.

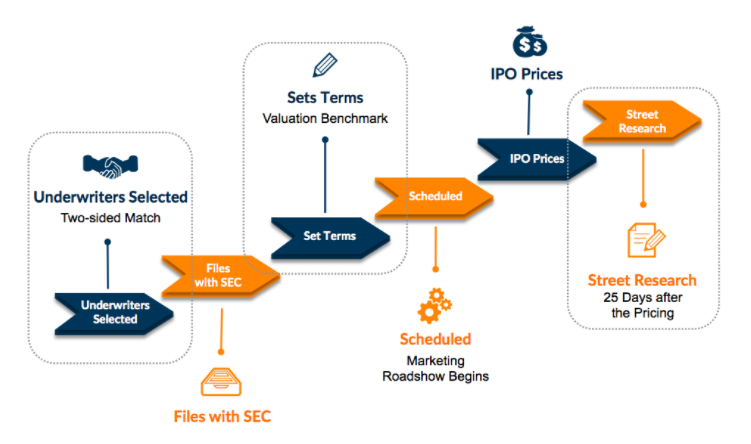

Coinbase IPO Underwriter

In my opinion and research the stronger the underwriter the stronger the IPO potential, with the investing bank(s) essentially acting as an endorsement with hopefully the strongest knowledge of the companies inner workings.

The underwriter is typically involved in a number of processes surrounding the IPO including the SEC filing, valuation, and IPO price determination and more.

Goldman Sachs; According to the SEC filing which can been [viewed here] Goldman Sachs has been "designated financial advisor to perform the functions under Nasdaq Rule 4120(c)(8)". I think it should also be pointed out that within the filings J.P. Morgan, Allen & Co., and Citigroup are also listed as financial advisors.

The listing of our Class A common stock on the Nasdaq Global Select Market and the registration of the registered stockholders’ shares of Class A common stock is a relatively novel process that is not an underwritten initial public offering. We have engaged Goldman Sachs, J.P. Morgan, Allen & Co., and Citigroup as our financial advisors. There will be no book building process and no price at which underwriters initially will sell shares of Class A common stock to the public to help inform efficient and sufficient price discovery with respect to the opening trades of the Class A common stock on the Nasdaq Global Select Market. -sec.gov

In summary, they've got all the big guns on their side and I would have to consider this a strength.

However it should be noted that Coinbase is not taking the traditional IPO path that sees investment banks build hype and finance the deal. As such they are only listed as "advisors" within the filing. This IPO process is known as a direct listing and has been used previously by companies such as Spotify and Palantir.

Core Fundamentals

Core fundamentals should objectively examine the overall strength of the company in question taking into considering factors such as growth, profitability, and the amount of debt the company is carrying plus other facts. For this review I'll focus on those three key areas.

What Does Coinbase Do?

First of all I think we all know what Coinbase does, but for those living in a cave; it's a centralized cryptocurrency exchange founded in summer 2012, and it's a spot exchange. Headquartered in San Fransico, California the exchange is currently one of the largest in the category, second only to Binance. Coinbase transacts across it's exchange a daily volume in the area of $2.6B!

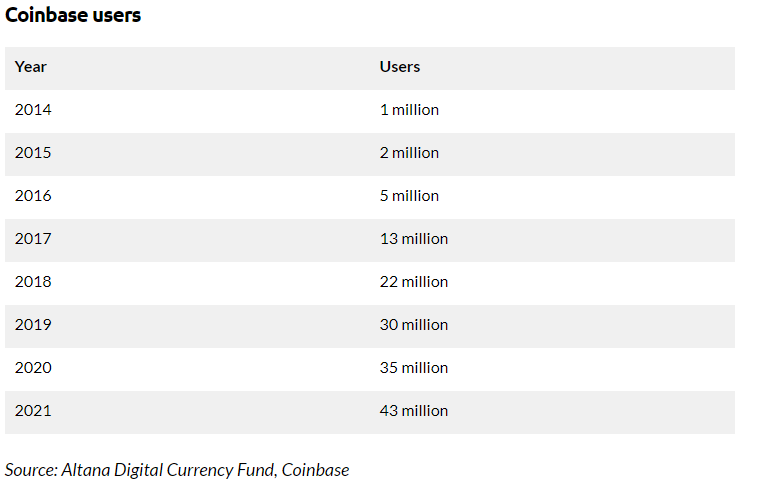

Growth: A

With a current monthly user base of 2.8M and 43 million users worldwide the exchange has experienced significant growth year over year.

If it weren't for the fact that growth seems to be tied to the rise and fall of the overall crypto market and price of Bitcoin I would score this an A+. None the less the business has experienced growth year over despite the ups and downs in the crypto market.

The brand name remains strong and the exchange continues to be a top choice among armature crypto investors particularly within North America.

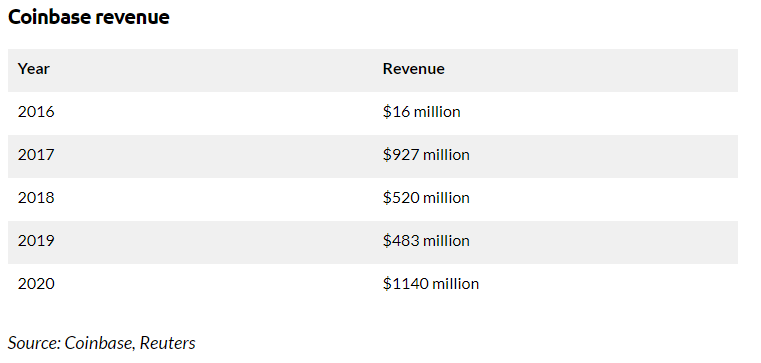

Profitability: B

Coinbase generated revenues of $1.14B in 2020 and is coming off of it's most successful quarter yet, generating $585M in Q4 2020 alone.

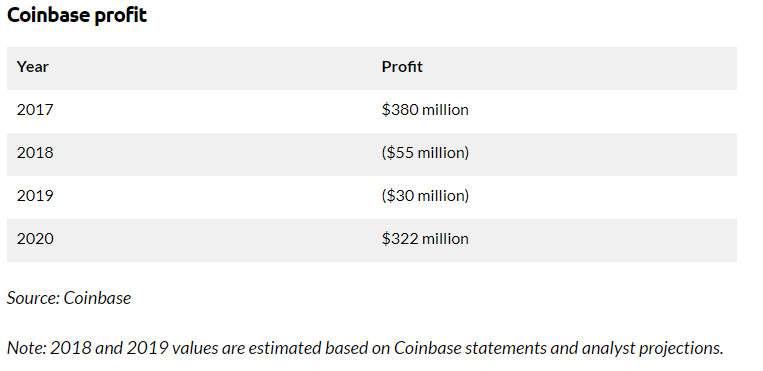

In 2020 the company generated $322 million in net profits, the first yearly profit since 2017. This tells us that revenues and profitability is largely tied to the overall crypto market up and downs.

While 2020 and 2021 may stand to be profitable years for the business it's very possible the next crypto winter will bring about an end to profitability until the markets next swing high potentially sometime in 2024/2025.

When the going is good it's really good, and appears to more than make up for the years that aren't profitable. However I view profits being largely tied to the rise and fall of Bitcoin price to be a weakness.

Perhaps if crypto winters become less and less fierce as more institutional investors enter the markets, a decline in volatility coupled with mainstream adoption will be the key to more consistent profitability year over year. Until then this is somewhat uncertain territory.

Debt: C

It was difficult for me to find good information on the amount of debt that Coinbase has occurred since beginning operations in 2012. For that reason it is hard to give an accurate rating. If you have any tips on how I could find this information please let me know below.

However I was able to find a figure representing the total operating expenses from as recently as 2020. That figure is $868.5B and includes transaction expenses, tech and development, sales and marketing, general and administrative expenses, and restructuring. -fool.com

Apparently operating expenses have grown considerably to the tune of nearly 50% compared with 2019.

However at the same time revenue has grown by as much as 130%. To me this signals that Coinbase understands when to reinvest capital and that would be preceding and during a bull market when the company is generating significantly more revenue which can offset the increase in expenses.

Final Thoughts

All said and done it's clear that both user acquisition and revenues are largely tied to the price of Bitcoin and would depend on Bitcoin continuing to increase in value over time.

I think most of us here would agree that we see the value of Bitcoin continuing to increase over time but what about the bear markets and long crypto winters? What would this mean to a publicly traded company whose valuation and stock price could be in for a wild rise for the foreseeable future?

Personally I feel I would be interested in owning this stock long term because of relatively strong fundamentals, and the innevitable growth in crypto adoption globally. That said I do see a fair amount of risk in the short to mid term until a good portion of volatility is removed from the price of Bitcoin, which isn't a sure thing.

What do you think? Would you buy or pass on the IPO?

Ciao for now,

This post was shared to Publish0x here.

Social Links: LeoFinance | Publish0x | D.Buzz | Noise.Cash

Additional LeoFinance Content:

- It's Time To Take Your Privacy Seriously!

- Investments: Everything Has To Generate Yield!

- HIVE's Passive Earning Options Are Exploding In Popularity!

- BroFi is Live! Earn Passive Income With HIVE's Newest Staking Pools

- Did False Data Reporting Cause BTC to Dip...Again?

![]()

Posted Using LeoFinance Beta

Very nice data and metrics.

I personally like the sector but I do not like Coinbase's position in it. I feel it is a normie kind of platform that could be taken over by more innovative ones (Binance even if it has flaws).

The only reason I would like Coinbase is because it is very strong in the US and with BIG CORPORATES (Tesla, Microstrategy). It would benefit from an institutional craze as it seems to be more compliant with governments than competitors.

The valuation is outrageous butit has good growth prospects though.

As you can tell, I am confused but I would prefer to invest int Bitcoin or other cryptos :D

Posted Using LeoFinance Beta

I know I didn't include the valuation, which in hind site I should have to build a more complete picture. From motley fool it mentions a $90B valuation. With 43M users that puts it at apx $2,000 USD per user, that seems insane. Buuuut... Compare that to Facebook with a valuation of $800B and 19M users, which is $42,000 per user maybe that's not so outrageous. Just playing devils advocate here.

Have to agree with you I like that it's big in North America, and has been an on ramp for institutions, and will continue to be into the foreseeable future.

Posted Using LeoFinance Beta

I think you got it wrong for Facebook. Facebook has hundred of millions of users and you need to add WhatsApp + Instagram + a dozen other companies has it is all part of the Facebook group !

Nevertheless listing Coinbase will be great for the entire crypto space.

Take care mate 😉

Posted Using LeoFinance Beta

yeah that didn't seem right .. Facebook has nearly 2.6B users, WhatsApp 1.5B, and Instagram 1B for a total of apx 5.1B users. That's $156 per user. That changes things a little!

Posted Using LeoFinance Beta

Indeed ! Thanks for looking for the real numbers though

Posted Using LeoFinance Beta

I think this stock has the potential to be as volatile as the bitcoin market itself! I suspect the price volatility will strongly mirror what's happening in the stock market AND ALSO crypto markets. It should be interesting to see how these two industries sort of intersect through this listing.

Besides price volatility from market conditions I think we need to look at security issues too. If there was ever an exchange hack (they do happen from time to time) that would be devastating to the stock price I'm sure.

The other factor for consideration is regulation. A heavy handed approach to regulation by the US government could cause turmoil with the stock price.

I think for these two reasons alone this stock will carry higher risk than a more traditional offering like IBM or Alphabet.

I'm up in the air with whether or not I'm going to jump right in. I could see myself owning a couple shares of this depending on the price, but I'd like to see some sort of price discovery first, and also how Wall St. receives this offering.

All good points.

This probably scares me the most, even though it's something many of us are used to already having been through a bull and full bear market already personally. I'm not interested in holding everything through a 3 year bear market..

Definitely looking forward to some price discovery on this, maybe even for a few months before I would consider parking some in a portfolio.

A heavy handed approach by US regulators would send all of crypto a tumbling, literally stop the bull market dead in it's tracks. Lets hope we never see this..

Posted Using LeoFinance Beta

https://twitter.com/BitcoinDood/status/1374800283981770752

Awesome, and thank you!

Posted Using LeoFinance Beta

Coinbase is well positioned for continued growth as one of the only platforms that conforms willingly with all the US laws and has an ever growing market as more kids turn 18 each year.

Now sure about how they are positioned for international growth or if they can compete for the global market. They also have name recognition like bitcoin, first mover has a lot of advantage and will be the easy first sign up for many as they exposed to crypto, but keeping people engaged and using their services as they get more comfortable will be their biggest struggle.

I will be watching the IPO, but if it keeps getting valued as a tech company and not as a payment/investment company I doubt I will find an entry point.

Posted Using LeoFinance Beta

Interesting points! conforming to US laws and regulations is a big plus, allows for on ramp for institutions which is important for crypto obviously but also good a good client base to have!

There are competitors, significant ones. I was considering talking about this in the post but didn't. They face competition from other exchanges like Binance and Kraken, but also new platforms like robinhood and wealth simple which offer both traditional securities and are beginning to offer crypto. First mover advantage will help for sure, and like mention user retention will be a battle in the future.

Posted Using LeoFinance Beta

Nice and interesting read for sure!

Posted Using LeoFinance Beta

Appreciated, and thanks for stopping by!

Posted Using LeoFinance Beta

a very well-written post! i was looking and looking over the profits as well as the people that joined. from 1 million to 43 in 7 years!

Posted Using LeoFinance Beta

Cheers, yeah I don't think growth will be an issue, at least hasn't been and we know there's many more people still to come. It's the profitability that would be a concern to me if I was buying this IPO. I'm trying to figure out if it's better to buy now or wait until crypto winter.. Perhaps a CDA strategy would be best here..starting at their IPO.

Posted Using LeoFinance Beta

I have been toying around with whether or not I want to buy in since they first announced their plans. I think the biggest thing that will hold me back is whatever the share price ends up being. If it is in the $300 to $400 range like they are projecting, I will probably less likely to buy than if it was in the $200 range. I was only going to be able to buy a couple shares at the most anyway. My bags are pretty small! I have no doubt some of the mutual funds I invest in will probably pick some Coinbase up though. I hope so anyway. I see they were hit with a fine and they are pushing the sale into April now. I don't think that will have too much impact on my decision.

Posted Using LeoFinance Beta

I see what you're saying and would have to agree, if it's 400 I would consider waiting out the bull run and then maybe in Q4 start the DCA to get into a position. It will most certainly take a hit if profitability dry's up during the next crypto winter.. could create a better opportunity to take a position.

Posted Using LeoFinance Beta

Yeah, that is the gamble isn't it? $400 is a tough number. I can totally see people getting disillusioned if another prolonged bear market hits.

Thanks for all the research it sounds like you have done your DD. I will be a buyer when the IPO comes out but will not bet money I can't lose. I feel this is a very speculative play due to the market being at all-time highs and possible regulation.

Posted Using LeoFinance Beta

I would be cautious too, maybe DCA over the course of the next year or so.

Posted Using LeoFinance Beta

Dollar-cost averaging (DCA), had to look it up....But yes I would agree. I also think this is like the dot comm phase of the internet. You can put money anywhere and it will get you a good return. Just as long as you don't lose your wallet password/key you will make some $$$$$

Posted Using LeoFinance Beta