Markets Bottom long before things get good again...

Markets tend to bottom at peak fear, not when there is a clear sign of recovery

Stock markets in general are forward looking by about 3 months. In today's fast paced ever changing economy, it is pretty tough to forecast things much beyond that.

Given that, it makes sense that prices of stocks (and other assets such as bitcoin) would bottom long before the all clear signals are given.

This is especially important when trying to figure out when to buy during this current coronavirus induced recession.

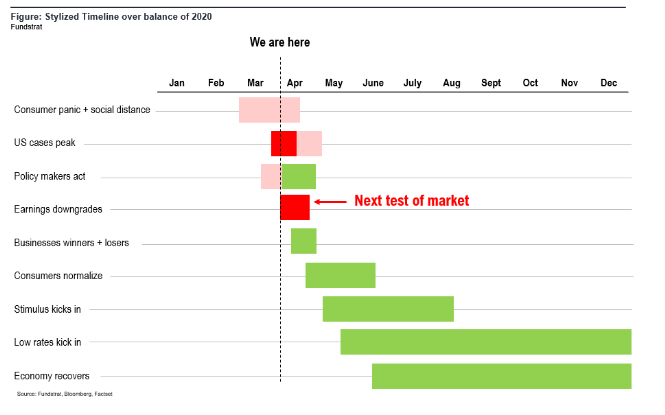

According to Tom Lee and Fundstrat Global Advisors we are actually already through most of the turmoil for asset prices...

Check this out:

(Source: https://twitter.com/fundstrat/status/1243210077986848770)

As you can see, we only have to work our way through a couple more potential headwinds and then the economy will start picking back up again.

He is mostly talking about stocks here, but the same principle applies to bitcoin as well...

Bitcoin was sold off right along with stocks partly due to the fact that wall street money was finally actually in bitcoin.

There was a liquidity event which resulted in everyone running for cash at the same time and everything that wasn't nailed down was sold off.

As things start to pick up again for stocks and the economy in the next couple months, I expect they will for bitcoin and crypto as well.

There is going to be all sorts of stimulus money sloshing around looking for a home, not to mention interest rates that likely stay at zero for the foreseeable future.

When you can't earn a yield on your money, it forces you to put it to work in risky assets.

Crypto, I'm looking at you.

Also, there is that Halving thing now less than 2 months away...

I think we are going to see an awesome second half of this year for stocks and bitcoin.

Hopefully you have been stock-piling cash and are now putting it to work in depressed assets.

If you have been, I think you are going to be very happy by the end of this year.

Stay informed my friends.

-Doc

This coming week will hopefully be as interesting as what we had in all of March when it comes to trading. I haven't seen Tom Lee's assessment but am very hesitant to say we have rode through most of the turmoil. Although stocks may have drop significantly the underling items that is at work has yet to be resolve. How long will Virus shut down countries? How much more QE and rate cuts CBs will do to provide liquidity in the markets? What corporations will need bailout due to lack of liquidity or drop in revenue. Oil price war when will it end? How many people will be unemployed in the coming weeks and how many will be able to return to work once the virus subsides?

I think the upcoming weeks will be interesting because a lot of firms are starting to pull away guidance for 1st quarter. This is a sign to me that not only will it be very bad news but it will be so bad they do not know how to project future quarters until there is clearer picture on when life gets back to normal for everyone. I am hoping within two weeks US virus cases flattens as a first sign of positive news.

I think US will take a bit longer... but that’s my view.

The most important bar of all is not the earnings downgrades, but the actual financial reports, the ones that come first in April and then July, onto August and perhaps even F2020 reports.

Staggering unemployment. Watching, waiting, going in and out then gonna jump when absolute despair kicks in.

GL