The importance of Tax Auditing for the effective development of Public Administration

Written by:Diomer Antonio Galán Rincón.

Bachelor's Degree.Public Accounting / MSc.Science of Higher Education.

Worldwide, all organizations seek to establish policies that lead to the optimization of their resources, implementing constant innovations in their organizational structure, looking for tools that are feasible in the development of their operations.

In the case of public institutions, fiscal activity is a discipline of utmost importance and has become essential to finance the development of communities in relation to the economic, educational, and social aspects of any country; in this sense, they have been given the task of designing various statutes (ordinances) that help to comply with the established methods, through programs and instruments of collection and control of formal duties of taxpayers, in order to prevent tax evasion and thus raise the levels of collection of public entities to contribute and be part of the public budget.

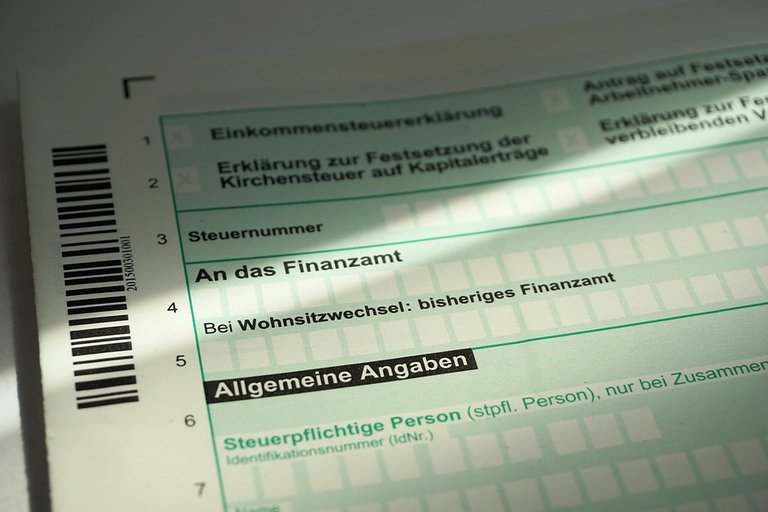

These elements have been elaborated with the purpose of being able to have certainty that the tax procedures are duly presented and regularized, and they are perfectly included in what is known as tax audit. According to Arnau and Arnau (1994), tax audit is defined as "The review and verification of accounting documents carried out by an expert, aimed at verifying whether a certain taxpayer has correctly complied with its tax obligations in a certain period of time, introducing the nuance that the expert does not necessarily have to be a civil servant

The tax audit evaluates the entity from the legal point of view, that is to say, its compliance with its tax obligations, taking into account the parameters and procedures established in the legislation in force, since the design and implementation of tax rules aimed at all taxpayers is becoming more and more frequent, with the purpose of ensuring that they comply with the legal framework.

In this same sense, the collection of government taxes, through their administrative denominations have developed a financial, administrative and functional autonomy, which has allowed them to develop mechanisms for obtaining resources through the demands of taxes to citizens, with the purpose of converting them into goods and services for the community, despite the demographic increase that has caused a greater demand for public services that must be met in time to not decrease the quality of life of the population and that this brings with it problems of social conflict.

It is for this reason that the public administration is in constant search of an adequate tax collection system, taking into account instruments and measures that allow them the greatest amount of income and be able to cover the infinite needs that citizens cannot cover by themselves, as well as achieve economic growth and social welfare of the population, for this reason municipal taxes according to Villegas (2002), defines them as: "Taxes required by the local government to those who are in situations considered by law as taxable events, being these taxable events outside of any state activity related to the obligor.

When it comes to government institutions, taking into account whether it is a developed economy or not, taxes play a fundamental role in their income, according to their policy and structure, and this is because tax revenues are part of the resources required for the operation of such entities, so that all the factors that must be used to achieve the goals set must be adequate.

That is why tax auditing arises from the need to facilitate legal compliance with the procedures applied in contributions and collections, as the case may be; in addition, thanks to tax auditing, the financial, administrative and operational information of an entity can be reliable, truthful and timely; that is, it is to check that the facts, phenomena and operations occur as they were planned, that the policies and guidelines have been observed and respected in order to comply with tax, legal and regulatory obligations in general.

I hope you like my article and I would appreciate all your comments.

Bibliographic references:

1.- Arnua Zoroa, F., and Arnau Moral, F. (1994): "Auditoría Tributaria de empresas.

2.- Villegas, Héctor. (2002). Curso de finanzas, derecho financiero y tributario. 8th updated and expanded edition. Editorial Astrea. Buenos Aires. Buenos Aires. Argentina.

0

0

0.000

Yeah,it alway good to Audit any tax.thank for sharing this post.

Greetings @ crystalwills, the audit is always valid in any company and also for the administration, because it allows us to know if we are performing in the best way the accounting, administrative and financial procedures.

Thank you very much for commenting