Silver prices, trends, inflation

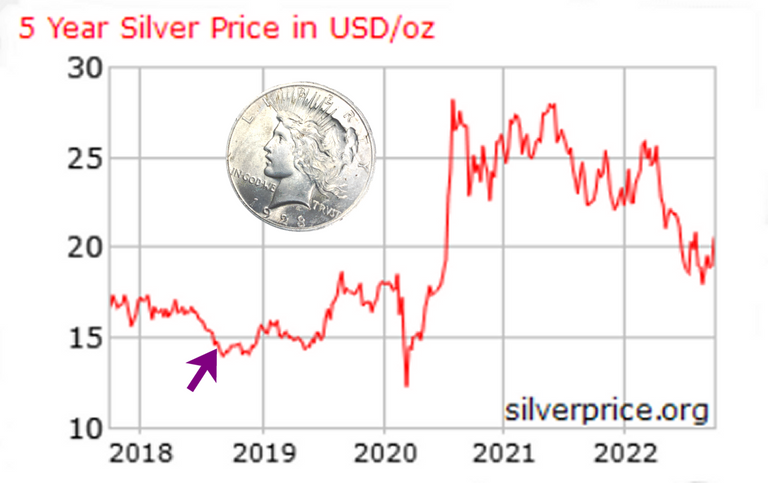

The "spot price" of silver as a commodity was relatively low for a number of years. It was during that lull in prices that I began to actually invest in silver (shown by the purple arrow in the below chart). Prior to that, I would save a piece of silver if I came across it in change (rarely), but didn't actively look for it. For the next two years, I bought a little silver on a regular basis and felt good about bolstering my financial security as well as had fun adding to my collection.

screenshot from silverprice.org

Then, in late 2020, the price of silver jumped quite a bit. No one really knows why that happened, of course, as the price of commodities, stocks, and crypto rises, then falls, on the whims of the market. There might be a Conference Room of speculators on Wall Street that laugh and know all the reasons for such fluctuations, but the common person (like me) knows nothing about such things. So, we just ride the waves and hope for the best.

The "spot price" basically reflects what a nondescript hunk of silver would cost. Once that silver has been carefully minted (or melted and poured) into an artistic and pleasing form, there is a nominal increase in price due to artistic efforts and/or production costs. And, that is fair! Those of us who "stack" (as precious metals collecting is called) understand those costs and don't complain too much about them, although we still shop comparatively to find the best deals, of course. There are shipping costs to be considered, too, whether they are quietly included with the sale price or listed separately.

As everyone already knows, we are in a time of some serious economic hardships, worldwide. The costs of goods and services has climbed steadily over the past year or two, and are still climbing. Costs of food, lodging, fuel, utilities are becoming problematic for many people. The silver market has reflected this.

A couple years ago when the "spot price" of silver was below USD 20, the aforementioned nominal increase due to artistic/production considerations made most one-ounce silver bars/rounds cost in the USD 20–30 range, with some special "limited edition" or "hard-to-find" pieces commanding more. When the "spot price" of silver exceeded USD 25 in late 2020, the normal retail prices of most items climbed into the USD 30–40 range. Now that the "spot price" of silver has again dropped below USD 20 — spot price is USD 18.65 at the time of this post being published — the retail prices of $30–$40 have not dropped to the $20–$30 range again.

As one example, here is a US 1923 Peace Silver Dollar KM# 150. I bought this one back in April 2020 for USD 22.99 but never posted about it. Just for kicks, this week I did some searching online and the absolute cheapest I found another 1923 Peace Dollar in similar condition was USD 32.50, but most sellers wanted more for them: $35, $37, $40, $45, etc.

So, is it worth it to pay USD 32.50 for a Peace Silver Dollar now? No one knows. If retail silver prices continue to hold or climb, then "Yes!" it would be wise to buy one now. However, if retail prices should drop to the levels they were a couple years ago, then "No!" as one would lose money. It's always a guessing game.

Even looking at silver prices over the past 20 years from silverprice.org isn't really any help. Sure, there is an upwards trend over time, but could that simply be due to inflation? I decided to do a little checking on that possibility.

The above chart shows that the "spot price" of silver in 2003 was about $5, roughly. Using the website US·Inflation·Calculator.com, I was able to determine that $5 in 2003-dollars is roughly equivalent to $8.07 in 2022-dollars, adjusted to inflation.

• U.S. BUREAU OF LABOR STATISTICS shows $8.01

• InflationTool.com shows $8.10

• others I tried gave values in the $7.00 to $7.71 range

With the current "spot price" at $18.65 rather than the $8-range, this leads me to believe that the market, indeed, considers silver to be a more valuable asset today as compared to 20 years ago.

I think the overall prevailing feeling I get from all this is to 'buy low' as always, but continue stacking as finances allow. I might go ahead and scoop up that cheaper Peace Dollar I saw. Of course, this just my instinct, NOT FINANCIAL ADVICE! 😉

😊

😊

19-Oct-2022

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thank you, @bhattg 😊

This is a great read! The goal is always to buy low as much as one possibly can during this hard economic times.

There is so much demand for silver. I think the price is being artificially suppressed. The value of silver should be significantly higher in my opinion. Unlike gold, silver has multiple uses and goes into so many "products". I would eventually expect it to pop... however, I would expect further manipulation to continue. We wait and see...

The cheapest I can with the legal tender coins.

Unless it's the FUN silver, premiums be damned, beat to quarters, full sail! 😉

!LADY

View or trade

LOHtokens.@kerrislravenhill, you successfully shared 0.1000 LOH with @thekittygirl and you earned 0.1000 LOH as tips. (1/13 calls)

Use !LADY command to share LOH! More details available in this post.

Yes, we all need some FUN silver sometimes, regardless of price! That was the case with my Sugar Skull pour from Ray, and the Rosamond steampunk piece! 😁

Whenever I buy Silver I prefer bars instead. Price has been steady here since the beginning of the year. Although, I think Gold's price has gone a bit down.

Yes, that 1923 Peace Dollar will be a hundred-years-old, real soon, Thanks for the report, 𝕜𝕚𝕥𝕥𝕪 - @thekittygirl.

I love the honesty you put in your content and it was also very informative, thanks for that and I'll be following for more , I hope you keep up the work

A great analysis. Nowadays the spot price for Silver is quite high. Still I buy the one's that are lower in premium. If they are brand new then it's ok !

With inflation and all it's all about making the most of every situation and finding better hedges in silver and gold. Getting cheap silver is a smart move

The bulk of my silver investment was purchased under $20/oz. Given today's market, it would be easy to recover that investment if I needed to.

Well, at time like this and if one wishes to stack coins, I suggest US Constitutional silver (not the BU ones, hehehe), and generic bars.

Very informative, sis!

!LADY 😍🌺🤙

Congratulations @thekittygirl! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 39000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP