BSC Enters Rug-Pull Phase. Can CeFi be Better Than DeFi to Tackle it?

We have already witnessed a lot of rug-pull or exit scams in DeFi space on Ethereum chain. Since this is a very early stage in DeFi, DeFi smart contracts are still evolving. Despite of all the audits, no one can still say these smart contracts are free from all possible vulnerabilities. However, with maturity and evolution, most smart contracts seems to be getting more reliable than before. But funds are always at some risk in DeFi as it requires us to rely on these smart contracts.

Binance Smart Chain has evolved rapidly. And as the chain forked Ethereum, many DeFi projects quickly forked Ethereum projects to get started on Binance Smart Chain. I believe, in this haste, some even copied the older codes of some popular projects along with their code vulnerabilities, which were actually upgraded to include fixes later in Ethereum projects.

Although it's hackers who take advantage of smart contract vulnerabilities to steal funds from the smart contracts, rug pulling is the outcome of malicious intentions from promoters themselves.

Yesterday, Meerkat Finance rug pulled its investors for about $32m. This one day old project got away with all user funds within hours of upgrading its contract for 2 of its vaults.

This is the largest rug pull incident on Binance chain since its adoption increased esp. after the PancakeSwap's popularity. However, about a month ago, we also saw PopcornSwap's rug pull incident of $2m.

It appears to me that as more and more new users starts using DeFi on BSC esp. small investors due to its negligible gas fee; we should be prepared to see more of such incidents.

Tron chain became popular among scammers, wallet phishing & ponzi projects probably due to zero gas fee & fast transactions. Yesterday, a friend told me that some large ponzi project was considering migrating from Tron to BSC.

Will BSC become a fertile bed for such projects? I think, in early stages, scammers may take advantage to skim this ecosystem and it may take some time for investors to get mature and understand how things work.

But is CeFi (or CeDeFi, the way it's being called) has an advantage over DeFi to recover stolen funds from such malicious activities?

Will Binance CEO make the victims' lost funds whole? Is BSC safu?

I think not.

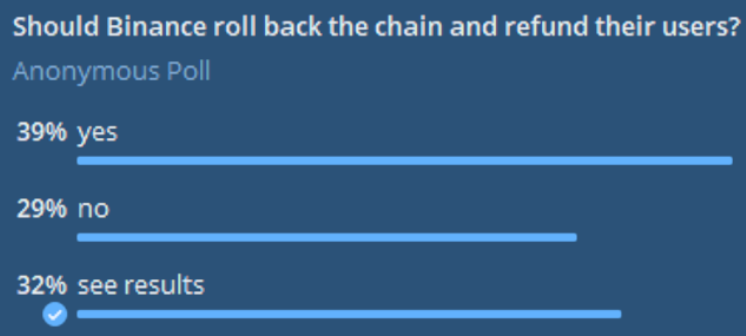

Although some people are expecting a roll back of BSC from CZ & team to refund its investors, it's very unlikely. Any attempt to roll back the chain may raise further questions about decentralization and tarnish BSC's image.

BSC needs to defend their ground when several L-2 projects are emerging to give it a fight!

However, BSC was quick to react and burnt all bridges so that stolen funds can't escape its chain. Yes, Binance Bridge was disabled probably for this reason. I haven't came across any update on the recovery of funds yet but we can hope that culprits could be tracked and may be investors' funds could be rescued too.

Binance Chain is already investigating into it and collecting information.

The hope is not entirely out of place. In November, Binance recovered 99.9% of the funds involved in Wine Swap exit scam.

None of the $32m could escape Binance Smart Chain. However, other BSC based projects must have lost some business because of disabling of Binance bridge.

- Do you think if these funds are rescued and refunded back to the users, it will boost BSC's image?

- If so, will you prefer CeDeFi over DeFi?

Whether or not the investors get their money back, we should always take care of the basic principle of investing in the wild west of crypto - invest only what you can afford to lose. This applies more to emerging fields like DeFi now.

Take care, be safu!